TPG Telecom Profit Dented by Abandoning Mobile Network

September 04 2019 - 7:24PM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--TPG Telecom Ltd.'s (TPM.AU) annual profit

was slugged by the decision to drop development of a new mobile

network in Australia, and the telecom operator warned earnings are

likely to again falter as customers increasingly migrate to

Canberra's national broadband network.

Net profit slumped by 56% to 173.8 million Australian dollars

(US$118.1 million) in the 12 months through July, from A$396.4

million the year before, while revenue was just 0.7% lower at

A$2.48 billion from A$2.50 billion, TPG said Thursday.

The result was squeezed by an almost A$237 million impairment

expense for the move in January to abandon its rollout of an

Australian mobile network after the federal government blocked the

use of equipment made by China's Huawei Technologies Co. on

national security grounds. The company also booked a A$9-million

hit for one-off costs tied to its planned tie-up with Vodafone

Hutchison Australia.

Stripping out the impairment and merger costs, underlying

earnings before interest, tax, depreciation and amortization for

the financial year were down 1% at A$818.4 million, it said.

TPG said it would hold its dividend for the second-half of the

year steady at 2 Australian cents a share, for a full-year payout

of 4 cents, although its dividend reinvestment plan would remain

suspended.

Australia's antitrust regulator earlier in the year blocked the

proposed merger between TPG and Vodafone Hutchison, arguing that

TPG remained the best opportunity in the country for the

development of a new competitive mobile network.

The companies argue there is little overlap between their

operations, and a deal would bring together Vodafone's strong

market position in the mobile market and TPG, which has the

second-largest fixed broadband business and no mobile network. In

May, the pair lodged proceedings in the Federal Court of Australia

seeking approval for their tie up.

TPG said it expected the 2020 financial year to hold the

greatest impact from customer migration to the federal government's

NBN network, and by the end of the period it anticipated having

less than 15% of its residential broadband customer base remaining

on ADSL. The NBN continues to roll out a wholesale broadband

network that sells open-access to retail phone and internet

providers.

TPG said its cost-efficiency program continued to deliver

savings and that its corporate division was expected to see another

year of growth, but its underlying earnings growth was unlikely to

offset what should be the peak year for NBN headwinds.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

September 04, 2019 19:09 ET (23:09 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

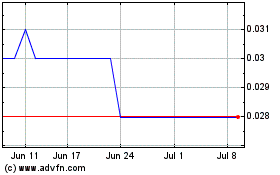

Hutchison Telecommunicat... (ASX:HTA)

Historical Stock Chart

From Mar 2024 to Apr 2024

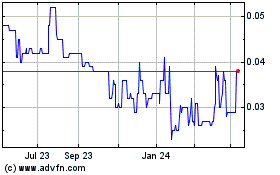

Hutchison Telecommunicat... (ASX:HTA)

Historical Stock Chart

From Apr 2023 to Apr 2024