theBlock Research Pins Stacks as a Key Player in the BTC Network

July 12 2022 - 6:59AM

NEWSBTC

Bitcoin is widely considered to be the world’s leading

cryptocurrency. However, builders can use this technology to

develop powerful applications, protocols, products, and services.

Several ecosystems emerged on top of Bitcoin over the years, and

Stacks continues to note tremendous growth. The Ongoing Evolution

of Stacks Many people may recall Stacks under its former name of

Blockstacks. It is a smart contract layer for Bitcoin tethered to

the Bitcoin blockchain through a cross-chain consensus mechanism.

The hash of the Stacks state is embedded into every Bitcoin network

block. More importantly, Stacks is not limited to Bitcoin’s scaling

– or lack thereof – as it relies on a different approach to process

transactions. Under the Stacks hood, the network relies on two

types of blocks: Anchor blocks: used to tether Stacks to Bitcoin

Microblocks: powering applications requiring high throughput and

low latency. One of the emerging partners through Stacks is Hiro,

an organization focused on building Bitcoin applications. They,

too, see merit in further scaling Stacks through Hyperchains and

increasing the throughput even further. Hiro proposes using trusted

federated hyperchains to evolve into a trustless hyperchain

solution. Stacks Adoption Increases Rapidly The approach by Stacks

immediately gained traction since launching its smart contracts in

2021. That resulted in a Total Value Locked increase following the

introduction of native-BTC swaps and support for Non-Fungible

Tokens. The current Total Value Locked in Stacks hovers near $100

million, most of which resides in the StackSwap DEX and token

launchpad. Another growth factor, as outlined in the recent

TheBlock research, is the number of projects building Stacks

to unlock more Bitcoin-oriented potential. The smart contract layer

is leveraged by Alex, Gamma, Arkadiko, HeyLayer, Zest, Xverse,

Planbetter, Block Survey, Provico, Byzantion, GoSats, and Moon.

That confirms overall interest in this technology keeps rising, and

more developers want to experiment with Bitcoin-capable smart

contracts. Moreover, the position of Stacks has been solidified by

Trust Machines that recently a massed a warchest of $150M. The

Trust Machines team wants to become the “ConsenSys of Bitcoin”,

which may sound rather ambitious to onlookers. However, it aims to

explore all opportunities brought to the Bitcoin ecosystem, and the

initial focus will shift to the Stacks ecosystem. Statistics-wise,

the network notes a healthy uptake on smart contracts, NFTs, and

other transactions. The coinciding growth of smart contract

deployment and NFT events is to be expected, although there will be

other use cases for these contracts in the future. The Push

Continues Although Stacks has seen tremendous growth since its

launch, there is more work to do. One focal point is introducing

developer incentives. Development for and on Bitcoin will only

advance when more people are interested in exploring the available

opportunities. So together with GSR, OKCoin, and Digital Currency

Group, the Stacks Foundation announced a $165 million incentive

dubbed Bitcoin Odyssey. That fund is designed to provide financial

support for applications and builders who drive Bitcoin adoption.

Another crucial catalyst to consider is how developers achieve

peace of mind when building on Stacks. One of its core benefits is

maintaining a design approach that doesn’t require changes to the

Bitcoin protocol. That also extends to applications getting

“stuck”, as they can resolve those issues quickly and seamlessly.

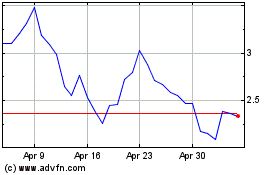

Stacks (COIN:STXUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Stacks (COIN:STXUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024