UniCredit Starts Final Year of Restructuring With Profit Beat - Update

May 09 2019 - 4:17AM

Dow Jones News

Adds CEO comments, analysts' comments, earnings details,

background

--UniCredit's first-quarter net profit rose 25% to 1.39 billion

euros, beating analysts' expectations

--Exceptional items, lower costs and declining provisions for

bad loans boosted the results for the quarter

--The bank's core tier 1 ratio rose to 12.25%

By Pietro Lombardi

UniCredit SpA (UCG.MI) kicked off the year with a profit beat in

what Chief Executive Jean Pierre Mustier deemed the bank's best

first quarter in a decade.

The results come as the Italian bank enters the final stretch of

its restructuring, under which it has cut costs and reduced bad

loans, and gears up for the new plan to be presented in December.

The bank has made strong progress on delivering the plan, the CEO

said Thursday, confirming the target for the year.

Exceptional items, lower costs and declining provisions for bad

loans boosted the results for the quarter and helped the bank beat

analysts' expectations despite the low interest-rate environment

and a struggling Italian economy.

"This was the best first-quarter results in a decade for the

second time in a row, underpinning the success of our current

strategic plan, and confirming we are well on track to achieve our

Transform 2019 objectives by the end of this year, that are all

confirmed," Mr. Mustier said.

Net profit for the period rose 25% to 1.39 billion euros ($1.56

billion), the Italian bank said. Adjusted net profit rose 1.5%.

Revenue decreased 3% to EUR4.95 billion.

Analysts had expected a net profit of EUR1.29 billion for the

period on revenue of EUR4.88 billion, according to a consensus

forecast provided by the bank.

"UniCredit reported a solid set of numbers," Goldman Sachs

said.

The results come during a busy week for the bank, which earned

more than EUR1 billion from the sale of a 17% stake in multichannel

bank FinecoBank SpA (FBK.MI), which will also boost its capital by

about 21 basis points. It also presented a number of financial

measures ahead of its new strategic plan. These include "gradually

align[ing] over time UniCredit's domestic sovereign bond portfolio

with the domestic bond holdings of its Italian and European peers

on a relative basis." This will be achieved through portfolio

run-off, the CEO said.

However, he confirmed the bank's commitment to Italy.

"Our commitment to Italy has never been stronger," Mr. Mustier

said Thursday.

UniCredit has been mentioned in the press as one of the banks

interested in Germany's Commerzbank AG (CBK.XE), whose merger talks

with Deutsche Bank AG (DBK.XE) collapsed last month. The CEO said

on Thursday the bank doesn't comment on rumors and speculation.

Results for the first three months of the year were boosted by

one-offs. UniCredit released provisions in the quarter after it

reached in April a $1.3 billion settlement with U.S. authorities

related to U.S. government-sanctions programs. The positive net

impact of this release was EUR320 million. It also posted a gain of

EUR258 million from real estate sale.

Operating costs declined 4.2% while provisions for bad loans

were down 5.8% on year.

Net interest income--the difference between what lenders earn

from loans and pay for deposits, and a key profit driver for retail

banks--rose 0.7% on year to EUR2.65 billion. Net fees and

commissions fell 5.3%.

UniCredit has already met its target of cutting roughly 14,000

jobs by 2019 and has closed 901 branches in Western Europe, of 944

closures planned by the end of this year.

The bank's core tier 1 ratio, a key measure of capital strength,

rose to 12.25% at the end of March from 12.07% in December.

"The market should be relieved by the progress on capital (a

concern in following Fineco Bank news), and better level of CET1

trough in 2Q (above 12% now vs 11.7% in 4Q), improving asset

quality and commitment to noncore rundown (accelerating 2019

disposals)," Citi said.

Write to Pietro Lombardi at pietro.lombardi@dowjones.com

(END) Dow Jones Newswires

May 09, 2019 04:02 ET (08:02 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

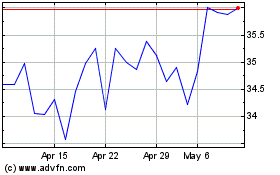

Unicredit (BIT:UCG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Unicredit (BIT:UCG)

Historical Stock Chart

From Apr 2023 to Apr 2024