Stacks (STX) Down By 14% Ahead Of Upcoming Hard Fork Upgrade

March 16 2023 - 5:30AM

NEWSBTC

Stacks (STX), one of 2023’s most profitable cryptocurrencies,

appears to be experiencing some market troubles. According to data

from CoinMarketCap, the altcoin has lost 14.3% of its value in the

last 24 hours, making it one of the biggest daily losers in the top

50 cryptocurrencies. The current downtrend in the STX market can be

considered as “unexpected,” following the token’s impressive start

to the week that saw its price soar by 71.4% to trade above the $1

mark. In addition to its price action, STX’s daily trading volume

is also down to the tune of 19.6%. Related Reading: XRP Price

Prediction: Topside Bias Vulnerable Unless It Surges Past $0.38

However, compared to its overall price movement, the present loss

by the STX token is quite insignificant, thus, causing no panic

among investors. For context, Stacks has gained by 46.9% in the

last seven days and a staggering 201.8% in the last 30 days.

Moreover, there is a high level of interest surrounding the Stacks

network due to its upcoming hard fork upgrade slated for later this

month. At the time of writing, STX is trading at a market price of

$0.9132, with its market cap set at $1.247 billion. Meanwhile,

STX’s maximum market supply remains at 1.818 billion, of which

1.366 billion tokens are in circulation. STX trading at

$0.9116 | Source: STXUSD Chart on Tradingview.com Stacks Hard Fork

Draws Nearer Last month, Stacks announced its plans to activate a

hard fork on its network on March 20, 2023, naming the upgrade

Stacks 2.1. Ever since, there has been much excitement around the

Stacks network, especially as the upgrade launch date approaches.

Just earlier today, Binance, the world’s biggest cryptocurrency

trading platform, announced its support for the Stacks hard fork

plans stating that the network upgrade will not affect STX trading

on its platform. Just like any update, Stacks 2.1 is

expected to bring some exciting new features to the Stacks

blockchain. According to the development team, the hard fork is

intended to strengthen the connection between Stacks and its

underlying platform – Bitcoin. Related Reading: Cardano May

Touch $0.30 But These Price Levels Are Vital For The Coin Some

notable features accompanying the Stacks 2.1 release include

decentralized mining pools, improved network bridges, and new

clarity functions for parsing and validating data. In addition, the

Stacks hard fork will enable the compatibility of all Stacks-native

assets – including NFTs – with Bitcoin wallets. Stacks (STX)

Price Prediction 2023 Following Stacks’ stunning performance in

2023 so far, there is a lot of interest in the token’s possible

price trajectory. According to the team at the popular prediction

firm, WalletInvestor, Stacks is expected to regain form very soon,

hitting a price of $1.254 in the next 14 days. However, their

price predictions also indicate that STX could be an unfavorable

long-term investment, as they forecast the altcoin will experience

a 93.5% loss within the next year. That said, it goes without

saying that these price predictions are not guaranteed. All

investors are reminded to conduct their personal research as well

as consult financial market experts before engaging the

market. Featured Image: Stacks, chart from Tradingview

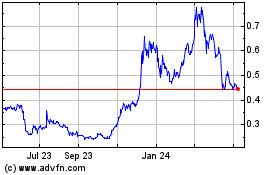

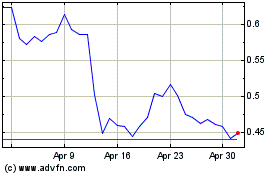

Cardano (COIN:ADAUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cardano (COIN:ADAUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024