The Reaves Utility Income Fund Announces Regular Monthly Dividend of $0.17 Per Share

April 09 2019 - 9:00AM

Business Wire

The Reaves Utility Income Fund (NYSE MKT: UTG) announced today

the next three monthly dividends at a rate of $0.17 per common

share per month, unchanged from the per share rate paid for the

previous quarter. As of April 5, 2019, the Fund’s market price was

$33.95 per share and its net asset value was $34.53 per share.

Ronald J. Sorenson, the Fund's portfolio manager and Chief

Investment Officer of Reaves Asset Management, the Fund's

investment adviser, commented, “The 10-year U.S. Treasury yield

continued declining in the 1st Quarter. At just under 2.34% on

March 31st, the lower yield increased the relative attractiveness

of the Fund’s 6% plus yield and the portfolio’s dividend paying

securities. With the Federal Reserve pausing, the supportive

interest rate climate is likely to persist. Portfolio investments

continue to meet our expectations for periodic dividend increases.

Stock price increases and rising dividends underpin the Fund’s

distributions.”

The Fund has formally implemented the 19b-1 exemption received

from the Securities and Exchange Commission in 2009. A portion of

each distribution may be treated as paid from sources other than

net income, including but not limited to short-term capital gain,

long-term capital gain and return of capital. The final

determination of the source of these distributions, including the

percentage of qualified dividend income, will be made after the

Fund’s year end.

Not less than eighty percent of the Fund’s assets will continue

to be invested in the securities of domestic and foreign companies

involved to a significant extent in providing products, services or

equipment for (i) the generation or distribution of

electricity, gas or water, (ii) telecommunications activities

or (iii) infrastructure operations, such as airports, toll

roads and municipal services (“Utilities” or the “Utility

Industry”). As a policy, the Fund continues to strive to provide a

high level of after-tax income and total return consisting

primarily of tax-advantaged distributions and capital

appreciation.

The following dates apply to the upcoming dividends that have

been declared:

Ex-Distribution Date: April 18, 2019Record Date: April 22,

2019Payable Date: April 30, 2019Ex-Distribution Date: May 20,

2019Record Date: May 21, 2019Payable Date: May 31,

2019Ex-Distribution Date: June 17, 2019Record Date: June 18,

2019Payable Date: June 28, 2019

The Reaves Utility Income Fund

The investment objective of the Fund is to provide a high level

of income and total return consisting primarily of tax-advantaged

distributions and capital appreciation. There were approximately

$2.1 billion of total assets under management and 48.7 million

common shares outstanding as of April 5, 2019.

An investor should consider investment objectives, risks,

charges and expenses carefully before investing. To obtain an

annual report or semi-annual report which contains this and other

information visit www.utilityincomefund.com or call

1-800-644-5571. Read them carefully before investing.

ALPS Portfolio Solutions Distributor, Inc., FINRA Member

Firm.

The Reaves Utility Income Fund is a closed-end fund and

closed-end funds do not continuously issue shares for sale as

open-end mutual funds do. Since the initial public offering, the

Fund now trades in the secondary market. Investors wishing to buy

or sell shares need to place orders through an intermediary or

broker. The share price of a closed-end fund is based on the

market’s value.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190409005252/en/

Ned Burke, ALPS+1 (303) 623 2577ned.burke@alpsinc.com

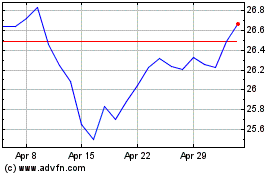

Reaves Utility Income (AMEX:UTG)

Historical Stock Chart

From Mar 2024 to Apr 2024

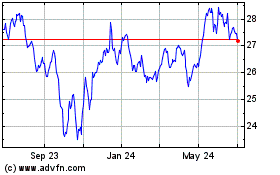

Reaves Utility Income (AMEX:UTG)

Historical Stock Chart

From Apr 2023 to Apr 2024