Bitcoin Is Crashing, But Why Are Transactions At New All-Time Highs

May 01 2023 - 5:30PM

NEWSBTC

In a day when Bitcoin prices are crashing, posting worrying drops

from April 2023 peaks, the underlying network is processing record

transactions. Bitcoin Prices Dropping, But Why? Dune Analytics data

on May 1 shows that the platform is processing record transactions

which, if going by historical performance, would typically point to

demand. In a normal scenario, this demand could translate to buying

pressure. However, as seen in the chart below, the spike in the

activity on the Bitcoin network is attributed to the non-fungible

token (NFT) collection “Ordinals.” The demand for these assets has

interfered with the normal on-chain dynamics. We can see a shift in

preference as it relates to inscription types. Image Inscriptions 🟧

dominated until very recently, but have been surpassed by text

based 🟦. Over 2.39M Inscriptions have been added to the #Bitcoin

ledger, adding 9.3GB in data, and paying 212 $BTC in fees.

pic.twitter.com/KZPy074WoP — glassnode (@glassnode) April 30, 2023

In that sense, despite the high block demand, BTC prices are down

4% in the past 24 hours, crashing 10% from April 2023 peaks, and

are likely to clear critical support levels

immediately. Notably, sellers have quickly reversed the gains

of April 27. Related Reading: Bitcoin Bearish Signal: Miners

Continue To Sell While Bitcoin prices remain under pressure when

writing, the coin is within a broader trade range. Key reaction

points remain at $31,000 on the upper hand, a level flashing with

April 2023 peaks, and $26.5k on the lower end, a support level

marking the 38.2% Fibonacci retracement level of the March to April

trade range. Moreover, from mid-March 2023, BTC rallied

approximately 60%, floating higher as the financial markets feared

another meltdown in the United States banking sector. Silicon

Valley Bank (SVB) experienced a bank run in March while two more

crypto-centric banks, including Signature Bank, closed shop. High

On Chain Activity, A New Normal For BTC? Bitcoin prices are now

cooling off, looking at the performance in the daily chart. This is

despite positive news based on blockchain activity. According

to Dune Analytics, the Bitcoin network has processed more

transactions than any other day since launching 14 years ago. On

May 1, on-chain data showed that the platform processed 568,300

transactions, 78,000 more than it processed at the peaks of the

2017 Bull Run. Even though activity has exploded, an analysis of

the chunk of transactions processed revealed that over 50%, or

307,000, were inscriptions from Bitcoin Ordinals. Dune data shows

that the number of inscriptions is up 16% from April 29 and

maintains an upward trend pointing to increasing user demand. The

Bitcoin Ordinals allow users to attach or “inscribe” files on the

Bitcoin network, including apps, videos, audio, images, texts, and

more. Related Reading: Bitcoin Faces Potential Price Drop To

$25,000, On-Chain Data Signals Bearish Trend These files are

unique, “inscribed” at the Satoshi level, and permanently stored on

Bitcoin blocks. The more files inscribed, the more transactions

there are, explaining the “spike” in the number of on-chain

transactions processed in recent days. As of May 1, over 2.9

million files were attached to the Bitcoin network, with the number

of average inscriptions rising from less than 10,000 in early

February to over 300,000 in early May 2023. As mentioned

above, the rapid rise of “inscriptions” doesn’t necessarily

translate to demand for BTC. The underlying network is a

transactional layer, enabling the transfer of funds. It is not

meant for storing files, a development that could dent the appeal

of the most valuable blockchain and slow down BTC demand leading to

a permanent spike in its transaction levels. Feature Image

From iStock, Chart From TradingView

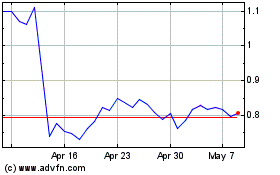

EOS (COIN:EOSUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

EOS (COIN:EOSUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024