Bitcoin To Drop Further? Whales Show Signs Of Dumping

May 08 2023 - 10:40AM

NEWSBTC

On-chain data shows the Bitcoin exchange whale ratio has spiked

recently, something that could lead to further downside in the

asset’s value. Bitcoin Exchange Whale Ratio Has Sharply Surged

Recently As pointed out by an analyst in a CryptoQuant post, the

exchange whale ratio is currently at its highest level since

September 2019. The “exchange whale ratio” is an indicator that

measures the ratio between the sum of the top 10 inflows to

exchanges and the total exchange inflows. An “exchange inflow” is

any movement of Bitcoin towards the wallets of centralized

exchanges from addresses outside such platforms (like

self-custodial wallets). The top 10 inflows here refer to the 10

largest inflow transactions going towards these platforms.

Generally, these largest transfers are coming from the whales, so

the exchange whale ratio can tell us how the inflow activity of the

whales currently compares with that of the entire market (the total

inflows). When this indicator has a high value, it means these

humongous holders are making up a large part of the total inflows

currently. As one of the main reasons why investors move their

coins to exchanges is for selling-related purposes, this kind of

trend can be a sign that whales are selling right now. On the other

hand, low values of the metric imply this cohort isn’t making too

many inflows relative to the rest of the market. Such a trend can

be either neutral or bullish for the cryptocurrency’s price,

depending on some other market conditions. Now, here is a chart

that shows the trend in the Bitcoin exchange whale ratio over the

last few years: Looks like the value of the metric has been pretty

high in recent days | Source: CryptoQuant As displayed in the above

graph, the Bitcoin exchange whale ratio has observed a pretty large

spike recently. This suggests that whales are making up a rather

large part of the total exchange inflows currently. Related

Reading: Bitcoin Block 788695: The Day Transaction Fees Took The

Crown The metric has crossed the value of 0.8 in this spike,

implying that more than 80% of the inflows are coming from these

humongous investors right now. This level of ratio hasn’t been seen

in the market since way back in 2019. This previous spike of

similar scale occurred as the price was winding down from the April

2019 rally, and shortly after it took place, Bitcoin registered an

extension in its drawdown. An even larger spike in the ratio was

also observed earlier in the same year, around when the

aforementioned April 2019 rally topped out. The timings of these

two spikes may suggest that it was the dumping from the whales that

influenced the market and caused the price to go down. Related

Reading: If Over 2,300 Banks In America Are Bankrupt, Will Bitcoin

Break Above $40,000? If these previous instances of whale inflow

activity of similar levels are anything to go by, then the Bitcoin

price may face a bearish decline in the near term due to the

current potential selling pressure from this cohort. The drawdown

may have possibly also already started, as the cryptocurrency’s

price has taken a dive below the $28,000 mark today. BTC Price At

the time of writing, Bitcoin is trading around $27,900, down 2% in

the last week. BTC has plunged in the past day | Source: BTCUSD on

TradingView Featured image from Thomas Lipke on Unsplash.com,

charts from TradingView.com, CryptoQuant.com

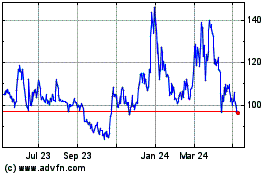

Quant (COIN:QNTUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

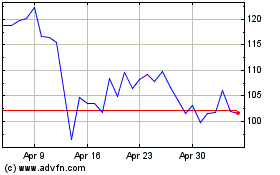

Quant (COIN:QNTUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024