Bitcoin (BTC) Drops Below $18,000 – What Can Stave Off The Selloff?

June 19 2022 - 2:50AM

NEWSBTC

Bitcoin further sank to about $17,750 for the first time since

December 2020 Saturday afternoon, as the selloff in the crypto

market intensifies. Bitcoin’s price is still falling steadily and

is currently testing the 2017 all-time high range of $17,000 to

$20,000. However, the descent shows no indication of abating, and

analysts are are not quite sure to call a bottom at this

time. The following hour, Ethereum followed suit and went below

$1,000. These numbers were feared as crucial support levels for the

top two coins by market capitalization. Suggested Reading | Ether

Drops Below $1K, Dragged Down By BTC Slide – What’s The Next ETH

Support? The next several days could be crucial for Bitcoin,

as a failure to establish support at this position could lead to a

further market decline into the $15,000 mark. Alternatively, if the

price recovers from the current region, the $24,000 level would be

the first hurdle before the key $30, 000 resistance and the 50-day

moving average. The current Crypto Winter differs from 2018 in that

cryptocurrencies are falling alongside tech stocks as the broader

economy is fragile, inflation is soaring, and a full-scale

recession appears impending. This year's Crypto Winter is different

from last year's because cryptocurrencies and tech stocks are both

in decline. Image: CNBC. During the past week, the price of Bitcoin

fell by more than 30 percent, and the market is arguably suffering

maximum anxiety. A significant amount of coins that have been

purchased and held over the past two years are being put into

exchanges, as indicated by exchange inflows. On Friday, Antoni

Trenchev, the founder of cryptocurrency lender Nexo, stated on

Bloomberg that the current slump “reminds me of the 1907 bank

panic.” Saturday, Kraken’s director of growth marketing and Bitcoin

influencer Dan Held warned, “We are on the path of maximal pain.”

Bitcoin’s decline occurred over the course of several months, and

was hastened in recent weeks by the collapse of two major

cryptocurrency projects, Terra-Luna and Celsius, which further

sowed worries about the market’s durability. BTC total market cap

at $350 billion on the weekend chart | Source: TradingView.com

Pressure from macroeconomic factors, such as growing inflation and

a series of interest rate hikes by the Federal Reserve, also

contributes to the calamity on the cryptocurrency market. Market

observers have also been keeping a close eye on top-tier

cryptocurrencies as they track equities lower. It doesn’t help that

crypto companies are issuing the pink slips and rendering a large

number of people jobless, and that some of the industry’s most

recognizable brands are facing solvency breakdowns. Meanwhile,

recent data from the analytics website Glassnode indicates that the

revenue generated by Bitcoin miners has continued to decline. With

rising mining expenses and a deteriorating macroeconomic

environment, miners are now less motivated and profitable.

Suggested Reading | Bitcoin Breaches $19K Level – Will Selloff

Continue? What’s The Next Bottom? Featured image from Domestika,

chart from TradingView.com

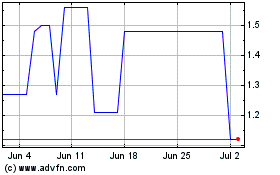

Nexo (COIN:NEXOUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nexo (COIN:NEXOUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024