Bitcoin Faces Potential Price Drop To $25,000, On-Chain Data Signals Bearish Trend

May 01 2023 - 1:30PM

NEWSBTC

Bitcoin (BTC) has been experiencing a volatile price action since

late April, with significant fluctuations in its value. At the time

of writing, the cryptocurrency has experienced a 3% decline in the

last 24 hours and is currently trading at $28,400. However, it has

now settled within an accumulation range of $27,800 to $30,000.

Related Reading: Shiba Inu Community Destroys 3.26 Billion SHIB in

April Amid Price Decline Bitcoin Bulls Take Caution BaroVirtual

from Cryptoquant recently shared his analysis regarding the

potential downside targets for Bitcoin. According to the analyst,

the bearish divergence of the BTC: On-Chain Summation Index

suggests a target of approximately $27.200. A Head and Shoulders

(H&S) pattern also indicates a lower range target of $25,000.

The BTC on-Chain Summation Index is a metric that tracks the number

of Bitcoin being transferred on the blockchain. When the index

shows a bearish divergence, it suggests a decrease in the amount of

Bitcoin being transferred, which could lead to a decline in price.

On the same note, Binance, one of the world’s largest

cryptocurrency exchanges, received its largest single Bitcoin

deposit in the past week. The deposit, made to an address that had

remained inactive for four months, came from five separate

addresses and totaled over 1,200 BTC, worth over $35M at current

market prices. Arkham, a blockchain analytics firm that tracks

cryptocurrency transactions, reported the news. The firm noted that

the deposit was made in a single transaction and that the funds

were sent to a previously unused deposit address. Will this

translate into an extension of the bearish momentum? It remains to

be seen. Moreover, according to Material Indicators, a crypto

analytics firm, the recent Bitcoin monthly candle close/open has

signaled a potential short-term price correction for the

cryptocurrency. The firm’s Trend Precognition A2+ algo flashed a

short signal, indicating a potential decline in Bitcoin’s price, as

seen in the chart below. However, according to Material

Indicators, the signal is tentative until the candle closes, and a

pump above the April high could invalidate it. Additionally,

Wednesday’s upcoming U.S. Federal Open Market Committee (FOMC)

Federal Reserve interest rate decision could catalyze a significant

price move in either direction. If the Federal Reserve raises

interest rates by 25 basis points, it could lead to a stronger US

dollar and put downward pressure on Bitcoin’s price. However,

continuing to pause or maintain current rates could boost investor

confidence and lead to a price increase for the cryptocurrency.

Although the potential downside targets predicted for BTC, evidence

suggests that the $27,000 mark could support the cryptocurrency and

push back the bears. This level has already demonstrated its

resilience as a support floor, holding up well against significant

selling pressure since April 21st. Related Reading: Chainlink

(LINK) Price Falls Below $7, Are The Bears Back In Control?

Featured image from Unsplash, chart from TradingView.com

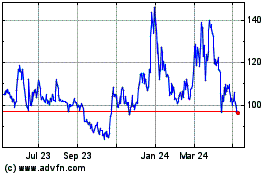

Quant (COIN:QNTUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

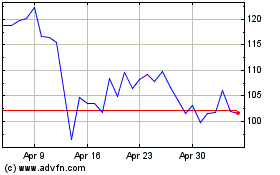

Quant (COIN:QNTUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024