Italian Banks Win From Sovereign Debt's Startling Rally

July 05 2019 - 7:59AM

Dow Jones News

By Avantika Chilkoti

A large rally in Italian bonds is making winners out of the

country's banks, whose shaky finances have weighed on global

markets in recent years.

Shares of the two largest Italian lenders, UniCredit SpA and

Intesa Sanpaolo SpA, have surged almost 7% since the end of last

week. Local banks, which have loaded up on the sovereign debt in

recent quarters, hold more government bonds than their counterparts

in other major European economies. That resulted in the lenders

carrying 20.1% of outstanding Italian government debt securities in

March, up from 17.5% a year earlier, according to data from Italy's

central bank.

Investors piled into Italy's bonds this week, after the

government pledged Monday to hit a lower budget deficit in 2019

than expected, helping end a standoff between Rome and European

Union authorities. Markets also grew more optimistic about fresh

monetary stimulus for the broader region following Christine

Lagarde's nomination to lead the European Central Bank.

On Wednesday, the fresh optimism over Italy's public finances

precipitated the sharpest single-day drop in Italian 10-year

government-bond yields since the peak of the sovereign-debt crisis

in August 2011. The yield on these bonds fell Thursday to as low as

1.569% -- a level not seen in more than 2 1/2 years -- after ending

the previous week at over 2%, according to Tradeweb data.

The rally in bond prices, which move inversely to yields, has

benefited not just the banks, but also fund managers on the hunt

for returns amid unprecedentedly low interest rates globally.

"A good part of European assets are in negative territory, which

sort of shrinks the universe of positively yielding securities,"

said Eric Brard, head of fixed income at Amundi, Europe's largest

asset manager.

Mr. Brard bought more Italian government debt this year as

yields looked increasingly attractive. "You have quite liquid

conditions and money looking for places to be put to work."

The gains this week mean Italy's government bonds have recovered

all the value lost since early May 2018. The debt was shunned by

investors after two populist parties came together to form the

government in 2018, with pledges to spend more on welfare while

cutting taxes. That put Italy in danger of breaching European Union

fiscal limits, triggering speculation about the nation's place in

the eurozone and sending shock waves through global markets.

On Wednesday, the European Commission decided that disciplinary

action was no longer warranted, following the government's promise

to cut the forecast deficit.

"That was really positive for the Italian banks," said Tom

Kinmonth, a senior fixed-income strategist at Amsterdam's ABN Amro,

who noted that Italian bank stocks have rallied for the past four

weeks.

The banking sector's sizable government bondholdings -- which

have bolstered the value of their assets this week -- are more

frequently a cause for concern among investors. During the last

debt crisis, the shrinking value of government debt led to

impairment in some banks' balance sheets and curbed lenders'

appetite for extending credit to businesses, resulting in a "doom

loop" that constrained economic growth.

The easing of tensions helped pare the prices of credit-default

swaps, a form of insurance on debt, for Italian sovereign bonds.

The annual cost of insuring $10 million of Italian government debt

for five years fell to $167,000 from around $200,000 at the end of

last week.

Pat Minczeski and Lauren Almeida contributed to this

article.

Write to Avantika Chilkoti at Avantika.Chilkoti@wsj.com

(END) Dow Jones Newswires

July 05, 2019 07:44 ET (11:44 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

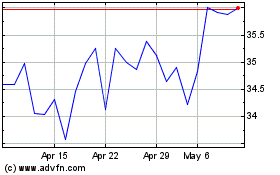

Unicredit (BIT:UCG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Unicredit (BIT:UCG)

Historical Stock Chart

From Apr 2023 to Apr 2024