UniCredit Investigating Data Breach Possibly Related to Capital One -- Update

July 31 2019 - 2:49PM

Dow Jones News

By Anuj Gangahar and Giovanni Legorano

Italian banking giant UniCredit SpA is investigating the

possibility of a data breach that the lender believes could be

related to a similar hacking incident at Capital One Financial

Corp., according to a person familiar with the matter.

The company is examining whether a directory held on a cloud

server was accessed without authorization, the person said.

UniCredit said in a statement that it had contacted the relevant

authorities and is actively investigating the matter.

"Data security and privacy are our key priorities at all times,"

the statement said.

Capital One, the fifth-largest U.S. credit-card issuer, said

Monday that a hacker accessed the personal information of

approximately 106 million card customers and applicants, one of the

largest-ever data breaches of a big bank.

The Federal Bureau of Investigation said Tuesday it seized

digital devices from the alleged hacker's home that not referenced

Capital One and other companies that may have been targeted.

In a blog post Tuesday, cybersecurity blogger Brian Krebs

published a screenshot that purports to show a list of files and

directories that the hacker accessed. One of the directories was

named "unicredit."

UniCredit's main regulator, the European Central Bank's

supervision arm, said it doesn't comment on specific banks. The arm

looks closely at cybersecurity risks at banks, including through

on-site inspections.

The ECB has permission to audit the outsourcing activities of

banks, meaning it can audit companies that provide cloud services

to a bank it supervises. Contracts between banks and outsourcing

providers must include a clause allowing the ECB to audit the

provider.

Italian banks have been slow to invest in technology as they

have struggled to digest piles of bad loans that accumulated on

their balance sheets during the financial and sovereign debt

crisis. Only three years ago, 17% of Italian banks loans, whose

face value was EUR360 billion ($401 billion), were sour, according

to the Bank of Italy.

The bad loans dented lenders profits for years, as the banks

were forced to set aside provisions for losses on loans and resort

to sell fresh shares to shore up their capital base.

UniCredit, Italy's largest bank by assets, has pushed through a

strategic plan in the past years that improved its financial

health. It raised EUR13 billion of fresh capital, sold assets, such

as an online bank and a Polish lender, got rid of billions of bad

loans and cut costs.

The bank, which has retail businesses in several European

countries and an investment banking unit, including in the U.S.,

has said it would complete the plan based on organic growth this

year.

Patricia Kowsmann contributed to this article.

Write to Giovanni Legorano at giovanni.legorano@wsj.com

(END) Dow Jones Newswires

July 31, 2019 14:34 ET (18:34 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

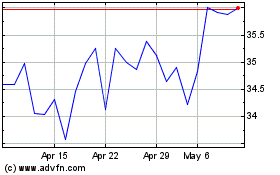

Unicredit (BIT:UCG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Unicredit (BIT:UCG)

Historical Stock Chart

From Apr 2023 to Apr 2024