FERRARI N.V.: COMPLETION OF THE FIRST TRANCHE AND ANNOUNCEMENT OF THE SECOND TRANCHE OF THE MULTI-YEAR SHARE REPURCHASE PROGRAM

December 01 2022 - 1:55PM

Maranello (Italy), December 1, 2022

– Ferrari N.V. (NYSE/EXM: RACE) (“Ferrari” or the

“Company”) informs that the Company has purchased,

under the Euro 150 million share buyback program announced on June

30, 2022, as the initial tranche of the multi-year share buyback

program of approximately Euro 2 billion expected to be executed by

2026 in line with the disclosure made during the 2022 Capital

Markets Day (the “First Tranche”), the additional

common shares - reported in aggregate form, on a daily basis - on

the Euronext Milan (EXM) and on the New York Stock Exchange (NYSE)

as follows:

|

|

EXM |

NYSE |

Total |

|

Trading |

Number of common shares purchased |

Average price per share |

Consideration excluding fees |

Number of common shares purchased |

Average price per share |

Consideration excluding fees |

Consideration excluding fees |

Number of common shares purchased |

Average price per share |

Consideration excluding fees |

|

Date |

excluding fees |

|

excluding fees |

|

|

excluding fees |

|

|

(d/m/y) |

(€) |

(€) |

($) |

($) |

(€)* |

(€)* |

(€)* |

|

|

|

|

|

|

|

|

|

|

28/11/2022 |

2,325 |

209.8319 |

487,859.17 |

6,900 |

217.2363 |

1,498,930.47 |

1,432,601.04 |

9,225 |

208.1800 |

1,920,460.21 |

|

29/11/2022 |

2,340 |

208.3664 |

487,577.38 |

4,084 |

215.8307 |

881,452.58 |

850,330.48 |

6,424 |

208.2671 |

1,337,907.86 |

|

30/11/2022 |

2,313 |

210.4785 |

486,836.77 |

- |

- |

- |

- |

2,313 |

210.4785 |

486,836.77 |

|

|

6,978 |

209.5548 |

1,462,273.32 |

10,984 |

216.7137 |

2,380,383.05 |

2,282,931.52 |

17,962 |

208.5071 |

3,745,204.84 |

|

Total |

|

|

(*) translated at the European Central Bank

EUR/USD exchange reference rate as of the date of each purchase

With the purchases described above the Company

has completed the First Tranche of the program announced on June

30, 2022.

The total consideration for such First Tranche

of the program was:

- Euro 119,999,801.43 for No. 618,880 common shares purchased on

the EXM

- USD 30,047,816.61 (Euro 29,999,832.02*) for No. 151,491 common

shares purchased on the NYSE.

As of November 30, 2022, the Company held in

treasury No. 11,835,481 common shares equal to 4.60% of the total

issued share capital including the common shares and the special

voting shares, net of shares assigned under the Company’s equity

incentive plan.

A comprehensive overview of the transactions

carried out under the buyback program, as well as the details of

the above transactions, are available on Ferrari’s corporate

website under the Buyback Programs section

(https://www.ferrari.com/en-EN/corporate/buyback-programs).

The Company intends to continue its already

disclosed multi-year share buyback program with a second tranche of

up to Euro 200 million to start on December 2, 2022 (the

“Second Tranche”) and to end no later than June

26, 2023 with two components:

- Firstly, Ferrari has entered into a non-discretionary buyback

agreement for an amount up to Euro 160 million to be executed on

the EXM market through a primary financial institution (the

“Bank”). The Bank will make its trading decisions

concerning the timing of the purchases of Ferrari’s common shares

independently of and uninfluenced by Ferrari and it will act in

compliance with applicable rules and regulations as well as in

accordance with the provisions of the Market Abuse Regulation

596/2014 and the Commission Delegated Regulation (EU) 2016/1052

(the “Regulations”). Under this agreement

purchases may continue during any closed periods of Ferrari in

accordance with the Regulations.

- Secondly, Ferrari has entered into an additional mandate with a

primary financial institution for up to Euro 40 million to be

executed on the NYSE. Pursuant to such mandate Ferrari would

provide the financial institution with purchase instructions from

time to time in compliance with applicable rules, regulations and

legal requirements. The actual timing, number and value of common

shares repurchased on the NYSE will depend on a number of factors,

including market and general business conditions.

Also the Second Tranche, like the First Tranche,

implements the resolution adopted by the Shareholders’ Meeting

(held on April 13, 2022) and duly communicated to the market, which

authorized the purchase of up to 10% of the Company’s common shares

during the eighteen-month period following such Shareholders’

Meeting. The repurchase authority will expire on October 12, 2023

or until such authority is extended or renewed before such

date.

Details of the repurchase transactions carried

out under the Second Tranche shall be disclosed to the market as

required by applicable regulation.

- FNV BB PR 1 December 2022 ENG

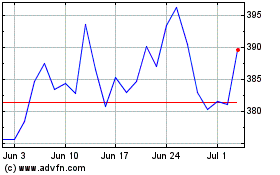

Ferrari NV (BIT:RACE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ferrari NV (BIT:RACE)

Historical Stock Chart

From Apr 2023 to Apr 2024