Bitcoin Trades Above $20,000, Has The Fed Failed Again?

August 31 2022 - 10:30AM

NEWSBTC

Bitcoin has been moving sideways over the past week in a tight

range, but the cryptocurrency might experience volatility as bulls

and bears fight over the monthly candle close. The benchmark has

been unable to recover its gains from last week and continues to

trade in the red over high timeframes. Related Reading: This

Indicator Predicts Probable Bearish Trend Ahead For Ethereum At the

time of writing, Bitcoin (BTC) trades at $20,300 with sideways

movement in 24 hours and a 6% loss over the past week. Along with

Solana (8%) and Dogecoin (8%), Bitcoin is the worst performer in

the crypto top ten by market cap. In a recent report, trading firm

QCP Capital shared some insights about the current market

conditions. The crypto sector and other global markets are heavily

influenced by the U.S. Federal Reserve (Fed) and its monetary

policy. Last week, Fed Chairman Jerome Powell gave his highly

anticipated Jackson Hole speech which, as QCP Capital said, was

addressed to the markets. The price of Bitcoin and other large

cryptocurrencies was trending upward ahead of the speech, but

quickly tumble as Powell turned hawkish. The trading firm believes

the U.S. financial institutions “failed again” with their

communication strategy. Rather than provide markets with clarity

and a roadmap, the Fed brought more uncertainty and instability.

The financial institution has been trying to slow down inflation in

the U.S. dollar, as measured by the Consumer Price Index (CPI), by

hiking interest rates. The markets have been trying to get ahead of

the Fed and priced in their upcoming hikes. In that sense, after

Jackson Hole, QCP Capital claims market participants are pricing a

90% chance of another 75-basis point (bps) hike. This is

potentially the continuation of the current bearish scenario for

Bitcoin and the crypto market. The trading firm said: Mkts are

already pricing a 90% chance of a 75bp hike- which seems rather

high, considering neither of these pieces of data are out yet. We

think this is because markets understand the Fed wants to hike

75bp, to make up for the 2-mth intermeeting period between the last

FOMC in July. What To Expect From Bitcoin Heading Into September?

The Fed Chair said that their upcoming interest rate increase will

be based on the CPI and the Nonfarm Payroll (NFP) indicator, used

to measure the number of workers in the U.S. outside of the farming

sector. This indicator can be “unpredictable” which adds to the

current uncertainty in global markets. The September NFP and CPI

will be critical to determining the upcoming Fed approach. As QCP

explained one metric could provide insight into the other

trajectory: We think a sizable Friday NFP miss will force markets

to bring pricing back to ~60% into CPI. A CPI Y/Y at least in-line

or lower than last month, or another flat or negative M/M print

will allow the Fed to downshift to 50bp hikes from Sep onwards.

Related Reading: VeChain Pulled In Sideways Motion As VET Price

Faces Rejection At $0.0247 This will provide some room for more

relief in the price of Bitcoin and the crypto market.

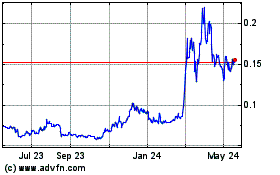

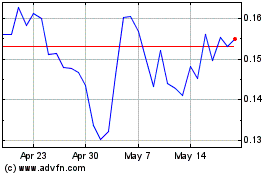

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024