UniCredit Faces Potential Antitrust Fine

April 11 2019 - 10:25AM

Dow Jones News

By Pietro Lombardi

Italy's UniCredit SpA (UCG.MI) may face a potential fine of up

to 10% of its annual turnover in relation to an investigation by

European authorities into suspected collusion in trading European

government bonds between 2007 and 2012.

The Italian bank said late Wednesday that in January it had

received a statement of objections from the European Commission

related to the investigation.

Having assessed the documents of the commission, "the bank

regards it no longer remote but possible, even though not likely,

that a cash outflow might be required to fulfill a potential fine

arising from the outcome of the investigation," it said.

The investigation "includes alleged activities by one of

UniCredit's subsidiaries in a part of this period," it said.

At the moment, it isn't possible to give estimates of the

potential fine, it added, noting that a fine could reach up to 10%

of its annual turnover.

This is "potentially meaningful but appears manageable,"

Jefferies analysts said. The U.S. bank estimates an upper limit of

roughly 2 billion euros ($2.25 billion) for a potential fine.

The Italian bank has a deadline of April 29 to submit its

response to the objections.

In January, the European Commission accused eight banks of

running a cartel in trading European government bonds between 2007

and 2012.

"Traders employed by the banks exchanged commercially sensitive

information and coordinated on trading strategies," it said at the

time, without mentioning the name of the banks involved.

Write to Pietro Lombardi at pietro.lombardi@dowjones.com

(END) Dow Jones Newswires

April 11, 2019 10:10 ET (14:10 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

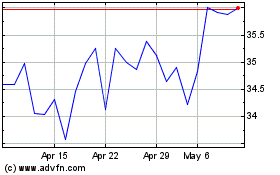

Unicredit (BIT:UCG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Unicredit (BIT:UCG)

Historical Stock Chart

From Apr 2023 to Apr 2024