Uniswap (UNI) Surges After A Bumpy Ride, Is Bearish Run Over?

May 11 2023 - 11:00AM

NEWSBTC

Uniswap (UNI) has been experiencing downward movement due to

general market sentiment. The downtrend started on April 19,

dropping from $6 to $5. However, the price rises gradually,

indicating that the bulls are building momentum. This slight

increase has left traders wondering if the bearish trend is over

and whether things might start getting better for Uniswap (UNI).

Signs of Bullish Sentiment As UNI Surges Notably, UNI is up today

by 3.27% at a high of $5.12 within the last 24-hour trading

session. The 24-hour trading volume is also up by over 97.72%

at $68 million, signifying that the UNI market is experiencing high

activity. This data shows that the bulls build strong momentum with

positive market sentiment. Related Reading: Bitcoin Price Blasts

Above $28,000 Following 4.9% April CPI Report Moreover, the token

still holds the 22nd position on the CoinMarketCap ranking with a

market cap of $2.9 billion. According to CFGI.io, the market

sentiment towards Uniswap (UNI) is bullish. The indicator

confirms the bullish sentiment with a 61 reading, meaning investors

are greedy. This further shows that investors are optimistic about

the future potential, and the recent increase in price may be

sustainable. UNI Technical Analysis Even with the increasing price

and trading volume, the technical indicators for UNI remained

contradictory, with some pointing towards a potential bear market.

UNI is currently trading below its 50-day & 200-day Simple

Moving Averages (SMAs) and has formed a Death Cross, a bearish

sign. The Death Cross contributed to the price drop as it caused

traders and investors to sell their holdings or take short

positions. The SMA indicator suggests that both the long-term

and short-term trend is bearish. But, the price might reverse if

the bulls hold their long positions. The Relative Strength Index

(RSI), with a reading of 40.20, suggests that the asset is not in

the overbought or oversold regions but in a neutral range.

This indicates that there’s no significant buying or selling

pressure and UNI might experience some level of consolidation or a

positive price change. Related Reading: Bitcoin Funding Rates On

BitMEX Turn Deep Red, Here’s Why This Is Bullish The MACD indicator

suggests a bearish trend, with the MACD currently below the signal

line. The histogram also confirms the bearish momentum as it is

trading below zero. UNI is trading at $5.14 at the time of writing.

The bears are trying to break through the first support level of

$4.746, a level several times. However, if the bulls build strong

momentum and break above the significant resistance level of

$5.731, it might trigger a bullish trend. The next support and

resistance level will be $3.358 and $7.651. Uniswap’s price can

also lose most of its gains if the bears break the support levels

successfully. Featured image from Pixabay and chart from

Tradingview

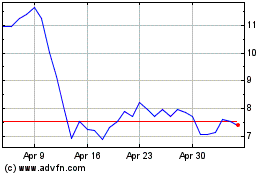

Uniswap (COIN:UNIUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

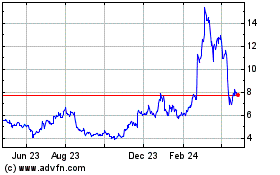

Uniswap (COIN:UNIUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024