Uniswap Price Decline May Bring Fresh Buying Opportunities For Traders

April 10 2023 - 3:00PM

NEWSBTC

Over the past few days, the Uniswap price has been trading sideways

with minor losses. On the daily time frame, the coin has only moved

up by 0.4%, indicating consolidation. Unfortunately, in the last

week, UNI has lost almost 2% of its value. For the past couple of

weeks, Uniswap’s trading range has been limited between $5.51 and

$5.90, respectively. If the price moves above $5.90, the buyers

will be in control of the altcoin’s price. At the time of writing,

the technical outlook of UNI indicated the presence of bearish

forces. The demand and accumulation of the altcoin remained low,

while consolidation continued. Related Reading: Ethereum Price

Looks Ready For Another Leg Higher Over $1,880 A drop from the

current price level would cause UNI to fall toward its immediate

support level, potentially entering the selling zone and bringing

the bears back. On their respective charts, major altcoins can only

move up if Bitcoin breaches the $28,500 mark. Additionally, the

daily chart shows a decline in UNI’s market capitalization,

pointing to a fall in demand. Uniswap Price Analysis: One-Day Chart

As of the time of writing, UNI was trading at $5.86, with the coin

facing overhead resistance at $6. However, before reaching that

level, UNI may encounter brief resistance at $5.90. If the price

falls below the $5.80 level, UNI could drop to $5.50, which is

considered the supply zone for Uniswap. If the price continues to

drop, UNI could trade at $5.10. Conversely, if UNI manages to

breach the $6 level, it could attempt to revisit $6.80 and

eventually $7. The $5.20-$5.11 zone might experience considerable

buying which could mean buy opportunities for traders. The altcoin

had formed a descending trendline over the past couple of months,

thereby, strengthening the bears in the market. In the last trading

session, the amount of Uniswap traded was red, indicating an

increase in selling pressure on the chart. Technical Analysis

Despite attempts at recovery, the demand for UNI has repeatedly

been pulled back into the supply zone. The Relative Strength Index

(RSI) is currently below the 50-mark, indicating a decline in

buying strength and demand. As a result, UNI’s price has fallen

below the 20-Simple Moving Average (SMA), indicating that sellers

are driving the price momentum in the market. To reverse this

trend, UNI needs to break through the $5.90 resistance level, which

would allow the altcoin to move above the 20-SMA line. If UNI can

achieve this, it may indicate that buyers are regaining control and

potentially signal a bullish trend reversal. In conjunction with

other technical indicators, UNI’s daily chart showed a decrease in

buy signals. The Moving Average Convergence Divergence (MACD)

indicator, which measures price momentum and reversal, indicated a

decline in the size of the green histograms, indicating that buy

signals were weakening. Related Reading: Bitcoin Price Regains

Traction But Key Resistance Is Still Intact The Directional

Movement Index (DMI), which measures the price direction, was

negative, with the -DI (orange) line above the +DI (blue) line.

Additionally, the Average Directional Index (ADX) was below the

20-mark, indicating a decrease in the strength of the price

direction. Taken together, these indicators suggest that the

Uniswap price momentum is weakening. Featured Image From UnSplash,

Charts From TradingView.com

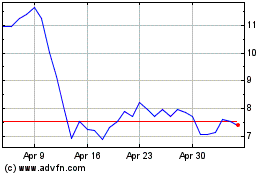

Uniswap (COIN:UNIUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

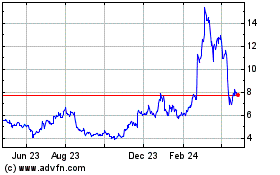

Uniswap (COIN:UNIUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024