Bitcoin Price: Can Cyclical Tools Predict The Next Bubble? | BTCUSD November 7, 2022

November 07 2022 - 3:42PM

NEWSBTC

In this episode of NewsBTC’s daily technical analysis videos, we

examine major Bitcoin price troughs with Hurst Cycle Theory and

cyclical tools to consider if the bottom could be in and if another

bubble is coming. Take a look at the video below: VIDEO: Bitcoin

Price Analysis (BTCUSD): November 7, 2022 In this video, we use

Hurst Cycle Theory and its several key principles to go through the

process of phasing out Bitcoin market cycles to predict when the

cryptocurrency will begin to rise again. Cycle analysis consists of

visual analysis, using a spectrogram, phasing the dominant cycle,

phasing any internal wave harmonics, then completing the phasing

process on the chart. Here is a closer look at that process:

Related Reading: MATIC On The Move After Polygon Tapped By META |

MATICUSD November 3, 2022 Bitcoin Cyclical Behavior Analyzed To

assist with the visual analysis, each Bitcoin halving has been

included. The halving has been a widely-discussed driver of

internal supply and demand mechanics. We know that Bitcoin bottoms

out visually prior to each halving. The log growth curve has also

been included for visual assistance. The next step is to turn on a

spectrogram. A spectrogram is a visual heatmap of the spectrum of

frequencies of a signal as it varies with time. The more green

heat, the stronger the bullish intensity. In contrast, the

more purple heat on the map, the stronger the bearish intensity is

and that’s where we would look for a cyclical bottom. Within each

purple zone we would find our cyclical trough for dominant cycle

phasing. Is a new Bitcoin cycle about to begin? | Source: BTCUSD on

TradingView.com Related Reading: Litecoin Recovery To End Ongoing

Crypto Darkness? LTCUSD November 2, 2022 Why This Bear Market Felt

So Extreme The next step would be to confirm the dominant cycle by

phasing out any harmonics. According to Hurst Cycle Theory,

harmonics in cycles come in twos and threes. Essentially, from each

major trough to trough, there should be one to two mid-cycle

dips. Not only does defining the mid-cycle harmonics assist

in confirming dominant cycle phasing, but it does also help prove

Hurst cycle theory to be accurate. Notice that cyclical troughs

tend to bottom in tandem, while the principle of summation explains

why the recent selloff felt so long and extreme – it was the sum of

a larger composite wave and a smaller harmonic wave combined. Each

correction was in near-perfect harmony | Source: BTCUSD on

TradingView.com Related Reading: Bitcoin And The Dollar Reach

Inverse Inflection Points | BTCUSD November 1, 2022 Why BTC Is

Gearing Up For Another Bubble Cycle The final step is completing

the phasing. For added confirmation, the Fisher Transform is used,

which helps to pinpoint precise turning points in markets, as well

as the Stochastic RSI. In this system, the Fisher Transform

highlights the potential turning point, while the Stoch RSI rising

from oversold levels confirms the new bull run. Is this the turning

point in the bear market? | Source: BTCUSD on TradingView.com A

Comparison With The Last Crypto Market Bottom Considering the

potential of a bottom in this area, it is worth examining past

bottom behavior. Comparing the current Adam and Eve bottom setup to

the 2018 bear market bottom is strikingly similar, albeit on a much

grander scale. When compared using the three-day timeframe and a

set of three slow, moderate, and fast moving averages, the fractal

could take Bitcoin price to around $100,000 per coin by the end of

Q1 2023. Will BTC close 2022 headed towards new highs? | Source:

BTCUSD on TradingView.com Learn crypto technical analysis yourself

with the NewsBTC Trading Course. Click here to access the free

educational program. Follow @TonySpilotroBTC on Twitter or

join the TonyTradesBTC Telegram for exclusive daily market

insights and technical analysis education. Please note: Content

is educational and should not be considered investment

advice. Featured image from iStockPhoto, Charts from TradingView.co

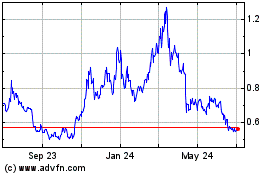

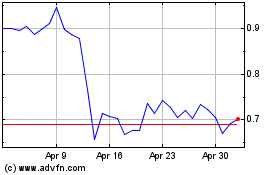

Polygon (COIN:MATICUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Polygon (COIN:MATICUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024