More Dip To Come: Bitcoin Liquidity On The Move Ahead Of Major Event

May 03 2023 - 1:00PM

NEWSBTC

As the Federal Reserve (Fed) prepares to announce its decision on

interest rates, Material Indicators, a research and analysis firm

in the cryptocurrency market, is keeping a close eye on the Bitcoin

(BTC) liquidity movements. FireCharts, a popular charting platform,

has tracked liquidity movements on the BTC/USDT Binance order book.

Their observations have led them to believe that the recent dip in

Bitcoin’s price may extend. Liquidity refers to the amount of

Bitcoin available for trading at a given price level. When there is

a large amount of liquidity at a particular price level, traders

can easily buy or sell Bitcoin at that price without significantly

affecting the market. However, low liquidity at a certain price

level can lead to volatility spikes as traders scramble to buy or

sell the asset. Related Reading: Polygon (MATIC) Price Shows

Vigor, Are Bulls Up To Something? Will Bitcoin Face Another Dip

Material Indicator’s FireCharts analysis shows that liquidity in

the Bitcoin order book has been moving ahead of the Federal

Reserve’s decision, indicating that traders are preparing for

potential volatility in the market. This could lead to further

price drops if liquidity to the upside declines. Added to the

above, according to Kaiko, a leading cryptocurrency market data

provider, liquidity in Bitcoin and Ethereum continues to

deteriorate, with market depth for both cryptocurrencies

approaching one-year lows, which could have significant

implications for bulls, as low liquidity can lead to increased

volatility and price instability. As of writing, the price of

Bitcoin stands at $28,300, representing a 1.4% decline over the

past 24 hours. Despite the recent news of more bank failures, which

briefly pushed the price above $29,000, Bitcoin has remained within

its established trading range of $27,800 to $28,600. The attempt to

exceed the $29,000 mark was unsuccessful, and the price has since

retraced to its current level. The market remains in flux as

investors monitor the ongoing price movements, waiting for a clear

direction to emerge after the Federal Open Market Committee

meeting. But will this lead to more retracement, or will the market

react positively to the news? BTC Braces For Potential Impact Of

Federal Reserve’s Rate Hike The Federal Reserve’s latest measures

on employment and wages suggest that more rate hikes may be on the

horizon. This comes after the key labor costs metric for the first

quarter came in higher than expected. One of the Fed’s preferred

inflation gauges, the Personal Consumption Expenditure (PCE) index,

remains persistently high. Furthermore, according to the

latest report by Bitfinex, a leading cryptocurrency exchange, the

labor costs metric for the first quarter came in hotter than

expected, indicating that wages are rising faster than anticipated.

This could lead to higher inflation, as companies may pass higher

labor costs to consumers through higher prices. This suggests that

the Federal Reserve may need to raise interest rates to manage

inflation and maintain price stability. The Fed has already

signaled that it may raise rates in May, and these latest measures

on employment and wages reinforce that decision. The implications

of a rate hike are significant for the financial markets, including

the cryptocurrency market. A rate hike could increase volatility

and uncertainty as investors adjust their expectations for future

economic growth and earnings. However, it could also lead to a

stronger dollar and increased demand for safe-haven assets like

gold and Bitcoin. Related Reading: $24,400 May Be Next Major Level

Of Support For Bitcoin, Here’s Why Featured image from iStock,

chart from TradingView.com

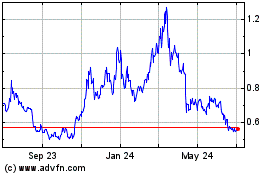

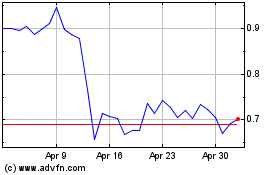

Polygon (COIN:MATICUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Polygon (COIN:MATICUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024