Coinbase Shows Crypto Market Performing Similar To Other Traditional Markets

July 07 2022 - 4:00PM

NEWSBTC

Crypto coins exhibited exponential growth through the years,

raising attention to the crypto space. There was no correlation

between crypto performance and the conventional stocks of different

commodities. However, all that seems to be fading into thin air

from the recent activities and trends of digital assets. The chief

economist of Coinbase, a crypto exchange, has reported a change in

the risk profile of crypto assets. According to the analysis from

Cesare Fracassi, crypto performance is similar to those of stock

commodities. This means that prices of crypto assets now share the

same trend as stocks like pharmaceutical, oil and gas, tech, etc.

Suggested Reading | Sandbox (SAND) Having A Blast With 12%

Spike In 24 Hours Fracassi gave his observation on July 6 through a

blog post. He stressed the 2020 global pandemic marked the increase

of the correlation between the prices of digital assets and stock.

In his explanation, Fracassi cited that Bitcoin returns gave more

significant proof for the similarities in the trend. According to

his argument, the average BTC returns over the past decade have

shown no correlation to stock market performance. However, the

trend twisted from the onset of the COVID pandemic. In Fracassi’s

analysis, the current market movements are taking along crypto

assets. Hence, cryptocurrency price trends and risk profiles are no

longer separate from the flow within the overall financial system.

Crypto Volatility Shows Similarities to Commodity Stocks In support

of his explanation, Fracassi pointed out Coinbase’s May report

highlighting the volatility trend for BTC and Ether. According to

the monthly insight report, the two leading cryptocurrencies show a

daily swing between 4% and 5%. Such fluctuations indicate

similarities to commodities like natural gas and oil. Suggested

Reading | ATOM Rises To Multi-Week High, Daily RSI Shows

Bullish Pattern Further observation showed that the natural

precious metals gold and silver showed a daily volatility range of

1% to 2%. These values are far lower risk profile than Bitcoin, the

digital gold. Fracassi’s argument stated that digital assets should

receive exposure to macro-economic forces obtainable in the

financial system. He reasoned that such action would move

cryptocurrency since they are correlated to the general system in

risk profiles. The economist analyzed market cap and volatility

with additional comparisons of crypto tokens with commodities. He

linked Ethereum and Lucid (LCID), an electric car manufacturer, and

Moderna (MRNA), a pharmaceutical firm. On the part of Bitcoin, he

linked it to Tesla (TSLA), the electric car manufacturer. The

economist mentioned that the current crypto bear market has

contributed to these similarities. But, according to his analysis,

two-thirds are linked to macro factors like hovering economic

recession and inflation. The other one-third is linked to the

ordinary weakening outlook attributed to cryptocurrency. Some

experts and analysts share the opinion that the role of macro

factors in the declining crypto market is a plus for the industry.

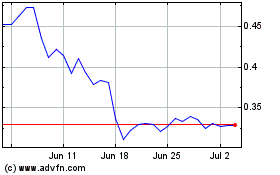

Featured image from BBC, chart from TradingView.com

Sandbox (COIN:SANDUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sandbox (COIN:SANDUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024