Rio Tinto Records Mixed Output; Bauxite Down, Copper Jumps -- Commodity Comment

January 17 2019 - 6:04PM

Dow Jones News

By Rhiannon Hoyle

SYDNEY--Rio Tinto PLC (RIO.LN), one of the world's largest

mining companies, published an operational report for 2018. The

miner reported a 2% rise in iron-ore shipments from its Australian

operations and forecast a further rise in 2019. Here are some

remarks from the report.

On iron-ore production:

"Pilbara operations produced 337.8 million [metric] tons (Rio

Tinto share 281.8 million tons) in 2018, 2% higher than 2017, at

the upper end of guidance. The production performance is

attributable to the ramp-up of expanded mines and minimal weather

events. Rio Tinto's Pilbara shipments in 2019 are expected to be

between 338 and 350 million tons, (100% basis), subject to weather

and market conditions. Following a plant fire at the port of Cape

Lambert A on Jan. 10, 2019, Rio Tinto expects limited disruption to

Robe Valley lump and fines shipments, which is reflected in the

above guidance."

On iron-ore prices:

"Approximately 17% of sales in 2018 were priced by reference to

the prior quarter's average index lagged by one month. The

remainder was sold either on current quarter average, current month

average or on the spot market. Achieved average pricing in 2018 was

$57.6 per wet metric ton on an FOB basis (equivalent to $62.5 per

dry metric ton). In 2017, the full year price achieved was $59.6

per wet metric ton (equivalent to $64.8 per dry metric ton)."

On bauxite output:

"Bauxite production in 2018 of 50.4 million tons was 1% lower

than 2017 and at the upper end of guidance. Strong production at

Gove and the Andoom mining area in Weipa was offset by lower

production at two non-managed operations. The CBG mine in Guinea

was impacted by planned tie-in works as part of the commissioning

of the expansion project, and MRN in Brazil was affected by the

Alunorte refinery outage."

On newest bauxite mine:

"The Amrun project achieved first shipment six weeks ahead of

schedule, with a total of nine ships loading 600,000 tons before

the end of 2018."

On Kennecott copper mine:

"Mined copper production in 2018 was 37% higher than 2017 as

mining activity continued in a higher grade area of the pit,

coupled with productivity improvements and increased plant

throughput. In 2019, the production profile will see increased

variability in grade as operations mine in lower levels of the pit,

together with waste stripping related to the south wall pushback

expansion. Anticipated south wall pushback grades begin to increase

in late-2020 and are expected to offset this variability over the

longer term."

On Oyu Tolgoi operation:

"Work continues on the critical shaft two equipping activities,

central heating plant, mine infrastructure, underground materials

handling systems and on priority underground development. Overall

progress continues to track in-line with the re-forecast undertaken

in the third quarter of 2018. The project workforce has now reached

peak levels of around 9,400, whilst maintaining a high (88%)

participation rate of Mongolian nationals."

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

(END) Dow Jones Newswires

January 17, 2019 17:49 ET (22:49 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

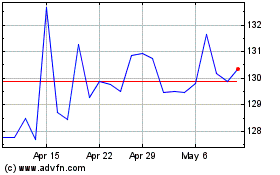

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

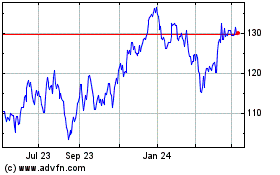

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Apr 2023 to Apr 2024