Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

July 13 2020 - 6:04AM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration No. 333-232144

Fact Sheet | July 10, 2020 Issue r: Tenor: Re fe ren ce Assets : Ba rcla ys Bank PLC App roxima tel y 42 months The S&P 500® Inde x (Bloombe rg ti cke r: “SPX <Inde x>”) an d the Nasdaq 100® Inde x (Bloombe rg ticke r: “NDX <Inde x>”) Hypothetical Pay ment at Mat urity CUSI P / I SI N: Ini tial Value : Ba rrie r Value: Final Value : Ini tial Valua tion Da te : Issue Da te : Final Valua tion Date : Ma tu ri ty Da te : 06747Q5W3 / US06747Q5W38 For each Refe ren ce Asset, its Closing Value on the Ini tial Valua tion Date For each Refe ren ce Asset, 75.00% of i ts I nitial Value For each Refe ren ce Asset, its Closing Value on the Final Valuation Date July 28, 2020 July 31, 2020 January 26, 2024 January 31, 2024 Selected Structure Definition Payment at Maturity: I f you h old the notes to maturity, you will re cei ve on the Maturi ty Date a cash pa ymen t pe r $1,000 p rin cipal amou n t of notes equal to: If the Final Value of the Least Performing Reference Asset is greater than or equal to the Initial Value, an amount calculated as follows: $1,000 + ($1,000 x Reference Asset Return of Least Performing Reference Asset ) If the Final Value of the Least Performing Reference Asset is less than the Initial Value, but greater than or equal to its Barrier Value, an amount calculated as follows: $1,000 + [$1,000 x Re fe ren ce Asset Retu rn of Least Pe rforming Re fe ren ce Asset x -1] If the Final Value of the Least Performing Reference Asset is less than its Barrier Value, an amount calculated as follows: $1,000 + [$1,000 x (Refe ren ce Asset Re tu rn of Least Pe rforming Re fe ren ce Asset )] If the Final Value of the Least Performing Reference Asset is less than its Barrier Value, you will lose 1.00% of the principal amount for every 1.00% that the Reference Asset Return of the Least Performing Reference Asset falls below its Barrier Value. You may lose up to 100.00% of your principal at maturity. All terms tha t a re not defined in this fact s heet s hall ha ve the mea nings set forth in the a ccompa nying prelimina ry pricing s upplement da ted June 30, 2020 (the “Pricing Supplement”). All terms set forth or defined herein, including a ll prices, levels , va lues a nd da tes , a re s ubject to a djustment as des cribed in the a ccompanying Pricing Supplement. In the event that a ny of the terms s et forth or defined in this fact s heet conflict with the terms as des cribed in the a ccompa nying Pricing Supplement, the terms des cribed in the a ccompa nying Pricing Supplement s ha ll control. The notes a re not s uitable for a ll inves tors . You s hould rea d ca refully the a ccompanyi ng Pricing Supplement (together with a ll documents incorpora ted by reference therein) for more informa tion on the ris ks as s ocia ted with investing in the notes . Any payment on the notes, including any Paym ent at Maturity, is not guaranteed b y any third party and is subject to both the creditworthiness o f the I ssu er and the exercise of any U.K. Bail-in Power, as further d escribed in the accompanying Pricing Supplement . Reference Asset Return Payment at Maturity Total Return on Notes 80.00% $1,800.00 80.00% 60.00% $1,600.00 60.00% 40.00% $1,400.00 40.00% 30.00% $1,300.00 30.00% 20.00% $1,200.00 20.00% 10.00% $1,100.00 10.00% 0.00% $1,000.00 0.00% -5.00% $1,050.00 5.00% -10.00% $1,100.00 10.00% -15.00% $1,150.00 15.00% -25.00% $1,250.00 25.00% -30.00% $700.00 -30.00% -40.00% $600.00 -40.00% -60.00% $400.00 -60.00% -80.00% $200.00 -80.00% D ual Di re c ti onal Note s

Fact Sheet | July 10, 2020 Summary Characteristics of the Notes Summary Risk Considerations Commissions—Barclays Ca pi tal Inc. will receive commissions from the Issuer of up to 3.85% of the principal a mount of the notes , or up to $38.50 per $1,000 principal a mount. Pl eas e s ee the a ccompa nyi ng Pricing Suppl ement for a ddi ti onal informa ti on a bout s elling concessions , commissions and fees . Es ti ma ted Val ue Lower Tha n Iss ue Price—Our es ti ma ted value of the notes on Credi t of Iss uer—The notes are s enior uns ecured debt obli ga tions of the Issuer and are not, ei ther di rectl y or i ndirectl y, an obli ga tion of any third party. In the event the Issuer were to defaul t on i ts obliga ti ons , you ma y not receive a ny a mounts owed to you, incl udi ng a ny Pa yment a t Ma turi ty, under the terms of the notes . U.K. Bail -In Power—Each holder of notes acknowl edges , accepts , agrees to be the Ini tial Val ua tion Da te is expected to be between $840.00 a nd $918.20 per note. Pl eas e s ee “Addi tional Informa ti on Regarding Our Es ti ma ted Value Of The Notes ” in the accompa nying Pricing Suppl ement for more informa ti on. Potential for Significant Loss—The terms of the notes provide only for a bound by, and cons ents to the exercis e of, a ny U.K. Bail -in Power by the rel eva nt U.K. res oluti on a uthori ty, which may be exercis ed so as to res ul t in you losing all or a part of the value of your i nves tment in the notes or recei ving a different s ecuri ty from the notes tha t is worth si gni fica ntly l ess than the notes . Pl eas e s ee “Cons ent to U.K. Bail -In Power” in the accompa nying Prici ng Suppl ement for more informa ti on. His torical Performance—The his torical performance of the Reference Ass ets is not partial return of principal, and you are not guaranteed any return of principal. If the Final Value of the Least Performing Reference Asset is less than its Barrier Value, you will lose 1.00% of the principal amount of your notes for every 1.00% that the Reference Asset Return of the Least Performing Reference Asset falls below its Barrier Value. You may lose up to 100.00% of the principal amount of your notes. Pa yment a t Ma turi ty Is Bas ed Sol ely on the Closing Value of Leas t Performi ng a n i ndica ti on of the future performa nce of the Reference Ass ets over the term of the notes . Conflict of I nteres t—We a nd our a ffiliates play a vari ety of rol es i n connecti on wi th the notes , including acti ng as calcula tion a gent a nd as a ma rket-maker for the notes . In each of thes e rol es , our a nd our a ffilia tes ’ economic interes ts may be a dvers e to your i nteres ts as a n inves tor in the notes . La ck of Li qui di ty—The notes will not be lis ted on any s ecuri ti es excha nge. There Reference Ass et on the Fi nal Val ua tion Da te—Each Final Value a nd Reference Ass et Return will be bas ed solely on the Cl osing Val ue of the respective Reference Ass et on the Fi nal Valua ti on Da te. Therefore, i f the value of a ny Reference Ass et drops on or before the Fi nal Val ua tion Da te, your Pa yment a t Ma turi ty ma y be si gni fica ntly l ess tha n i t woul d ha ve been ha d it been linked to the value(s ) of s uch Reference Ass et a t a ny ti me pri or to s uch drop. Return Linked Onl y to Leas t Performing Reference Ass et—Your return on the ma y be no s econdary ma rket for the notes or, i f there is a s econdary market, there ma y be i nsuffici ent li qui di ty to allow you to s ell the notes easily. Tax Trea tment—Si gnifi cant aspects of the ta x trea tment of the notes a re uncertai n. You shoul d consul t your tax advisor a bout your ta x si tua ti on. notes will be determi ned bas ed solely on the performance of the Leas t Performing Reference Ass et, regardl ess of the performa nce of the other Reference Ass et. In a ddi ti on to the s ummary ris ks a nd cha racteris tics of the notes discuss ed under the headi ngs a bove, you shoul d ca refully consi der the ris ks di scuss ed under the headi ng “Sel ected Ris k Consi dera ti ons ” i n the a ccompa nyi ng Prici ng Suppl ement and under the hea ding “Ris k Factors ” in the accompanyi ng prospectus s uppl ement. Other Information This fact s heet is a general s ummary of the terms a nd condi ti ons of this offeri ng of notes . The Issuer has fil ed a regis tra ti on s ta tement (i ncl udi ng a prospectus ) wi th the U.S. Securi ti es and Exchange Commission (the “SEC”) for this offering of notes . Before you i nves t, you s houl d read carefully the f ull des cripti on of the ter ms a nd condi ti ons of, and ris ks ass ocia ted wi th i nves ting in, the notes contai ned in the Prici ng Suppl ement as well as the i nforma tion contained in the accompanying index s uppl ement, prospectus suppl ement a nd prospectus tha t are i ncorpora ted by reference i n the Pri cing Suppl ement. The Pricing Suppl ement, as fil ed with the SEC, is a vailabl e a t the foll owing hyperli nk: https://www.creativeservices.barclays/docs/200007927/06747Q5W3.pdf You may access the index suppl ement, prospectus s uppl ement a nd prospectus tha t a re i ncorpora ted by reference in the Pri cing S uppl ement by clicki ng on the res pecti ve hyperli nk for ea ch document i ncl uded i n the Pricing Suppl ement under the hea ding “Addi ti onal Documents Rela ted To The Offering Of The Notes ,” or by r eques ting such documents from the Iss uer or any underwri ter or deal er pa rticipa ti ng in this offering. We s trongl y a dvis e you to car efully read thes e documents before inves ti ng in the notes . You may revoke your offer to purchase the notes at any time prior to the Initial Valuation Date . We reserve the right to change the terms of, or reject any offer to purchase, the notes prior to the Initial Valuation Date. In the event of any changes to the terms of the notes, we will notify you and you will be asked to accept such changes in connection with your purchase of the notes. You may choose to reject such changes, in which case we may reject your offer to purchase the notes. D ual Di re c ti onal Note s

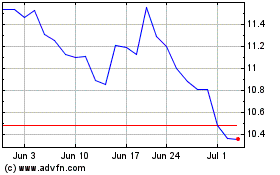

iPath Series B S&P 500 V... (AMEX:VXX)

Historical Stock Chart

From Mar 2024 to Apr 2024

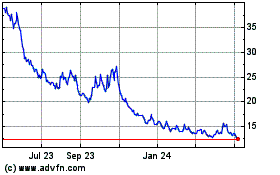

iPath Series B S&P 500 V... (AMEX:VXX)

Historical Stock Chart

From Apr 2023 to Apr 2024