Eni to Relaunch Buyback Program, Cancel Treasury Shares

February 28 2020 - 3:58AM

Dow Jones News

By Giulia Petroni

Eni SpA said Friday that it would propose the relaunch of a

buyback program for 2020 and the cancellation of previously

acquired treasury shares at its shareholder meeting in May.

The Italian oil-and-gas company said the proposal concerns the

purchase of treasury shares for a maximum outlay of 1.2 billion

euros ($1.32 billion).

The buyback programme would amount to EUR400 million in 2020,

according to Eni.

The company will also propose the cancellation of around 28.6

million treasury shares acquired in 2019. Eni holds around 61.6

million treasury shares, which equate to 1.70% of its share

capital.

The company is scheduled to hold a shareholder meeting on May

13.

Write to Giulia Petroni at giulia.petroni@wsj.com

(END) Dow Jones Newswires

February 28, 2020 03:43 ET (08:43 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

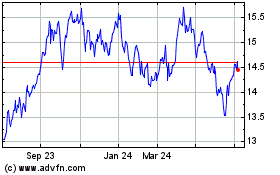

Eni (BIT:ENI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Eni (BIT:ENI)

Historical Stock Chart

From Apr 2023 to Apr 2024