Bitcoin Small Addresses Have Been Rapidly Growing, Here’s What It Means

February 06 2023 - 6:00PM

NEWSBTC

On-chain data shows that the number of small Bitcoin addresses has

rapidly grown recently. Here’s what it may mean for the market.

Bitcoin Addresses With 0.1 BTC Or Less Have Sharply Risen In Number

Recently According to data from the on-chain analytics firm

Santiment, 620,000 new small addresses have appeared on the network

since the 20th of last month. The relevant indicator here is the

“BTC Supply Distribution,” which measures the number of Bitcoin

addresses that currently fall inside each wallet group in the

market. The “wallet groups” here refer to ranges that define the

number of coins inside wallets falling into a particular group

currently holding them. For example, the 10 to 100 coins group

includes all BTC addresses holding between 10 and 100 BTC. If the

Supply Distribution is applied on this wallet cohort, then the

indicator would tell us the total number of addresses on the

network that satisfy this condition. Related Reading: Cardano

Whales, Sharks Have Accumulated 406M ADA In 2023: Santiment The

wallet group of interest here is the 0 to 0.1 coins band. Here is a

chart that shows the trend in the Bitcoin Supply Distribution for

this cohort over the last few months: Looks like the value of the

metric has been climbing in recent days | Source: Santiment on

Twitter The 0 to 0.1 coins wallet group comprises multiple cohorts

(three, to be precise); their data has just been merged to display

as one group. The significance behind this range is that it covers

all the small investors in the Bitcoin market. Many such holders

are new to the market, so data of this range can tell us about the

general interest in the cryptocurrency and whether it’s attracting

users right now. Related Reading: Bitcoin Price Dips As Dollar

Rips, Key Support Nearby As shown in the above graph, the Supply

Distribution’s value for the 0 to 0.1 coins cohort had been moving

sideways during the second half of 2022, showing that there weren’t

many small investors ushering into the network, likely because of

the dull bear market price movement. In November, following the

collapse of crypto exchange FTX, the number of wallets falling into

this band finally observed a rapid rise. The volatility due to the

crash and the potential bottom probably attracted new investors to

the asset. However, the increase didn’t last long, and the metric’s

value soon sunk back to the average values for the year. Since 2023

has started, though, the indicator has been seeing some fresh

growth again. Around 620,000 new Bitcoin addresses appeared

belonging to these small investors since the 13th of January when

BTC reclaimed the $20,000 level. This suggests that the latest

rally has encouraged new investors to enter the market. Santiment

notes that, unlike in 2022, trader optimism has returned to the

Bitcoin network this year. BTC Price At the time of writing,

Bitcoin is trading around $23,000, down 1% in the last week. BTC

seems to have declined in the last few days | Source: BTCUSD on

TradingView Featured image from André François McKenzie on

Unsplash.com, charts from TradingView.com, Santiment.net

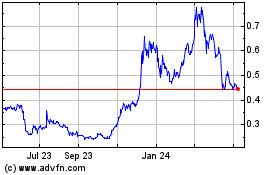

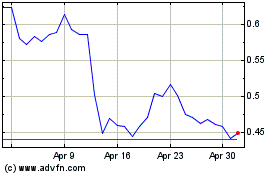

Cardano (COIN:ADAUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cardano (COIN:ADAUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024