Bitcoin ‘ESR’ Continues To Show Bullish Divergence, Will Price Follow?

April 24 2023 - 1:30PM

NEWSBTC

Bitcoin on-chain indicator Exchange Stablecoin Ratio (ESR) has

continued to show bullish divergence recently. Will the price also

mimic this? Bitcoin ESR Has Continued To Sharply Ascend In Recent

Weeks As explained by an analyst in a CryptoQuant post, the ESR is

currently acting as a leading indicator for BTC’s price. A relevant

metric here is the “exchange reserve,” which measures the total

amount of a cryptocurrency that’s currently sitting in the wallets

of all centralized exchanges. The “ESR” is an indicator that tells

us about the ratio between the exchange reserve for Bitcoin and

that for the combined stablecoins market (both denominated in USD).

Generally, investors shift assets like BTC into stables whenever

they want to escape the volatility associated with the former. When

holders like these eventually want to switch back into the volatile

markets, they deposit their stablecoins into exchanges to do so.

The coins they exchange their stables for naturally feel a buying

pressure from the conversion. Because of this reason, the

stablecoin exchange reserve may be looked at as the “available

buying power” for other cryptocurrencies like BTC. Related Reading:

What’s Behind The Recent Bitcoin Drop? Here’s What On-Chain Data

Says The exchange reserve for Bitcoin itself, however, represents

the selling supply in the market, as investors generally deposit

their BTC into these platforms for selling purposes. Now, here is a

chart that shows the trend in the BTC ESR over the last year: Looks

like the value of the metric has rapidly risen in recent weeks |

Source: CryptoQuant According to the quant, the Bitcoin price and

ESR were showing convergence during the year 2021, meaning that the

two curves were moving in close tandem. This convergence continued

in early 2022, as the chart above displays. However, the

convergence broke with the 3AC bankruptcy in June of that year, as

the price of the asset plummeted, but the ESR didn’t register any

significant fluctuations at all. In late 2022, a positive

divergence started forming between the two lines, as the ESR began

to climb while Bitcoin continued to move sideways around the

post-FTX crash lows. In January of this year, the BTC price also

finally started following in the direction of the indicator, as it

began its rally. The ESR has continued to sharply climb since then,

while BTC has also generally observed strong upwards momentum. An

interesting trend was seen back at the beginning of March when the

ESR had taken a plunge. Not too long after this drawdown in the

indicator occurred, the BTC price also plummeted down. Related

Reading: Bitcoin Market Update: Is $27,000 The Local Bottom? But

while this decline in the price was happening, the metric had

already reversed back to an uptrend. As it turned out, the

cryptocurrency also did the same after finishing its drop. “In the

current market structure, ESR acts as a magnet to Bitcoin’s spot

price,” explains the analyst. Earlier this month, the ESR again

observed some decline, but it wasn’t long before the metric

reversed its trend and resumed the upward trajectory. Recently, BTC

has also been plunging, as its price has now gone below the $28,000

level. If the pattern that followed earlier is anything to go by,

this divergence between the two lines should mean that BTC will

also reverse its current decline, in order to mimic what the ESR

has been doing. BTC Price At the time of writing, Bitcoin is

trading around $27,600, down 6% in the last week. BTC has plunged

in the last few days | Source: BTCUSD on TradingView Featured image

from Kanchanara on Unsplash.com, charts from TradingView.com,

CryptoQuant.com

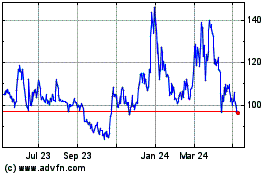

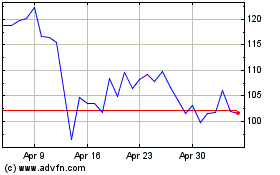

Quant (COIN:QNTUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Quant (COIN:QNTUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024