Pricing Supplement No. 4162

(To the Prospectus dated August 1, 2019, the Prospectus Supplement dated August 1, 2019, the Prospectus Supplement Addendum dated

February 18, 2021 and the Product Supplement EQUITY STR-1 dated March 5, 2021)

|

|

Filed

Pursuant to Rule 424(b)(2)

Registration Statement No. 333-232144

|

300,000 Units

$10 principal amount per unit

CUSIP No. 06747X599

|

Pricing Date

Settlement Date

Maturity Date

|

September 9, 2021

September 17, 2021

September 26, 2024

|

|

|

|

|

|

|

|

|

Strategic Accelerated Redemption Securities®

Linked to the MSCI Emerging Markets Index

§ Automatically

callable if the closing level of the Index on any Observation Date, occurring approximately one, two and three years after the pricing

date, is at or above the Starting Value

§ In

the event of an automatic call, the amount payable per unit will be:

§ $11.121

if called on the first Observation Date

§ $12.242

if called on the second Observation Date

§ $13.363

if called on the final Observation Date

§ If

not called on the first and second Observation Dates, a maturity of approximately three years

§ If

not called, 1-to-1 downside exposure to decreases in the Index, with up to 100% of your principal at risk

§ All

payments are subject to the credit risk of Barclays Bank PLC

§ No

periodic interest payments

§ In

addition to the underwriting discount set forth below, the notes include a hedging-related charge of $0.05 per unit. See “Structuring

the Notes”

§ Limited

secondary market liquidity, with no exchange listing

§ The

notes are our unsecured and unsubordinated obligations and are not deposit liabilities of Barclays Bank PLC. The notes are not covered

by the U.K. Financial Services Compensation Scheme or insured by the U.S. Federal Deposit Insurance Corporation or any other governmental

agency or deposit insurance agency of the United States, the United Kingdom, or any other jurisdiction

|

|

|

|

|

|

|

|

The notes are being issued by Barclays Bank PLC (“Barclays”).

There are important differences between the notes and a conventional debt security, including different investment risks. See “Risk

Factors” and “Additional Risk Factors” beginning on page TS-7 of this term sheet and “Risk Factors” beginning

on page PS-7 of product supplement EQUITY STR-1 and beginning on page S-7 of the prospectus supplement.

Our initial estimated value of the notes, based on our internal pricing

models, is $9.43 per unit on the pricing date, which is less than the public offering price listed

below. See “Summary” on the following page, “Risk Factors” beginning on page TS-7 of this term sheet

and “Structuring the Notes” on page TS-18 of this term sheet.

Notwithstanding and to the exclusion of any other term of the notes

or any other agreements, arrangements or understandings between Barclays and any holder or beneficial owner of the notes, by acquiring

the notes, each holder and beneficial owner of the notes acknowledges, accepts, agrees to be bound by, and consents to the exercise of,

any U.K. Bail-in Power by the relevant U.K. resolution authority. All payments are subject to the risk of exercise of any U.K. Bail-in

Power by the relevant U.K. resolution authority. See “Consent to U.K. Bail-in Power” on page TS-3 and “Risk Factors”

beginning on page TS-7 of this term sheet.

_________________________

None of the Securities and Exchange Commission (the “SEC”),

any state securities commission, or any other regulatory body has approved or disapproved of these securities or determined if this Note

Prospectus (as defined below) is truthful or complete. Any representation to the contrary is a criminal offense.

_________________________

|

|

Per Unit

|

Total

|

|

Public offering price

|

$ 10.00

|

$ 3,000,000

|

|

Underwriting discount

|

$ 0.15

|

$ 45,000

|

|

Proceeds, before expenses, to Barclays…

|

$ 9.85

|

$ 2,955,000

|

The notes:

|

Are Not FDIC Insured

|

Are Not Bank Guaranteed

|

May Lose Value

|

BofA Securities

September 9, 2021

Strategic Accelerated Redemption Securities®

Linked to the MSCI Emerging Markets Index, due September 26, 2024

|

|

Summary

The Strategic Accelerated Redemption Securities® Linked

to the MSCI Emerging Markets Index, due September 26, 2024 (the “notes”) are our unsecured and unsubordinated obligations

and are not deposit liabilities of Barclays. The notes are not covered by the U.K. Financial Services Compensation Scheme or insured by

the U.S. Federal Deposit Insurance Corporation or any other governmental agency or deposit insurance agency of the United States, the

United Kingdom or any other jurisdiction. The notes will rank equally with all of our other unsecured and unsubordinated debt. Any

payments due on the notes, including any repayment of principal, will be subject to the credit risk of Barclays and to the risk of exercise

of any U.K. Bail-in Power (as described herein) or any other resolution measure by any relevant U.K. resolution authority. The notes

will be automatically called at the applicable Call Amount if the closing level of the Market Measure, which is the MSCI Emerging Markets

Index (the “Index”), on any Observation Date is equal to or greater than the Starting Value. If your notes are not called,

you will lose all or a portion of the principal amount of your notes. Payments on the notes, including the amount you receive at maturity

or upon an automatic call, will be calculated based on the $10 principal amount per unit and will depend on the performance of the Index,

subject to our credit risk. See “Terms of the Notes” below.

On the cover page of this term sheet, we have provided the estimated

value for the notes. This estimated value was determined based on our internal pricing models, which take into account a number of variables,

including volatility, interest rates and our internal funding rates, which are our internally published borrowing rates and the economic

terms of certain related hedging arrangements. The notes are subject to an automatic call, and the initial estimated value is based on

an assumed tenor of the notes. This estimated value is less than the public offering price.

The economic terms of the notes (including the Call Amounts and Call

Premiums) are based on our internal funding rates, which may vary from the levels at which our benchmark debt securities trade in the

secondary market, and the economic terms of certain related hedging arrangements. The difference between these rates, as well as the underwriting

discount, the hedging-related charge and other amounts described below, reduced the economic terms of the notes. For more information

about the estimated value and the structuring of the notes, see “Structuring the Notes” on page TS-18.

|

Terms of the Notes

|

Payment Determination

|

|

Issuer:

|

Barclays Bank PLC (“Barclays”)

|

Automatic Call Provision:

Redemption Amount Determination:

If the notes are not called you will receive the Redemption Amount per

unit on the maturity date, determined as follows:

Because the Threshold Value for the notes is equal to the Starting

Value, you will lose all or a portion of your investment if the Ending Value is less than the Starting Value.

|

|

Principal Amount:

|

$10.00 per unit

|

|

Term:

|

Approximately three years, if not called on the first or second Observation Dates

|

|

Market Measure:

|

The MSCI Emerging Markets Index (Bloomberg symbol: “MXEF”), a price return index

|

|

Starting Value:

|

1,299.97

|

|

Ending Value:

|

The Observation Level of the Market Measure on the final Observation Date

|

|

Observation Level:

|

The closing level of the Market Measure on the applicable Observation Date

|

|

Observation Dates:

|

September 22, 2022, September 21, 2023 and September 19, 2024, (the

final Observation Date).

The Observation Dates are subject to postponement in the event

of Market Disruption Events, as described beginning on page PS-25 of product supplement EQUITY STR-1.

|

|

Call Level:

|

1,299.97 (100% of the Starting Value)

|

|

Call Amounts (per Unit) and Call Premiums:

|

$11.121, representing a Call Premium of 11.21% of the principal amount,

if called on the first Observation Date;

$12.242, representing a Call Premium of 22.42% of the principal amount,

if called on the second Observation Date; and

$13.363, representing a Call Premium of 33.63% of the principal

amount, if called on the final Observation Date.

|

|

Call Settlement Dates:

|

Approximately the fifth business day following the applicable Observation Date, subject to postponement as described on page PS-22 of product supplement EQUITY STR-1; provided however, that the Call Settlement Date related to the final Observation Date will be the maturity date.

|

|

Threshold Value:

|

1,299.97 (100% of the Starting Value)

|

|

Fees Charged:

|

The public offering price of the notes includes the underwriting discount of $0.15 per unit as listed on the cover page and a hedging-related charge of $0.05 per unit described in “Structuring the Notes” on page TS-18.

|

|

Calculation Agents:

|

Barclays and BofA Securities, Inc. (“BofAS”).

|

|

Strategic Accelerated Redemption Securities®

|

TS-2

|

Strategic Accelerated Redemption Securities®

Linked to the MSCI Emerging Markets Index, due September 26, 2024

|

|

The terms and risks of the notes are contained in this term sheet and

the documents listed below (together, the “Note Prospectus”). The documents have been filed as part of a registration statement

with the SEC, which may, without cost, be accessed on the SEC website as indicated below or obtained from Merrill Lynch, Pierce, Fenner

& Smith Incorporated (“MLPF&S”) or BofAS by calling 1-800-294-1322:

Before you invest, you should read the Note Prospectus, including this

term sheet, for information about us and this offering. Any prior or contemporaneous oral statements and any other written materials you

may have received are superseded by the Note Prospectus. Capitalized terms used but not defined in this term sheet have the meanings set

forth in product supplement EQUITY STR-1. Unless otherwise indicated or unless the context requires otherwise, all references in this

document to “we,” “us,” “our” or similar references are to Barclays.

Consent to U.K. Bail-in Power

Notwithstanding and to the exclusion of any other term of the notes

or any other agreements, arrangements or understandings between us and any holder or beneficial owner of the notes, by acquiring the notes,

each holder and beneficial owner of the notes acknowledges, accepts, agrees to be bound by, and consents to the exercise of, any U.K.

Bail-in Power by the relevant U.K. resolution authority.

Under the U.K. Banking Act 2009, as amended, the relevant U.K. resolution

authority may exercise a U.K. Bail-in Power in circumstances in which the relevant U.K. resolution authority is satisfied that the resolution

conditions are met. These conditions include that a U.K. bank or investment firm is failing or is likely to fail to satisfy the Financial

Services and Markets Act 2000 (the “FSMA”) threshold conditions for authorization to carry on certain regulated activities

(within the meaning of section 55B FSMA) or, in the case of a U.K. banking group company that is a European Economic Area (“EEA”)

or third country institution or investment firm, that the relevant EEA or third country relevant authority is satisfied that the resolution

conditions are met in respect of that entity.

The U.K. Bail-in Power includes any write-down, conversion, transfer,

modification and/or suspension power, which allows for (i) the reduction or cancellation of all, or a portion, of the principal amount

of, any interest on, or any other amounts payable on, the notes; (ii) the conversion of all, or a portion, of the principal amount of,

any interest on, or any other amounts payable on, the notes into shares or other securities or other obligations of Barclays or another

person (and the issue to, or conferral on, the holder or beneficial owner of the notes such shares, securities or obligations); (iii)

the cancellation of the notes and/or (iv) the amendment or alteration of the maturity of the notes, or amendment of the amount of any

interest or any other amounts due on the notes, or the dates on which any interest or any other amounts become payable, including by suspending

payment for a temporary period; which U.K. Bail-in Power may be exercised by means of a variation of the terms of the notes solely to

give effect to the exercise by the relevant U.K. resolution authority of such U.K. Bail-in Power. Each holder and beneficial owner of

the notes further acknowledges and agrees that the rights of the holders or beneficial owners of the notes are subject to, and will be

varied, if necessary, solely to give effect to, the exercise of any U.K. Bail-in Power by the relevant U.K. resolution authority. For

the avoidance of doubt, this consent and acknowledgment is not a waiver of any rights holders or beneficial owners of the notes may have

at law if and to the extent that any U.K. Bail-in Power is exercised by the relevant U.K. resolution authority in breach of laws applicable

in England.

For more information, please see “Risk Factors” below

as well as “U.K. Bail-in Power,” “Risk Factors—Risks Relating to the Securities Generally—Regulatory action

in the event a bank or investment firm in the Group is failing or likely to fail could materially adversely affect the value of the securities”

and “—Under the terms of the securities, you have agreed to be bound by the exercise of any U.K. Bail-in Power by the relevant

U.K. resolution authority” in the accompanying prospectus supplement.

The preceding discussion supersedes the discussion in the accompanying

prospectus and prospectus supplement to the extent it is inconsistent therewith.

|

Strategic Accelerated Redemption Securities®

|

TS-3

|

Strategic Accelerated Redemption Securities®

Linked to the MSCI Emerging Markets Index, due September 26, 2024

|

|

Investor Considerations

|

You may wish to consider an investment in the notes if:

|

|

The notes may not be an appropriate investment for you if:

|

|

|

|

|

|

§ You

anticipate that the closing level of the Index on any of the Observation Dates will be equal to or greater than the Starting Value and,

in that case, you accept an early exit from your investment.

§ You

accept that the return on the notes will be limited to the return represented by the applicable Call Premium even if the percentage change

in the level of the Index is significantly greater than the applicable Call Premium.

§ If

the notes are not called, you accept that your investment will result in a loss, which could be significant.

§ You

are willing to forgo the interest payments that are paid on traditional interest bearing debt securities.

§ You

are willing to forgo dividends or other benefits of owning the stocks included in the Index.

§ You

are willing to accept a limited or no market for sales prior to maturity, and understand that the market prices for the notes, if any,

will be affected by various factors, including our actual and perceived creditworthiness, the inclusion in the public offering price of

the underwriting discount, the hedging-related charge and other amounts, as described on page TS-2.

§ You

are willing to assume our credit risk, as issuer of the notes, for all payments under the notes, including the Call Amounts and the Redemption

Amount.

§ You

are willing to consent to the exercise of any U.K. Bail-in Power by U.K. resolution authorities.

|

|

§ You

wish to make an investment that cannot be automatically called prior to maturity.

§ You

believe that the level of the Index will decrease from the Starting Value to the Ending Value.

§ You

anticipate that the Observation Level will be less than the Call Level on each Observation Date.

§ You

seek an uncapped return on your investment.

§ You

seek principal repayment or preservation of capital.

§ You

seek interest payments or other current income on your investment.

§ You

want to receive dividends or other distributions paid on the stocks included in the Index.

§ You

seek an investment for which there will be a liquid secondary market.

§ You

are unwilling or are unable to take market risk on the notes or to take our credit risk as issuer of the notes.

§ You

are unwilling to consent to the exercise of any U.K. Bail-in Power by U.K. resolution authorities.

|

We urge you to consult your investment, legal, tax, accounting, and

other advisors before you invest in the notes.

|

Strategic Accelerated Redemption Securities®

|

TS-4

|

Strategic Accelerated Redemption Securities®

Linked to the MSCI Emerging Markets Index, due September 26, 2024

|

|

Examples of Hypothetical Payments

The following examples are for purposes of illustration only. They are

based on hypothetical values and show hypothetical returns on the notes. They illustrate the calculation of the Call Amount

or Redemption Amount, as applicable, based on the hypothetical terms set forth below. The actual amount you receive and the resulting

return will depend on the actual Starting Value, Threshold Value, Call Level, Observation Levels and term of your investment. The

following examples do not take into account any tax consequences from investing in the notes. These examples are based on:

|

|

1)

|

a Starting Value of 100.00;

|

|

|

2)

|

a Threshold Value of 100.00;

|

|

|

3)

|

a Call Level of 100.00;

|

|

|

4)

|

the term of the notes from September 17, 2021 to September 26, 2024, if the notes are not called on the first or second Observation

Dates;

|

|

|

5)

|

the Call Premium of 11.21% of the principal amount if the notes are called on the first Observation Date, 22.42% if called on the

second Observation Date and 33.63% if called on the final Observation Date; and

|

|

|

6)

|

Observation Dates occurring on September 22, 2022, September 21, 2023, and September 19, 2024 (the final Observation Date).

|

The hypothetical Starting Value of 100.00

used in these examples has been chosen for illustrative purposes only. The actual Starting Value is 1,299.97, which was the closing level

of the Market Measure on the pricing date. For recent actual levels of the Market Measure, see “The Index” section below.

The Index is a price return index and as such the level of the Index will not include any income generated by dividends paid on the stocks

included in the Index, which you would otherwise be entitled to receive if you invested in those stocks directly. In addition, all payments

on the notes are subject to issuer credit risk.

Notes Are Called on an Observation Date

The notes will be called at $10.00 plus the applicable Call Premium

on one of the Observation Dates if the Observation Level is equal to or greater than the Call Level.

Example 1 - The Observation Level on the first Observation Date

is 150.00. Therefore, the notes will be called at $10.000 plus the Call Premium of $1.121 = $11.121 per unit. After the notes are called,

they will no longer remain outstanding and there will not be any further payments on the notes.

Example 2 - The Observation Level on the first Observation Date

is below the Call Level, but the Observation Level on the second Observation Date is 105.00. Therefore, the notes will be called at $10.000

plus the Call Premium of $2.242 = $12.242 per unit. After the notes are called, they will no longer remain outstanding and there will

not be any further payments on the notes.

Example 3 - The Observation Levels on the first and second Observation

Dates are below the Call Level, but the Observation Level on the third and final Observation Date is 105.00. Therefore, the notes will

be called at $10.000 plus the Call Premium of $3.363 = $13.363 per unit.

|

Strategic Accelerated Redemption Securities®

|

TS-5

|

Strategic Accelerated Redemption Securities®

Linked to the MSCI Emerging Markets Index, due September 26, 2024

|

|

Notes Are Not Called on Any Observation Date

Example 4 - The notes are not called on any Observation Date

and the Ending Value is less than the Threshold Value. The Redemption Amount will be less, and possibly significantly less, than the principal

amount. For example, if the Ending Value is 50.00, the Redemption Amount per unit will be:

|

|

Notes Are Called on an Observation Date

|

Notes Are Not Called on Any Observation Date

|

|

|

Example 1

|

Example 2

|

Example 3

|

Example 4

|

|

Starting Value

|

100.00

|

100.00

|

100.00

|

100.00

|

|

Call Level

|

100.00

|

100.00

|

100.00

|

100.00

|

|

Threshold Value

|

100.00

|

100.00

|

100.00

|

100.00

|

|

Observation Level on the First Observation Date

|

150.00

|

90.00

|

90.00

|

88.00

|

|

Observation Level on the Second Observation Date

|

N/A

|

105.00

|

90.00

|

78.00

|

|

Observation Level on the Final Observation Date

|

N/A

|

N/A

|

105.00

|

50.00

|

|

Return on the Index

|

50.00%

|

5.00%

|

5.00%

|

-50.00%

|

|

Return on the Notes

|

11.21%

|

22.42%

|

33.63%

|

-50.00%

|

|

Call Amount / Redemption Amount per Unit

|

$11.121

|

$12.242

|

$13.363

|

$5.000

|

|

Strategic Accelerated Redemption Securities®

|

TS-6

|

Strategic Accelerated Redemption Securities®

Linked to the MSCI Emerging Markets Index, due September 26, 2024

|

|

Risk Factors

There are important differences between the notes and a conventional

debt security. An investment in the notes involves significant risks, including those listed below. You should carefully review the more

detailed explanation of risks relating to the notes in the “Risk Factors” sections beginning on page PS-7 of product supplement

EQUITY STR-1 and page S-7 of the Series A MTN prospectus supplement identified above. We also urge you to consult your investment, legal,

tax, accounting, and other advisors before you invest in the notes.

Structure-related Risks

|

|

§

|

If the notes are not called, your investment will result in a loss; there is no guaranteed return of principal.

|

|

|

§

|

Your return on the notes may be less than the yield you could earn by owning a conventional fixed or floating rate debt security of

comparable maturity.

|

|

|

§

|

Your investment return is limited to the return represented by the applicable Call Premium and may be less than a comparable investment

directly in the stocks included in the Index.

|

Issuer-related Risks

|

|

§

|

Payments on the notes are subject to our credit risk, and any actual or perceived changes in our creditworthiness are expected to

affect the value of the notes. If we become insolvent or are unable to pay our obligations, you may lose your entire investment.

|

|

|

§

|

Payments on the notes are subject to the exercise of U.K. Bail-in Power by the relevant U.K. resolution authority. As described above

under “Consent to U.K. Bail-in Power,” the relevant U.K. resolution authority may exercise any U.K. Bail-in Power under the

conditions described in such section of this term sheet. If any U.K. Bail-in Power is exercised, you may lose all or a part of the value

of your investment in the notes or receive a different security, which may be worth significantly less than the notes and which may have

significantly fewer protections than those typically afforded to debt securities. Moreover, the relevant U.K. resolution authority may

exercise its authority to implement the U.K. Bail-in Power without providing any advance notice to the holders and beneficial owners of

the notes. By your acquisition of the notes, you acknowledge, accept, agree to be bound by, and consent to the exercise of, any U.K. Bail-in

Power by the relevant U.K. resolution authority. The exercise of any U.K. Bail-in Power with respect to the notes will not be a default

or an Event of Default (as each term is defined in the senior debt securities indenture relating to the notes). The trustee will not be

liable for any action that the trustee takes, or abstains from taking, in either case, in accordance with the exercise of the U.K. Bail-in

Power with respect to the notes. See “Consent to U.K. Bail-in Power” above as well as “U.K. Bail-in Power,” “Risk

Factors—Risks Relating to the Securities Generally—Regulatory action in the event a bank or investment firm in the Group is

failing or likely to fail could materially adversely affect the value of the securities” and “—Under the terms of the

securities, you have agreed to be bound by the exercise of any U.K. Bail-in Power by the relevant U.K. resolution authority” in

the accompanying prospectus supplement for more information.

|

Valuation- and Market-related Risks

|

|

§

|

The estimated value of your notes is based on our internal pricing models. Our internal pricing models take into account a number

of variables and are based on a number of subjective assumptions, which may or may not materialize, typically including volatility, interest

rates, and our internal funding rates. These variables and assumptions are not evaluated or verified on an independent basis and may prove

to be inaccurate. Different pricing models and assumptions of different financial institutions could provide valuations for the notes

that are different from our estimated value.

|

|

|

§

|

The estimated value is based on a number of variables, including volatility, interest rates and our internal funding rates. Our internal

funding rates may vary from the levels at which our benchmark debt securities trade in the secondary market. As a result of this difference,

the estimated value referenced in this term sheet may be lower if such estimated value was based on the levels at which our benchmark

debt securities trade in the secondary market.

|

|

|

§

|

The estimated value of your notes is lower than the public offering price of your notes. This difference is a result of certain factors,

such as the inclusion in the public offering price of the underwriting discount, the hedging-related charge, the estimated profit, if

any, that we or any of our affiliates expect to earn in connection with structuring the notes, and the estimated cost which we may incur

in hedging our obligations under the notes, as further described in “Structuring the Notes” on page TS-18. If you attempt

to sell the notes prior to maturity, their market value may be lower than the price you paid for the notes and lower than the estimated

value because the secondary market prices take into consideration the levels at which our debt securities trade in the secondary market,

but do not take into account such fees, charges and other amounts.

|

|

|

§

|

The estimated value of the notes is not a prediction of the prices at which MLPF&S, BofAS or its affiliates, or any of our affiliates

or any other third parties may be willing to purchase the notes from you in secondary market transactions. The price at which you may

be able to sell your notes in the secondary market at any time will be influenced by many factors that cannot be predicted, such as market

conditions, and any bid and ask spread for similar size trades, and may be substantially less than our estimated value of the notes. Any

sale prior to the maturity date could result in a substantial loss to you.

|

|

|

§

|

A trading market is not expected to develop for the notes. We, MLPF&S, BofAS and our respective affiliates are not obligated to

make a market for, or to repurchase, the notes. There is no assurance that any party will be willing to purchase your notes at any price

in any secondary market.

|

Conflict-related Risks

|

Strategic Accelerated Redemption Securities®

|

TS-7

|

Strategic Accelerated Redemption Securities®

Linked to the MSCI Emerging Markets Index, due September 26, 2024

|

|

|

|

§

|

Our business, hedging and trading activities, and those of MLPF&S, BofAS and our respective affiliates (including trading in securities

of companies included in the Index), and any hedging and trading activities we, MLPF&S, BofAS or our respective affiliates engage

in for our clients’ accounts, may affect the market value and return of the notes and may create conflicts of interest with you.

|

|

|

§

|

There may be potential conflicts of interest involving the calculation agents, one of which

is us and one of which is BofAS. We have the right to appoint and remove the calculation agents.

|

Market Measure-related Risks

|

|

§

|

The Index sponsor may adjust the Index in a way that affects its level, and has no obligation to consider your interests.

|

|

|

§

|

You will have no rights of a holder of the securities included in the Index, and you will not be entitled to receive securities or

dividends or other distributions by the issuers of those securities.

|

|

|

§

|

While we, MLPF&S, BofAS or our respective affiliates may from time to time own securities of companies included in the Index,

we, MLPF&S, BofAS and our respective affiliates do not control any company included in the Index, and have not verified any disclosure

made by any company.

|

|

|

§

|

Your return on the notes and the value of the notes may be affected by exchange rate movements and factors affecting the international

securities markets.

|

Tax-related Risks

|

|

§

|

The U.S. federal income tax consequences of the notes are uncertain, and may be adverse to a U.S. investor of the notes. See “Tax

Considerations” below.

|

Additional Risk Factors

An investment in the notes will involve risks that are associated

with investments that are linked to the equity securities of issuers from emerging markets.

The equity securities included in the Index have been issued by companies

based in emerging markets. Emerging markets pose further risks in addition to the risks associated with investing in foreign equity markets

generally. Countries with emerging markets may have relatively unstable financial markets and governments; may present the risks of nationalization

of businesses; may impose restrictions on currency conversion, exports or foreign ownership and prohibitions on the repatriation of assets;

may pose a greater likelihood of regulation by the national, provincial and local governments of the emerging market countries, including

the imposition of currency exchange laws and taxes; and may have less protection of property rights, less access to legal recourse and

less comprehensive financial reporting and auditing requirements than more developed countries. The economies of countries with emerging

markets may be based on only a few industries, may be highly vulnerable to changes in local or global trade conditions, and may suffer

from extreme and volatile debt burdens or inflation rates. Local securities markets may trade a small number of securities and may be

unable to respond effectively to increases in trading volume, potentially making prompt liquidation of holdings difficult or impossible

at times. Moreover, the economies in such countries may differ unfavorably from the economy in the United States in such respects as growth

of gross national product, rate of inflation, capital reinvestment, resources, self-sufficiency and balance of payment positions. The

currencies of emerging markets may also be less liquid and more volatile than those of developed markets and may be affected by political

and economic developments in different ways than developed markets. The foregoing factors may adversely affect the performance of companies

based in emerging markets.

Since June 2018, the Index has included equity securities that are traded

on mainland Chinese exchanges (as distinct from exchanges in Hong Kong). Shares traded on mainland Chinese exchanges, referred to as A-shares,

are subject to regulation by Chinese authorities, as well as certain foreign ownership restrictions. These regulations may adversely affect

the price of A-shares. Trading in A-shares may be less liquid and subject to greater volatility, including as a result of actions by the

Chinese government, than trading on international exchanges outside of mainland China.

Governmental legislative or regulatory actions, such as sanctions,

could adversely affect your investment in the notes.

Governmental legislative or regulatory actions, including, without limitation,

sanctions-related actions by the U.S. or a foreign government, could prohibit or otherwise restrict persons from holding the notes or

securities included in the Index, or engaging in transactions in them, and any such action could adversely affect the value of the Index.

These legislative or regulatory actions could result in restrictions on the notes. You may lose a significant portion or all of your initial

investment in the notes if you are forced to divest the notes due to government mandates, especially if such divestment must be made at

a time when the value of the notes has declined.

|

Strategic Accelerated Redemption Securities®

|

TS-8

|

Strategic Accelerated Redemption Securities®

Linked to the MSCI Emerging Markets Index, due September 26, 2024

|

|

Other Terms of the Notes

Market Measure Business Day

The following definition shall supersede and replace the definition

of “Market Measure Business Day” set forth in product supplement EQUITY STR-1.

A “Market Measure Business Day” means a day on which:

|

|

(A)

|

the London Stock Exchange, the Hong Kong Stock Exchange, the São Paulo Stock Exchange and the Korea Stock Exchange (or any

successor to the foregoing exchanges) are open for trading; and

|

|

|

(B)

|

the Index or any successor thereto is calculated and published.

|

|

Strategic Accelerated Redemption Securities®

|

TS-9

|

Strategic Accelerated Redemption Securities®

Linked to the MSCI Emerging Markets Index, due September 26, 2024

|

|

The Index

All disclosures contained in this term sheet regarding the Index, including,

without limitation, its make-up, method of calculation, and changes in its components, have been derived from publicly available sources

without independent verification. The information reflects the policies of, and is subject to change by, MSCI Inc. (“MSCI”

or the “Index sponsor”). The Index is calculated, maintained and published by

the Index sponsor, which licenses the copyright and all other rights to the Index, has no obligation to continue to publish, and may discontinue

publication of, the Index. The consequences of the Index sponsor discontinuing publication of the Index are discussed in the section entitled

“Description of the Notes—Discontinuance of an Index” beginning on page PS-28 of product supplement EQUITY STR-1. None

of us, the calculation agents, MLPF&S or BofAS accepts any responsibility for the calculation, maintenance or publication of the Index

or any successor index.

General

The Index is a free float-adjusted market capitalization index that

is designed to measure the equity market performance of global emerging markets. The Index currently consists of the following 27 emerging

market country indices: Argentina, Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Kuwait,

Malaysia, Mexico, Pakistan, Peru, Philippines, Poland, Qatar, Russia, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey and the United

Arab Emirates. As of June 2018, the Index includes shares traded on mainland Chinese exchanges, referred to as A-shares. The Index covers

approximately 85% of the free float-adjusted market capitalization in each country. The U.S. dollar price return version of the Index

is reported by Bloomberg L.P. under the ticker symbol “MXEF.”

Constructing the MSCI Global Investable Market Indices

The MSCI Global Investable Market Indices, including the Index, are

constructed and maintained at an individual market level. MSCI undertakes an index construction process that, with respect to the MSCI

Global Investable Market Indices, involves: (i) defining the equity universe for each market; (ii) determining the market investable equity

universe for each market; (iii) determining market capitalization size segments for each market and (iv) applying Index Continuity Rules

for the Standard Index.

Defining the Equity Universe

|

|

(i)

|

Identifying Eligible Equity Securities: All listed equity securities, including real estate investment trusts and certain income trusts

listed in Canada, are eligible for inclusion in the equity universe. Limited partnerships, limited liability companies, and business trusts,

which are listed in the United States and are not structured to be taxed as limited partnerships, are likewise eligible for inclusion

in the equity universe. Conversely, mutual funds, exchange-traded funds (“ETFs”), equity derivatives and most investment trusts

are not eligible for inclusion in the equity universe. Preferred shares that exhibit characteristics of equity securities are eligible.

Stapled securities are considered eligible if each of the underlying components exhibit characteristics of equity securities.

|

|

|

(ii)

|

Country Classification of Eligible Securities: The equity universe initially looks at securities listed in any of the countries in

the MSCI Global Index Series, which will be classified as Developed Markets (“DM”), Emerging Markets (“EM”) or

Frontier Markets (“FM”). Each company and its securities (i.e., share classes) are classified in one and only one country,

which allows for a distinctive sorting of each company by its respective country.

|

Determining the Market Investable Equity Universes

A market investable equity universe for a market is derived by (i) identifying

eligible listings for each security in the equity universe; and (ii) applying investability screens to individual companies and securities

in the equity universe that are classified in that market. A market is equivalent to a single country, except in DM Europe, where all

DM countries in Europe are aggregated into a single market for index construction purposes. Subsequently, individual DM Europe country

indices within the MSCI Europe Index are derived from the constituents of the MSCI Europe Index under the Global Investable Market Indices

methodology.

|

|

(i)

|

Identifying Eligible Listings: A security may have a listing that trades in the country where it is classified (a “local listing”)

and/or a listing that trades in a different country (a “foreign listing”). A security may be represented by either a local

listing or a foreign listing (including a depositary receipt) in the global investable equity universe as determined by MSCI.

|

|

|

(ii)

|

Applying Investability Screens: Some of the investability requirements are applied at the individual security level and some at the

overall company level, represented by the aggregation of individual securities of the company. As such, the inclusion or exclusion of

one security does not imply the automatic inclusion or exclusion of other securities of the same company.

|

The investability screens used to determine the investable

equity universe in each market are as follows:

|

|

a.

|

Equity Universe Minimum Size Requirement: This investability screen is applied at the company level. In order to be included in a

market investable equity universe, a company must have the required minimum full market

|

|

Strategic Accelerated Redemption Securities®

|

TS-10

|

Strategic Accelerated Redemption Securities®

Linked to the MSCI Emerging Markets Index, due September 26, 2024

|

|

capitalization. A company will meet this

requirement if its cumulative free float-adjusted market capitalization is within the top 99% of the equity universe sorted in descending

order by full market capitalization.

|

|

b.

|

Equity Universe Minimum Float-Adjusted Market Capitalization Requirement: This investability screen is applied at the individual security

level. To be eligible for inclusion in a market investable equity universe, a security must have a free float-adjusted market capitalization

equal to or higher than 50% of the equity universe minimum size requirement.

|

|

|

c.

|

DM and EM Minimum Liquidity Requirement: This investability screen is applied at the individual security level. To be eligible for

inclusion in a market investable equity universe, a security must have adequate liquidity as measured by the annualized traded value ratio

(“ATVR”) and the frequency of trading. In addition to the ATVR and frequency of trading requirements, securities in the MSCI

China equity universe will not be eligible for inclusion in the market investable equity universe if the securities are suspended on the

price cutoff date of the index review or have been suspended for 50 consecutive days or more in the past 12 months.

|

Only one listing per security may be included in the market

investable equity universe. In instances when a security has two or more eligible listings that meet the above liquidity requirements,

then the following priority rules are used to determine which listing will be used for potential inclusion of the security in the market

investable equity universe: (i) local listing; (ii) foreign listing in the same geographical region; and (iii) foreign listing in a different

geographical region.

|

|

d.

|

Global Minimum Foreign Inclusion Factor Requirement: This investability screen is applied at the individual security level. To be

eligible for inclusion in a market investable equity universe, a security’s foreign inclusion factor (“FIF”) must reach

a certain threshold. The FIF of a security is defined as the proportion of shares outstanding that is available for purchase in the public

equity markets by international investors. This proportion accounts for the available free float of and/or the foreign ownership limits

applicable to a specific security (or company). In general, a security must have an FIF equal to or larger than 0.15 to be eligible for

inclusion in a market investable equity universe. Exceptions to this general rule are made only in the limited cases where the exclusion

of securities of a very large company would compromise the Standard Index’s ability to fully and fairly represent the characteristics

of the underlying market.

|

|

|

e.

|

The Minimum Length of Trading Requirement: This investability screen is applied at the individual security level. For an initial public

offering (“IPO”) to be eligible for inclusion in a market investable equity universe, the new issue must have started trading

at least three months before the implementation of a semi-annual index review. This requirement is applicable to small new issues in all

markets. Large IPOs and large primary / secondary offerings of non-index constituents are not subject to the Minimum Length of Trading

Requirement and may be included in a market investable equity universe and the Standard Index outside of a Quarterly or semi-annual index

review.

|

|

|

f.

|

The Minimum Foreign Room Requirement: This investability screen is applied at the individual security level. For a security that is

subject to a foreign ownership limit (“FOL”) to be eligible for inclusion in a market investable equity universe, the proportion

of shares still available to foreign investors relative to the maximum allowed (referred to as “foreign room”) must be at

least 15%.

|

|

|

g.

|

Treatment of Securities that Exhibit Extreme Price Increase: This investability screen is applied at the individual security level.

Securities that exhibit extreme price increase will not be eligible for addition into the Standard Index but will continue to be considered

as part of the market investable equity universe. Such securities will be re-evaluated for Standard Index inclusion at the subsequent

index review using Standard Index inclusion criteria, including the applicable return-based thresholds for extreme price increase. MSCI

will evaluate the 5-day to 60-day excess returns, in increments of 5 days, as of the price cutoff date of the index review, for additions

to the Standard index. Excess return is calculated as the difference between the return of a security for the relevant period and the

average return of Investable Market Index constituents belonging to the same country-sector where the security is classified (in terms

of country of classification and Global Industry Classification Standard classification at the sector level). For country-sectors that

have five or fewer Investable Market Index constituents, the relevant country Investable Market Index return is used instead. IPOs that

do not meet the minimum length of trading requirement but meet all other criteria for Standard Index inclusion are not subject to this

requirement.

|

Defining Market Capitalization Size Segments for Each Market

Once a market investable equity universe is defined, it is segmented

into the following size-based indices, with the following free float-adjusted market capitalization market coverage target ranges:

|

|

(i)

|

Investable Market Index (Large + Mid + Small): 99%+1% or -0.5%

|

|

|

|

|

|

|

(ii)

|

Standard Index (Large + Mid): 85% ± 5%

|

|

Strategic Accelerated Redemption Securities®

|

TS-11

|

Strategic Accelerated Redemption Securities®

Linked to the MSCI Emerging Markets Index, due September 26, 2024

|

|

|

|

(iii)

|

Large Cap Index: 70% ± 5%

|

|

|

(iv)

|

Mid Cap Index: The Mid Cap Index market coverage in each market

is derived as the difference between the market coverage of the Standard Index and the Large Cap Index in that market.

|

|

|

(v)

|

Small Cap Index: The Small Cap Index market coverage in each

market is derived as the difference between the free float-adjusted market capitalization coverage of the Investable Market Index and

the Standard Index in that market.

|

Index Continuity Rules for the Standard Indices

In order to achieve index continuity, as well as provide some basic

level of diversification within a market index, notwithstanding the effect of other index construction rules, a minimum number of five

constituents will be maintained for a DM Standard Index and a minimum number of three constituents will be maintained for an EM Standard

Index.

If after the application of the index construction methodology, a Standard

Index contains fewer than five securities in a Developed Market or three securities in an Emerging Market, then the largest securities

by free float-adjusted market capitalization among the securities included in the market investable equity universe are added to the Standard

Index in order to reach five constituents in that Developed Market or three in that Emerging Market. At subsequent index reviews, if after

the application of the index maintenance methodology a Standard Index contains less than five securities in a Developed Market or three

securities in an Emerging Market, then the remaining securities are selected for inclusion by multiplying market capitalization of such

securities by a factor of 1.5.

Constructing and Calculating the Individual Global Investable Market

Indices

After companies are allocated to their respective Size-Segments and

securities are reviewed for complying with the final Size-Segment requirements, the final list of constituents for each Market Size-Segment

Index is determined. The MSCI Investable Market Indices are composed of the MSCI Standard Indices and the MSCI Small Cap Indices. The

MSCI Standard Indices are further subdivided into the MSCI Large Cap and the MSCI Mid Cap Indices. Two or more Market Indices can be combined

to form Composite Indices. Market Indices can be grouped either on the basis of Market Classification definition, geographical regions,

economic regions or other criteria.

Maintenance of the MSCI Global Investable Market Indices

The MSCI Global Investable Market Indices are maintained with the objective

of reflecting the evolution of the underlying equity markets and segments on a timely basis, while seeking to achieve index continuity,

continuous investability of constituents and replicability of the indices, and index stability and low index turnover.

In particular, index maintenance involves semi-annual index reviews

in May and November of the Size Segment and Global Value and Growth Indices and quarterly index reviews in February and August of the

Size Segment Indices. Semi-annual index review include updating the indices on the basis of a fully refreshed equity universe; taking

buffer rules into consideration for migration of securities across size and style segments; and updating FIFs and number of shares (“NOS”).

Quarterly index reviews include adding significant new eligible securities (such as IPOs that were not eligible for earlier inclusion)

in the index; allowing for significant moves of companies within the Size Segment Indices, using wider buffers than in the semi-annual

index reviews; and reflecting the impact of significant market events on FIFs and updating NOS.

In addition, ongoing event-related changes to the indices are made as

the result of mergers, acquisitions, spin-offs, bankruptcies, reorganizations and other similar corporate events. They can also result

from capital reorganizations in the form of rights issues, bonus issues, public placements and other similar corporate actions that take

place on a continuing basis. These changes are reflected in the indices at the time of the event. Significantly large IPOs are included

in the indices after the close of the company’s tenth day of trading.

Index Calculation

The MSCI Global Investable Market Indices are calculated using the Laspeyres’

concept of a weighted arithmetic average together with the concept of chain-linking. As a general principle, today’s index level

is obtained by applying the change in the market performance to the previous period index level.

Treatment of Investment Sanctions Related to U.S. Executive Order

13959

The U.S. Executive Order 13959 dated November 12, 2020 which prohibits

transactions by U.S. persons in certain Chinese companies (the “Order”), along with clarification from the Office of Foreign

Assets Control, results in the deletion from/non-inclusion in the MSCI Global Investable Market Indices of relevant impacted securities.

|

Strategic Accelerated Redemption Securities®

|

TS-12

|

Strategic Accelerated Redemption Securities®

Linked to the MSCI Emerging Markets Index, due September 26, 2024

|

|

On January 5, 8 and 26, 2021, the Index sponsor deleted securities impacted

by the Order from the MSCI Global Investable Market Indices. At the time of their deletion from the MSCI Global Investable Market Indices,

the securities were retained in their existing Size-Segment and continue to be included in the market investable equity universe.

The Index Sponsor continues to monitor for updates the list of securities

impacted by the Order. Any changes to the list of securities would be publicly announced. The same treatment would be applicable for such

securities at the time of the deletion.

|

Strategic Accelerated Redemption Securities®

|

TS-13

|

Strategic Accelerated Redemption Securities®

Linked to the MSCI Emerging Markets Index, due September 26, 2024

|

|

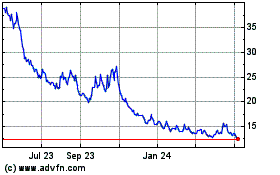

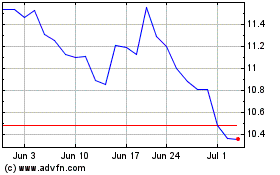

The following graph shows the daily historical performance of

the Index in the period from January 1, 2011 through September 9, 2021. We obtained this historical data from Bloomberg L.P. We have not

independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. On the pricing date, the closing level

of the Index was 1,299.97.

Historical Performance of the Index

This historical data on the Index is not necessarily indicative

of the future performance of the Index or what the value of the notes may be. Any historical upward or downward trend in the level of

the Index during any period set forth above is not an indication that the level of the Index is more or less likely to increase or decrease

at any time over the term of the notes.

Before investing in the notes, you should consult publicly available

sources for the levels of the Index.

License Agreement

We have entered into a non-exclusive license agreement with MSCI whereby

we, in exchange for a fee, are permitted to use the MSCI Indices in connection with certain securities, including the notes. We are not

affiliated with MSCI; the only relationship between MSCI and us is any licensing of the use of MSCI’s indices and trademarks relating

to them.

The license agreement provides that the following language must be set

forth herein:

“THE NOTES ARE NOT SPONSORED OR ENDORSED BY MSCI, ANY AFFILIATE

OF MSCI OR ANY OTHER PARTY INVOLVED IN, OR RELATED TO, MAKING OR COMPILING ANY MSCI INDEX. THE NOTES ARE NOT SOLD OR PROMOTED BY MSCI,

ANY AFFILIATE OF MSCI OR ANY OTHER PARTY INVOLVED IN, OR RELATED TO, MAKING OR COMPILING ANY MSCI INDEX. THE MSCI INDICES ARE THE EXCLUSIVE

PROPERTY OF MSCI. MSCI AND THE MSCI INDEX NAMES ARE SERVICE MARKS OF MSCI OR ITS AFFILIATES AND HAVE BEEN LICENSED FOR USE FOR CERTAIN

PURPOSES BY BARCLAYS BANK PLC. NEITHER MSCI, ANY OF ITS AFFILIATES NOR ANY OTHER PARTY INVOLVED IN, OR RELATED TO, MAKING OR COMPILING

ANY MSCI INDEX MAKES ANY REPRESENTATION OR WARRANTY, EXPRESS OR IMPLIED, TO THE HOLDERS OF THE NOTES OR ANY MEMBER OF THE PUBLIC REGARDING

THE ADVISABILITY OF INVESTING IN FINANCIAL SECURITIES GENERALLY OR IN THE NOTES PARTICULARLY OR THE ABILITY OF ANY MSCI INDEX TO TRACK

CORRESPONDING STOCK MARKET PERFORMANCE. MSCI OR ITS AFFILIATES ARE THE LICENSORS OF CERTAIN TRADEMARKS, SERVICE MARKS AND TRADE NAMES

AND OF THE MSCI INDICES WHICH ARE DETERMINED, COMPOSED AND CALCULATED BY MSCI WITHOUT REGARD TO THE NOTES OR TO BARCLAYS BANK PLC OR ANY

HOLDER OF THE NOTES. NEITHER MSCI, ANY OF ITS AFFILIATES NOR ANY OTHER PARTY INVOLVED IN, OR RELATED TO, MAKING OR COMPILING ANY MSCI

INDEX HAS ANY OBLIGATION TO TAKE THE NEEDS OF BARCLAYS BANK PLC OR HOLDERS OF THE NOTES INTO CONSIDERATION IN DETERMINING, COMPOSING OR

CALCULATING THE MSCI INDICES. NEITHER MSCI, ITS AFFILIATES NOR ANY OTHER PARTY INVOLVED IN, OR RELATED TO, MAKING OR COMPILING ANY MSCI

INDEX IS RESPONSIBLE FOR OR HAS PARTICIPATED IN THE DETERMINATION OF THE TIMING OF, PRICES AT, OR QUANTITIES OF THE NOTES TO BE ISSUED

OR IN THE DETERMINATION OR CALCULATION OF THE EQUATION BY WHICH THE NOTES ARE REDEEMABLE FOR CASH. NEITHER MSCI, ANY OF ITS AFFILIATES

NOR ANY OTHER PARTY INVOLVED IN, OR RELATED TO, THE MAKING OR COMPILING ANY MSCI INDEX HAS ANY OBLIGATION OR LIABILITY TO THE HOLDERS

OF THE NOTES IN CONNECTION WITH THE ADMINISTRATION, MARKETING OR OFFERING OF THIS FINANCIAL PRODUCT.

NOTWITHSTANDING THE FOREGOING, CERTAIN AFFILIATES OF MSCI MAY ACT AS

DEALERS IN CONNECTION WITH THE SALE OF THE NOTES AND, AS SUCH, MAY SELL OR PROMOTE THE NOTES OR MAY BE INVOLVED IN THE ADMINISTRATION,

MARKETING OR OFFERING OF THIS FINANCIAL PRODUCT. ALTHOUGH MSCI SHALL OBTAIN INFORMATION FOR INCLUSION

|

Strategic Accelerated Redemption Securities®

|

TS-14

|

Strategic Accelerated Redemption Securities®

Linked to the MSCI Emerging Markets Index, due September 26, 2024

|

|

IN OR FOR USE IN THE CALCULATION OF THE MSCI INDICES FROM SOURCES WHICH

MSCI CONSIDERS RELIABLE, NEITHER MSCI, ANY OF ITS AFFILIATES NOR ANY OTHER PARTY INVOLVED IN, OR RELATED TO, MAKING OR COMPILING ANY MSCI

INDEX WARRANTS OR GUARANTEES THE ORIGINALITY, ACCURACY AND/OR THE COMPLETENESS OF ANY MSCI INDEX OR ANY DATA INCLUDED THEREIN. NEITHER

MSCI, ANY OF ITS AFFILIATES NOR ANY OTHER PARTY INVOLVED IN, OR RELATED TO, MAKING OR COMPILING ANY MSCI INDEX MAKES ANY WARRANTY, EXPRESS

OR IMPLIED, AS TO RESULTS TO BE OBTAINED BY BARCLAYS BANK PLC, BARCLAYS BANK PLC’S CUSTOMERS OR COUNTERPARTIES, HOLDERS OF THE NOTES,

OR ANY OTHER PERSON OR ENTITY, FROM THE USE OF ANY MSCI INDEX OR ANY DATA INCLUDED THEREIN IN CONNECTION WITH THE RIGHTS LICENSED HEREUNDER

OR FOR ANY OTHER USE. NEITHER MSCI, ANY OF ITS AFFILIATES NOR ANY OTHER PARTY INVOLVED IN, OR RELATED TO, MAKING OR COMPILING ANY MSCI

INDEX SHALL HAVE ANY LIABILITY FOR ANY ERRORS, OMISSIONS OR INTERRUPTIONS OF OR IN CONNECTION WITH ANY MSCI INDEX OR ANY DATA INCLUDED

THEREIN. FURTHER, NEITHER MSCI, ANY OF ITS AFFILIATES NOR ANY OTHER PARTY INVOLVED IN, OR RELATED TO, MAKING OR COMPILING ANY MSCI INDEX

MAKES ANY EXPRESS OR IMPLIED WARRANTIES OF ANY KIND, AND MSCI, ANY OF ITS AFFILIATES AND ANY OTHER PARTY INVOLVED IN, OR RELATED TO, MAKING

OR COMPILING ANY MSCI INDEX HEREBY EXPRESSLY DISCLAIM ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE, WITH RESPECT

TO ANY MSCI INDEX AND ANY DATA INCLUDED THEREIN. WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT SHALL MSCI, ANY OF ITS AFFILIATES

OR ANY OTHER PARTY INVOLVED IN, OR RELATED TO, MAKING OR COMPILING ANY MSCI INDEX HAVE ANY LIABILITY FOR ANY DIRECT, INDIRECT, SPECIAL,

PUNITIVE, CONSEQUENTIAL OR ANY OTHER DAMAGES (INCLUDING LOST PROFITS) EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES.

No purchaser, seller or holder of the notes, nor any other person or

entity, should use or refer to any MSCI trade name, trademark or service mark to sponsor, endorse, market or promote the notes without

first contacting MSCI to determine whether MSCI’s permission is required. Under no circumstances may any person or entity claim

any affiliation with MSCI without the prior written permission of MSCI.”

|

Strategic Accelerated Redemption Securities®

|

TS-15

|

Strategic Accelerated Redemption Securities®

Linked to the MSCI Emerging Markets Index, due September 26, 2024

|

|

Supplement to the Plan of Distribution

Under our distribution agreement with BofAS, BofAS will purchase the

notes from us as principal at the public offering price indicated on the cover of this term sheet, less the indicated underwriting discount.

BofAS has advised us that MLPF&S will purchase

the notes from BofAS for resale, and will receive a selling concession in connection with the sale of the notes in an amount up to the

full amount of underwriting discount set forth on the cover of this term sheet.

We will deliver the notes against payment therefor in New York, New

York on a date that is greater than two business days following the pricing date. Under Rule 15c6-1 of the Securities Exchange Act of

1934, trades in the secondary market generally are required to settle in two business days, unless the parties to any such trade expressly

agree otherwise. Accordingly, purchasers who wish to trade the notes more than two business days prior to the original issue date will

be required to specify alternative settlement arrangements to prevent a failed settlement.

The notes will not be listed on any securities exchange. In the original

offering of the notes, the notes will be sold in minimum investment amounts of 100 units. If you place an order to purchase the notes,

you are consenting to MLPF&S and/or one of its affiliates acting as a principal in effecting the transaction for your account.

MLPF&S and BofAS may repurchase and resell the notes, with repurchases

and resales being made at prices related to then-prevailing market prices or at negotiated prices, and these prices will include MLPF&S’s

and BofAS’s trading commissions and mark-ups or mark-downs. MLPF&S and BofAS may act as principal or agent in these market-making

transactions; however, neither is obligated to engage in any such transactions. BofAS has advised us that, at MLPF&S’s and BofAS’s

discretion, for a short, undetermined initial period after the issuance of the notes, MLPF&S and BofAS may offer to buy the notes

in the secondary market at a price that may exceed the estimated value of the notes at the time of purchase. Any price offered by MLPF&S

or BofAS for the notes will be based on then-prevailing market conditions and other considerations, including the performance of the Index,

the remaining term of the notes and our creditworthiness. However, none of us, MLPF&S, BofAS nor any of our respective affiliates

is obligated to purchase your notes at any price, or at any time, and we cannot assure you that we, MLPF&S, BofAS or our respective

affiliates will purchase your notes at a price that equals or exceeds the initial estimated value of the notes.

The value of the notes shown on your account statement produced by MLPF&S

will be based on BofAS’s estimate of the value of the notes if BofAS or another of its affiliates were to make a market in the notes,

which it is not obligated to do. That estimate will be based upon the price that BofAS may pay for the notes in light of then-prevailing

market conditions, and other considerations, as mentioned above, and will include transaction costs. At certain times, this price may

be higher than or lower than the initial estimated value of the notes.

The distribution of the Note Prospectus in connection with these offers

or sales will be solely for the purpose of providing investors with the description of the terms of the notes that was made available

to investors in connection with their initial offering. Secondary market investors should not, and will not be authorized to, rely on

the Note Prospectus for information regarding Barclays or for any purpose other than that described in the immediately preceding sentence.

Prohibition of Sales to UK Retail Investors

The notes are not intended to be offered, sold or otherwise made available

to, and should not be offered, sold or otherwise made available to, any retail investor in the United Kingdom (“UK”). For

these purposes, a UK retail investor means a person who is one (or more) of: (i) a retail client as defined in point (8) of Article 2

of Regulation (EU) No 2017/565 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 (as amended,

the “EUWA”); (ii) a customer within the meaning of the provisions of the Financial Services and Markets Act 2000 (as amended,

the “FSMA”) and any rules or regulations made under the FSMA to implement Directive (EU) 2016/97, where that customer would

not qualify as a professional client as defined in point (8) of Article 2(1) of Regulation (EU) No 600/2014 as it forms part of UK domestic

law by virtue of the EUWA; or (iii) not a qualified investor as defined in Article 2 of Regulation (EU) 2017/1129 as it forms part of

UK domestic law by virtue of the EUWA (as amended, the “UK Prospectus Regulation”). Consequently, no key information document

required by Regulation (EU) No 1286/2014 as it forms part of UK domestic law by virtue of the EUWA (as amended, the “UK PRIIPs Regulation”)

for offering or selling the notes or otherwise making them available to retail investors in the United Kingdom has been prepared and therefore

offering or selling the notes or otherwise making them available to any retail investor in the United Kingdom may be unlawful under the

UK PRIIPs Regulation.

Prohibition of Sales to EEA Retail Investors

The notes are not intended to be offered, sold or otherwise made available

to, and should not be offered, sold or otherwise made available to, any retail investor in the European Economic Area (“EEA”).

For these purposes, an EEA retail investor means a person who is one (or more) of: (i) a retail client as defined in point (11) of Article

4(1) 2014/65/EU (as amended, “MiFID II”); (ii) a customer within the meaning of Directive (EU) 2016/97, as amended, where

that customer would not qualify as a professional client as defined in point (10) of Article 4(1) of MiFID II; or (iii) not a qualified

investor as defined in Regulation (EU) 2017/1129 (as amended, the “EU Prospectus Regulation”). Consequently, no key information

document required by Regulation (EU) No 1286/2014 (as amended, the “EU PRIIPs Regulation”) for offering or selling the notes

or otherwise making them available to retail investors in the European Economic Area has been prepared and therefore offering or selling

the notes or otherwise making them available to any retail investor in the European Economic Area may be unlawful under the EU PRIIPs

Regulation.

|

Strategic Accelerated Redemption Securities®

|

TS-16

|

Strategic Accelerated Redemption Securities®

Linked to the MSCI Emerging Markets Index, due September 26, 2024

|

|

The preceding discussion supersedes the discussion in the accompanying

prospectus and prospectus supplement to the extent it is inconsistent therewith.

|

Strategic Accelerated Redemption Securities®

|

TS-17

|

Strategic Accelerated Redemption Securities®

Linked to the MSCI Emerging Markets Index, due September 26, 2024

|

|

Structuring the Notes

The notes are our debt securities, the return on which is linked to

the performance of the Index. As is the case for all of our debt securities, including our market-linked notes, the economic terms of

the notes reflect our actual or perceived creditworthiness at the time of pricing. The economic terms of the notes are based on our internal

funding rates, which are our internally published borrowing rates based on variables such as market benchmarks, our appetite for borrowing,

and our existing obligations coming to maturity. Our internal funding rates may vary from the levels at which our benchmark debt securities

trade in the secondary market. Our estimated value on the pricing date was based on our internal funding rates. Our estimated value of

the notes may be lower if such valuation were based on the levels at which our benchmark debt securities trade in the secondary market.

Payments on the notes, including the amount you receive at maturity

or upon an automatic call, will be calculated based on the $10 principal amount per unit and will depend on the performance of the Index.

In order to meet these payment obligations, at the time we issue the notes, we may choose to enter into certain hedging arrangements (which

may include call options, put options or other derivatives) with BofAS or one of its affiliates. The terms of these hedging arrangements

are determined by seeking bids from market participants, including MLPF&S, BofAS and its affiliates or our affiliates, and take into

account a number of factors, including our creditworthiness, interest rate movements, the volatility of the Index, the tenor of the notes

and the tenor of the hedging arrangements. The economic terms of the notes and their estimated value depend in part on the terms of these

hedging arrangements, any estimated profit that we or any of our affiliates expect to earn in connection with structuring the notes, and

estimated costs which we may incur in hedging our obligations under the notes.

BofAS has advised us that the hedging arrangements will include a hedging

related charge of approximately $0.05 per unit, reflecting an estimated profit to be credited to BofAS from these transactions. Since

hedging entails risk and may be influenced by unpredictable market forces, additional profits and losses from these hedging arrangements

may be realized by us, BofAS or any third party hedge providers.

For further information, see “Risk Factors—General Risks

Relating to the Notes” beginning on page PS-7 and “Use of Proceeds and Hedging” on page PS-17 of product supplement

EQUITY STR-1.

|

Strategic Accelerated Redemption Securities®

|

TS-18

|

Strategic Accelerated Redemption Securities®

Linked to the MSCI Emerging Markets Index, due September 26, 2024

|

|

Tax Considerations

You should review carefully the sections in the accompanying prospectus

supplement entitled “Material U.S. Federal Income Tax Consequences—Tax Consequences to U.S. Holders—Notes Treated as

Prepaid Forward or Derivative Contracts” and, if you are a non-U.S. holder, “—Tax Consequences to Non-U.S. Holders.”

The following discussion, when read in combination with those sections, constitutes the full opinion of our special tax counsel, Davis

Polk & Wardwell LLP, regarding the material U.S. federal income tax consequences of owning and disposing of the notes.

Based on current market conditions, in the opinion of our special tax

counsel, it is reasonable to treat the notes for U.S. federal income tax purposes as prepaid forward contracts with respect to the Index.

Assuming this treatment is respected, upon a sale or exchange of the notes (including redemption upon an automatic call or at maturity),

you should recognize capital gain or loss equal to the difference between the amount realized on the sale or exchange and your tax basis

in the notes, which should equal the amount you paid to acquire the notes. This gain or loss on your notes should be treated as long-term

capital gain or loss if you hold your notes for more than a year, whether or not you are an initial purchaser of notes at the original

issue price. However, the IRS or a court may not respect this treatment, in which case the timing and character of any income or loss

on the notes could be materially and adversely affected. In addition, in 2007 the U.S. Treasury Department and the IRS released a notice

requesting comments on the U.S. federal income tax treatment of “prepaid forward contracts” and similar instruments. The notice

focuses in particular on whether to require investors in these instruments to accrue income over the term of their investment. It also

asks for comments on a number of related topics, including the character of income or loss with respect to these instruments; the relevance

of factors such as the nature of the underlying property to which the instruments are linked; the degree, if any, to which income (including

any mandated accruals) realized by non-U.S. investors should be subject to withholding tax; and whether these instruments are or should

be subject to the “constructive ownership” regime, which very generally can operate to recharacterize certain long-term capital

gain as ordinary income and impose a notional interest charge. While the notice requests comments on appropriate transition rules and

effective dates, any Treasury regulations or other guidance promulgated after consideration of these issues could materially and adversely

affect the tax consequences of an investment in the notes, possibly with retroactive effect. You should consult your tax advisor regarding

the U.S. federal income tax consequences of an investment in the notes, including possible alternative treatments and the issues presented

by this notice.

U.S. Federal Estate Tax Treatment of Non-U.S. Holders. Subject

to estate tax treaty relief, a note may be subject to U.S. federal estate tax if an individual Non-U.S. Holder holds the note at the time

of his or her death. The gross estate of a Non-U.S. Holder domiciled outside the United States includes only property situated or deemed

situated in the United States. Individual Non-U.S. Holders should consult their tax advisors regarding the U.S. federal estate tax consequences

of holding the notes at death.

Validity of the Notes

In the opinion of Davis Polk & Wardwell LLP, as special United States

products counsel to Barclays Bank PLC, when the notes offered by this pricing supplement have been executed and issued by Barclays Bank

PLC and authenticated by the trustee pursuant to the indenture, and delivered against payment as contemplated herein, such notes will

be valid and binding obligations of Barclays Bank PLC, enforceable in accordance with their terms, subject to applicable bankruptcy, insolvency

and similar laws affecting creditors’ rights generally, concepts of reasonableness and equitable principles of general applicability

(including, without limitation, concepts of good faith, fair dealing and the lack of bad faith) and possible judicial or regulatory actions

giving effect to governmental actions or foreign laws affecting creditors’ rights, provided that such counsel expresses no opinion

as to the effect of fraudulent conveyance, fraudulent transfer or similar provision of applicable law on the conclusions expressed above.

This opinion is given as of the date hereof and is limited to the laws of the State of New York. Insofar as this opinion involves matters

governed by English law, Davis Polk & Wardwell LLP has relied, with Barclays Bank PLC’s permission, on the opinion of Davis

Polk & Wardwell London LLP, dated as of August 5, 2021, filed as an exhibit to a report on Form 6-K by Barclays Bank PLC on August

5, 2021, and this opinion is subject to the same assumptions, qualifications and limitations as set forth in such opinion of Davis Polk

& Wardwell London LLP. In addition, this opinion is subject to customary assumptions about the trustee’s authorization, execution