Earnings Calendar: Three S&P 500 Stocks to Watch Out for This Week

June 01 2021 - 5:39AM

Finscreener.org

As we head into the final month of the second quarter of CY

2021, a few technology companies are going to report their

quarterly earnings this week. This is because companies follow

different accounting periods and their fiscal year can very well be

different from a calendar year.

According to the earnings

calendar, tech companies such as Hewlett Packard Enterprise

(NYSE:

HPE), NetApp (NASDAQ: NTAP), and

Broadcom (NASDAQ: AVGO) are

expected to report quarterly earnings this week. All these stocks

are part of the S&P 500 (AMEX:

SPY) index and let’s see what Wall Street expects from each of

them.

Hewlett Packard Enterprise

Hewlett Packard Enterprise will be reporting its results on June

1 for the quarter ended in April. The company is involved in the

sales of HPC (high-performance computing), storage as well as edge

computing hardware and software solutions. In fiscal 2020, HPE saw

its revenue fall by 7% while its earnings decline was wider at 24%

year over year.

As the COVID-19 pandemic weighed heavily on businesses, HPE was

hurt by lower enterprise spending and related headwinds. Analysts

expect HPE to increase sales by 5.2% to $6.62 billion while

earnings per share are forecast to almost double to $0.42 in the

fiscal Q2 of 2021. During its last earnings call, HPE increased its

free-cash-flow forecast to $1.4 billion, up from $1.1 billion in

2021. In fiscal 2020, its free cash flow stood at just $560

million.

HPE stock is trading at a forward price to earnings multiple of

8.7x which is really attractive given its profit margins are

forecast to rise at an annual rate of 12.5% in the next five years.

Add in its dividend yield of 3% and HPE may end up on the buying

list of income and value investors.

NetApp

NetApp will report its fiscal Q4 of 2021 results on June 2. A

company valued at a market cap of $17.22 billion, NetApp provides

data management solutions that simplify the process of storing

enterprise data.

In Q4, analysts expect NetApp to report sales of $1.5 billion, a

year-over-year growth of 7%. Comparatively, earnings are forecast

to decline by 5% to $1.12 per share. For fiscal 2021, Wall Street

expects NetApp to increase sales by 5% to $5.7 billion while

earnings might fall by 1% to $4.01 per share.

During the last earnings call, NetApp had forecast sales between

$1.44 billion and $1.54 billion while earnings were estimated

between $1.06 and $1.14 per share. Investors should note that the

company has beaten analyst estimates in each of the last four

quarters.

Broadcom

Semiconductor giant Broadcom will report its fiscal Q2 of 2021

results on June 3. A company that is valued at a market cap of $192

billion and an enterprise value of $225 billion, Broadcom has been

one of the top performers in the S&P 500. In the last 10

years, Broadcom stock is up 1,250% and despite its market-beating

gains, it still provides a tasty dividend yield of 3.05%.

Analysts expect Broadcom sales to rise by 14% year over year in

fiscal Q2 to $6.51 billion while earnings growth is forecast at 25%

compared to the prior-year period.

Broadcom provides enterprises with solutions in the data center,

broadband, and server storage verticals. Currently, it generates

considerable cash flows from its Wi-Fi 6E solution which is a chip

that delivers

high speed with lower latency.

In fiscal 2020, the company’s free cash flow soared by 25% to

$11.6 billion. In fiscal Q1 this growth accelerated to 36% year

over year as Broadcom reported $3 billion in cash flows. Broadcom’s

interest payments stood at $570 million and its dividend payouts

were over $1.5 billion in Q1 which suggests it has enough room to

increasing dividends going forward.

Alternatively, investors might be worried about the company’s

high debt of $42 billion. But the tech giant also ended the January

quarter with close to $10 billion in cash.

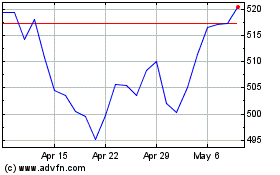

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Mar 2024 to Apr 2024

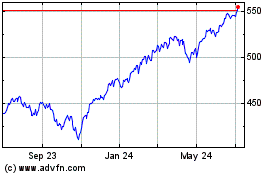

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Apr 2023 to Apr 2024