Eni Unveils Targets of Retail, Renewables, E-Mobility Entity Ahead of Planned IPO

November 22 2021 - 10:23AM

Dow Jones News

By Giulia Petroni

Eni SpA on Monday unveiled the financial and sustainability

targets of its newly rebranded entity comprising retail, renewables

and e-mobility activities ahead of its planned initial public

offering next year.

The Italian oil-and-gas major said at its capital markets day

that the entity, which will be named "Plenitude," plans to have an

annual investment program of around 1.8 billion euros ($2.03

billion) through the 2022-25 period, funded by its cash flow and

own borrowing.

The company is targeting earnings before interest, taxes,

depreciation and amortization of EUR1.3 billion for 2025 from

EUR600 million in the current year.

Cash flow from operations is expected to reach around EUR1

billion by 2025, while net debt will be around zero as of Jan. 1,

2022, according to Eni. Cash will be mainly allocated to accelerate

growth investments, but will also allow shareholder

distribution.

"The new entity fits into Eni's strategy and long-term

commitment to be a decarbonized energy company with sustainability

at its core," the Italian company said. "The decision also aligns

with a supportive industry backdrop, with an increasing demand for

renewables and green energy products for retail customers."

Plenitude plans to reach net zero by 2040, with all power sales

fully decarbonized by 2030 and renewable generation expected to

cover customer demand in 2040, according to Eni. It also aims to

provide fully decarbonized gas by 2040.

The entity, which will count around 2000 employees operating

across the power value chain, will be led by Stefano Goberti.

Write to Giulia Petroni at giulia.petroni@wsj.com

(END) Dow Jones Newswires

November 22, 2021 10:08 ET (15:08 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

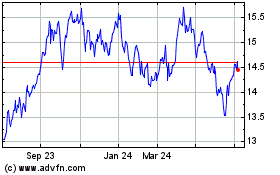

Eni (BIT:ENI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Eni (BIT:ENI)

Historical Stock Chart

From Apr 2023 to Apr 2024