South32 Cuts Cannington, Brazil Aluminium Output Guidance -- Update

January 22 2023 - 6:45PM

Dow Jones News

By Rhiannon Hoyle

South32 Ltd. on Monday downgraded annual production guidance for

its Cannington and Brazil Aluminium operations, but said group

output rose sharply in its fiscal first half and should rise

further in the months ahead.

The mining company also estimated first-half operating unit

costs to be in line with or below company forecasts at the majority

of its sites, as cost-cutting measures and weaker currencies in

some of the places it operates partly offset inflation

pressures.

Perth-based South32 said output guidance for the Cannington mine

in Australia's Queensland state, one of the world's biggest

producers of silver and lead, has been cut by 11%, citing lower

mill throughput and labor shortages.

"While the transition to truck haulage was completed at the end

of the December 2022 quarter and is expected to bring forward

higher-grade material in the mine plan, the ability to recover

production volumes in 2H FY23 [second half of fiscal 2023] is

expected to be constrained with near-term labor availability

challenges expected to impact mining rates," the miner said.

South32 also said its guidance for the Brazil Aluminium

business--which it owns in a joint venture with Alcoa Corp.--had

been lowered by 25% due to a slower-than-expected ramp up to

nameplate capacity. South32 announced a year ago it would

participate in a restart the Alumar aluminum smelter in Brazil,

which had been shuttered since 2015, after securing renewable power

under long term contracts.

"During the December 2022 quarter, the smelter experienced

temporary challenges with its alumina feeding systems and higher

than expected pot failure rates," said the miner. "As a result,

fewer pots are in operation than planned, and the ramp-up to

nameplate capacity is delayed to the September 2023 quarter."

Still, South32 said first-half group copper-equivalent

production increased by 12%. The company reported an increase in

second-quarter output of most of its commodities, with the

exception of copper, compared to the three months immediately

prior.

"We are well positioned to capture the benefit of improved

market conditions, with further expected production growth in 2H

FY23 and our ongoing focus on cost management to mitigate

inflationary pressures," the miner said.

In addition to first-half costs that are expected to mostly be

in line or better than expected, South32 said second-half costs

should enjoy some tailwinds.

"Operating unit costs in 2H FY23 are expected to benefit from

higher production volumes as we realize the benefit of prior

investments, embedded improvement projects and maintenance

completed in 1H FY23," South32 said. The company expects to report

production costs in its half-year fiscal report next month.

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

(END) Dow Jones Newswires

January 22, 2023 18:30 ET (23:30 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

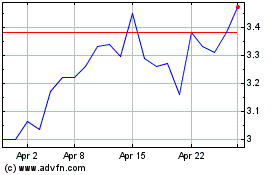

South32 (ASX:S32)

Historical Stock Chart

From Mar 2024 to Apr 2024

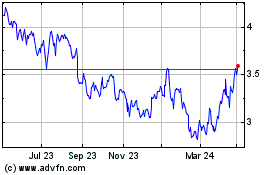

South32 (ASX:S32)

Historical Stock Chart

From Apr 2023 to Apr 2024