EssilorLuxottica : Good resistance for the first quarter with

revenue down 10%, Taking measures to control costs and preserve

cash & Preparing for recovery and delivering on our

responsibilities to all

Good resistance for the first quarter

with revenue down 10%Taking measures to

control costs and preserve cashPreparing

for recovery and delivering on our

responsibilities to all

- Solid growth up to February, followed by material

declines in March due to COVID-19

- Optical business less affected, Online sales up double

digits

- Robust balance sheet and liquidity with Euro 4.9

billion in cash and short-term investments

- Positioned for recovery with strong product pipeline

and go to market strategy

- Enhanced corporate citizenship to support communities,

employees and customers

Charenton-le-Pont, France (May 5, 2020 –

7:00am) – EssilorLuxottica today announced that

consolidated revenue for the first quarter of 2020 totalled Euro

3,784 million, representing a year-on-year decline of 10.1%

compared to Q1 2019 revenue (-10.9% at constant exchange rates1),

revealing good resistance in the current unprecedented global

crisis.

“The market is going through an unprecedented

crisis and we have answered the call as a leader with a

responsibility to everyone whose lives we touch. Leading by example

during the COVID-19 pandemic, we are working hard to keep our

employees and their families safe, provide essential vision care

for emergency workers on the front lines and do our part to support

the customers and partners who make up the lifeblood of our

business.

While we are adapting the organization for the

few months ahead, early experience from the first countries to open

is encouraging. When the crisis fades, the resilient demand for

better vision will be visible again and we will be ready to serve

it.

The digitally powered network that we have

worked hard to build, connecting more than 400,000 optical stores

and labs, can now guarantee the best support to our customers and

an open door for all consumers even in the most difficult

times.

This combination of social and business

leadership will strongly help EssilorLuxottica and the entire

industry when a wider recovery materializes. Until then, we

continue to sharpen our digital assets, feed our consumers’ love

for brands and build on our talents”, commented Francesco Milleri,

CEO and Deputy Chairman of Luxottica, and Paul du Saillant, CEO of

Essilor.

Update on the COVID-19

crisis

EssilorLuxottica entered the COVID-19 crisis

with the advantage of a balanced market exposure spanning multiple

products, channels, price points and geographies as well as about

70% of revenue exposed to resilient optical prescription needs. Its

recent digital transformation has allowed the Company to strengthen

its customer and consumer relationships during this downturn

through CRM, e-commerce, online learning and social media.

In responding to the crisis, EssilorLuxottica’s

priority has been to ensure the health and safety of its employees.

It swiftly leveraged its strong IT capabilities to implement remote

connections with employees, customers and consumers and deliver a

functional and productive work-from-home strategy. It launched a

Euro 100 million fund to support employees and their families in

need and activated emergency pay for its most vulnerable employee

population in factories and retail stores. The Company also honored

its commitment to social responsibility by donating over two

million pieces of personal protective equipment including safety

goggles, protective eyewear and face masks to hospitals, public

institutions, employees and partners wherever it has local

roots.

EssilorLuxottica implemented strict measures to

secure business continuity, control costs and preserve cash in

order to position itself for a successful future:

- The Company relied on its diverse and flexible manufacturing,

logistics and optical lab footprint to provide business continuity

despite closures required by government guidelines and adapted the

capacity utilization to current demand.

- Costs were quickly controlled through employee furloughs,

reductions or deferrals of manager compensation, suspension of

marketing expenses and negotiations with suppliers and

landlords.

- Cash was preserved thanks to the cessation of share buybacks,

the decision not to propose a dividend distribution to the Annual

Shareholders’ Meeting and the suspension of all non-crucial

investments.

- New acquisitions and partnerships were put on hold until the

economy stabilizes.

Although group revenue has declined further in

April, worldwide needs for better vision are structural and likely

to fuel pent-up demand when the crisis fades, leading optical to be

one of the first essential categories to restart. For instance,

online sales staged an acceleration since March, when they reached

7% of group revenue versus 5% for the quarter, and they increased

further in April. In the first countries to reopen, domestic sales

of prescription products have regained momentum since the end of

March. In China, domestic sales of prescription lenses returned to

year-on-year growth since the end of April, even though total sales

were still down. The Company is prepared for wider recovery with a

pipeline of innovative branded products well suited to the new

environment.

The first quarter of 2020 was marked by solid

trends until March, followed by a rapid decline in most markets due

to store closures related to the COVID-19 pandemic. Given the

Company’s reliance on eye exam activity and retail traffic,

activity slowed across all divisions and geographies where social

distancing measures were enacted.

First-quarter 2020 revenue by operating

segment

|

In millions of Euros |

1Q 2020 |

1Q 2019* |

Change at constant rates1 |

Currency effect |

Change (reported) |

| Lenses &

Optical Instruments |

1,589 |

1,674 |

-5.8% |

0.7% |

-5.1% |

| Sunglasses &

Readers |

134 |

167 |

-20.5% |

1.2% |

-19.3% |

| Equipment |

38 |

44 |

-14.4% |

1.5% |

-12.9% |

|

Essilor revenue |

1,762 |

1,885 |

-7.3% |

0.8% |

-6.5% |

| Wholesale |

695 |

867 |

-19.8% |

0.0% |

-19.8% |

| Retail |

1,327 |

1,458 |

-10.3% |

1.3% |

-9.0% |

|

Luxottica revenue |

2,023 |

2,325 |

-13.8% |

0.8% |

-13.0% |

| Total

revenue |

3,784 |

4,210 |

-10.9% |

0.8% |

-10.1% |

* The breakdown of 2019 revenue has been

restated following the integration of Costa into Luxottica’s brand

portfolio.

Lenses & Optical

Instruments

The Lenses & Optical Instruments division

saw revenue decline by 5.1% (-5.8% at constant exchange rates1).

This resilient performance was adversely affected by closures of

optical retail outlets across North America, Latin America, Europe

and Asia, most of which have continued in April. However, market

activity started a gradual recovery from early March in China as

reopening began. E-commerce activity has strengthened since March

as consumers have continued to complete optical purchases of both

eyeglasses and contact lenses online. The global roll-out of

innovation from the Company’s product pipeline was postponed but is

ready to resume upon broader market reopening, including

Transitions Signature GEN 8, AVA lenses for better accuracy and the

successful Vision-R 800 measuring instrument.

Sunglasses & Readers

The Sunglasses & Readers division reported

revenue down 19.3% (-20.5% at constant exchange rates1). The

current scope includes Xiamen Yarui Optical (Bolon) and MJS, which

operate mainly in China, and FGX, which operates primarily in North

America.While the year started well for all three businesses,

Xiamen Yarui Optical (Bolon) and MJS were impacted by the COVID-19

related lockdowns in China from late January. Their decrease

gradually subsided from mid-March with the optical prescription

category outperforming sun, which has been much slower so far in

the recovery. FGX was impacted by the lockdowns in Europe and the

United States from March. Online sales for the division posted

double-digit growth in the first quarter.

Equipment

The Equipment division reported a decrease of

12.9% in revenue (-14.4% at constant exchange rates1). First

quarter dynamics carried over from 2019 in most markets ahead of

the COVID-19 impact. In response to the crisis customers took steps

to shore up near term supplies, which positively impacted

consumable sales, and postponed new orders of machine equipment

pending a stabilization in market conditions.

Wholesale

In the first quarter of the year, Luxottica

Wholesale posted Euro 695 million revenue, with a 19.8% decline

versus the same period of last year at both current and constant

exchange rates1. The division’s performance sharply deteriorated in

March, when more than two thirds of the Company’s customers shut

down stores worldwide and foot traffic in the remaining locations

collapsed. In the quarter, all the regions were equally down and

the positive price mix, the consolidation of Barberini and the

integration of Costa into Luxottica’s brand portfolio (included in

2019 revenue on a restated basis) could not materially offset the

sales decline due to COVID-19. In terms of mix, the prescription

business proved to be more resilient than sunglasses. Third-party

e-commerce platforms recorded solid growth, in particular in North

America where sales were up double digit.

Retail

Luxottica Retail recorded Euro 1,327 million

revenue, down year-on-year 9.0% at current and 10.3% at constant

exchange rates1. The division posted a strong start to the year in

January-February with sales up 8.0% (+5.5% at constant exchange

rates1) and then experienced a visible contraction in March as the

lockdown measures and mobility restrictions introduced in most of

the countries took effect. These restrictions forced the Company to

enact massive store closures and caused material traffic decline in

the locations that were still operating. The unprecedented

situation led to the closure of approximately one third of

Luxottica’s retail optical stores and most of the sun locations on

a global scale at the end of the quarter. Retail optical in North

America and Australia-New Zealand proved to be relatively less

affected, down low-to-mid single digit in sales at constant

exchange rates1 in the quarter after a strong performance in

January-February. This was due to a later emergence of COVID-19 in

those regions as well as the continued essential eyecare the

optical networks provided to their clients in need. Luxottica’s

direct e-commerce was up 14% in the first quarter, with all the

major proprietary platforms posting solid growth.

First-quarter 2020 revenue by geographical

area

|

In millions of Euros |

1Q 2020 |

1Q 2019* |

Change at constant rates1 |

Currency effect |

Change (reported) |

| North

America |

2,070 |

2,188 |

-8.1% |

2.7% |

-5.4% |

| Europe |

906 |

1,056 |

-14.1% |

-0.2% |

-14.3% |

| Asia, Oceania and

Africa |

587 |

705 |

-16.4% |

-0.4% |

-16.8% |

| Latin

America |

222 |

261 |

-6.8% |

-8.1% |

-14.9% |

|

Total |

3,784 |

4,210 |

-10.9% |

0.8% |

-10.1% |

* The geographical breakdown of 2019 revenue has

been revised to reflect a reclassification of certain geographic

markets, which the Group considers immaterial.

North America

In North America revenue decreased by 5.4%

(-8.1% at constant exchange rates1).

Essilor revenue proved resilient in this context

with a decline of 4.7% at constant exchange rates1. The Lenses

& Optical Instruments division experienced steady trends across

the US and Canada until the middle of March, after which it was

negatively impacted by store closures. In response to the crisis,

the division rapidly adjusted its cost base and supply chain and

has leveraged its alliance network to provide support for

independent eyecare professionals, while getting ready for the

recovery when it comes.Online sales continued to expand with

eyeglasses and contact lenses driving the performance. EyeBuyDirect

and Clearly saw record sales growth in April with a strong inflow

of new customers.

Sunglasses & Readers sales were down

mid-single digit for the quarter despite a strong start to the

year. FGX declined sharply in the second half of March with readers

proving more resilient than sunglasses in the downturn.

The Equipment division saw a slightly later

onset of COVID-19 related weakness as its primary customers began

to reduce activity along a different timeline.

For Luxottica, North America had a solid start

in January-February, with sales up 7% at constant exchange rates1,

in further acceleration versus the strong trend of the fourth

quarter 2019. Business deterioration started in March when the

COVID-19 outbreak reverted the trend.Wholesale had a promising

start to the year driven by independents and key accounts as well

as the strong performance of Oakley, then stalled in March when

most customers began to close their doors due to the pandemic.

Retail turned negative as well, as one-third of

the group’s optical retail stores and all Sunglass Hut and Oakley

locations shut down from mid-March and traffic into open stores was

drying up. Strong signs of business health in January-February,

with LensCrafters and the overall retail optical network up mid- to

high-single digit in sales, were erased by the sharp contraction of

March. Luxottica’s directly operated e-commerce platforms were up

double digit, mostly thanks to Ray-Ban.com and SunglassHut.com

performance.

The sound trajectory of the optical retail

business in North America before the COVID-19 outbreak in the

region is a source of confidence for the Company. When the economy

stabilizes and restarts, given optical retail’s nature of primary

non-discretionary service, it will be ready to serve the wide

pent-up demand.

Europe

In Europe revenue decreased by 14.3% (-14.1% at

constant exchange rates1).

Essilor revenues were down 6.7% at constant

exchange rates1. In Lenses and Optical instruments, the business

was boosted by the successful launch of Transitions Signature GEN 8

in Italy, Spain and the UK in the earlier part of the year. In

March, Italy, France and Spain were among the most impacted

countries whereas Eastern Europe resisted better. Online sales

delivered double-digit growth driven by contact lenses and

prescription solutions throughout the first quarter, with a visible

acceleration in March. Vision Direct, Europe’s largest online

contact lens supplier, experienced a surge in spontaneous new

buyers in March with no additional client acquisition cost.

Instruments followed the same trend as the lens business but

interest for new products such as the Vision-R 800 phoropter

remained strong.

Sunglasses & Readers sales started the year

with double-digit growth but were severely impacted in March,

especially in Italy and the UK.

The Equipment division started to see a decline

in sales at the beginning of March. Demand for consumables

benefitted from pre-lockdown inventory build-ups. Demand for

surfacing and coating machines stabilised at a subdued level.

For Luxottica, Europe was the most affected

region by the COVID-19 outbreak, with negative trends similarly

affecting both Retail and Wholesale. The weakness of the region was

worsened by a difficult year-on-year comparison for both the

divisions.With the exception of Germany, Turkey and Russia, the

Wholesale division suffered from material slowdown in sales in

every market, as business conditions progressively worsened in

March, severely hitting key markets like Italy, Spain and France

(where the new reimbursement regulation introduced at the beginning

of this year also weighed heavily).

The marked decrease in Retail sales was

attributable to the social distancing measures progressively

implemented by the European countries in March. At the end of the

quarter, in Italy, most Salmoiraghi & Viganò stores were

operating with ample limitations in terms of opening hours, while

all Sunglass Hut locations in Europe were closed.

Asia, Oceania and Africa

In Asia, Oceania and Africa, consolidated

revenue contracted by 16.8% (-16.4% at constant exchange

rates1).

After a strong first few weeks of the year,

Essilor’s Lenses and Optical Instruments division saw a swift

contraction in revenue at the end of January, as the region was the

first one to be hit by the COVID-19 pandemic. Revenue in China

troughed in mid-February with high double-digit declines as the

country’s lockdown took its toll, before starting a gradual

recovery from March. Domestic sales of prescription lenses have

returned to year-on-year growth since the end of April.

Anti-fatigue and blue-cut products proved more resilient in this

volatile environment, boosted by home working and increased screen

time. The launch of Transitions Signature GEN 8 in China was

postponed to the second quarter. Revenue in the rest of the region

started to deteriorate markedly in March with South East Asia,

India and South Korea particularly affected while Japan and

Australia proved more resilient. The Sunglasses & Readers

division experienced a sharp decline in revenue from end of

January. At the peak of the Chinese lockdowns in mid-February,

sales were down by high double-digit percentages. Since then, a

gradual recovery has materialized, with prescription activities

outperforming sun and wholesale outperforming retail. Within

retail, although most stores have reopened, post COVID-19 consumers

have shown a preference for high-street shopping over shopping

malls. These trends have led Xiamen Yarui Optical (Bolon) to fare

better than MJS in the recovery so far.

For Luxottica too, Asia, Oceania and Africa was

the first region to experience a contraction in both the Wholesale

and Retail divisions. Trends progressively deteriorated towards the

end of the quarter, with all countries in negative territory in

March.The Wholesale division experienced weak trends in Greater

China and Japan for most of the quarter, while trading conditions

in South Korea, Southeast Asia and Middle East worsened at the end

of the quarter.

In the Retail division, store closures peaked in

Greater China around mid-February, while locations in Australia,

New Zealand, South East Asia and South Africa were partly affected

by shutdown measures starting from the second half of March. In

terms of sales trends, Australia and New Zealand started the year

on a positive note, with a nice progression in January-February. On

the other hand, sales in Greater China posted sequential

improvement, remaining subdued even after lockdowns were

lifted.

Latin America

In Latin America, sales decreased by 14.9%

(-6.8% at constant exchange rates1).

At Essilor, sales in the region finished the

quarter up by 1.9% at constant exchange rates1 thanks to brisk

activity in Mexico, Chile, Costa Rica, Brazil and others ahead of

COVID-19 related closings. These highly positive trends were

disrupted in mid to late March as stores closed and retail traffic

slowed significantly. Recovery efforts are underway to develop

consumer outreach programs to encourage a return to optical stores,

drive additional myopia solutions enabled by the recent Miraflex

acquisition and support lab and retail partners.

For Luxottica, the Latin America region

experienced an overall positive trend in January-February, enduring

the negative impacts of lockdown measures only towards the end of

the quarter.The Wholesale division suffered from adverse trends in

both Brazil and Mexico, challenged further by a difficult

comparison base in particular for Brazil.

As for Retail, the division drove the overall

business expansion in the region during the first two months of the

year, which were double-digit positive in sales. Trading conditions

progressively worsened towards the end of March, with almost all

the retail locations in the region closed at the end of the

quarter, Mexico being the only market with a store base partially

operating.

Eliminating poor vision around the

world

EssilorLuxottica expanded its efforts to create

sustainable access to vision care reaching over 345 million

people. During the first quarter alone, it helped

deliver vision solutions to over 1.9 million wearers at the base of

the pyramid through its efforts to eliminate poor vision from the

world by 2050.

While the COVID-19 situation has slowed progress

through the suspension of its inclusive business expansion and

charitable clinics, Essilor has tapped into the influence of its

rural network of primary vision care providers to raise awareness

among their communities about social distancing, hand washing and

keeping safe during the pandemic.

Before the virus outbreak, Essilor signed an

official partnership with hiring company Truck Lagbe enabling truck

drivers in Bangladesh to visit Eye Mitras or attend screening

events to get eye tests and glasses at affordable rates. Essilor

also announced, together with The Fred Hollows Foundation and other

partners, the expansion of the “See Now” campaign in Uttar Pradesh,

India, in February. “See Now” will reach 200 million people with

messaging around eye health and offer free eyecare to 400,000

people in Uttar Pradesh. In China, Essilor drove discussions on

myopia with government officials, academics and other key opinion

leaders, and unveiled the China findings of its “Eliminating Poor

Vision in a Generation” report at a leading national health forum.

As a result of these efforts and more, Essilor was recognized by

change makers at the World Economic Forum in Davos through several

feature stories and reports.

In the first quarter, Luxottica, through its

support for OneSight, an independent non-profit organization of

which the group is the founding sponsor, served over 8,800

patients across 7 charitable clinics and 177 sustainable

centers around the world. OneSight ran clinics in locations

such as Bangladesh, Australia, New Zealand and the United States

and opened 7 new sustainable vision centers in Rwanda in Q1.

Finally, EssilorLuxottica took the 4th spot in

the Impak French 40 ranking, which rates CAC 40 companies according

to their impact on society and the environment.

Eyewear license renewals

In the first quarter of the year, Luxottica

announced the early ten-year renewal of exclusive license

agreements with Dolce & Gabbana and Versace, for the

development, production and worldwide distribution of sunglasses

and prescription frames under the Dolce & Gabbana and Versace

brands, respectively. Both agreements are scheduled to expire on

December 31, 2029.

Synergies and integration

Many integration projects continued unabated

during the crisis, including the creation of a single IT platform

and of a single network of prescription laboratories across the

Company. A few revenue synergy projects were temporarily delayed,

such as the penetration of Essilor lenses within the Company’s own

retail networks or the availability of prescription products under

the Ray-Ban brand. However, the environment also created

opportunities for deeper cooperation between Essilor and Luxottica

on a range of topics from procurement to joint key account

programs, joint sales protocols and deeper online integration.

Liquidity

The Company ended the quarter with Euro 4.9

billion in cash and short-term investments and a net debt of Euro

4.8 billion (including IFRS 16 – Leases liabilities). In addition,

the Company has undrawn credit facilities of Euro 5.2 billion.

Dividend

The Board of Directors decided not to submit any

dividend distribution proposal to the Annual Shareholders’ Meeting

of June 25, 2020. It will further assess the state of the business

in the second half of the year and the efficacy of all the measures

undertaken to face the COVID-19 outbreak. If the recovery is solid

enough, the Board of Directors may propose a special dividend

payment before the end of 2020.

Outlook

As announced on March 27, 2020 the Company’s

outlook for 2020, initially published on March 6, 2020 is no longer

valid. At present, the Company has insufficient visibility to

provide an assessment of the full impact of COVID-19 on its future

activity, as the situation remains volatile. It is however likely

that second quarter revenue and profitability will still be

negatively impacted by the crisis, and more severely so than in the

first quarter.

Conference call

No conference call will be held following the

first quarter trading update.Management is closely monitoring the

evolution of the business conditions, in order to assess the impact

of the COVID-19 on the next months. As soon as visibility improves,

the Company will share its view with the financial market.

Forthcoming investor events

- June 25, 2020: Annual Shareholders' Meeting

- July 31, 2020: H1 2020 results and conference call

- November 3, 2020: Q3 2020 sales and conference call

Notes 1 Figures at

constant exchange rates have been calculated using the

average exchange rates in effect for the corresponding period in

the previous year.

EssilorLuxottica is a global leader in the

design, manufacture and distribution of ophthalmic lenses, frames

and sunglasses. Formed in 2018, its mission is to help people

around the world to see more, be more and live life to its fullest

by addressing their evolving vision needs and personal style

aspirations. The Company brings together the complementary

expertise of two industry pioneers, one in advanced lens technology

and the other in the craftsmanship of iconic eyewear, to set new

industry standards for vision care and the consumer experience

around it. Influential eyewear brands including Ray-Ban and Oakley,

lens technology brands including Varilux® and Transitions®, and

world-class retail brands including Sunglass Hut and LensCrafters

are part of the EssilorLuxottica family. In 2019, EssilorLuxottica

had over 150,000 employees and consolidated revenues of Euro 17.4

billion. The EssilorLuxottica share trades on the Euronext Paris

market and is included in the Euro Stoxx 50 and CAC 40 indices.

Codes and symbols: ISIN: FR0000121667; Reuters: ESLX.PA; Bloomberg:

EL:FP.

CONTACTS

|

EssilorLuxottica Investor

Relations(Charenton-le-Pont) Tel: + 33 1 49 77 42

16(Milan) Tel: + 39 (02) 8633 4870E-mail:

ir@essilorluxottica.com |

EssilorLuxottica Corporate

Communications(Charenton-le-Pont) Tel: + 33 1 49 77 45

02(Milan) Tel: + 39 (02) 8633 4470E-mail:

media@essilorluxottica.com |

- DOWNLOAD PDF VERSION OF THE NEWS RELEASE

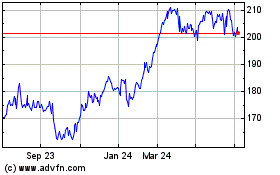

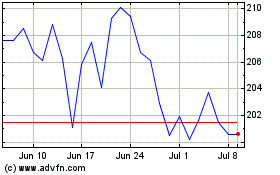

Essilorluxottica (BIT:1EL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Essilorluxottica (BIT:1EL)

Historical Stock Chart

From Apr 2023 to Apr 2024