Up to 5,500,000 Common Shares of Beneficial

Interest

REAVES UTILITY INCOME FUND

Common Shares of Beneficial Interest

Supplement dated May 11, 2020 to Prospectus

dated November 12, 2019

Suspension and Recommencement

of Offering. In accordance with an undertaking required by the U.S. Securities and Exchange Commission, the Reaves Utility

Income Fund (the “Fund”) temporarily suspended its “at the market” offering (the “Offering”)

as of the close of business on March 13, 2020 because of a greater than 10% decline in net asset value per common share of beneficial

interest, no par value (the “Shares”), from the effective date of the Prospectus. The net asset value of the Fund as

of March 13, 2020 was $29.03, representing a decline of 18.64% from its net asset value of $35.68 as of November 12, 2019.

The net asset value at

the close of business on May 8, 2020 was $28.99, representing a decline of approximately 18.75% (or $6.69) from the November 12,

2019 NAV, and the last reported market price per Share on May 8, 2020 on the New York Stock Exchange was $30.24.

The decline in the Fund's

net asset value is principally the result of market value decreases in the Fund's investments, particularly in light of general

market and government reactions to the spread of COVID-19 in the United States. The Offering will recommence on or about the day

of this supplement.

Disclosure Updates.

Effective immediately,

the "Prospectus Summary – Market Disruption and Geopolitical Risk" section of the Prospectus is deleted and replaced

with the following:

Market Disruption and Geopolitical Risk.

The value of your investment in the Fund is based on the values of the Fund’s investments, which may change due to economic

and other events that affect markets generally, as well as those that affect particular regions, countries, industries, companies

or governments. These movements, sometimes called volatility, may be greater or less depending on the types of securities the Fund

owns and the markets in which the securities trade. The increasing interconnectivity between global economies and financial markets

increases the likelihood that events or conditions in one region or financial market may adversely impact issuers in a different

country, region or financial market. Securities in the Fund’s portfolio may underperform due to inflation (or expectations

for inflation), interest rates, global demand for particular products or resources, natural disasters, pandemics, epidemics, terrorism,

regulatory events and governmental or quasi-governmental actions. The occurrence of global events similar to those in recent years,

such as terrorist attacks around the world, natural disasters, social and political discord or debt crises and downgrades, among

others, may result in market volatility and may have long term effects on both the U.S. and global financial markets. The occurrence

of such events may be sudden and unexpected, and it is difficult to predict when similar events affecting the U.S. or global financial

markets may occur, the effects that such events may have and the duration of those effects. Any such event(s) could have a significant

adverse impact on the value, liquidity and risk profile of the Fund’s portfolio, as well as its ability to sell securities

to meet redemptions. There is a risk that you may lose money by investing in the Fund.

Social, political, economic and other conditions

and events, such as natural disasters, health emergencies (e.g., epidemics and pandemics), terrorism, conflicts and social unrest,

may occur and could significantly impact issuers, industries, governments and other systems, including the financial markets. As

global systems, economies and financial markets are increasingly interconnected, events that once had only local impact are now

more likely to have regional or even global effects. Events that occur in one country, region or financial market will, more frequently,

adversely impact issuers in other countries, regions or markets. These impacts can be exacerbated by failures of governments and

societies to adequately respond to an emerging event or threat. These types of events quickly and significantly impact markets

in the U.S. and across the globe leading to extreme market volatility and disruption. The extent and nature of the impact on supply

chains or economies and markets from these events is unknown, particularly if a health emergency or other similar event, such as

the recent COVID-19 (the “Coronavirus”) outbreak, persists for an extended period of time. Social, political, economic

and other conditions and events, such as natural disasters, health emergencies (e.g., epidemics and pandemics), terrorism, conflicts

and social unrest, could reduce consumer demand or economic output, result in market closures, travel restrictions or quarantines,

and generally have a significant impact on the economies and financial markets and the Adviser’s investment advisory activities

and services of other service providers, which in turn could adversely affect the Fund’s investments and other operations.

The value of the Fund’s investment may decrease as a result of such events, particularly if these events adversely impact

the operations and effectiveness of the Adviser or key service providers or if these events disrupt systems and processes necessary

or beneficial to the investment advisory or other activities on behalf the Fund.

In addition, effective

immediately, the "Risk Factors – Market Disruption and Geopolitical Risk" section of the Prospectus is deleted

and replaced with the following:

Market Disruption and

Geopolitical Risk

The value of your investment in the Fund is

based on the values of the Fund’s investments, which may change due to economic and other events that affect markets generally,

as well as those that affect particular regions, countries, industries, companies or governments. These movements, sometimes called

volatility, may be greater or less depending on the types of securities the Fund owns and the markets in which the securities trade.

The increasing interconnectivity between global economies and financial markets increases the likelihood that events or conditions

in one region or financial market may adversely impact issuers in a different country, region or financial market. Securities in

the Fund’s portfolio may underperform due to inflation (or expectations for inflation), interest rates, global demand for

particular products or resources, natural disasters, pandemics, epidemics, terrorism, regulatory events and governmental or quasi-governmental

actions. The occurrence of global events similar to those in recent years, such as terrorist attacks around the world, natural

disasters, social and political discord or debt crises and downgrades, among others, may result in market volatility and may have

long term effects on both the U.S. and global financial markets. The occurrence of such events may be sudden and unexpected, and

it is difficult to predict when similar events affecting the U.S. or global financial markets may occur, the effects that such

events may have and the duration of those effects. Any such event(s) could have a significant adverse impact on the value, liquidity

and risk profile of the Fund’s portfolio, as well as its ability to sell securities to meet redemptions. There is a risk

that you may lose money by investing in the Fund.

Social, political, economic and other conditions

and events, such as natural disasters, health emergencies (e.g., epidemics and pandemics), terrorism, conflicts and social unrest,

may occur and could significantly impact issuers, industries, governments and other systems, including the financial markets. As

global systems, economies and financial markets are increasingly interconnected, events that once had only local impact are now

more likely to have regional or even global effects. Events that occur in one country, region or financial market will, more frequently,

adversely impact issuers in other countries, regions or markets. These impacts can be exacerbated by failures of governments and

societies to adequately respond to an emerging event or threat. These types of events quickly and significantly impact markets

in the U.S. and across the globe leading to extreme market volatility and disruption. The extent and nature of the impact on supply

chains or economies and markets from these events is unknown, particularly if a health emergency or other similar event, such as

the recent COVID-19 (the “Coronavirus”) outbreak, persists for an extended period of time. Social, political, economic

and other conditions and events, such as natural disasters, health emergencies (e.g., epidemics and pandemics), terrorism, conflicts

and social unrest, could reduce consumer demand or economic output, result in market closures, travel restrictions or quarantines,

and generally have a significant impact on the economies and financial markets and the Adviser’s investment advisory activities

and services of other service providers, which in turn could adversely affect the Fund’s investments and other operations.

The value of the Fund’s investment may decrease as a result of such events, particularly if these events adversely impact

the operations and effectiveness of the Adviser or key service providers or if these events disrupt systems and processes necessary

or beneficial to the investment advisory or other activities on behalf the Fund.

Many countries have experienced outbreaks of

infectious illnesses in recent decades, including swine flu, avian influenza, SARS and the Coronavirus. In December 2019, an initial

outbreak of the Coronavirus was reported in Hubei, China. Since then, a large and growing number of cases have been confirmed around

the world. The Coronavirus outbreak has resulted in numerous deaths and the imposition of both local and more widespread “work

from home” and other quarantine measures, border closures and other travel restrictions, causing social unrest and commercial

disruption on a global scale and significant volatility in financial markets. In March 2020, the World Health Organization declared

the Coronavirus outbreak a pandemic.

The ongoing spread of the Coronavirus has had,

and is expected to continue to have, a material adverse impact on local economies in the affected jurisdictions and also on the

global economy, as cross border commercial activity and market sentiment are increasingly impacted by the outbreak and government

and other measures seeking to contain its spread. The global impact of the outbreak has been rapidly evolving, and many countries

have reacted by instituting quarantines and restrictions on travel. These actions are creating disruption in supply chains, and

adversely impacting a number of industries, including but not limited to retail, transportation, hospitality and entertainment.

In addition to these developments having adverse consequences for certain companies and other issuers in which the Fund invests

and the value of the Fund’s investments therein, the operations of the Adviser (including those relating to the Fund) could

be impacted adversely, including through quarantine measures and travel restrictions imposed on the Adviser’s or service

providers’ personnel located in affected countries, regions or local areas, or any related health issues of such personnel.

Any of the foregoing events could materially and adversely affect the Adviser’s ability to source, manage and divest investments

on behalf of the Fund and pursue the Fund’s investment objectives and strategies. Similar consequences could arise with respect

to other infectious diseases. Given the significant economic and financial market disruptions associated with the Coronavirus pandemic,

it is expected that the valuation and performance of the Fund’s investments may be impacted adversely.

No Other Changes.

Except as described in this supplement, the terms of the Offering and all other information the Fund described in the Prospectus

remain unchanged. This includes the aggregate number of Shares offered (5,500,000).

Any questions related to

the Offering should be directed to the Fund at (800) 644-5571.

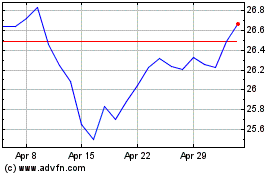

Reaves Utility Income (AMEX:UTG)

Historical Stock Chart

From Mar 2024 to Apr 2024

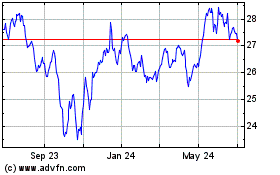

Reaves Utility Income (AMEX:UTG)

Historical Stock Chart

From Apr 2023 to Apr 2024