PancakeSwap Voting To Make CAKE Deflationary, But Prices Are Free-falling

April 19 2023 - 5:00PM

NEWSBTC

A proposal to make PancakeSwap (CAKE) scarce isn’t preventing the

token from collapsing, reading from the candlestick recorded on

April 19. CAKE Slides 25% From February Highs CAKE is the utility

token of PancakeSwap, a decentralized exchange running on the

Binance Smart Chain (BSC). Like the rest of the cryptocurrency

market, CAKE is under immense pressure, dropping four percent on

the last trading day. Related Reading: CAKE Remains Under Pressure

Despite PancakeSwap Dominating BSC Notably, CAKE is also down 25%

from early February. The token price is at March 2023 lows and

looks likely to break the support line at around $3.45. The

bearish engulfing bar of April 19 is wide-ranging and with decent

volumes. It is a continuation of losses of March 27 and a

confirmation of sellers set in motion on February 9. On this day,

the Uniswap community voted to deploy Uniswap v3 on BNB Chain, a

smart contracting platform similar to Ethereum. It also marked the

first time Uniswap, a decentralized exchange, had been deployed to

a high-activity platform like the BNB Chain. The contraction of

CAKE prices was in response to the expected competition considering

Uniswap’s dominance in Ethereum and decentralized finance (DeFi),

judging from the protocol’s total value locked (TVL). As an

illustration, DeFiLlama data on April 19 shows

that Uniswap had a TVL of $4.29 billion, more than $2

billion that of PancakeSwap. Despite initial fears, PancakeSwap

remains the dominant DEX on the BNB Chain ecosystem, enabling the

trading of BEP-20 tokens. PancakeSwap’s Tokenomics Proposal CAKE’s

dump continues even after a proposal from the PancakeSwap community

to make CAKE more deflationary. In the new proposal, CAKE

would have an annual inflation rate of 3% and 5%, prioritizing

shifting to a more sustainable staking model. Here, the goal is to

have low staking inflation of CAKE, wherein the real yield is from

PancakeSwap’s revenue. At the same time, the goal is to create a

structure that favors long-term CAKE staking. Related Reading:

PancakeSwap TVL Drops 12%, Did This Exchange Received A Lethal

Blow? Breaking down details, staking allocation per block will drop

from 6.65 CAKE per block to a target of about 0.35 – 1 CAKE per

block. At the same time, a system favoring long-term stakers will

see CAKE holders who choose to tie their tokens for longer earn a

bigger share of the platform’s revenue. CAKE stakers will be

allocated 5% of trading fees generated from PancakeSwap v3. 1/14

🥞GM ev3ryone! The anticipated #PancakeSwapv3 is now LIVE on both

BNB Chain and Ethereum!🥳 🚀Upgrade offers:😍Lowest fees in the

industry💰Increased fee earnings for liquidity providers🛠️New tools

for seamless user experience Read more : https://t.co/l7GQVxqVC3

pic.twitter.com/5G9TnFzxOb — PancakeSwap🥞Ev3ryone's Favourite D3X

(@PancakeSwap) April 3, 2023 Voting on this proposal started on

April 19, 4 PM UTC and ends on April 21, same time. The voting

period is to allow for consensus. As of writing, 63% of all voters

favor the proposal to make CAKE “ultrasound.” For this system to be

implemented, it should receive majority support from the community.

Feature Image From Canva, Chart From TradingView

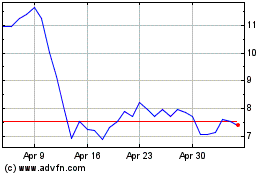

Uniswap (COIN:UNIUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

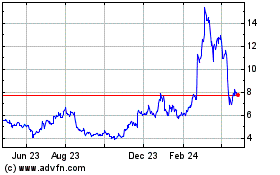

Uniswap (COIN:UNIUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024