Rio Tinto Faces Delays, Added Costs for Big Copper-Mine Project

July 16 2019 - 12:54AM

Dow Jones News

By Rhiannon Hoyle

SYDNEY-- Rio Tinto PLC said it will take longer and cost more

than expected to finish building one of the world's biggest copper

mines in Mongolia's remote southern Gobi desert.

Prospects of an around two-year delay to an underground mine at

the Oyu Tolgoi operation risks worsening a global shortage of

copper that is predicted to deepen in coming years. Copper is an

industrial commodity used in everything from smartphones to

electric cars and power cables, and demand has been rising as

households in China and India become wealthier.

At Oyu Tolgoi, located near Mongolia's border with China where

locals have historically relied on nomadic herding and animal

husbandry, Rio Tinto wants to build a network of underground

tunnels some 4,000-feet deep. That's proven to be increasingly

difficult, with the varying strength of rocks deep below the

Earth's surface heightening a risk of rockfalls.

"The ground conditions are more challenging than expected," said

Stephen McIntosh, Rio Tinto's head of growth and innovation. A new

mining plan probably won't be ready until next year.

Mining safety has become a more-urgent issue in the wake of two

devastating spills of waterlogged waste in Brazil and the deaths of

potentially dozens of miners illegally working on an African copper

mine owned by Glencore PLC.

Oyu Tolgoi is Rio Tinto's biggest new investment, after

management completed a major expansion in Australian iron-ore

production. It represents a big shift in global mining away from

commodities such as coal that powered Asia's first phase of

industrialization to materials used in consumer products.

On Tuesday, Rio Tinto said it may not be able to produce copper

sustainably from the underground pit until possibly as late as June

2023. That represents a delay of up to 30 months from its earlier

forecast, and means the cost of the project could blow out by as

much as US$1.9 billion to US$7.2 billion.

A near-term impact is likely to be on Rio Tinto's net profit,

with management reviewing the carrying value of Oyu Tolgoi and

planning to update investors on Aug. 1 when it is due to release

its half-year result.

Rio Tinto, which manages the Oyu Tolgoi project, has an indirect

interest in the mine. It holds 50.8% of publicly traded Turquoise

Hill Resources Ltd., which in turn controls 66% of Oyu Tolgoi LLC,

the mine's owner. The Mongolian government owns 34%.

The development of Oyu Tolgoi was for a long time overseen by

Jean-Sébastien Jacques before his promotion to chief executive from

head of Rio Tinto's copper unit.

Oyu Tolgoi has a track record of delays--a victim of fraught

talks with Mongolia's government over how to divide profits. While

copper has been produced via an open pit since 2013, Rio Tinto

needs to dig underground to access the most valuable ore.

Management estimate 80% of the value can't be reached directly from

the surface.

When the underground mine is completed, Oyu Tolgoi will be the

world's third-largest copper mine, according to Rio Tinto's

projections.

Rio Tinto believes the world will need the same amount of copper

in the next 25 years that was produced in the previous five

centuries to meet global demand. That estimate is tied to continued

economic growth in China and emerging markets, as well as a rising

global population and a ballooning middle class.

Global copper output totals around 25 million metric tons

annually, but the market is expected to record a deficit of 190,000

tons this year, widening to 250,000 tons in 2020, according to the

International Copper Study Group, an organization of

copper-producing and -consuming countries. Many analysts think that

will deepen next decade.

Rio Tinto's other main copper project, Resolution, a joint

venture with BHP Group Ltd. in Superior, Ariz., isn't expected to

be built until the middle or later part of the next decade. It

recently discovered a copper deposit in Australia, called Winu,

where exploration drilling is continuing.

(END) Dow Jones Newswires

July 16, 2019 00:39 ET (04:39 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

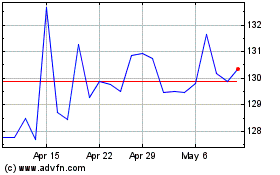

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

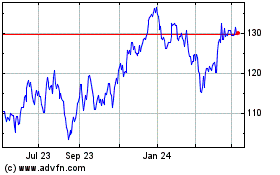

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Apr 2023 to Apr 2024