As filed with the Securities and Exchange Commission on October 15, 2021

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

UNIQUE FABRICATING, INC.

(Exact name of registrant as specified in its Charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

800 Standard Parkway

Auburn Hills, MI 48326

(248) 853-2333

|

|

46-1846791

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

|

|

(IRS Employer Identification No.)

|

Byrd Douglas Cain, III

President and Chief Executive Officer

Unique Fabricating, Inc.

800 Standard Parkway

Auburn Hills, MI 48326

(248) 853-2333

(Address including zip code, and telephone number, including area code, of agent for service)

with copies to:

Ira A. Rosenberg, Esq.

Sills Cummis & Gross, P.C.

One Riverfront Plaza

Newark, NJ 07102

(973) 643-7000

Approximate date of commencement of proposed sale to the public:

From time to time after the effective date of this Registration Statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: o

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or reinvestment plans, check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box.o

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Large accelerated filer o

|

Accelerated filer o

|

Non-accelerated filer x

|

Smaller reporting company x

|

Emerging growth company o

|

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class of securities to be registered

|

|

Amount

to be

Registered (1)(2)

|

|

Proposed

Maximum

Offering Price

Per Share (4)

|

|

Proposed

Maximum

Aggregate

Offering Price (4)

|

|

Amount of

Registration Fee

|

|

Common Stock, par value $0.001 per share

|

|

1,954,000

|

|

3.21

|

|

6,272,340

|

|

$581.45

|

|

Common Stock issuable upon exercise of Placement Agent Warrants(3)

|

|

156,320

|

|

3.21

|

|

501,787

|

|

$46.52

|

|

Total

|

|

2,110,320

|

|

|

|

$6,774,127

|

|

$627.97

|

__________________________

|

|

|

|

|

|

|

|

(1)

|

Pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), this registration statement also registers an indeterminate number of shares of the registrant’s Common Stock which may become issuable by reason of any stock dividend, stock split or other similar transaction effected without the receipt of consideration that results in an increase in the number of the outstanding shares of the registrant’s Common Stock.

|

|

(2)

|

Consists of an aggregate of 1,954,000 shares of the registrant’s common stock, par value $0.001 per share (“Common Stock”), all of which were acquired by the selling stockholders in a private placement.

|

|

(3)

|

Includes the number of shares issuable upon exercise of the issued and outstanding Placement Agent Warrant.

|

|

(4)

|

Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(c) under the Securities Act. The price per share and aggregate offering price are based on the average of the high and low sales price of the registrant’s Common Stock reported by the New York Stock Exchange American on October 14, 2021.

|

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933, AS AMENDED, OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE SECURITIES AND EXCHANGE COMMISSION ACTING PURSUANT TO SAID SECTION 8(a), MAY DETERMINE.

Subject to Completion, Dated October 15, 2021

PROSPECTUS

2,110,320 Shares

Common Stock

This prospectus covers the offer and resale of up to an aggregate of 2,110,320 shares of our common stock by the selling stockholders identified in the “Selling Stockholders” section of this prospectus as follows: (1) 1,954,000 shares of our common stock registered hereunder were sold to the selling stockholders in a private placement on September 21, 2021, which we refer to as the Private Placement, pursuant to the securities purchase agreement, dated as of September 21, 2021, by and among us and the selling stockholders, which we refer to as the Securities Purchase Agreement; and (2) 156,320 shares of our common stock that are issuable upon exercise of a warrant issued to the placement agent for the private placement, which we refer to as the Placement Agent Warrant, at an exercise price of $3.12 per share.

We are not selling any shares of common stock under this prospectus and will not receive any of the proceeds from the sale of shares by the selling stockholders, except that the Company will receive up to $487,718.40 in gross proceeds from the exercise of the Placement Agent Warrant if such warrant is exercised for cash and not on a cashless basis.

The selling stockholders may sell the shares of common stock described in this prospectus in a number of different ways and at varying prices. We provide more information about how the selling stockholders may sell shares of common stock in the section titled “Plan of Distribution” on page 17.

We are paying the cost of registering the shares of common stock covered by this prospectus as well as various related expenses. The selling stockholders are responsible for all selling commissions, transfer taxes and other costs related to the offer and sale of their shares.

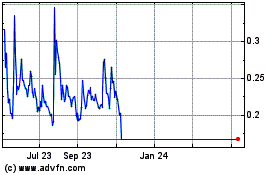

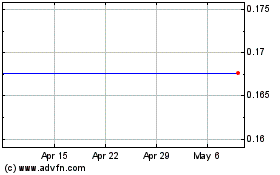

Our common stock is listed on The NYSE American under the symbol “UFAB.” On September 30, 2021, the closing price for our common stock, as reported on The NYSE American, was $3.30 per share.

Investing in our securities involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors” contained in this prospectus beginning on page 4 and any applicable prospectus supplement, and under similar headings in the other documents that are incorporated by reference into this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

We are a “smaller reporting company,” as that term is defined under the federal securities laws and, as such, are subject to certain reduced public company reporting requirements.

The date of this prospectus is October 2021.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission, or the SEC, using a “shelf” registration process. Under this registration statement, the selling stockholders may sell from time to time in one or more offerings the common stock described in this prospectus.

We have not authorized any dealer, agent or other person to give any information or to make any representation other than those contained or incorporated by reference in this prospectus and, if applicable, any accompanying prospectus supplement. You must not rely upon any information or representation not contained or incorporated by reference in this prospectus or, if applicable, any accompanying prospectus supplement. This prospectus and, if applicable, any accompanying prospectus supplement, do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the registered securities to which they relate, nor do this prospectus and, if applicable, any accompanying prospectus supplement, constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. You should not assume that the information contained in this prospectus and, if applicable, any accompanying prospectus supplement, is accurate on any date subsequent to the date set forth on the front of the document or that any information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus and, if applicable, any accompanying prospectus supplement, is delivered or securities are sold on a later date.

Unless the context otherwise requires, “Unique Fabricating,” “Unique,” the “Company,” “we,” “us,” “our” and similar names refer to Unique Fabricating, Inc. References to “selling stockholders” refer to the stockholders listed herein under the heading “Selling Stockholders” on page 15, who may sell shares from time to time as described in this prospectus.

SUMMARY

The following summary provides an overview of certain information about us, the Private Placement and selected information contained elsewhere in or incorporated by reference into this prospectus. This summary is not complete and does not contain all of the information that you should consider before investing in our securities. You should carefully read this entire prospectus, including the risks of investing discussed under “Risk Factors” beginning on page 4, the financial statements and related notes and other information incorporated by reference into this prospectus, and, if applicable, any prospectus supplement, and the additional information described under the captions “Where You Can Find More Information” and “Incorporation by Reference,” before investing in our securities.

About This Prospectus

The securities described in this prospectus were registered on a registration statement that we filed with the SEC using a “shelf” registration process to register 2,110,320 shares of our common stock. Of these shares, 1,954,000 shares were issued to the selling stockholders pursuant to the Securities Purchase Agreement, and as described in the Current Report on Form 8-K filed by us with the SEC on September 21, 2021. The shares are being registered for resale or other disposition by the selling stockholders. We will not receive any proceeds from the sale or other disposition of the shares registered hereunder, or interests therein. The securities described in this prospectus also include 156,320 shares of our common stock issuable upon exercise of the Placement Agent Warrant, which shares are registered for resale or disposition by the Placement Agent.

About the Company

We are engaged in the engineering and manufacture of multi-material foam, rubber, and plastic components utilized in noise, vibration and harshness, acoustical management, water and air sealing, decorative and other functional applications. Unique Fabricating has combined a history of organic growth with strategic acquisitions to diversify its products and process capabilities and the markets we serve.

The Company's markets are North America transportation, appliance, medical, and consumer off-road markets. Sales are conducted directly to major transportation, appliance, medical, and consumer off-road manufacturers, referred to as original equipment manufacturers (“OEMs”), or indirectly through the Tier 1 suppliers of these OEMs. The Company has its principal executive offices in Auburn Hills, Michigan and has sales, engineering and production facilities in Auburn Hills, Michigan; Concord, Michigan; LaFayette, Georgia; Louisville, Kentucky; Monterrey, Mexico; Querétaro, Mexico; and London, Ontario.

The Company derives most of its net sales from the sales of foam, rubber plastic, and tape adhesive related automotive products. These products are produced by a variety of manufacturing processes including die cutting, compression molding, thermoforming, reaction injection molding and fusion molding. We believe Unique Fabricating has a broader array of processes and materials utilized than any of its direct competitors, based on our product offerings. By sealing out air, noise, and water intrusion, and by providing sound absorption and blocking, Unique Fabricating’s products improve the interior comfort of a vehicle, increasing perceived vehicle quality and the overall experience of its passengers. Unique Fabricating’s products perform similar functions for appliances, water heaters, and heating, ventilation, and air conditioning systems (“HVAC”), improving thermal characteristics, reducing noise, and prolonging equipment life.

Recent Developments

Forbearance Agreement

The Company’s financial results for the six months ended December 31, 2020 and nine months ended March 31, 2021 resulted in violations of the following financial covenants in our bank credit agreement: (1) Maximum Total Leverage Ratio; (2) Minimum Debt Service Coverage Ratio; and (3) Minimum Consolidated EBITDA; as defined in the Company’s Amended and Restated Credit Agreement. The Company entered into a forbearance agreement, providing a period commencing on April 9, 2021 and through June 15, 2021, during which the Company was able to borrow on the revolving line of credit included in its bank credit agreement, subject to the terms and conditions to making a revolving credit advance, including availability. The bank lenders agreed, subject to the terms of the forbearance agreement, to forbear from enforcing their rights or seeking to collect payment of the Company’s debt or disposing of the collateral securing the debt. On June 14, 2021 the Company entered into the First Amendment to forbearance agreement, which among other things, extended the forbearance period from June 15, 2021 to February 28, 2022. On September 21, 2021, we entered in the Second Amendment to forbearance agreement. The First Amendment suspended the testing of the Total Leverage Ratio and the Debt Service Ratio during the forbearance period and contains revised requirements for Minimum Liquidity and Minimum Consolidated EBITDA for the monthly periods through and including February 28, 2022. The Second Amendment suspended the testing of such covenants on August 31, 2021 and revised the required amounts for subsequent periods. During the extended period, the Company will continue to be able to borrow under the revolving line of credit, subject to availability and the satisfaction of certain other conditions. The Second Amendment reduced the amount that may be borrowed under the revolving line of credit to $27 million from $30 million.

Entering into the forbearance agreement, as amended, will not alleviate the substantial doubt about the Company’s ability to continue as a going concern. Our forbearance agreement, as amended, contains certain financial covenants with which we are required to comply, commencing with the nine-month period ended September 30, 2021, through and including the twelve-month period ending February 28, 2022. There cannot be any assurance that we will be able to comply with these covenants contained in the forbearance agreement, as amended, given the industry-wide and other challenges that we face, as described elsewhere herein, or that our lenders would waive a default if that were to occur.

The Company intends to use the forbearance period to continue negotiations with the Lenders to enter into an amendment and waiver to cure the defaults. During the forbearance period, the Company may not make any payment, transfer, or distribution out of the ordinary course of business or payments, including salary or compensation or distributions to or for the benefit of any member, owner, or director other than normal and customary employment salaries which do not exceed sums paid for similar positions in the Company’s marketplace.

Possible Goodwill Impairment

The Company had $22.1 million of goodwill on its balance sheet as of June 30, 2021. Under U.S. GAAP, goodwill is required to be reviewed for impairment at least annually, or more frequently if potential interim indicators exist. A decline in the Company’s market capitalization, if more than temporary, may be an indicator of impairment which could require the Company to perform an interim impairment analysis. Given the continued uncertainty in the automotive market because of the ongoing global semiconductor shortages and the decline in the Company’s market capitalization during 2021, the Company has contracted a specialist firm to perform an interim impairment analysis as of September 30, 2021. Although the interim impairment analysis is not yet complete, it is more likely than not that the Company will recognize an impairment of goodwill. The Company cannot determine at this time what the effect of an impairment, if it were determined to have occurred, would be. See “Risk Factors.”

COVID-19 Pandemic

The Company’s operations continue to be adversely affected by the COVID-19 pandemic. In response to the continued impact that the COVID-19 pandemic is having on the global automotive industry, the Company has taken actions to reduce costs and increase financial flexibility. These actions include actively managing costs, capital expenditures, and working capital. Additionally, in April 2020 the Company received a loan of approximately $6.0 million pursuant to the U.S. Small Business Administration Paycheck Protection Program under Title I of the Coronavirus Aid, Relief, and Economic Security Act. The Company applied for forgiveness of the loan in the fourth quarter of 2020. On August 9, 2021, the Company received notification that the Small Business Administration approved the Company’s PPP Loan forgiveness application for the entire PPP Loan, including accrued interest. The forgiveness of the PPP Loan will be recognized during the Company’s third quarter ending September 30, 2021.

The adverse impacts of the COVID-19 pandemic led to a significant slowdown in North American vehicle production in the first half of 2020, as many automotive companies idled their facilities or reduced production. Increased consumer demand and vehicle production schedules in the second half of 2020, was unexpected in certain areas of the automotive supply chain. This surge in demand, as well as a significant increase in consumer demand for personal electronics led to a worldwide semiconductor supply shortage in early 2021 which has continued through at least the third quarter of 2021, resulting in decreased demand for our products as automotive OEMs have canceled or reduced planned production. In addition to the uncertainty in our customers’ release schedules, we have experienced longer lead-times, higher costs, and delays in procuring raw materials due to shortages because of the extreme weather pattern in early 2021 that impacted petroleum refining operations in Texas. As a result, we are currently experiencing incremental costs relating to these supply chain related disruptions. We are continuing to work closely with our suppliers and customers to minimize the potential adverse impacts on us and we are monitoring closely supply disruptions and customer vehicle production schedules. The magnitude of the adverse impact on our financial condition, results of operations and cash flows will depend on the duration and unpredictability of the supply shortages, North American vehicle production schedules and supply chain impacts, as to which we cannot be certain at this time.

The Company continues to monitor the COVID-19 pandemic and will continue to follow health and safety guidelines issued by various governmental entities in the jurisdictions where we operate in order to protect our employees.

Corporate Information

Our principal executive offices are located at 800 Standard Parkway, Auburn Hills, Michigan 48326 and our telephone number is (248) 853-2333.

UFI Acquisition, Inc, a Delaware Corporation, was formed in January 2013 to acquire 100% of the outstanding equity of Unique Fabricating, Inc., and its wholly-owned subsidiaries, Unique Fabricating South, Inc. and Unique Fabricating de Mexico, S.A. de C.V. In September 2014, UFI Acquisition, Inc. changed its name to Unique Fabricating, Inc., which is now the parent

company of the group. As a result of the name change, the subsidiary previously named Unique Fabricating, Inc. became Unique Fabricating NA, Inc.

Our website address is www.uniquefab.com. The information contained on our website is not incorporated by reference into this prospectus, and you should not consider any information contained on, or that can be accessed through, our website as part of this prospectus or in deciding whether to purchase our securities.

Our filings with the SEC are posted on our website at www.uniquefab.com. The information found on our website is not part of this or any other report we file with or furnish to the SEC. The public can also read and copy these filings by visiting the SEC's Public Reference Room at 100 F Street NE, Washington DC 20549. You may call the SEC at 1-800-SEC-0330 for further information on the operation of the Public Reference Room. Our filings, including the registration statement of which this prospectus is a part, also will be available to you on the Internet Web site maintained by at the SEC at www.sec.gov.

Private Placement

On September 21, 2021, we entered into the Securities Purchase Agreement with the selling stockholders named in this prospectus, pursuant to which we sold and issued shares of our common stock in the Private Placement.

At the closing of the Private Placement on September 21, 2021, we sold and issued to the selling stockholders 1,954,000 shares of our common stock at a purchase price of $2.25 per share. The total purchase price paid by the selling stockholders at the closing was approximately $4.4 million.

We agreed to prepare and file, within 30 days after the closing of the Private Placement, a registration statement with the SEC to register for resale the shares of our common stock issued under the Securities Purchase Agreement, and generally to cause the registration statement(s) to become effective as soon as practicable and in any event within 60 days from the filing of the applicable registration statement with the SEC.

In connection with the Private Placement we issued the Placement Agent Warrant for 156,320 shares, exercisable commencing September 21, 2021 and until September 21, 2026, at an exercise price of $3.12 per share.

RISK FACTORS

An investment in the shares offered hereby is speculative and involves a high degree of risk. You should carefully consider the following risks, as well as the other information contained in this prospectus and the risk factors included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020, as amended, filed with the SEC, and in the Company’s periodic and current reports filed thereafter with the SEC, before you decide to buy the shares. These risks and uncertainties should be considered in evaluating forward-looking statements and you should not place undue reliance on these forward-looking statements, which apply only as of the date of this prospectus. We undertake no obligation to release publicly the result of any revisions to these forward-looking statements that may be made to reflect events or circumstances in the future or to reflect the occurrence of unanticipated events, except as required by U.S. federal securities laws. The risks and uncertainties described below are not the only ones facing the Company. Additional risks and uncertainties may also adversely impair the Company’s business operations. If any of the following risks actually occur, the Company’s business, financial condition or results of operations would likely suffer significantly. In such case, the value of the Company’s common stock could decline, and you may lose all or part of the money you paid to buy the Company’s common stock.

Risks Related to Going Concern

The Company’s consolidated financial statements are prepared in accordance with U.S. generally accepted accounting principles, or GAAP, applicable to a going concern, as a result of violations by us of loan covenants in our senior secured credit facility which, to date, have not been amended or waived. This condition raises substantial doubt about the Company’s ability to continue as a going concern.

As of December 31, 2020, the Company was in violation of a number of its loan covenants. Absent an amendment and waiver, failure to be in compliance with the Company’s financial covenants would constitute a default when reported. Such a default, if not waived by our lenders, would allow the lenders to accelerate the maturity of the debt, making it due and payable at that time. If the maturity of the debt were accelerated, the Company would not have sufficient available liquidity to repay such debt within one year after the date that the financial statements are issued. This condition raises substantial doubt about the Company’s ability to continue as a going concern.

The Company has been actively discussing the Company’s failure to meet its financial covenants with the Administrative Agent and entered into a forbearance agreement and First and Second Amendments to the forbearance agreement, providing a period through and including February 28, 2022, during which the Company will be able to borrow on its revolving line of credit, subject to the terms and conditions to making a revolving credit advance, including availability, and the lenders have agreed, subject to the terms of the forbearance agreement, as amended, to forbear from enforcing their rights or seeking to collect

payment of the Company’s debt or disposing of the collateral securing the debt. However, entering into the forbearance agreement will not alleviate the substantial doubt about the Company’s ability to continue as a going concern. Our forbearance agreement, as amended, contains certain financial covenants with which we are required to comply, commencing with the nine-month period ended September 30, 2021, through and including the twelve-month period ending February 28, 2022. There cannot be any assurance that we will be able to comply with these covenants contained in the forbearance agreement, as amended, given the industry-wide and other challenges that we face, as described elsewhere herein, or that our lenders would waive a default if that were to occur. The Company intends to use the forbearance period to continue negotiations with the Lenders to enter into an amendment and waiver to cure the defaults. There can be no assurance that the Company will be able to enter into an amendment or waiver with the lenders or if it enters into an amendment, what the terms, restrictions, and covenants of the amendment will contain. Without an amendment and waiver that cures the defaults, substantial doubt about the Company’s ability to continue as a going concern remains.

Risks Related to the Coronavirus

The coronavirus (COVID-19) pandemic has and will continue to materially and adversely affect our business, financial condition and results of operations.

The ongoing outbreak of COVID-19, and any other outbreaks of COVID-19, other contagious diseases or other adverse public health developments have had and could continue to have a material adverse effect on our business, financial condition and results of operations. In 2020, COVID-19 significantly impacted economic activity and markets worldwide, and it could continue to negatively affect our business in a number of ways. These effects include, but are not limited to:

▪Disruptions or restrictions on our employees’ ability to work effectively due to illness, travel bans, quarantines, shelter-in-place orders or other limitations.

▪Net sales to automotive customers, most of whom idled their manufacturing facilities as a result of the COVID-19 pandemic, were approximately 88% of the Company’s net sales during the fiscal year ended December 31, 2020. The closures of our customers’ operations from April 2020 through June 2020 had a substantial adverse effect on our results of operation and financial condition. Additionally, increased consumer demand and vehicle production schedules in the second half of 2020 was unexpected in certain areas of the automotive supply chain. This surge in demand, as well as a significant increase in consumer demand for personal electronics led to a worldwide semiconductor supply shortage in early 2021 which has continued through at least the third quarter of 2021, resulting in decreased demand for our products as automotive OEMs have canceled or reduced planned production.

▪In an effort to increase the wider availability of needed medical and other supplies and products, we have elected and may further elect to, or governments may require us to, allocate manufacturing capacity in a way that could adversely affect our regular operations and that may adversely impact our customer and supplier relationships.

▪Costs incurred and revenues lost during and from the effects of the COVID-19 pandemic have not been and likely will not be recoverable.

▪The failure of third parties on which we rely, including our suppliers, customers, contractors, commercial banks and other business partners, to meet their respective obligations to the Company, or significant disruptions in their ability to do so, which may be caused by their own financial or operational difficulties.

▪The COVID-19 pandemic has significantly increased economic and demand uncertainty and has led to disruption and volatility in the global credit and financial markets, which increases the cost of capital and adversely impacts access to capital for both the Company and our customers and suppliers.

The extent to which the COVID-19 pandemic, or other outbreaks of disease or similar public health threats, materially and adversely impacts our business, financial condition and results of operations is highly uncertain and will depend on future developments. Such developments may include the geographic spread and duration of the virus, the severity of the disease and the actions that may be taken by various governmental authorities and other third parties in response to the outbreak. In addition, how quickly, and to what extent, normal economic and operating conditions can resume cannot be predicted, and the resumption of normal business operations may be delayed or constrained by lingering effects of the COVID-19 pandemic on our suppliers, third-party service providers, and/or customers.

Risks Related to Our Debt

The Company’s cash flows from operations and borrowings under our Amended and Restated Credit Agreement, may not be sufficient to cover the Company’s liquidity needs.

Our principal sources of liquidity are cash flows from operations and borrowings under our amended and restated bank credit agreement from our lenders. As of June 30, 2021 we had $6.7 million, available to be borrowed under our revolving credit facility and approximately $0.9 million cash and cash equivalents. Our ability to borrow, however, under the revolving line of

credit is dependent on our compliance with the forbearance agreement, as amended, which currently expires in February 2022. The Company intends to use the forbearance period to continue negotiations with the Lenders to enter into an amendment and waiver to cure the defaults. Until such time as an amendment is granted, and there is no guarantee that an amendment will be granted, the Company must manage its liquidity needs with cash flows from operations and remaining availability, if any, subject to the amended and restated bank credit agreement and the Forbearance Agreement. There can be no assurance that such sources will be available to us or sufficient to fund our operating and other requirements.

The Company’s financial performance may not meet the covenant requirements in the Amendments to the Forbearance Agreement.

We have entered into the First Amendment and Second Amendment to the forbearance agreement, which among other things, suspend the testing of the Total Leverage and the Debt Service Ratios during the forbearance period, and contains revised requirements for Minimum Liquidity and Minimum Consolidated EBITDA for the measurement periods, as defined, commencing with the period ending September 30, 2021, through and including the period ending February 28, 2022. There cannot be any assurance that we will be able to comply with these covenants contained in the forbearance agreement, given the industry-wide and other challenges that we face, as described elsewhere herein or that our lenders would waive a default, if that were to occur. If the lenders were to exercise their remedies under the bank credit agreement or the related documents, we could be compelled, in the absence of other remedies, to avail ourselves of the protections of the bankruptcy laws, in which event stockholders would likely lose their entire investment in us.

We have substantial debt and we have failed to comply with certain of the covenants in our secured credit agreement, which allows our lenders to take action that would likely cause our stockholders to lose their entire investment in us.

As of June 30, 2021, we had approximately $48.5 million of debt outstanding under our bank credit facility. Substantially all our assets are pledged to the lenders to secure this outstanding debt. As a result of our failure to comply with financial and other covenants contained in the senior secured bank credit facility, the lenders have declared an event of default, although they have not accelerated the amounts outstanding or sought to foreclose on the collateral securing such indebtedness. We have entered into a forbearance agreement pursuant to which our Lenders have agreed, among other things, during the period through and including February 28, 2022, to forbear from enforcing their rights or seeking to collect payment of the Company’s debt or disposing of collateral securing the debt. There can be no assurance that the Company, during the forbearance period, will be able to enter into an amendment or waiver curing the defaults. If the Company does not obtain an amendment or waiver of the defaults or if the lenders take the position that the Company has not complied with the terms of the forbearance agreement, there can be no assurance that the lenders will not take action to collect payment of our debt or dispose of collateral securing the debt. In such event, we could be forced to file for bankruptcy protection and stockholders would likely lose their entire investment in us.

The agreement governing our senior secured bank credit facility contains financial covenants and other covenants that may restrict our current and future operations, particularly our ability to respond to changes in our business or to take certain actions. Our inability to comply with these covenants, would materially and adversely affect our business, results of operations and liquidity.

As of December 31, 2020, the Company was in violation of its loan covenants. The Company has requested certain amendments to these covenants but its lenders have not agreed to such amendments. Our ability to comply with the covenants in the senior secured credit facility agreement even if they are amended may be affected by economic or business conditions beyond our control. If we are not able to comply with covenants when required and we are unable to obtain necessary waivers or amendments from the lenders, we would be precluded from borrowing under the credit facility. If we are unable to borrow under the bank credit facility, we will need to meet our liquidity requirements using other sources. Based on our results for the six months ended June 30, 2021, we cannot be assured that alternative sources of liquidity will be available. In addition, if we do not comply with the financial or other covenants in the credit facility when required, the lenders could declare an event of default under the credit facility, and our indebtedness thereunder could be declared immediately due and payable. The lenders would also have the right in these circumstances to terminate any commitments they have to provide further borrowings. Any of these events would have a material adverse effect on our business, financial condition and liquidity.

In addition, the senior secured bank credit facility contains covenants that, among other things, restrict our ability to:

▪incur liens;

▪incur or assume additional debt or guarantees;

▪pay dividends, or make redemptions and repurchases, with respect to capital stock;

▪make loans and investments;

▪make capital expenditures;

▪engage in mergers, acquisitions, asset sales, sale/leaseback transactions and transactions with affiliates; and

▪change the business conducted by us or our subsidiaries.

The operating and financial restrictions and covenants in this debt agreement and any future financing agreements may adversely affect our ability to finance future operations or capital needs or to engage in other business activities.

Our substantial amount of indebtedness may adversely affect our cash flow and our ability to operate our business, remain in compliance with debt covenants and make payments on our indebtedness.

Our substantial level of indebtedness increases the possibility that we may be unable to generate sufficient cash to pay, when due, the principal of, interest on or other amounts due with respect to our indebtedness. The level of our indebtedness could have other important consequences to you as a stockholder. For example, it could:

▪make it more difficult for us to satisfy our obligations with respect to our indebtedness and any failure to comply with the obligations under our credit facility, including financial and other restrictive covenants, could result in an event of default under the senior secured credit facility;

▪make us more vulnerable to adverse changes in general economic, industry and competitive conditions and adverse changes in government regulation;

▪require us to dedicate a substantial portion of our cash flow from operations to payments on our indebtedness, thereby reducing the availability of our cash flows to fund working capital, capital expenditures, acquisitions, pay dividends and other general corporate purposes;

▪limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate;

▪place us at a competitive disadvantage compared to our competitors that have less debt; and

▪limit our ability to borrow additional amounts for working capital, capital expenditures, acquisitions, debt service requirements, execution of our business strategy or other purposes.

Any of the above listed factors could materially adversely affect our business, financial condition and results of operations.

The senior secured bank credit facility contains restrictive covenants that may limit our ability to engage in activities that are in our long-term best interests. Our failure to comply with those covenants could result in an event of default which, if not cured or waived, could result in the acceleration of our debt.

The phaseout of the London Interbank Offered Rate (LIBOR), or the replacement of LIBOR with a different reference rate, may have an adverse effect on our business.

In July 2017, the United Kingdom Financial Conduct Authority (the authority that regulates LIBOR) announced that it would phase out LIBOR by the end of 2021. It is unclear whether new methods of calculating LIBOR will be established or if alternative rates or benchmarks will be adopted. Our senior bank facility has utilized LIBOR as a benchmark for calculating the applicable interest rate. Changes in the method of calculating LIBOR, the elimination of LIBOR or the replacement of LIBOR with an alternative rate or benchmark may adversely affect interest rates and result in higher borrowing costs for us. This could materially and adversely affect our results of operations, cash flows and liquidity. The Company has agreed with its Lenders to alternate benchmarks for establishing interest rates in the First Amendment to its forbearance agreement. However, we cannot predict the effect of the potential changes to or elimination of LIBOR or the establishment and use of alternative rates or benchmarks and the corresponding effects on our cost of capital.

Risks Related to Our Internal Controls and Accounting

We have identified inadequate internal controls over financial reporting which led to material weaknesses. We may identify additional material weaknesses in the future that may cause us to fail to meet our reporting obligations or result in material misstatements of our financial statements. If we fail to remediate our material weakness or if we fail to establish and maintain an effective system of internal control over financial reporting, we may not be able to report our financial results accurately or to prevent fraud. Any inability to report and file our financial results accurately and timely could harm our business and our ability to comply with the requirements of our senior credit facility or other financing agreements and adversely impact the trading price of our securities.

Our management is responsible for establishing and maintaining internal controls over financial reporting, disclosure controls, and complying with other requirements of the Sarbanes-Oxley Act and the rules promulgated by the SEC thereunder. Internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements in accordance with GAAP. A material weakness is defined as a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a

material misstatement of a company’s annual or interim financial statements will not be prevented or detected on a timely basis by the company’s internal controls.

In connection with the preparation of our December 31, 2020 financial statements, we identified material weaknesses, primarily related to ineffective controls over the financial close process, which resulted from limited staffing levels that were not commensurate with the Company’s complexity and its financial accounting and reporting requirements. This resulted from turnover of key management positions during 2019, including the Company’s Chief Financial Officer, IT Manager and Controller. While we are working to remediate the material weaknesses as quickly and efficiently as possible and expect to have remediated the material weaknesses during the year ending December 31, 2021, these remediation measures may be time consuming, costly, and might place significant demands on our financial and operational resources. If we are unable to successfully remediate this material weaknesses, and if we are unable to produce accurate and timely financial statements, our financial statements and other disclosures could contain material misstatements or omissions that, when discovered in the future, could cause us to fail to meet our future reporting obligations and cause the price of our Common Stock to decline or otherwise materially adversely affect our financial results or condition.

Our goodwill has been subject to impairment and may continue to be subject to impairment in the future.

The Company had $22.1 million of goodwill on our balance sheet as of June 30, 2021. Under U.S. GAAP, goodwill is required to be reviewed for impairment at least annually, or more frequently if potential interim indicators exist. Impairment may result from various factors, including adverse changes in assumptions used for valuation purposes, such as actual or projected revenue growth rates, profitability or discount rates. If the testing indicates that an impairment has occurred, we are required to record a non-cash impairment charge for the difference between the carrying value of the goodwill and the fair value of the goodwill. Events and conditions that could result in impairment include a prolonged period of global economic weakness, a decline in economic conditions, or a slow economic recovery, adverse changes in the market share of our products, or other factors which could result in reductions in our sales or profitability over an extended period. We cannot predict the amount and timing of any future impairments, if any. We have experienced impairment charges with respect to goodwill, and we may experience such charges in the future, particularly if our business performance declines or expected growth is not realized. For the fiscal year ended December 31, 2020, we incurred no goodwill impairment charges. Given the continued uncertainty in the automotive market because of the ongoing global semiconductor shortages and the decline in the Company’s market capitalization during 2021, the Company has contracted a specialist firm to perform an interim impairment analysis as of September 30, 2021. Although the interim impairment analysis is not yet complete, it is more likely than not that the Company will recognize an impairment of goodwill. The Company cannot determine at this time what the effect of an impairment, if it were determined to have occurred, would be. It is possible that material changes in our business, market conditions, or assumptions about our market share or position could occur over time. Any future impairment of our goodwill or other intangible assets could have a material adverse effect on our financial condition and results of operations, as well as the trading price of our securities.

Risks Related to Our Operations

We would be adversely affected by the loss of key personnel.

Our success is dependent upon the continued services of our senior management team and other key employees. Although certain key members of our senior management have employment agreements for their continued services, there is no guaranty that each such person will choose to remain with us. The loss of any key employees (including such members of our senior management team) could materially adversely affect our business, results of operations and financial condition.

In addition, our success depends in part on our ability to attract, hire, train and retain qualified managerial, engineering, sales and marketing personnel. The forbearance agreement, as amended, into which we entered with our lenders prohibits, during the forbearance period ending on February 28, 2022, our making any payments out of the ordinary course of business, including salary or compensation or distributions for the benefit of any member, owner or director other than normal and customary employment salaries which do not exceed sums paid for similar positions in the Company’s marketplace. These restrictions, together with our financial condition and any new restrictions our lenders may impose, could impair our ability to attract, hire and retain qualified personnel. We face significant competition for these types of employees in our industry. We may be unsuccessful in attracting and retaining the personnel we require to conduct our operations successfully. The loss of any member of our senior management team or other key employees could impair our ability to execute our business plans and strategic initiatives, cause us to lose customers and experience reduced net sales, or lead to employee morale problems and/or the loss of other key employees. In any such event, our financial condition, results of operations, internal control over financial reporting, or cash flows could be adversely affected.

Our major customers may exert significant influence over us.

The vehicle component supply industry has traditionally been highly fragmented and serves a limited number of large OEMs. As a result, OEMs have historically had a significant amount of leverage over their outside suppliers. Our arrangements with major OEM and Tier 1 customers frequently provide for an annual productivity cost reduction. Historically, cost reductions

through product design changes, increased productivity and efficiency, and cost reduction programs with our suppliers have generally offset these customer-imposed cost down requirements. However, if we are unable to generate sufficient production cost savings in the future to offset price reductions gross margin and profitability would be adversely affected. In addition, changes in our customers’ purchasing policies or payment practices could have an adverse effect on our business.

The loss or insolvency of any of our major customers would adversely affect our future results.

Our three largest direct customers, in the aggregate, accounted for approximately 21% of our direct net sales for the year ended December 31, 2020 and 23% for the six months ended June 30, 2021. Predominantly, we enter into purchase order commitments with our customers, based on their current or projected needs. We have in the past lost, and may in the future, lose customers due to the highly competitive conditions in the industries we serve. A decision by any significant customer, whether motivated by competitive conditions, financial difficulties or otherwise, to materially decrease the amount of products purchased from us, to change their manner of doing business with us or to stop doing business with us altogether could have a material adverse effect on our business, financial condition and results of operations.

Margin compression from changing sales and raw material prices.

We generally commit to end-product pricing for a specified quantity of product for the duration of a vehicle’s production, generally five to seven years. In the past, we successfully mitigated price volatility though aggressive supplier management and alternative material substitution strategies. Typically, our products are refreshed during a vehicle’s production life creating opportunities to modify pricing if material costs have risen. However, there can be no assurance that we will be able to implement or sustain such strategies in the future or modify pricing to pass potential increases in material costs to customers. Our inability to do so could materially adversely affect our business, financial condition and results of operations.

We rely on raw materials suppliers in our business and significant shortages, supplier capacity constraints or supplier production disruptions could adversely affect our financial condition and operating results.

Our reliance on suppliers to secure raw materials exposes us to volatility in the prices and availability of our raw materials and components. A disruption in deliveries from suppliers could have a material adverse effect on our ability to meet our commitments to customers or could increase our operating costs. Moreover, the cost of raw materials used in the production of our products, represents a significant portion of our direct manufacturing costs. The number of customers to which we are not able to pass on such price increases may increase in the future. We believe that our supply management and production practices are based on an appropriate balancing of the foreseeable risks and the costs of alternative practices. Nonetheless, price increases, supplier capacity constraints, supplier production disruptions or the unavailability of some raw materials may have a material adverse effect on our cash flows, competitive position, financial condition or results of operations. If we are not able to buy raw materials at fixed prices or pass on price increases to our customers, we may lose orders or enter into orders with less favorable terms, any of which could have a material adverse effect on our business, financial condition and results of operations.

We conduct certain of our manufacturing in Mexico and Canada, therefore, are subject to risks associated with doing business outside the United States, including the possible effects of currency exchange rate fluctuations.

We have two manufacturing facilities in Mexico and one in Canada. There are several risks associated with doing business in Mexico and Canada, including, exposure to local economic and political conditions, export and import restrictions, tariffs, and the potential for shortages of trained labor. Our sales are primarily denominated in U.S. dollars. Because a portion of our manufacturing costs are incurred in Mexican pesos and Canadian dollars, fluctuations in the U.S. dollar/Mexican peso and U.S dollar/Canadian dollar exchange rates may have a material effect on our profitability, cash flows, financial position, and may significantly affect the comparability of our results between financial periods. Any depreciation in the value of the U.S. dollar in relation to the value of the Mexican peso or Canadian dollar will adversely affect the cost of our Mexican and Canadian operations when remeasured into U.S. dollars. Similarly, any appreciation in the value of the U.S. dollar in relation to the value of the Mexican peso or Canadian dollar will decrease the cost of our Mexican and Canadian operations when remeasured into U.S. dollars. These risks may materially adversely impact our business, results of operations and financial condition.

Changes in U.S. administrative policy, including changes to existing trade agreements and any resulting changes in international relations, could adversely affect our financial performance.

As a result of changes to U.S. administrative policy, among other possible changes, there may be (i) changes in policies pertaining to the environment; (ii) changes to existing trade agreements; (iii) greater restrictions on free trade generally; and (iv) significant increases in customs duties and tariffs on goods imported into the United States. The United States, Mexico and Canada signed a new trade agreement, the United States-Mexico-Canada Agreement (“USMCA”), which serves as the successor agreement to the North American Free Trade Agreement (“NAFTA”). The USMCA became effective on July 1, 2020. There can be no assurance that the ongoing transition from NAFTA to USMCA will not adversely affect our business. It remains unclear what specific actions the current U.S. administration may take to resolve trade-related issues. A trade war, other governmental action related to tariffs or international trade agreements, changes in U.S. social, political, regulatory and

economic conditions or in laws and policies governing foreign trade, manufacturing, development and investment in the countries where we currently manufacture and sell products or any resulting negative sentiments towards the United States could adversely affect our business, financial condition, operating results and cash flows.

Our business is cyclical in nature and downturns in the automotive industry could reduce the sales and profitability of our business.

The demand for our products is largely dependent on the North American production of automobiles. The markets for our products have been cyclical, because new vehicle demand is dependent on, among other things, consumer spending and is tied closely to the overall strength of the economy. Because our products are used principally in the production of vehicles for the automotive market, our net sales, and therefore results of operations, are significantly dependent on the general state of the economy and other factors which affect these markets. A decline in vehicle production would adversely impact our results of operations and financial condition. The forecast for North American vehicle production in 2022 and 2023 includes increases over the low levels in 2020 and 2021. However, we cannot provide any assurance as to the level of growth in our markets. If the market suffers an extended downturn, it could materially affect our business, financial condition and results of operations.

We may pursue acquisitions that involve inherent risks, any of which may cause us to not realize anticipated benefits.

Our business strategy includes the potential acquisition of businesses that we expect will complement and expand our existing business. During the last six fiscal years, we acquired the businesses and substantially all the assets of PTI, Chardan, Great Lakes, and Intasco. We may not be able to successfully identify suitable acquisition opportunities or complete any specific acquisition, combination or other transaction on acceptable terms. Our identification of suitable acquisition candidates involves risks inherent in assessing the values, strengths, weaknesses, risks and profitability of these opportunities, including their effects on our business, diversion of our management’s attention and risks associated with unanticipated problems or unforeseen liabilities. If we are successful in pursuing future acquisitions, we may be required to expend significant funds, incur additional debt, or issue additional shares of Common Stock, which may materially and adversely affect our results of operations and be dilutive to our stockholders. If we spend significant funds or incur additional debt, our ability to obtain financing for working capital or other purposes could decline and we may be more vulnerable to economic downturns and competitive pressures. In addition, we cannot guarantee that we will be able to finance additional acquisitions or that we will realize any anticipated benefits from acquisitions that we complete. Should we successfully acquire other businesses, the process of integrating acquired operations into our existing operations may result in unforeseen operating difficulties and may require significant financial resources that would otherwise be available for the ongoing development or expansion of our existing business. Our failure to identify suitable acquisition opportunities may restrict our ability to grow our business.

We may experience increased costs and other disruptions to our business associated with labor unions.

As of December 31, 2020, we had 1,001 full-time and 50 contract workers. We renewed a collective bargaining agreement covering hourly workers at our Auburn Hills, Michigan facility in August 2019 with an expiration date in August 2022. We renewed our Louisville collective bargaining agreement in August 2020, effective as of February 2020 with an expiration in February 2023. Many of our customers and their suppliers also have unionized work forces. Work stoppages or slow-downs experienced by us, customers or their other suppliers could result in slow-downs or closures of assembly plants where our products are included in assembled commercial vehicles. Any work stoppage or other labor disruption involving our employees, employees of our customers, or employees of our suppliers could have a material adverse effect on our business, financial condition or results of operations by disrupting our ability to manufacture our products or reducing the demand for our products.

Our results of operations may be negatively impacted by product liability lawsuits and claims.

Our automotive products expose us to potential product liability risks that are inherent in the design, manufacture, sale and use of our products. While we currently maintain what we believe to be suitable product liability insurance, we cannot assure you that we will be able to maintain this insurance on acceptable terms, that this insurance will provide adequate protection against potential liabilities or that our insurance providers will remain financially viable. One or more successful claims against us could materially adversely affect our reputation and our business, financial condition, results of operations and cash flows.

Regulatory Risks

Our businesses are subject to statutory environmental and safety regulations in multiple jurisdictions, and the impact of any changes in regulation and/or the violation of any applicable laws and regulations by our businesses could result in a material adverse effect on our business, financial condition and results of operations.

We are subject to foreign, federal, state, and local laws and regulations governing the protection of the environment and occupational health and safety, including laws regulating: air emissions; wastewater discharges; the generation, storage, handling, use and transportation of hazardous materials; the emission and discharge of hazardous materials into the soil, ground or air; and the health and safety of our employees. We are also required to obtain permits from governmental authorities for

certain of our operations. We cannot assure you that we are, or have been, in complete compliance with such environmental and safety laws, regulations and permits. If we violate or fail to comply with these laws, regulations or permits, we could be fined or otherwise sanctioned by regulators. In some instances, such a fine or sanction could have a material and adverse effect on us. The environmental laws to which we are subject have become more stringent over time, and we could incur material expenses in the future to comply with environmental laws. We are also subject to laws imposing liability for the cleanup of contaminated property. Under these laws, we could be held liable for costs and damages relating to contamination at our past or present facilities and at third party sites to which we sent waste containing hazardous substances. The amount of such liability could be material.

Certain of our operations generate hazardous substances and wastes. If a release of such substances or wastes occurs at or from our properties, or at or from any offsite disposal location to which substances or wastes from our current or former operations were taken, or if contamination is discovered at any of our current or former properties, we may be held liable for the costs of cleanup and for any other claim by governmental authorities or private parties, together with any associated fines, penalties or damages. In most jurisdictions, this liability would arise even if we had complied with environmental laws governing the handling of hazardous substances or wastes.

New laws or regulations or changes in existing laws or regulations could adversely affect our financial performance.

We and the automotive industry are subject to a variety of federal, state, local and foreign laws and regulations, including those related to health, safety and environmental matters. Governmental regulations also affect taxes and levies, capital markets, healthcare costs, energy usage, data privacy, international trade and immigration and other labor issues, all of which may have a direct or indirect effect on our business and the businesses of our customers and suppliers. We cannot predict the substance or impact of pending or future legislation or regulations, or the application thereof. The introduction of new laws or regulations or changes in existing laws or regulations, or the interpretation thereof, could increase the costs of doing business for us or our customers or suppliers or restrict our actions and adversely affect our financial condition, operating results and cash flows.

We may be adversely affected by the impact of government regulations on our customers.

Although the products we manufacture and supply to vehicle customers are not subject to significant government regulation, our business is indirectly impacted by the extensive governmental regulation applicable to our automotive customers. These regulations primarily relate to emissions and noise standards imposed by the Environmental Protection Agency, or EPA, state regulatory agencies, such as the California Air Resources Board, or CARB, and other regulatory agencies around the world. Vehicle customers are also subject to the National Traffic and Motor Vehicle Safety Act and Federal Motor Vehicle Safety Standards promulgated by the National Highway Traffic Safety Administration. Changes in emission standards and other proposed governmental regulations could impact the demand for vehicles and, as a result, indirectly impact our operations. To the extent that current or future governmental regulation has a negative impact on the demand for vehicles, our business, financial condition or results of operations could be adversely affected.

Risks Related to Our Intellectual Property Rights

We have only limited protection for our proprietary rights in our intellectual property, which makes it difficult to prevent third parties from infringing upon our rights.

We protect trade secrets, know-how and other confidential information against unauthorized use by others or disclosure by persons who have access to them, such as our employees, through contractual or other arrangements. These arrangements may not provide meaningful protection for our trade secrets, know-how or other proprietary information in the event of any unauthorized use, misappropriation or disclosure of such trade secrets, know-how or other proprietary information. If we are unable to maintain the proprietary nature of our technologies, our revenues could be materially adversely affected.

Risks Relating to Ownership of Our Common Stock

We are not able to pay dividends and are unlikely to pay dividends in the future.

Our senior secured bank credit facility precludes the payments of dividends altogether while we are in default and any waiver of covenant violations or amendment likely will restrict or prohibit dividend payments in the future. In addition, our ability to pay dividends is affected by our results and our needs for funds for use in our operations and to fund our business.

If our executive officers, directors and principal stockholders choose to act together, they will be able to exert significant influence over us and our significant corporate decisions and may act in a manner that advances their best interests and not necessarily those of other stockholders.

Our executive officers, directors, and certain of our large stockholders and their affiliates, to our knowledge, beneficially own approximately 23% of our outstanding Common Stock as of September 30, 2021. As a result, these persons, if they were to act together, have the ability to significantly influence the outcome of all matters requiring stockholder approval, including the

election and removal of directors and any merger, consolidation, or sale of all or substantially all of our assets, and they could act in a manner that advances their best interests and not necessarily those of other stockholders, by among other things:

▪delaying, deferring or preventing a change in control of the Company;

▪entrenching our management and/or our board of directors;

▪impeding a merger, consolidation, takeover or other business combination involving the Company;

▪discouraging a potential acquirer from making a tender offer or otherwise attempting to obtain control of the Company; or

▪causing us to enter into transactions or agreements that are not in the best interests of all stockholders.

Securities analysts may not initiate or continue coverage of our Common Stock or may issue negative reports, which may have a negative impact on the market price of our Common Stock.

There has been limited coverage of our Common Stock by securities analysts. We believe that the lack of research coverage may adversely affect the market price and trading volume for our Common Stock. The trading market for our Common Stock may be affected in part by the research and reports that industry or financial analysts publish about our business. If one or more of the analysts who elect to cover us downgrade our stock, our stock price would likely decline rapidly. If one or more of these analysts cease coverage of us, we could lose visibility in the market, which in turn could cause our stock price to decline. In addition, under the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, and a global settlement among the SEC, other regulatory agencies and a number of investment banks, which was reached in 2003, many investment banking firms are required to contract with independent financial analysts for their stock research. It may be difficult for a company such as ours, with a smaller market capitalization, to attract independent financial analysts that will cover our Common Stock. This likely has had and could have a negative effect on the market price of and trading volume for our stock.

Future sales of our common stock in the public market may cause our stock price to decline and impair our ability to raise future capital through the sale of our equity securities.

As of September 30, 2021, we had outstanding 11,733,147 shares of Common Stock, including 2,702,500 shares of our common stock issued in our initial public offering and 9,030,647 shares of Common Stock issued in private placements, including the 2,110,320 shares offered hereby. The shares owned by non-affiliates issued in private placements before our initial public offering can be traded without restriction under Rule 144 or otherwise at this time. In addition, 2,729,068 shares of Common Stock issued before our initial public offering are owned by affiliates but can be traded subject to restrictions under Rule 144. In addition, we have registered all shares that may be issued pursuant to our 2013 Stock Incentive Plan and the 2014 Omnibus Performance Award Plan. Sales of a large number of these securities on the public market or the perception that a large number of shares may be sold could reduce the market price of our Common Stock or impair our ability to raise capital.

Anti-takeover provisions in our organizational documents and Delaware law may discourage or prevent a change in control, even if an acquisition would be beneficial to our stockholders, which could affect our stock price adversely and prevent attempts by our stockholders to replace or remove our current management.

Our restated certificate of incorporation and restated bylaws contain provisions that could discourage, delay or prevent a merger, acquisition or other change in control of our company or changes in our board of directors that our stockholders might consider favorable, including transactions in which you might receive a premium for your shares. These provisions also could limit the price that investors might be willing to pay in the future for shares of our common stock, thereby depressing the market price of our common stock. Stockholders who wish to participate in these transactions may not have the opportunity to do so. Furthermore, these provisions could prevent or frustrate attempts by our stockholders to replace or remove management. These provisions:

▪allow the authorized number of directors to be changed only by resolution of our board of directors;

▪provide for a classified board of directors, such that not all members of our board will be elected at one time;

▪prohibit our stockholders from filling board vacancies, limit who may call stockholder meetings, and prohibit the taking of stockholder action by written consent; and

▪require advance written notice of stockholder proposals that can be acted upon at stockholder’s meetings and of director nominations to our board of directors.

In addition, we are subject to the provisions of Section 203 of the Delaware General Corporation Law, which may prohibit certain business combinations with stockholders owning 15% or more of our outstanding voting stock. Any delay or prevention of a change in control transaction or changes in our board of directors could cause the market price of our Common Stock to decline.

An investment in the shares is speculative and there can be no assurance of any return on any such investment.

An investment in the Shares is speculative and there is no assurance that investors will obtain any return on their investment. Investors will be subject to substantial risks involved in an investment in the Company, including the risk of losing their entire investment.

Risks Related to Public Companies

We incur costs as a result of being a public company, and potentially will incur more after we are no longer a “smaller reporting company”. Our management devotes substantial time to public company compliance programs and will be required to continue to devote substantial time in the future.

As a public company, we incur significant legal, insurance, accounting and other expenses. In addition, our administrative staff is required to perform additional tasks. We expect that these expenses will increase if we no longer qualify as a “smaller reporting company”. We have invested and intend to invest resources to comply with evolving laws, regulations and standards. This investment has resulted in increased general and administrative expenses and may divert management’s time and attention from product development and commercial activities. If our efforts to comply with new laws, regulations and standards differ from the activities intended by regulatory or governing bodies due to ambiguities related to practice, regulatory authorities may initiate legal proceedings against us, and our business may be harmed. In addition, if we are unable to continue to meet these requirements, we may not be able to maintain the listing of our common stock on the NYSE American which would likely have a material adverse effect on the trading price of our Common Stock.

In the future, it may be more expensive for us to obtain director and officer liability insurance, and we may be required to accept reduced coverage or incur substantially higher costs to obtain coverage. These factors could also make it more difficult for us to attract and retain qualified executive officers and qualified members of our board of directors, particularly to serve on our audit and compensation committees.

Our internal control over financial reporting as a public company requires us to meet the standards required by Section 404 of the Sarbanes-Oxley Act. Failure to achieve and maintain effective internal control over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act has and, in the future, could result in material misstatements of our annual or interim financial statements and have a material adverse effect on our business and share price.

We are required to comply with the SEC’s rules that implement Section 404 of the Sarbanes-Oxley Act, and are therefore required to make a formal assessment of the effectiveness of our internal control over financial reporting for that purpose. This requires management to certify financial and other information in our quarterly and annual reports and provide an annual management report on the effectiveness of our internal control over financial reporting. This assessment includes the disclosure of any material weaknesses or significant deficiencies in our internal control over financial reporting identified by our management or our independent registered public accounting firm. A “material weakness” is a deficiency, or a combination of deficiencies, in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of our annual or interim financial statements will not be prevented or detected on a timely basis. A “significant deficiency” is a deficiency, or a combination of deficiencies, in internal controls over financial reporting that is less severe than a material weakness, yet important enough to merit attention by those responsible for oversight of our financial reporting, including the audit committee of the board of directors.