Market News:

FTSE 100 6,524.36 -7.20 -0.11%

FTSE 250 20,996.44 -116.50 -0.55%

FTSE AIM 1,211.51 -0.31 -0.03%

Shares in London closed moderately in red territory as the

momentum that had driven gains in recent days has now ebbed. For

much of the day, investor sentiment was higher as it appeared

likely that the U.S. government was nearing approval of its $1.9

trillion spending plan. "Roughly an hour ago, sentiment turned a

little bearish as U.S. tech stocks rolled over and that impacted

confidence on this side of the Atlantic," said David Madden, Market

Analyst at CMC Markets UK.

Companies News:

AdEPT Technology Says 3Q Performance Was in Line With Views

AdEPT Technology Group PLC said Wednesday that its performance

for the third quarter of fiscal 2021 was in line with management

expectations, with revenue higher than the average of the previous

two quarters.

---

Aseana Abandons Demerger Plan After Failing to Get Banking

Approval

Aseana Properties Ltd. said Wednesday that a planned demerger of

around half of its assets can no longer take place after it failed

to get approval from banking syndicates that had lent funds for

construction of two properties.

---

Ashmore 1H Assets Under Management, Pretax Profit Rise

Ashmore Group PLC reported Wednesday a rise in assets under

management and pretax profit for the first half of fiscal 2021 and

said its performance showed early stages of recovery.

---

Crossword Cybersecurity Raises GBP1.6 Mln

Crossword Cybersecurity PLC said Wednesday that it has raised

around 1.6 million pounds ($2.2 million) via a discounted share

placing and subscription to drive growth in its Rizikon Pro

risk-mitigation platform.

---

Dunelm 1H Profit Rises on Pandemic-Boosted Revenue

Dunelm Group PLC on Wednesday reported a jump in pretax profit

for the first half of fiscal 2021 on higher revenue during the

coronavirus pandemic.

---

Ingenta Expects Fall in 2020 Revenue and Adjusted Ebitda

Ingenta PLC said on Wednesday that it expects a fall in 2020

revenue and adjusted Ebitda, and said the board confirmed its

intention to pay a dividend.

---

JD Sports May Move UK Jobs to Europe Due to Brexit

Regulation

JD Sports Fashion PLC Chairman Peter Cowgill has warned over the

potential need to transfer jobs from the U.K. to Europe due to

Brexit-related costs during an interview with BBC Radio 4 released

Wednesday.

---

Persimmon Sets GBP75 Mln Aside for UK Buildings-Cladding Safety

Issues

Persimmon PLC said Wednesday that it has made a 75 million

pounds ($103.6 million) provision in its 2020 accounts to pay for

cladding remediation and safety issues in its legacy development

portfolio.

---

Pittards Sees 2020 Revenue Fall

Pittards PLC said Wednesday that it expects a fall in 2020

revenue and that it finished the year with a reduced break-even

point and the cost base aligned to current conditions.

---

Redrow 1H Pretax Profit Rises; Reinstates Dividends

Redrow PLC said Wednesday that pretax profit and revenue both

rose in the first half of fiscal 2021, and reintroduced

dividends.

---

Safestyle to Post Losses for 2020 on Pandemic Hit

Safestyle UK PLC said Wednesday that it expects the coronavirus

pandemic to cause an underlying pretax loss of 4.7 million pounds

($6.5 million) for 2020 on lower revenue, despite progress in the

second half of the year.

---

SDI Group Sees Profit and Revenue Rising in FY 2021, FY 2022

SDI Group PLC said Wednesday that it anticipates revenue and

adjusted pretax profit to beat expectations for both fiscal 2021

and fiscal 2022 thanks to coronavirus-related contracts and despite

the pandemic hurting most other areas of the business.

---

Smurfit Kappa 2020 Pretax Profit Rose; Raises Dividend

Smurfit Kappa Group PLC said Wednesday that its pretax profit

rose despite a fall in revenue in 2020 and increased its final

dividend.

---

Starcom Sees Swing to Loss in 2020 on Pandemic Hit

Starcom PLC said Wednesday that it expects a swing to an

adjusted Ebitda loss in 2020 on lower revenue and higher costs amid

the coronavirus pandemic.

---

UK Oil & Gas Appeals Permit Refusal for Loxley Gas

Project

UK Oil & Gas PLC said Wednesday that it has submitted an

appeal to the U.K.'s Planning Inspectorate against the local

authority's decision to refuse a consent for the Loxley gas

appraisal project.

---

WPP Buys Brazil's DTI Digital for Undisclosed Sum

WPP PLC said Wednesday that it has acquired DTI Digital, a

Brazilian innovation and software-engineering company, for an

undisclosed sum.

Market Talk:

AstraZeneca Results to Be Dominated by Vaccine News

1314 GMT - AstraZeneca's coronavirus vaccine is likely to be the

focus of investor interest in the drug company's full-year results

Thursday. South Africa has suspended planned inoculations with the

jab amid concerns about its effectiveness against a new variant of

the virus. UBS says it believes investors will focus on latest

analyses of the vaccine, supply delays in Europe and recent

approvals by the European Medicines Agency and others. The Swiss

investment bank also predicts investor interest in the company's

China business and progress of drugs such as Tagrisso, Lynparza,

Imfinzi and Calquence. "We'll also look for any commentary around

Covid-19 potential impact in 2021 and the path to recovery," UBS

analyst Michael Leuchten says.

---

Pernod Ricard's Full-Year Guidance in Focus at 1H Results, Says

Citi

1251 GMT - The market will be looking more to Pernod Ricard's

full-year guidance than a 1H consensus beat that may already be

priced in, Citi says ahead of the French drinks group's first-half

results. Pernod has been trading high since U.K. peer Diageo posted

its own strong 1H results, and Citi thinks the company will need to

post guidance of high-single-digit organic full-year EBIT growth if

it is to impress investors. However, with Chinese New Year still

ahead and U.S. shipments and depletions set to lag Diageo's, such

guidance isn't likely to be forthcoming before the subsequent

quarterly results in April

---

Ashmore's 1H Earnings Surpassed Market Views

1232 GMT - Ashmore's results for the first half of fiscal 2021

were well ahead of expectations given higher seed capital gains,

Peel Hunt says. The U.K. brokerage says the FTSE 250-listed fund

manager remains well placed to capture improved flows into emerging

markets, given the relative attractions compared to developed

markets. "We shall review our forecasts this morning with the

expectation of a meaningful increase given the first-half

performance," Peel Hunt adds. Shares are up 0.6% at 482.40

pence.

Contact: London NewsPlus, Dow Jones Newswires;

+44-20-7842-931

(END) Dow Jones Newswires

February 10, 2021 12:16 ET (17:16 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

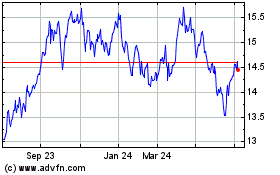

Eni (BIT:ENI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Eni (BIT:ENI)

Historical Stock Chart

From Apr 2023 to Apr 2024