Leading Data and Analytics Provider for Energy

and Commodities Markets Will Provide New Pillars of Growth for Dow

Jones

Growing, High Margin, Subscription-Based

Business Expected To Transform the Dow Jones Professional

Information Business

News Corp announced today that it has entered into an agreement

to acquire the Oil Price Information Service (OPIS) and related

assets from S&P Global and IHS Markit.

The scaled, highly profitable and consistently growing digital

data, analytics and insights provider will become part of Dow

Jones’ burgeoning Professional Information Business (PIB), which

includes Dow Jones Risk & Compliance, Dow Jones Newswires and

Factiva. OPIS has a revenue base that is nearly 100% digital, 95%

recurring and operates at approximately 50+% Adjusted EBITDA

margins1, with modest Capex requirements.

News Corp is acquiring OPIS for $1.150 billion in a cash

transaction, subject to customary adjustments, and also expects to

receive an estimated tax benefit of $180 million as part of the

transaction2. S&P Global and IHS Markit announced in May their

exploration of the divestiture of the businesses to ensure a timely

merger of both companies. News Corp’s acquisition of OPIS is

subject to customary closing conditions, including regulatory

approvals and the consummation of the S&P Global and IHS Markit

merger, which is expected in the fourth quarter of this calendar

year.

Founded in 1977, OPIS today is a global industry standard for

benchmark and reference pricing and news and analytics for the oil,

natural gas liquids and biofuels industries, and a growing provider

of insights and analytics in renewables and carbon pricing. At its

core, OPIS provides end-to-end pricing and analytics information to

the energy industry from the refinery to the retailer.

With this acquisition, Dow Jones will also be providing pricing

and news and analytics for the Coal, Mining and Metals end markets

through McCloskey, among other brands. In addition, Dow Jones will

be well poised to leverage the global transition to renewables and

the growth opportunities resulting from emerging energy categories

like hydrogen, carbon credits, biofuels, LNG, solar, water and

electric vehicles.

OPIS will also help Dow Jones in its goal of building the

leading global business news and information platform for

professionals. With its valuable data, which is used as a currency

for the industry, OPIS has deep and trusted customer relationships

with high renewal rates, and a seasoned management team with an

average of 18 years of experience.

“OPIS will be the cornerstone for a rising commodities, energy

and renewables digital business that we are convinced will have a

positive impact on Dow Jones and News Corp,” said Robert Thomson,

Chief Executive of News Corp. “We certainly believe OPIS and Dow

Jones will be more than the sum of their valuable parts. Dow Jones

is ideally positioned to accelerate growth at OPIS, while OPIS will

be a powerful pillar, alongside Risk & Compliance, in the

fast-growing Dow Jones Professional Information Business.”

OPIS and related assets revenues have grown at an approximate

10% CAGR, including acquisitions, since 2016, as disclosed by IHS

Markit, and grew at a consistent rate through the 2008-2009 global

financial crisis, the 2014-2015 oil market downturn and the current

pandemic. In its current fiscal year (ending November 30, 2021),

OPIS is expected to generate approximately $129 million in

revenues, with Adjusted EBITDA growing at a faster rate, and

expected Adjusted EBITDA margins exceeding 50%.

The energy and commodity pricing information industry is

estimated to be at $3 billion as of 2020 (source: Burton-Taylor),

with a 5-year CAGR of more than 7%. Given the large scale and

global corporate and societal response to climate change, the

fast-growing renewable energy markets have rising demand for the

kind of data and analytics Dow Jones will be able to supply with

OPIS. OPIS’ retail offerings have the ability to grow outside the

US and in segments like connected cars and electric vehicles.

“Dow Jones and OPIS together can be a leading provider of energy

and renewable information, combining trusted news, data, analytics,

events and an interconnected professional community,” said Almar

Latour, CEO of Dow Jones. “OPIS’s expertise in commodities, energy

and renewables aligns with Dow Jones’ focus on building deeper

specialization in specific verticals around valuable content. OPIS

is expected to accelerate PIB’s growth by adding a highly

profitable, growing business that can expand even faster as part of

Dow Jones.”

OPIS, headquartered in Rockville, Maryland, also has offices in

Mexico, the United Kingdom, France, Romania and Singapore. The

company employs approximately 400 professionals globally.

News Corp will report its full year 2021 results on August 5,

2021. As of the Third Quarter year to date, Dow Jones revenues

increased 4 percent while Segment EBITDA expanded 49 percent, on

21% Segment EBITDA margins, and achieved record profitability.

###

1 Adjusted EBITDA margin is the ratio of

Adjusted EBITDA to revenues. In its fiscal year ended November 30,

2020, OPIS generated revenue and Adjusted EBITDA of approximately

$121 million and $61 million, respectively. Adjusted EBITDA

excludes corporate allocations of $11 million from EBITDA. EBITDA

for the OPIS business excludes depreciation expense of $2.8

million, restructuring and other expense, net of $4.5 million and

equity losses from investees of $0.2 million from net income of

$42.1 million. All figures based on information provided by IHS

Markit Ltd.

2 News Corp expects to receive a step up

in tax basis resulting in an annual deduction over the next 15

years with an estimated tax benefit of $180 million on a present

value basis.

Forward-Looking Statements

This release contains forward-looking statements based on

current expectations or beliefs, as well as assumptions about

future events, and these statements are subject to factors and

uncertainties that could cause actual results to differ materially

from those described in the forward-looking statements. The words

“expect,” "will," “estimate,” “anticipate,” “predict,” “believe,”

“potential” and similar expressions and variations thereof are

intended to identify forward-looking statements. These statements

appear in a number of places in this release and include statements

with respect to, among other things, the expected timing for the

completion of, and the potential benefits from, the acquisition of

OPIS. Readers are cautioned that any forward-looking statements are

not guarantees of future performance and involve risks and

uncertainties. Many factors, such as the risks and uncertainties

related to the parties’ efforts to comply with and satisfy

applicable regulatory approvals and closing conditions relating to

the acquisition, could cause actual results to differ materially

from those described in these forward-looking statements. The

forward-looking statements in this release speak only as of this

date and News Corp and Dow Jones undertake no obligation (and

expressly disclaim any obligation) to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law.

About News Corp

News Corp (Nasdaq: NWS, NWSA; ASX: NWS, NWSLV) is a global,

diversified media and information services company focused on

creating and distributing authoritative and engaging content and

other products and services. The company comprises businesses

across a range of media, including: digital real estate services,

subscription video services in Australia, news and information

services and book publishing. Headquartered in New York, News Corp

operates primarily in the United States, Australia, and the United

Kingdom, and its content and other products and services are

distributed and consumed worldwide. More information is available

at: http://www.newscorp.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210802005338/en/

News Corp Investor Relations Michael Florin 212-416-3363

mflorin@newscorp.com

News Corp Corporate Communications Jim Kennedy 212-416-4064

jkennedy@newscorp.com

Dow Jones Corporate Communications Matthew Hutchison

+1415-583-2119 Matthew.hutchison@dowjones.com

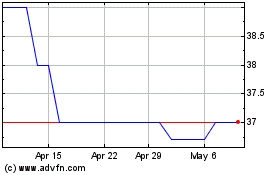

News (ASX:NWSLV)

Historical Stock Chart

From Mar 2024 to Apr 2024

News (ASX:NWSLV)

Historical Stock Chart

From Apr 2023 to Apr 2024