Bitcoin Plunge Under $28,000 Only Temporary? This Metric Suggests So

May 09 2023 - 8:30AM

NEWSBTC

Bitcoin has now plunged under the $28,000 level, but the data of an

on-chain indicator may suggest that this drop could only be

temporary. Bitcoin Short-Term Holder SOPR Has Dropped Just Under

The 1 Level As pointed out by an analyst in a CryptoQuant post, the

current values of the metric have generally served as ideal buying

opportunities during rallies in the past. The relevant indicator

here is the “Spent Output Profit Ratio,” which tells us whether the

average Bitcoin investor is selling their coins at a profit or at a

loss right now. When this indicator has a value greater than 1, it

means the profits being realized in the market are currently

greater than the losses. On the other hand, values below this

threshold suggest a dominance of loss-taking from the holders. The

SOPR being exactly equal to 1 naturally corresponds to a neutral

state, where the average holder is just breaking even on their

investment, as profits are equal to losses here. While the SOPR is

generally defined for the entire Bitcoin market, it can also be

applied to specific segments of the market. In the context of the

current discussion, the “short-term holder” (STH) segment is of

interest. Related Reading: Bitcoin To Drop Further? Whales Show

Signs Of Dumping The STHs make up a cohort that includes all

investors who have been holding onto their coins since less than

155 days ago. The STHs who manage to hold beyond this threshold

enter into the “long-term holder” (LTH) group. Now, here is a chart

that shows the trend in the Bitcoin STH SOPR over the last few

years: The value of the metric seems to have seen some decline

recently | Source: CryptoQuant As displayed in the above graph, the

Bitcoin STH SOPR was below the 1 mark during last year’s bear

market, suggesting that the average STH had been selling at a loss

in this period. This is the typical behavior observed in bearish

periods, as the constant price decline makes investors panic and

sell at losses. An interesting pattern that is seen during such

periods is that the line where SOPR attains a value of 1 starts

providing resistance to the asset. The reason this happens is that

at this level, the STHs are selling at the price they bought in.

During bear markets, they usually go into losses, so whenever they

find the opportunity to sell to recoup their original investment,

they jump right on it. This is why the level provides resistance

and forces the indicator to stay under it. Related Reading: Bitcoin

Bull Run In Jeopardy As Parabolic SAR Flips Bearish On Daily Chart

The opposite behavior is seen in price rallies, however, as holders

start looking at the break-even level as a profitable entry point,

which leads to a large amount of buying taking place at the level.

This assures that the indicator quickly returns above the 1 level

if it falls below it. From the chart, it’s visible that the rally

this year has also seen a similar trend so far, as the Bitcoin STH

SOPR has maintained above 1 (besides a temporary drop in March,

which ended up resulting in a sharp surge in the price). In the

last few days, the indicator has again plunged to this level of

much historical significance as the price has slipped under

$28,000. If the past pattern is anything to go by, a rebound could

become more probable for the BTC price here. BTC Price At the time

of writing, Bitcoin is trading around $27,600, down 1% in the last

week. Looks like BTC has sharply dropped in value during the last

few days | Source: BTCUSD on TradingView.com Featured image from

iStock.com, charts from TradingView.com, CryptoQuant.com

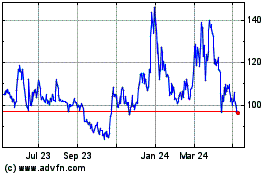

Quant (COIN:QNTUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

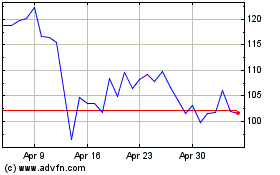

Quant (COIN:QNTUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024