Polkadot (DOT) Price Slumps Below $6 – Any Chances For Reversal?

April 22 2023 - 10:43PM

NEWSBTC

The price of Polkadot (DOT) has been gradually moving south over

the past few days. The price decline cuts across the entire crypto

market, with strong signs of bears. The cumulative market cap has

dropped by 2.58% to sit at $1.25 trillion in 24 hours. Related

Reading: OKB Token Shines With 23% Gains On Weekly Chart, What’s

Pushing It? DOT has finally lost its grip on the $6 region as the

bears became aggressive on the token over the past 24 hours. The

market is wondering if Polkadot still has a chance to reverse the

downtrend. Polkadot Price Drops Drastically With Prevailing Bearish

Trend The past few days seem to be turning out more

negatively for DOT. The asset hovered between $6.1 and $6.9 last

week except on April 21, when it dipped. Currently, the

60-day and 90-day price action for Polkadot shows negative values

of 4.45% and 5.36%, respectively. Also, DOT dipped by 12.46% over

the past 7 days. Related Reading: These Top 5 Cryptos Are Thriving

Despite A Slippery Market After losing its hold on the price level

of $7 in February, DOT has maintained a trading price within the $6

region. As of April 21, the price of DOT dropped to its resistance

point of $5.8 before correcting. However, the price analysis

of DOT for the past 24 hours shows the token is gradually going

down again within the past few hours. At the time of writing,

DOT is trading at $5.921, indicating a slight reversal after

plunging. The bearish push on DOT from the past few days has

spilled over to the weekend. The crypto market is undergoing a

bearish trend, with most crypto assets battling for price

stability. Polkadot is included in the market performance. Hence,

the selling pressure for the token has exceeded its buying

pressure, forcing the price of DOT below the $6 region. Bears Push

DOT Below $6 After three consecutive red days, DOT has formed a

green candle on the price chart. However, the bears are still in

control as they struggle to reclaim past price levels. DOT

has dropped below its 50-day and 200-day Simple Moving Averages

(SMA), indicating a bearish sentiment in the short and long term.

DOT’s support levels are $5.15 and $5.75. A decline below its

support will bring further price fall. Also, the resistance levels

are $6.71 and $7.89. However, the $6 price level has transformed

into a psychological resistance level. The Relative Strength Index

(RSI) indicator is 39.74, close to the oversold region of 30.

However, the indicator points upwards, suggesting a bullish

reversal in the short term. DOT’s indicators are mostly bearish.

Its next price action depends on traders’ decisions in the coming

weeks. Further drop into the oversold region will likely lead to a

trend reversal at the $5.75 support level. Featured image from

Pixabay and chart from Tradingview

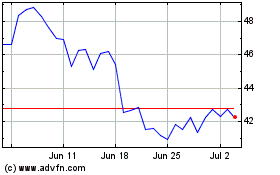

OKB (COIN:OKBUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

OKB (COIN:OKBUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024