Price Of Bitcoin Retreats Under $42,000 As Enthusiasm From Miami Event Fizzles

April 11 2022 - 8:12AM

NEWSBTC

The price of Bitcoin failed to break through the $43,500 resistance

zone and fell below the $42,000 mark before changing course. The

world’s most valuable cryptocurrency is now exhibiting bearish

characteristics and remains vulnerable to a move towards $40,500,

multiple charts show. Bitcoin dipped below the $42K level for the

first time since March 22, returning to the range in which it has

traded this year, owing to increased anxieties about mounting

interest rates. Suggested Reading | Bitcoin And Ether Up As BTC

Whales Get Busy Acquiring New Supply From Sellers Bitcoin

Backpedals For 6th Straight Day The most popular cryptocurrency

plummeted to $41,818 on Monday morning in Asia, backpedaling for

the sixth day in a row. Since late March, when it peaked just above

$48K, BTC – and other tokens – have been dragged lower by concerns

about restrictive monetary policy. The cryptocurrency market was

trading sideways Monday. Bitcoin and Ethereum were both down in the

early hours, while altcoins experienced a strong decline. Global

unrest intensifying as a result of Russia’s invasion on Ukraine,

combined with economic uncertainty, is pushing markets into a

tailspin. Other major risks for the digital sector include rising

prices and interest rate hikes. Ascent Wanes After Miami Conference

The excitement generated by last week’s Bitcoin 2022 conference in

Miami was insufficient to halt the trend. Antoni Trenchev, managing

partner of cryptocurrency lender Nexo, noted in an emailed

statement: “Now that the sugar rush associated with Bitcoin 2022

has passed, Tuesday’s (likely) dismal US consumer price report

serves as a reminder that the central bank is caught between a rock

and a hard place when it comes to addressing uncontrolled inflation

without imploding the economy.” BTC total market cap at $785.54

billion on the weekend chart | Source: TradingView.com Bitcoin has

spent the majority of the year trading in a region of roughly

$35,000 to $45,000. Last month’s burst above $48,000 briefly

reversed the token’s year-to-date losses, but BTC encountered

resistance at its 200-day moving average. Suggested Reading |

What’s Next For Bitcoin As Prices Encounter Difficulty Reclaiming

$43,000? BTC Market Cap Down The world’s cryptocurrency market

capitalization has decreased to $1.93 trillion, down as much as 3%

in the last 24 hours. However, the overall volume of cryptocurrency

trade surged by more than 15% to $63.91 billion. Expectations of

tighter monetary policy have weighed on demand for riskier assets

like cryptocurrencies and technology stocks, which are increasingly

moving in lockstep. Other popular cryptocurrencies also fell on

Monday, with Polkadot falling 8.7 percent and Ether falling 4.6

percent. Meanwhile, as Bitcoin grows in maturity and use, its price

becomes increasingly associated with the pricing of traditional

assets such as equities. This rising link implies that any

occurrence that results in price reductions in traditional markets

will almost certainly result in comparable or bigger price declines

in Bitcoin. Featured image from Medium, chart from TradingView.com

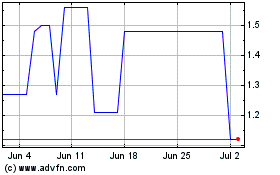

Nexo (COIN:NEXOUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nexo (COIN:NEXOUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024