Crypto Sees Increased Fund Flow Due To Investor Sentiment, Report Shows

February 06 2023 - 3:00PM

NEWSBTC

The crypto industry has seen a significant increase in fund flows

since the beginning of 2023. This has been reflected in the recent

price action, which has led the market to what appears to be the

beginning of a new bull cycle. Related Reading: On-chain

Activity On BNB Chain Grew In Q4 Amid Market Downtrend: Messari

According to a report from investment firm CoinShares, investor

sentiment is improving, leading to a $230 spike in inflows

year-to-date. Digital asset investment products saw total inflows

of $76 million last week alone. A Decisive Shift In Investor

Sentiment With reports of inflation and expectations of looser

monetary policy in 2023, investors are returning to the crypto

market. Last week was the 4th consecutive week of inflows, with

year-to-date inflows reaching a new high in recent months.

According to CoinShares, this highlights a decisive shift in

investor sentiment for 2023. According to CoinShares, total

investment assets under management (AuM) are up 39% year-to-date to

$30.3 billion, the highest level since mid-August 2022. Regionally,

the inflows were primarily concentrated in the U.S., Canada, and

Germany, with inflows of $38 million, $25 million, and $24 million,

respectively. Bitcoin continues to be the primary focus of

investors and holders in the crypto ecosystem, with inflows

increasing last month to $69 million, representing 90% of the

week’s total flows. The rest of the inflows came from

short-Bitcoin, selling positions, which totaled $8.2 million over

the same period, highlighting that opinions remain divided on the

sustainability of the current rally and whether Bitcoin will

overcome the following obstacles in its price action. Short-Bitcoin

positions inflows remain relatively small compared to long-Bitcoin

inflows, data shows, with the last three weeks of inflows totaling

$38 million, or 26% of total assets under management, according to

CoinShares. For CoinShares, from a relative scaling perspective,

this is meaningful, although this trade hasn’t worked well so far

year-to-date, with total short-Bitcoin assets under management

falling by 9.2%. Is The Current Bullish Trend Sustainable The

improving clarity around the upcoming Shanghai upgrade scheduled

for March and the withdrawal of staked Ethereum (ETH) can fuel a

bullish trend in Ethereum’s price action; the second-largest

cryptocurrency on the market has seen only $0.7 million in inflows.

Related Reading: Cardano Whales, Sharks Have Accumulated 406M ADA

In 2023: Santiment According to CoinShares, altcoins saw small

inflows of $0.5 million for Solana (SOL), $0.6 million for Cardano

(ADA), and $0.3 million for Polygon (MATIC), while Polygon saw

outflows of $0.5 million. The global cryptocurrency market cap at

press time is $1.1 trillion, with a 1.35% loss in the last 24 hours

and a 44.97% loss year-to-date. Bitcoin’s market cap stands at $440

billion, with a 40% dominance over the sector. On the other hand,

stablecoin’s market cap stands at $138 billion, with a 12.51% share

of the total crypto market cap. Bitcoin is trading at $22,780, with

a 1.6% loss in the past 24 hours and a 3% setback in the past seven

days. Currently, Bitcoin’s Relative Strength Index (RSI) is sitting

in the oversold zone, suggesting a high probability of continuing

the bullish trend it has been experiencing since the beginning of

2023.

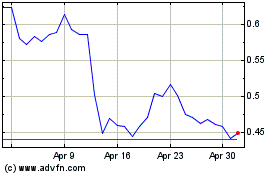

Cardano (COIN:ADAUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

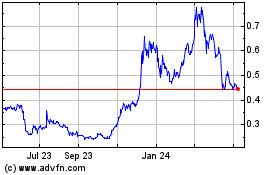

Cardano (COIN:ADAUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024