How The Davos Protocol Is Transforming Staking on Polygon

March 29 2023 - 6:29AM

NEWSBTC

In this interview, Varun Satyam — CEO and Co-founder of Davos

Protocol, explains how their stable asset ecosystem enhances

capital efficiency through the innovative application of liquid

staking for the benefit of its community. Q: What can you tell us

about the Davos Protocol? What are your vision and objective? A:

Davos Protocol is an innovative DeFi ecosystem that aims to

establish itself as a leading lending and borrowing protocol on the

Polygon Network, providing users with a more capital-efficient

version of MakerDAO. On Davos, users will be able to borrow the

DAVOS Stable Asset by staking MATIC as collateral. The platform

uses a combination of over-collateralization and liquid staking to

solve the widely discussed “Stablecoin trilemma” from the

capital-efficiency perspective without compromising on

decentralization. With Davos Protocol, our vision is to provide

real and sustainable yield streams to users by using liquid

staking. The largest source of crypto yield from Proof-of-Stake

(PoS), by leveraging liquid staking, the rewards from PoS are

accessible and extractable in DeFi, allowing Davos to extract yield

from a volatile asset and transfer it into a Stable Asset (DAVOS).

The underlying assumption is that people are more attracted to the

yield on a stable asset than the yield on a volatile asset.

Ultimately, Davos Protocol intends to provide the market with a

reference rate for stablecoins, marking a shift away from previous

Collateralized-Debt-Positions (CDPs) that prioritize cheaper

borrowing but do little to contribute to the yield of stablecoins.

By providing a reference rate, the Davos Protocol may become an

essential part of the DeFi ecosystem, providing both real and

sustainable yields to users while contributing to the overall

stability of the market. DAVOS is a new stable asset that offers

new channels for revenue generation and wealth preservation, making

it an exciting development in the DeFi space. Q: We know the Davos

Protocol launched the first liquid staking product on top of

Polygon; what is liquid staking, and how is it different from

regular staking? A: Proof-of-Stake (PoS) networks offer an

opportunity for token holders to lock up their tokens and use their

weight to validate transactions, earning attractive returns for

their participation. However, traditional staking has a significant

drawback as it renders the tokens illiquid, meaning that they

cannot be transacted, traded, or used as collateral. To solve this

problem, liquid staking provides a solution that enables users to

receive a token that represents their staked amount and rewards

earned, which can be used as collateral or traded elsewhere. Liquid

staking remedies the liquidity challenges faced by traditional

staking – by offering users timely access to funds, alternative

strategies, yield stacking, and exposure to crypto-backed loans

while generating a passive income in the background. With this

approach, users can maximize their earning potential while enjoying

the best of both worlds, earning rewards for staking and yield

generation activities in the DeFi space. Q: Can you give us a brief

description of the mechanism behind your liquid staking model? How

does it work? A: Davos Protocol has implemented a clever strategy

on top of the MakerDAO architecture to maximize the returns on

deposited collateral while minimizing risk. This is achieved by

taking advantage of liquid staking, which involves staking the

collateral, generating a reward-bearing token, and then converting

the resulting yield. Hence, instead of your collateral remaining

idle, the protocol stakes it, thereby putting capital to work for

you. To execute this strategy, the protocol uses a yield converter

to split the yield from the principal amount in the form of

deposited collateral. It allows the protocol to extract rewards on

a weekly basis, which is sent to the Davos Revenue Pool. In

addition to the liquid staking rewards, the pool also receives

borrowing interest generated by the protocol. The use of the

low-risk MATIC liquid staking strategy allows Davos Protocol to

become a high-yield generating protocol where it is able to

accumulate a large amount of combined revenue from liquid staking

and borrowing interest, which is then distributed among stakers and

liquidity providers respectively. As a result, Davos is able to

generate both real and attractive returns for its users. Q: Are

there any compromises in terms of security or decentralization? Why

should someone put their money into your product and not a

competitor? A: Fundamentally, the objective of Davos is to attract

stablecoin investors, who are the largest contributor of TVL in

DeFi by leveraging liquid staking on staked assets to generate a

sustainable and real yield on a Stable Asset (DAVOS). Our focus is

on providing greater capital efficiency at minimal risk by

combining the fully redeemable DAVOS Stable Asset with a strategy

to generate yield against MATIC collateral via liquid staking. As a

decentralized, unbiased, over-collateralized cryptocurrency, DAVOS

is able to avoid slashing and the lockup of user tokens, which

should attract more investors in the long term. We’re continuously

striving to guarantee low-risk and attractive yields without

impermanent loss or market risk. This will remain a fundamental

pillar of Davos Protocol’s search for capital efficiency, allowing

us to resolve the shortcomings associated with stablecoins.

Furthermore, our development team has a deep understanding of the

security needs and requirements of a protocol like ours. With a

focus on secure and transparent code, we are dedicated to providing

our users with a stable and secure platform for yield generation.

Our team’s commitment to security is reflected in our audits

(Veridise and Quantstamp), and the fact that we are continually

seeking out opportunities for further assessments (3rd audit

scheduled for Q2) to ensure the highest level of security for our

users. Q: In addition to traditional staking rewards, what are the

benefits for users leveraging Davos’ product? A: Davos Protocol has

positioned itself in an attractive corner of the market by learning

from the success of UST on Terra and addressing the fundamental

flaws in their mechanisms. The platform recognizes that investors

desire attractive and sustainable returns to be easily accessible

without the need for complex yield farming or DeFi participation.

To meet the needs of both DeFi experts and retail users, Davos

offers a range of options that cater to their investment appetites.

For the more experienced DeFi users, Davos will provide various

opportunities to generate returns through yield farming, arbitrage

and boosted vaults. Additionally, once the DGT (Davos Governance

Token) is released, users will be able to participate in gauge

weight voting related to liquidity gauges and borrowing gauges.

Furthermore, the DGT token will allow users to have a say in the

platform’s governance and monetary policy-related decision-making

processes. These options provide experienced DeFi users with the

possibility to receive returns ranging from 12-24% APY, making it a

lucrative option for those looking for attractive earning potential

on DeFi ecosystems through active participation. For retail

investors, Davos Protocol offers a simple and hassle-free way to

potentially earn a yearly APY of 7-9% by purchasing and staking

DAVOS on the platform. This provides a sustainable and predictable

return on investment without the need for active involvement in the

DeFi ecosystem. Moreover, Davos plans to be integrated with certain

centralized exchanges (CEXs) that will offer their user base a

non-custodial staking solution. This will enable retail investors

to stake their DAVOS tokens directly on CEXs, thereby making it

even easier for them to earn a stable return on their investment.

By offering a non-custodial staking solution, Davos Protocol allows

investors to retain full control over their funds, thereby

providing an added layer of security. This feature is likely to

appeal to retail investors who are new to DeFi and may be hesitant

to use decentralized solutions. By providing a range of options

that caters to the needs of both veteran DeFi users and retail

investors, Davos Protocol has positioned itself as a versatile

platform that can meet the needs of a diverse range of investors.

We believe this is an important factor that can attract a larger

user base by providing investors with sustainable and attractive

returns accompanied by simplicity. Q: Why should a user transition

from a traditional staking model to a liquid staking model? What

are the main advantages? A: Liquid Staking offers a unique

opportunity to bridge the gap between staking and DeFi, enabling

users to benefit from both. It unlocks the potential of PoS as a

significant source of crypto yield while providing liquidity to use

staked assets in DeFi projects during the lock-up period. This not

only increases yields for users but also promotes staking

participation, strengthening the network and the crypto ecosystem

as a whole. Davos Protocol recognizes liquid staking as DeFi in its

purest form, providing users with the best of both worlds. Davos

just takes it one step further by offering users a stable asset

that can leverage liquid staking and over-collateralization to

allow for the generation of real and sustainable returns on the

Stable Asset DAVOS. Q: Besides the first liquid staking product on

Polygon, there are reports of Davos launching a stablecoin on this

network. What can you tell us about it? Are stablecoins necessary

for the long-term adoption of DeFi? A: DAVOS cannot be considered a

stablecoin since the goal of DAVOS is not to hold an absolute peg

to the U.S. Dollar or any other fiduciary currency. It is a stable

asset that aims for high price stability over an absolute peg. We

have achieved this by applying a monetary policy in governing Davos

Protocol to distribute the bulk of its income to DAVOS

stakeholders. Currently, DAVOS Stable Assets are backed by the

capital-efficient Collateralized Debt Position (CDP) of Davos

Protocol. We see this changing in the future with the protocol

extending its support to major PoS chains, enabling the use of

their native assets as collateral. Q: Finally, what is your vision

for the future of DeFi and Decentralized Applications? Liquid

staking is innovative, but do you see it becoming the standard for

other platforms? What is the Davos Protocol’s contribution to the

crypto space in this context? A: Liquid staking is an innovative

feature in DeFi that allows users to free up their tokens from

their contracts and profit from them. This means users are not

required to maintain a long lockup period, a feature typically

associated with crypto staking. It also enables users to earn

passive income from their funds while accessing the capital

markets. PoS networks require users to stake their assets to secure

the network. When the first networks emerged, their native tokens

had limited functionality. The best option for users was to stake

their assets to the network’s validators. But with the emergence of

DeFi, the share of assets that users own has decreased. This is

because the newer models of economic activity related to farming

and lending have increased the efficiency of these assets, allowing

users to extract more value from fewer assets. Davos functions as a

layer-2 smart contract platform that’s Polygon-compatible and

optimized for DeFi with built-in liquidity and ready-made financial

applications. Furthermore, Davos’ open-source nature allows other

DeFi projects to build on top of the protocol. The protocol’s

product layer is just as decentralized as its smart contracts, thus

creating more incentives for frontends to grow the Davos ecosystem

and provide unique tools for users.

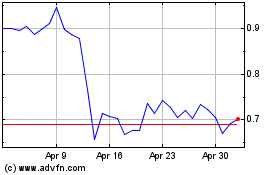

Polygon (COIN:MATICUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

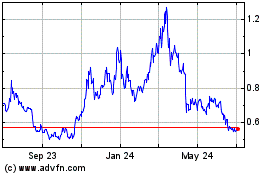

Polygon (COIN:MATICUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024