Conflux Blasts Off Nearly 40% In Single Day – Will CFX Soar Higher Amid Banking Crisis?

March 14 2023 - 3:14AM

NEWSBTC

The price of Conflux (CFX) increased for the second consecutive day

as cryptocurrencies rebounded amid the ongoing crisis hounding the

banking sector. Binance reports that CFX is the top-performing

cryptocurrency on Monday. CFX achieved a peak of $0.2093, which was

approximately 50% higher than the token’s all-time low less than a

week earlier. In recent weeks, the price of CFX tokens increased by

nearly 700%, reaching a high of $0.3595. CFX was trading at $0.2599

at the time of writing, up 38% in the previous 24 hours and 31% in

the past seven days. Source: Coingecko Conflux Rises On

Legalization Of Crypto Trading In HK Conflux’s trading volume grew

in response to the enormous demand for China-related blockchains

and tokens. It is the first blockchain in China that complies with

regulatory requirements and uses the Tree-Graph consensus technique

to boost bandwidth and scalability. According to analysts, the

legalization of crypto trading in Hong Kong is the key factor

behind Conflux’s increase. The expectation is that China will soon

follow. The price of CFX has risen dramatically as word of this has

circulated. Yet, it is unclear whether this report of China opening

its market to cryptocurrencies is merely a speculation or whether

it is grounded in truth. This has not hindered Conflux users from

achieving profits in excess of 1,000%. Continual wagers that the

U.S. Federal Reserve would not be as hawkish as anticipated also

contribute to the growing price of CFX. Image: Financial Services

Compensation Scheme The majority of analysts anticipate that the

central bank will be more cautious in dealing with inflation in the

upcoming sessions due to the changing market conditions. In

February, the U.S. economy added over 300,000 jobs, according to

data released on Friday. The unemployment rate is stagnant around

3.6%, although wage inflation is declining. Experts predict

that the United States’ inflation rate remained high last month.

The blockchain’s recent agreement with China Telecom to deliver

Web3-enabled mobile devices with blockchain-powered SIM cards has

yielded substantial benefits. It is predicted that Conflux would

connect conventional industry to Web3 technologies. Conflux has

also recently formed a strategic agreement with NFT-social

media site Little Red Book. Banking Crises: A Boon For Crypto?

Banking crises can provide a favorable atmosphere for the

widespread adoption of cryptocurrencies as an alternative

investment and store of wealth. Reduced confidence in conventional

banking institutions, inflation fears resulting from the printing

of more currency, and a rise in demand for safe-haven assets can

all contribute to this. Related Reading: Cardano Sheds 23% In Value

As ADA Woes Pile Up – Here’s Why CFX total market cap at $674

million on the daily chart | Chart: TradingView.com Related

Reading: USDC Feeling Intense Pressure Despite Fed Action To Halt

SVB Contagion Some investors view cryptocurrencies as a safer

choice because of their limited supply and decentralized nature.

Meanwhile, the global crypto market capitalization recovered and

reclaimed the $1.02 trillion milestone over the weekend, following

several days of decline. At the time of writing, the

global crypto market valuation was $1.03 trillion,

representing an 8.33% increase over the previous 24 hours.

-Featured image from NASA

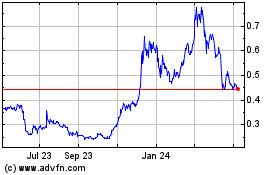

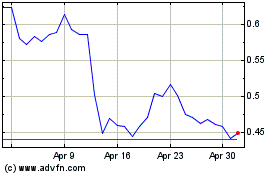

Cardano (COIN:ADAUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cardano (COIN:ADAUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024