Stablecoins Market Cap Continues To Slump Since Last Year – Here’s Why

February 23 2023 - 9:37AM

NEWSBTC

Stablecoins are cryptocurrencies built to withstand the market’s

volatility as it is backed by a specific asset. In the case of most

stablecoins, the US dollar backs the cryptocurrency, pegging the

coin’s value to one USD. Investors use stablecoins regularly as a

medium of exchange in both decentralized exchanges and centralized

exchanges, providing them a quick way to carry out their trading

activities. However, a recent report by CryptoCompare shows

that although investors still recognize the utility of stablecoins,

their market capitalization has consistently dropped since hitting

its peak back in April of 2022. This shows the market reacting

negatively with recent external developments surrounding these

asset types. Related Reading: This Little-Known Altcoin

Shoots Up 180% In Single Week After Series Of Updates A Dash Of

Pain And Sweet Developments Just last week, Paxos, the issuer

of Binance’s BUSD, was hit by charges by the Securities and

Exchange Commission with the New York State Department of Financial

Services ordering the company to stop the issuance of BUSD. This

development deals a massive blow for investors and traders who are

using these digital currencies as a means of transacting in the

crypto space. Going against the United States’ stance on

stablecoins, governments around the world have been experimenting

with the concept of CBDCs, or central bank digital currencies.

These are a type of digital currencies issued by a governing body

with the same legality and regulation as traditional fiat

currencies. Image: CoinGeek However, with some losing

dominance in the space, USDT, Tether’s official stable coin, has

risen in its dominance in the space. The report shows that its

dominance rose from 48.7% to 51.7%, being one of, if not, the most

dominant in the space. This most recent change is attributed to the

recent regulatory actions against BUSD. Decentralized

Stablecoins Take The Spotlight – Will They Gain Dominance?

The decline of stablecoins issued by centralized entities sets the

spotlight on these decentralized currencies. CryptoCompare recorded

a nearly 1% increase in decentralized stablecoin market cap, a

continuance of a three-month long increase. However, the market

share of decentralized stablecoins is currently at 6.38%, a long

shot since the sector’s all-time high of 18.3%. Issuers of

decentralized stablecoins also experienced big gains with Curve

showing a 36% increase in price. However, this recent event may not

last for long as algorithmic stablecoins are facing regulatory

scrutiny. With Canada banning algorithmic stablecoins, we might see

the market share of decentralized stablecoins fall even more.

Crypto total market cap at $1 trillion on the daily chart | Chart:

TradingView.com Related Reading: As Chainlink Adoption Grows, Will

It Strengthen LINK Price? The recent hawkish regulatory actions by

government authorities might ramp up this year. However, with

governments around the world looking upon stablecoins as a way to

digitize fiat currency, stablecoin regulation might come sooner

than we think. -Image from Techiexpert.com

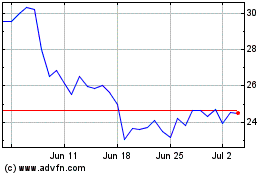

Dash (COIN:DASHUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

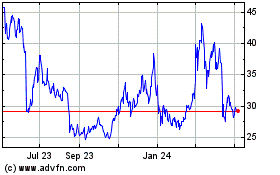

Dash (COIN:DASHUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024