Rio Tinto Stuck Between a Rock and a Hard Place With Too Much Cash

July 31 2019 - 1:11AM

Dow Jones News

By Rhiannon Hoyle

SYDNEY-- Rio Tinto PLC is preparing to share billions of dollars

in profits with its investors but is finding its options squeezed

by a decade-old restriction that limits how big a stake can be

owned by a Chinese investor.

Rio Tinto is forecast to return as much as $4 billion to

investors following its half-year result due Thursday, but the

miner risks upsetting its largest shareholder--and putting it in

potential conflict with Australia's antitrust regulator--if it

again opts to buy back shares in addition to paying a regular

dividend.

The issue is Rio Tinto's biggest investor--Aluminum Corp. of

China, known as Chinalco--is running up against a 15% ownership

ceiling imposed by Australian regulators in 2008 when cash-rich

Chinese companies were snapping up global resources assets. China

is the world's biggest buyer of iron ore, and Australian mines

owned by Rio Tinto and BHP Group Ltd. dominate global supply.

Rio Tinto's Chief Financial Officer, Jakob Stausholm, earlier

this year said the miner was mindful of the cap when deciding how

to return surplus cash, but it wouldn't dictate capital-management

plans.

Chinalco's shareholding in Rio Tinto's London-listed stock has

risen to 14.5% after the Anglo-Australian miner bought back almost

$10 billion in shares across the dual-listed group since the start

of 2017, including using cash from the sale of its coal mines.

Global miners have been lavishing investors with returns in

recent years after emerging from a market downturn, and investors

this year are expecting a fresh cash windfall from booming iron-ore

prices, which have surged to a more-than five-year high.

Companies buying back shares have been one of the biggest

sources of demand for equities on global exchanges in recent years.

In the U.S., companies listed on the S&P 500 index spent

roughly $800 billion last year alone on share repurchases--the most

ever in a single year. Companies and investors often applaud share

repurchases because they juice per-share earnings and can boost

stock prices.

Another buyback by Rio Tinto could push Chinalco's interest

above the 15% cap, which might force the Chinese group to sell

stock against its wishes, analysts say. Rio Tinto's management may

be deterred in doing a buyback by the 27% rise this year in its

London stock price, which has benefited from the surge in iron-ore

prices.

Rio Tinto declined to comment, as did a spokesman for

Australia's Treasurer, who oversees foreign investments in the

country. A spokesperson for Chinalco couldn't be reached for

comment.

Chinalco's stake in Rio Tinto is a legacy of one of the biggest

takeover tussles in the history of the global mining industry.

BHP's hostile bid for Rio Tinto about a decade ago threatened to

create a dominant force in the supply of iron ore, a vital

commodity for China's industrialization. While Chinalco's stake

purchase helped to scuttle BHP's bid, regulators worried the

Chinese group could gain too much influence over iron-ore pricing

and Rio Tinto's strategy if it wasn't kept in check.

Australia's treasurer at the time, Wayne Swan, said Chinalco

would need to seek permission to breach the 15% cap and its request

would be scrutinized on national-interest grounds.

At Rio Tinto's annual shareholder meeting in April, the Chinese

group voted against the miner repurchasing more shares. The

resolution still passed, however, with 79% of those who voted

supporting the plan.

Some analysts predict Rio Tinto will unveil a special dividend

on top of its promise to pay out 40%-60% of underlying earnings,

estimated at $5 billion in the six months through June.

"We think an increase to the buyback is unlikely with Chinalco's

stake approaching 15%," Glyn Lawcock, a Sydney-based resources

analyst at UBS Investment Bank.

Others are less sure. "My perspective is this is a Chinalco

problem, not a Rio Tinto problem," said Paul McTaggart, analyst at

Citi Research.

Rio Tinto's result likely will continue an upbeat tone for the

mining sector where profits are being supported by iron ore's rally

on industry-supply setbacks from Brazil to Australia, and booming

Chinese steel production. Anglo American PLC said last week it

would buy back $1 billion in stock and raised its interim dividend

by 27% as it reported a jump in half-year profits.

Miners including BHP and Glencore PLC are also expected to

report bumper profits, along with large capital returns, in

August.

Rob Taylor in Canberra contributed to this article.

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

(END) Dow Jones Newswires

July 31, 2019 00:56 ET (04:56 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

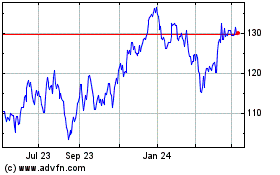

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

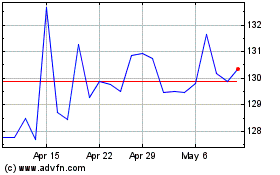

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Apr 2023 to Apr 2024