Janus Henderson Investors (NYSE/ASX: JHG) today announced the

innovative Janus SG Global Trends Index has been licensed to Global

Atlantic Financial Group, a leading U.S. retirement and life

insurance company. The Index was developed in partnership with

Société Générale who acts as the index sponsor and licensor. As

part of this agreement, Global Atlantic will have exclusive usage

rights to the index within their Fixed Index Annuity offering.

Janus Henderson Indices has been providing quantitative index

strategies since 2012, and these strategies are now the basis for

$3.5 billion in investment products with major financial partners

including Fixed Indexed Annuities, Variable Annuities, and Exchange

Traded Funds. Janus Henderson Indices specializes in building

custom indices to meet the needs of sophisticated financial

partners such as Global Atlantic who today announced that the Janus

SG Global Trends Index will be available in a first-of-its-kind

crediting method for Fixed Index Annuities known as the Enhanced

Accumulation Strategy, or EAS, available within Global Atlantic’s

Choice Accumulation Edge product.

The Janus SG Global Trends Index uses dynamic risk management

tools designed to effectively diversify among global stocks, bonds

and commodities. Traditional tools have typically relied on the

assumption that stocks are always higher risk, while bonds are

relatively safe, which does not always hold true. Such asset

allocation approaches can overallocate to bonds in rising interest

rate environments, and may not consider the changing return

potential of different asset classes over time. The Janus SG Global

Trends Index uses market signals to manage these challenges

dynamically, adapting to changes in risk profiles between bonds,

stocks and commodities.

“We believe that this innovative approach to dynamic asset

allocation and the risk aware features of the Janus SG Global

Trends Index can make it more likely than traditional approaches to

deliver consistent, stable returns across varying market

conditions. The index is particularly suited to the innovative

crediting method, EAS, which Global Atlantic has today announced,”

said Nick Cherney, Head of Exchange Traded Products for Janus

Henderson.

“We’re excited to feature the Janus SG Global Trends Index

within our Choice Accumulation Edge FIA as the basis for our

innovative EAS crediting method. This option gives customers a

compelling new avenue to pursue their growth objectives,” says

Paula Nelson, President of Retirement at Global Atlantic.

Janus Henderson Indices is an innovator in index construction,

offering investors sophisticated approaches to understanding

complex markets. Grounded in our decades of experience in asset

management, our rigorous, rules-based approach powers transparent

and investable products around the world in a variety of asset

classes, markets and weighting methodologies. For more information,

visit https://indices.janushenderson.com/.

Notes to editors

About Janus Henderson

Janus Henderson Group is a leading global active asset manager

dedicated to helping investors achieve long-term financial goals

through a broad range of investment solutions, including equities,

fixed income, quantitative equities, multi-asset and alternative

asset class strategies.

As of March 31, 2020, Janus Henderson has approximately US$294

billion in assets under management, more than 2,000 employees, and

offices in 28 cities worldwide. Headquartered in London, the

company is listed on the New York Stock Exchange (NYSE) and the

Australian Securities Exchange (ASX).

About Société Générale

Societe Generale is one of the largest European financial

services groups. It is renowned for its equity strategies and its

expertise as a leading derivatives house. It serves 31 million

clients in 67 countries worldwide.

In addition, Societe Generale is a leading index provider.

Through a fully coordinated and global approach, Societe Generale

provides clients with investment and hedging solutions via

innovative and efficient underlyings. It is headquartered in Paris,

France.

About Global Atlantic

Global Atlantic Financial Group, through its subsidiaries,

offers a broad range of retirement, life and reinsurance products

designed to help customers address financial challenges with

confidence. A variety of options help Americans customize a

strategy to fulfill their protection, accumulation, income, wealth

transfer and end-of-life needs.

Global Atlantic was founded at Goldman Sachs in 2004 and

separated as an independent company in 2013. Its success is driven

by a unique heritage that combines deep product and distribution

knowledge with leading investment and risk management, alongside a

strong financial foundation of nearly $90 billion in assets.

Past performance is no guarantee of future results. Investing

involves risk, including the possible loss of principal and

fluctuation of value.

An index is unmanaged and not available for direct investment.

There is no assurance that the proprietary rules-based index

methodology will select securities that individually, or in the

aggregate, outperform the applicable broader market universe.

IMPORTANT LEGAL NOTICE

The Janus SG Global Trends Index (the “Index”) is the exclusive

property of SG Americas Securities, LLC (together with its

affiliates, “SG”). “SG Americas Securities, LLC”, “SGAS”, “Société

Générale”, “SG”, “Société Générale Indices”, “SGI”, and “Janus SG

Global Trends” (collectively, the “SG Marks”) are trademarks or

service marks used by SG. The index is not directly investible.

Exposure to the index may be possible through products which

reference the index value (each, an “Index Product”). This document

does not constitute an offer, solicitation, promotion,

recommendation or sale of the Index or any Index Product by SG.

Anyone seeking to invest in an Index Product should seek

appropriate legal, tax, accounting, and/or financial advice from

qualified professional advisors prior to making investment

decisions.

Neither Janus Henderson Indices LLC or its affiliates (“Janus

Henderson”) nor any other party makes any representation or

warranty, express or implied, to the owners of any Index Product or

any member of the public regarding the advisability of investing in

any Index Product generally or the similarities or variations

between the performance of the Index Product, Model or the Index

and the performance of the underlying securities or financial

instruments. Janus Henderson Indices is the licensor of certain

trademarks, service marks and trade names of Janus Henderson. Any

Index Product is not issued, sponsored, offered, structured or

endorsed by Janus Henderson, and Janus Henderson has not provided

investment advice to any person in connection with the Index

Product. Neither Janus Henderson nor any other party guarantees the

accuracy and/or the completeness of the indices, models or any data

included therein or any calculations made with respect to any Index

Product. Janus Henderson disclaims all warranties of

merchantability or fitness for any particular purpose with respect

to the indices or any data included therein.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200623005180/en/

Janus Henderson Investors Media Contact: Sarah Johnson,

+1 720-364-0708 sarah.johnson@janushenderson.com

Investor Relations Contact: James Kurtz, 303-336-4529

James.Kurtz@janushenderson.com

Global Atlantic Media Contact: ICR Inc.

GlobalAtlantic@icrinc.com (203) 682-8268

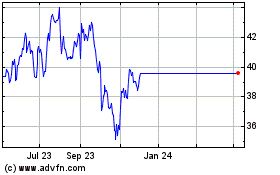

Janus Henderson (ASX:JHG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Janus Henderson (ASX:JHG)

Historical Stock Chart

From Apr 2023 to Apr 2024