LUNA Hits ATH After Astroport’s Deployment, Why Terra Could Continue Growing In 2022

December 21 2021 - 5:00PM

NEWSBTC

Maybe one of the best-performing assets in 2021, LUNA has been

trending against the market for the past 2 weeks. While Bitcoin,

Ethereum, and other major cryptocurrencies remained rangebound, the

native token for the Terra ecosystem re-entered uncharted

territories. Related Reading | Terra Begins LUNA Burning, Why It

Could Target $140 As of press time, LUNA trades at $87 coming in

from a monthly low at $38 which represents almost a 40% increase

over that period. As reported by NewsBTC, Terra deployed several

improvements on its mainnet in the past months. These included

Colombus-5, Wormhole v2, and an Inter-Blockchain Communication

(IBC) protocol. The first of these upgrades could be the fuel that

has triggered LUNA’s rally as it implemented a burning mechanism

into the network. Effectively, this upgrade has turned LUNA into a

deflationary asset that will continue to see buying pressure into

the future. Per a report by Delphi Digital, the Terra ecosystem has

also benefited from the deployment of Astroport, an Automated

Market Maker (AMM). The protocol is yet in an early phase but has

already seen over $1 billion in capital inflows. This capital

injection into Terra’s ecosystem coincides with LUNA’s rally which

goes to show the importance of adoption for this token’s

performance. Delphi Digital said: LUNA price notched another ATH

today before retracing lower. The price increase over the last few

days was likely triggered by investors buying spot LUNA to lock up

in the Astroport lockdrop, then hedging their position via

perpetual futures to remain delta neutral. As the chart also shows,

LUNA has the right ingredients to continue its rally: reaching

price discovery on negative funding rates for the derivatives

sector, which suggests speculators expected more downside in a

short time. It remains to be seen if the trend will be able to hold

in 2022. Terra (LUNA) And Its Potential To Take Over 2022 LUNA’s

ecosystem has displayed strength in other sectors. The network’s

native stablecoin UST has been gaining more adoption and could

potentially disrupt this sector of the crypto market. Delphi

Digital records an increase in market capitalization for UST since

December 15th. This stablecoin has been in a close fight with DAI,

one of Ethereum’s most prominent assets, as seen below. Delphi

Digital added: UST and DAI have been neck-and-neck in terms of

market capitalization, with UST briefly overtaking DAI as the 4th

largest stablecoin last week. Yesterday, UST overtook DAI more

decisively as it had been trading higher for at least the last 24

hours. Related Reading | LUNA Outperforms Bitcoin’s Rally, Why It’s

Ready For Massive Gains Christmas is still some days away, but

December has already proven itself as one of LUNA and Terra’s most

important months in 2021. With solid fundamentals, this network

seems poised to continue its upwards trend in the near future.

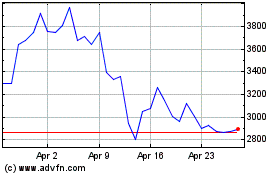

Maker (COIN:MKRUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

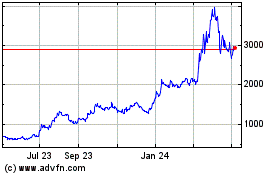

Maker (COIN:MKRUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024