UniCredit Cut Revenue Outlook as 2Q Net Profit Soars on Sale of Fineco Stake

August 07 2019 - 1:49AM

Dow Jones News

By Pietro Lombardi

UniCredit SpA (UCG.MI) cut its revenue guidance for the year and

said its second-quarter net profit rose sharply, boosted by the

sale of the bank's stake in FinecoBank SpA (FBK.MI).

Net profit for the period was 1.85 billion euros ($2.07 billion)

compared with EUR1.02 billion a year earlier, the Italian bank said

Wednesday.

On an adjusted basis, which excludes one-offs, net profit grew

0.4% to EUR1.03 billion.

Revenue fell 4.6% on year to EUR4.52 billion.

These results compare with analysts' expectation of a net profit

of EUR2.23 billion on revenue of EUR4.62 billion, according to a

consensus forecast provided by the bank.

Net interest income--the difference between what lenders earn

from loans and pay for deposits, and a key profit driver for retail

banks--fell 2.1%. Net fees and commissions were down 3% while

trading income plunged 19%.

The low interest rates environment led the bank to cut its

revenue guidance for the year. It now sees revenue at EUR18.7

billion, down from a previous target of EUR19 billion.

"We delivered another solid set of results in the first half of

2019 in what was a tough macroeconomic environment," Chief

Executive Jean Pierre Mustier said.

Write to Pietro Lombardi at pietro.lombardi@dowjones.com

(END) Dow Jones Newswires

August 07, 2019 01:34 ET (05:34 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

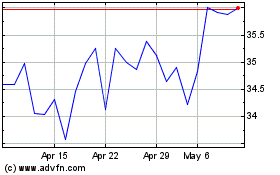

Unicredit (BIT:UCG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Unicredit (BIT:UCG)

Historical Stock Chart

From Apr 2023 to Apr 2024