CVC to Take Stake in DKV Mobility -- WSJ

November 19 2018 - 3:02AM

Dow Jones News

By Eric Sylvers and Ben Dummett

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (November 19, 2018).

Private-equity firm CVC Capital Partners agreed on Friday to buy

a minority stake in DKV Mobility Services Group, as buyout firms

continue to show a desire to broaden their investment

strategies.

CVC and the private German fleet-services company didn't report

the value of the deal. The Wall Street Journal earlier reported the

pact would value DKV at about EUR2 billion ($2.27 billion),

including debt.

European-based CVC said it will take a 20% stake and let the

current management continue. DKV's family owners will hold 80% of

the company.

DKV, which had EUR7.2 billion of revenue last year, issues cards

that are used by commercial drivers to pay for fuel, toll and other

services in more than 40 European countries without having to carry

cash. It has more than 900 employees, according to its website.

Traditionally, large private-equity firms such as CVC tend to

buy companies outright. They bet on cost-cutting and other measures

to improve the operations over three to five years with the aim of

generating outsize returns from a subsequent sale or initial public

offering of the business.

But the CVC-DKV deal reflects efforts in recent years within the

buyout industry to diversify investment strategies. Amid increased

competition, cash is being deployed to acquire or invest in assets,

such as family-controlled businesses, whose owners previously

hesitated to sell to private equity.

Historically, family-controlled businesses such as DKV have been

reluctant to sell to investment firms on concerns that such a move

would spur job cuts and other belt-tightening measures.

"Family businesses are still very important in Europe and it's

important for them to have access to capital," said Richard Burton,

head of financing and advisory at UniCredit SpA, which with

Commerzbank AG advised the seller.

Royal Bank of Canada advised CVC.

CVC, in recent years, has broadened its approach to use

partnerships as a way of funding investments in companies, working

with the existing management to ensure the operation's continuity.

In June, CVC struck a deal to acquire a majority in Italy's

Recordati SpA from the pharmaceutical company's controlling family

in a deal valued at EUR3.03 billion. In another deal this summer,

CVC joined industrial-gases company Messer Group to acquire the

majority of Linde AG's gases business in North America along with

certain business activities in South America.

Write to Eric Sylvers at eric.sylvers@wsj.com and Ben Dummett at

ben.dummett@wsj.com

(END) Dow Jones Newswires

November 19, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

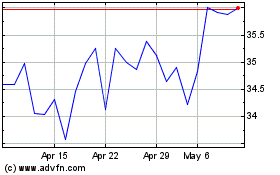

Unicredit (BIT:UCG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Unicredit (BIT:UCG)

Historical Stock Chart

From Apr 2023 to Apr 2024