Filed Pursuant to Rule 497(b)

Registration File No. 033-46080

PROSPECTUS DATED FEBRUARY 18, 2021

SPDR® S&P 500®

ETF Trust

(“SPDR 500 Trust” or the “Trust”)

(formerly known as “SPDR Trust, Series 1”)

(A Unit Investment Trust constituted outside Singapore and

organized in the United States)

PROSPECTUS

ISSUED PURSUANT TO

DIVISION 2 OF PART XIII OF

THE SECURITIES AND FUTURES ACT,

CHAPTER 289 OF SINGAPORE

This Prospectus incorporates and is not valid without

the U.S. Prospectus dated January 14, 2021

issued by the SPDR 500 Trust, attached hereto

The collective investment scheme offered in this Prospectus is a recognised scheme under the Securities and Futures Act, Chapter 289 of Singapore (the

“Act”). A copy of this Prospectus has been lodged with and registered by the Monetary Authority of Singapore (the “Authority”). The Authority assumes no responsibility for the contents of the Prospectus. Registration of the

Prospectus by the Authority does not imply that the Act or any other legal or regulatory requirements have been complied with. The Authority has not, in any way, considered the investment merits of the collective investment scheme. The date of

registration of this Prospectus with the Authority is February 18, 2021. This Prospectus will expire on February 18, 2022 (12 months after the date of registration).

The SPDR 500 Trust has been admitted to the Official List of the Singapore Exchange Securities Trading Limited

(“SGX-ST”), and permission has been granted by the SGX-ST to deal in and for quotation on the SGX-ST Mainboard of all

the units in the SPDR 500 Trust (“Units”) already issued as well as those Units which may be issued from time to time. The SGX-ST assumes no responsibility for the correctness of any of the

statements made or opinions expressed in this Prospectus and admission to the Official List of the SGX-ST is not to be taken as an indication of the merits of the SPDR 500 Trust or the Units.

IMPORTANT: If you are in doubt about the contents of this Prospectus, you should consult your stockbroker, bank manager, solicitor, accountant or other

financial adviser.

SPDR® S&P 500® ETF Trust

PROSPECTUS

TABLE OF CONTENTS

“Standard & Poor’s®”, “S&P®”, “S&P 500®”, “Standard & Poor’s

500®”, “500®”, “Standard & Poor’s Depositary

Receipts®”, “SPDR®” and “SPDRs®” are registered

trademarks of Standard & Poor’s Financial Services LLC and have been licensed for use by S&P Dow Jones Indices LLC (“S&P”) and sublicensed for use by State Street Global Advisors Funds Distributors, LLC. The Trust is

permitted to use these trademarks pursuant to a sublicense from State Street Global Advisors Funds Distributors, LLC. The Trust is not sponsored, endorsed, sold or marketed by S&P, its affiliates or its third party licensors.

S-2

SPDR® S&P

500® ETF TRUST

This Prospectus, relating to the SPDR® S&P 500® ETF Trust (“SPDR 500 Trust” or the “Trust”), which is issued pursuant to Division 2 of

Part XIII of the Securities and Futures Act, Chapter 289 of Singapore, has been lodged with and registered by the Monetary Authority of Singapore, who assumes no responsibility for its contents.

This Prospectus incorporates and is not valid without the attached U.S. Prospectus, dated January 14, 2021 issued by the Trust (“U.S.

Prospectus”). Terms defined in the U.S. Prospectus shall have the same meaning when used in this Prospectus.

The Trust’s fiscal

year end is September 30.

The Trust is a unit investment trust organised in the United States (“U.S.”), and is a single fund

that issues securities called “Units”, which represent an undivided ownership interest in the common stocks that are actually held by the Trust and make up the Trust’s Portfolio (the “Portfolio Securities”). The

“Portfolio” means the portfolio of the common stocks that are included in the Index (as defined below). The Trust seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the

S&P 500® Index (the “Index”). The Trust’s Portfolio consists of substantially all of the component common stocks that comprise the Index, which are weighted in accordance

with the terms of the Trust Agreement (defined below).

The Trust’s portfolio turnover ratio, calculated based on the lesser of

purchases or sales of underlying investments of the Trust and expressed as a percentage of daily average net asset value, was 2% during the most recent fiscal year. The Trust’s portfolio turnover ratio, expressed as a percentage of monthly

average value, can be found on page 2 of the U.S. Prospectus and in the “Financial Highlights” section on pages 23 to 24 of the U.S. Prospectus.

The top ten constituents (by weight) of the Trust as of February 16, 2021 are set out below:

|

|

|

|

|

|

|

|

|

|

|

No.

|

|

Name

|

|

Weighting

|

|

1.

|

|

Apple Inc.

|

|

6.41%

|

|

2.

|

|

Microsoft Corporation

|

|

5.55%

|

|

3.

|

|

Amazon.com Inc.

|

|

4.20%

|

|

4.

|

|

Facebook Inc. Class A

|

|

1.98%

|

|

5.

|

|

Alphabet Inc. Class A

|

|

1.91%

|

|

6.

|

|

Alphabet Inc. Class C

|

|

1.86%

|

|

7.

|

|

Tesla Inc.

|

|

1.82%

|

|

8.

|

|

Berkshire Hathaway Inc. Class B

|

|

1.44%

|

|

9.

|

|

JPMorgan Chase & Co.

|

|

1.33%

|

|

10.

|

|

Johnson & Johnson

|

|

1.31%

|

S-3

For additional details regarding the Trust’s Portfolio, please consult pages 61 to 66

in the U.S. Prospectus attached hereto. All Units are denominated in U.S. dollars.

PDR Services LLC, the sponsor of the Trust (the

“Sponsor”), accepts full responsibility for the accuracy of information contained in this Prospectus, other than that given in the U.S. Prospectus under the heading “Report of Independent Registered Public Accounting Firm”, and

confirms, having made all reasonable enquiries, that to the best of its knowledge and belief the facts stated and the opinions expressed in this Prospectus are fair and accurate in all material respects as at the date of this Prospectus and there

are no other facts the omission of which would make any statement in this Prospectus misleading.

The Trust is governed by an amended and

restated trust agreement (the “Trust Agreement”) dated as of January 1, 2004 and effective as of January 27, 2004, as amended by an amendment dated November 1, 2004 (effective as of November 8, 2004), by an

amendment dated February 1, 2009 (effective as of February 13, 2009), by an amendment dated November 23, 2009 (effective as of January 27, 2010), each made between State Street Bank and Trust Company, the retired trustee of

the Trust (the “Retired Trustee”), and the Sponsor, by an amendment dated April 12, 2017 (effective as of June 16, 2017), made between State Street Global Advisors Trust Company, the trustee of the Trust (the

“Trustee”), and the Sponsor, and by an amendment dated August 4, 2017 (effective as of September 5, 2017), made between the Trustee and the Sponsor. Terms defined in the U.S. Prospectus shall have the same meaning when used in

this Prospectus.

Copies of the Trust Agreement are available for inspection, free of charge, at the offices of State Street Global

Advisors Trust Company, at One Iron Street, Boston, Massachusetts, U.S. 02210 during normal U.S. business hours, or State Street Global Advisors Singapore Limited1, at 168 Robinson Road, #33-01, Capital Tower, Singapore 068912 during normal Singapore business hours.

Investors

should seek professional advice to ascertain (a) the possible tax consequences, (b) the legal requirements and (c) any foreign exchange restrictions or exchange control requirements which they may encounter under the laws of the

countries of their citizenship, residence or domicile and which may be relevant to the subscription, holding or disposal of Units.

Investors in the Trust are advised to carefully consider the risk factors set out under the headings “Principal Risks of Investing in the

Trust” on pages 4 to 6 of the U.S. Prospectus and “Additional Risk Information” on pages 72 to 74 of the U.S. Prospectus, and to refer to pages S-18 to

S-23 of this Prospectus for a discussion of the U.S. and Singapore tax consequences of an investment in Units.

|

1

|

State Street Global Advisors Singapore Limited will hold copies of the Trust Agreement for inspection by

investors; however, it is not in any way acting as an agent for or acting as the Trustee.

|

S-4

ENQUIRIES

All enquiries about the Trust or requests for additional copies of this Prospectus should be directed to an investor’s local broker.

|

|

|

|

|

IMPORTANT:

|

|

READ AND RETAIN THIS PROSPECTUS FOR FUTURE REFERENCE

|

S-5

CORPORATE INFORMATION

|

|

|

|

|

Sponsor to the Trust:

|

|

PDR Services LLC

c/o NYSE Holdings LLC

11 Wall Street

New York, New York

U.S. 10005

|

|

|

|

|

Legal advisers to the Sponsor as to U.S. law:

|

|

Davis Polk & Wardwell LLP

450 Lexington Avenue

New York, New York

U.S. 10017

|

|

|

|

|

Legal advisers to the Sponsor as to Singapore law:

|

|

Morgan Lewis Stamford LLC

10 Collyer Quay

#27-00 Ocean Financial Centre

Singapore 049315

Singapore

|

|

|

|

|

Trustee:

|

|

State Street Global Advisors Trust Company

One Iron Street

Boston, Massachusetts

U.S. 02210

|

|

|

|

|

Legal advisers to the Trustee as to Singapore law:

|

|

Allen & Gledhill LLP

One Marina Boulevard, #28-00

Singapore 018989

Singapore

|

|

|

|

|

Auditors:

|

|

PricewaterhouseCoopers LLP

101 Seaport Boulevard

Suite 500

Boston, Massachusetts

U.S. 02210

|

|

|

|

|

U.S. Distributor of Creation Units:

|

|

ALPS Distributors, Inc.

1290 Broadway, Suite 1000

Denver, Colorado

U.S. 80203

|

S-6

TRADING AND SETTLEMENT

Trust Units are listed for trading on the Singapore Exchange Securities Trading Limited

(“SGX-ST”) where they may be bought and sold in the secondary market at any time during the trading day. Market prices for Units traded on the SGX-ST are

available on the SGX-ST website https://www2.sgx.com/securities/securities-prices?code=etfs. Units may also be purchased by Authorized Participants directly from

the Trust in the U.S. by placing orders with the U.S. Distributor, as facilitated through the Trustee, in a minimum unit, called a “Creation Unit”, of 50,000 Units or multiples thereof. Creation Units may also be redeemed through a tender

to the Trustee in the U.S. Creation Unit transactions are conducted in exchange for the deposit or delivery of in-kind securities and/or cash constituting a substantial replication of the common stocks that

are included in the Index, as determined by the index provider, S&P Dow Jones Indices LLC (“S&P”) (“Index Securities”). Such purchases and redemptions can be made only in the U.S. at the then-current valuation as

described herein on pages S-7 to S-10 and pages S-13 to S-14 under the heading

“Redemption.” For the purposes of such purchases and redemptions of the Creation Units, the Evaluation Time (as defined on page S-13) is the closing time of the regular trading session on the New

York Stock Exchange LLC (ordinarily 4:00 p.m. New York time). For additional details on trading and settlement, please consult pages 7 and 50 to 59 in the U.S. Prospectus attached hereto.

The primary trading market for Units is in the U.S., where Units are listed on NYSE Arca, Inc. (“NYSE Arca”). Investors should note

that trading in Units may be halted under certain circumstances. Please refer to pages 66 to 67 and pages 72 to 74 in the U.S. Prospectus for more details.

As with other securities, investors will pay negotiated brokerage commissions and typical Singapore clearing fees and applicable taxes. In

addition, cash dividends to be distributed to investors in Singapore will be net of expenses incurred by CDP (defined below), and where such expenses equal or exceed the amount of the dividends, the investors will not receive any distributions.

Brokerage commissions may be subject to Goods and Services Tax (“GST”) at the prevailing standard rate of seven percent (7%). There will be a Singapore clearing fee, which is currently at the rate of 0.0325% of the contract value (or such

other amount as the CDP may decide from time to time). Clearing fees may be subject to GST in Singapore at the prevailing standard rate of seven percent (7%). Units are traded in U.S. dollars on the SGX-ST in

10 unit round lots. The term “market day” as used in this Prospectus means a business day in which transactions in Units can be executed and settled. Trading of Units on the SGX-ST may be halted

if the Trust fails to comply with continuing listing requirements and advertising guidelines of the SGX-ST.

With respect to holders of Units in Singapore, the trading and settlement process, the system through which they receive distributions or the

manner in which information may be made available, among other aspects, may differ from the information set forth in the U.S. Prospectus. Holders of Units in Singapore should

S-7

read this Prospectus carefully and all enquiries in relation hereto should be directed to their local brokers.

The SGX-ST imposes certain requirements for the continued listing of securities, including the Units,

on the SGX-ST. There can be no assurance that the requirements of the SGX-ST necessary to maintain the listing of the Units of the Trust will continue to be met, the SGX-ST will not change its listing requirements or that the Units will always be listed on the SGX-ST. The Trust will not be terminated if Units are delisted from the SGX-ST. If the Units are delisted from the SGX-ST, investors may deliver the Units they hold out of CDP for trading on NYSE Arca through the delivery mechanisms described in

section “3. Delivery of Units out of CDP for Trading on NYSE Arca” on pages S-9 to S-10 of this Prospectus.

1. General

Units are issued by the Trust in the form of scripless securities which are eligible “book-entry-only” securities of The Depository

Trust Company (“DTC”). As “book-entry-only” securities, Units are represented by one or more global securities registered in the name of Cede & Co., as nominee for DTC and deposited with, or on behalf of, DTC.

The Central Depository (Pte) Limited (“CDP”) maintains an account—Account No. 5700 (“DTC Account”)—with DTC.

CDP may receive Units from or deliver Units to accounts maintained by member participants in DTC (“DTC Participants”).

Settlement of dealings through the CDP system may be effected only by Depository Agents of CDP or holders of Units who have their own direct

securities accounts with CDP. Investors may open a direct securities account with CDP or a securities sub-account with any Depository Agent to hold their Units in CDP. The term “Depository Agent”

shall have the same meaning as that ascribed to it in Section 81SF of the Securities and Futures Act, Chapter 289 of Singapore.

Through the delivery mechanisms discussed below, it is possible for investors to purchase Units in Singapore and sell them in the U.S. and vice

versa. Although both CDP and DTC, within their own respective market settlements, provide for Delivery Versus Payment and Free-of-Payment transfers of securities, all of

the linked transfers between the two depositories are effected only on a Free-of-Payment basis (i.e., there is no related cash movement to parallel the securities

movement. Any related cash transfers may only be effected outside DTC and CDP directly between the buyer and seller through their own arrangements). Investors should be aware that Singapore time is generally 12 hours ahead of Eastern Daylight

Saving Time (13 hours Eastern Standard time) in New York, and that NYSE Arca and the SGX-ST are not open at the same time. Because of this time difference between the Singapore and U.S. markets, trading

in Units between the two markets cannot occur simultaneously. Please refer to pages 50 to 59 and 66 to 67 of the U.S. Prospectus for details on circumstances under which there may be suspension of dealings or trading.

S-8

All dealings in, and transactions of, Units in Singapore must be effected for settlement through

the computerised book-entry (scripless) settlement system in the CDP. Investors should ensure that Units sold on the SGX-ST are available for settlement in their CDP account no later than the second market day

following the transaction date.

Investors’ holdings of Units in their CDP account will be credited or debited for settlement on the

second market day following the transaction date, i.e., T+2, T being the transaction date. If Units are not in an investor’s CDP account for settlement by 1:30 p.m. on T+2, the investor will be subject to the

buy-in cycle on that afternoon. More information on the buy-in cycle is available on the SGX-ST website at

http://www.sgx.com.

In the absence of unforeseen circumstances, the delivery of Units into and out of CDP will take a minimum of

one market day after the duly completed documentation has been submitted to CDP for processing, assuming that the investor has given proper instructions to his or her DTC Participant. Instructions and forms received by CDP after

1 p.m. Singapore time on a given market day will be treated as being received on the next market day and, as such, will be processed on the next market day. Please refer to pages 1 and 68 to 71 of the U.S. Prospectus for details on the

fees and expenses of the Trust.

The Trust has adopted a code of ethics which is described on page 91 of the U.S. Prospectus.

2. Delivery of Units to CDP for Trading on the

SGX-ST

Investors who hold Units in DTC’s system in the U.S. and wish to trade

them on the SGX-ST can direct delivery of the Units to CDP; this book-entry transfer to CDP’s DTC Account may be effected only on a

Free-of-Payment basis. Investors may deliver their Units by informing their Singapore broker or Depository Agent to submit delivery instructions to CDP, together with

the applicable CDP delivery fee and GST, no later than 1 p.m. Singapore time on the specified delivery date. Investors must concurrently instruct their DTC Participant to deliver such Units into the DTC Account on the delivery date. Upon

notification that its DTC Account has been credited, CDP will accordingly credit Units to the investor’s account.

Investors should

ensure that their Units are delivered into their securities account with CDP in time for settlement. In the event an investor cannot deliver the Units for settlement pursuant to the trade, the CDP may buy-in

against him or her.

3. Delivery of Units out of CDP for Trading on NYSE Arca

Investors who hold Units with CDP and wish to trade on NYSE Arca must arrange to deliver the Units into their accounts with their DTC

Participant for settlement of any such trade, which will occur on the second market day following the transaction date. For such delivery, investors must submit a duly completed CDP

S-9

delivery form together with the applicable CDP delivery fee and GST through their Singapore broker or Depository Agent, no later than 1 p.m. Singapore time on the second market day

following the specified delivery date in the U.S. Investors must concurrently instruct their DTC Participant to expect receipt of the relevant number of Units from the DTC Account. Upon receipt of the duly completed CDP delivery form, CDP will

earmark the investor’s securities account for the relevant number of Units and then instruct DTC to deliver the Units to the DTC Participant account as specified by the investor. The relevant number of Units will be debited from the

investor’s securities account after CDP receives DTC’s confirmation that the Units have been transferred out of its DTC account.

S-10

EXCHANGE RATES AND RISKS

Units traded on the SGX-ST are denominated and traded in U.S. dollars. Units may only be created or

redeemed in U.S. dollars at the then-current value calculated in U.S. dollars in the manner set out in the U.S. Prospectus. Similarly, the Trust holds only Portfolio Securities that are denominated in U.S. dollars and the distributions which may be

made by the Trustee are in U.S. dollars.

The Trust has no ability to manage its investments to hedge against fluctuations in exchange

rates between the U.S. dollar and the Singapore dollar. To the extent a Singapore investor wishes to convert such U.S. dollar holdings or distributions to Singapore dollars, fluctuations in the exchange rate between the Singapore dollar and the U.S.

dollar may affect the value of the proceeds following a currency conversion.

S-11

GENERAL AND STATUTORY INFORMATION

1. Appointment of Auditors

The Trust Agreement provides that the accounts of the Trust shall be audited, as required by U.S. law, by independent registered public

accountants designated from time to time by the Trustee.

2. Duties and Obligations of the

Trustee

The key duties and obligations imposed on the Trustee under the Trust Agreement are summarized as follows:

(i) the Trustee will accept on behalf of the Trust deposits of Portfolio Deposits and be authorized to effect

registration or transfer of the Portfolio Securities in its name or the name of its nominee or the nominee of its agent;

(ii) the Trustee must hold money received pursuant to the Trust Agreement as a deposit for the account of the Trust;

(iii) the Trustee shall not be liable for the disposition of money or securities or evaluation performed under the

Trust Agreement except by reason of its own gross negligence, bad faith, wilful misconduct, wilful malfeasance or reckless disregard of its duties and obligations under the Trust Agreement;

(iv) the Trustee is not obligated to appear in, prosecute or defend any action if it is of the opinion that it may involve

expense or liability unless it is furnished with reasonable security and indemnity against such expense or liability; if reasonable indemnity is provided, the Trustee shall, in its discretion, undertake such action as it may deem necessary to

protect the Trust and the rights and interest of all beneficial owners;

(v) the Trustee must provide to

brokers/underwriters accounts of the Trust audited by the auditors of the Trust, and the brokers/underwriters will deliver such accounts to beneficial owners;

(vi) in performing its functions under the Trust Agreement the Trustee will not be held liable except by reason of

its own gross negligence, bad faith, wilful misconduct or wilful malfeasance for any action taken or suffered to be taken by it in good faith and believed by it to be authorized or within the discretion, rights or powers conferred on it or reckless

disregard of its duties and obligations;

(vii) the Trustee must ensure that no payment made to the Sponsor is for

expenses of the Trust, except for payments not in excess of amounts and for purposes prescribed by the U.S. Securities and Exchange Commission and authorized by the Trust Agreement;

(viii) the Trustee must keep proper books of record and account of all transactions under the Trust Agreement,

including the creation and redemption of Creation Units, at its offices, and keep such books open for inspection by any beneficial owner at all reasonable times during usual business hours;

S-12

(ix) the Trustee must make, or cause to be made, such reports and file such

documents as are required by the Securities Act of 1933, the Securities Exchange Act of 1934, the Investment Company Act of 1940 and U.S. state or federal tax laws and regulations;

(x) the Trustee must keep a certified copy of the Trust Agreement, together with the Indenture for each

Trust Series then in effect and a current list of Portfolio Securities therein, on file at its office and make the same available for inspection; and

(xi) the Trustee must charge and direct from the assets of the Trust all expenses and disbursements incurred under the

Trust Agreement, or shall reimburse itself from the assets of the Trust or the sale of securities in the Trust for any advances made out of its own funds for such expenses and disbursements.

3. Contracts

A holder of a Unit is not required, obliged or entitled in connection with the Trust to enter into any contract with any person or corporation

whether by way of lease or otherwise.

4. Vesting of Assets in the Trust

The Trustee has legal title to all securities and other property in which funds of the Trust are invested, all funds held for such investment,

all equalisation, redemption, and other special funds of the Trust, and all income upon accretions to, and proceeds of such property and funds, and the Trustee is required to segregate and hold the same in trust until distribution thereof to the

holders of the Units.

5. Redemption

The Trust is not administered by a management company, and there is no obligation on the Sponsor or the Trustee to redeem any Units. As

described on pages 55 to 59 in the U.S. Prospectus, it is the Trust itself that is obligated to effect the redemption (although it is the Trustee acting as agent for the Trust that will actually effect the redemption).

Only Units in Creation Units may be redeemed at their then-current valuation, which is calculated on the Business Day on which the redemption

order is properly received, as of the Evaluation Time, which is the closing time of the regular trading session on the New York Stock Exchange LLC (ordinarily 4:00 p.m. New York time). For redemptions through the Clearing Process, the Trustee

effects a transfer of the Cash Redemption Payment and stocks to the redeeming beneficial owner by the second (2nd) NSCC Business Day following the date on which request for redemption is deemed received. For redemptions outside the Clearing

Process, the Trustee transfers the Cash Redemption Payment and the stocks to the redeeming beneficial owner by the second (2nd) Business Day following the date on which the request for

S-13

redemption is deemed received. The Trustee will cancel all Units delivered upon redemption. Please refer to pages 3, 55 to 59 and 72 to 74 of the U.S. Prospectus for a further description of

this process.

Investors owning Units in an amount less than a whole Creation Unit (i.e., less than 50,000 Units) or multiples thereof,

are not permitted to tender their Units to the Trustee for redemption. Such investors can only dispose of their Units by selling them on the secondary market at any time during the trading day at market prices.

6. Transfer of Units

As described on page S-8 of this Prospectus, Cede & Co., as nominee for DTC, will be the

registered owner of all outstanding Units on the DTC system. Beneficial ownership of Units will be shown on the records of DTC or its participants. Beneficial ownership records for holders of Units in Singapore will be maintained at CDP.

No certificates will be issued in respect of Units. Transfers of Units between investors will normally occur through the trading mechanism of

the SGX-ST or NYSE Arca as described on pages S-7 to S-10 in this Prospectus and pages 66 to 67 in the U.S. Prospectus.

7. Meetings of Holders of Units; Voting; Distribution of Annual Reports

The Trust is not required by law to convene meetings of beneficial owners of the Units.

The Sponsor, the Retired Trustee and CDP have entered into a Depository Agreement dated May 18, 2001, as supplemented by a supplemental

depository agreement dated May 22, 2009 (the “CDP Depository Agreement”), pursuant to which CDP has agreed to act as the depository for Units in Singapore. The Sponsor, the Retired Trustee, CDP and the Trustee have entered into a deed

of novation dated December 29, 2018 in relation to the CDP Depository Agreement (the “Deed of Novation”) pursuant to which, inter alia, CDP has agreed to release and discharge the Retired Trustee subject to the

Trustee undertaking to observe, perform and be bound by the terms of the CDP Depository Agreement in every respect as if the Trustee were named in the CDP Depository Agreement as a party thereto in place of the Retired Trustee, subject to the terms

and conditions of the Deed of Novation. CDP’s duties under the CDP Depository Agreement include, among other things: (i) acting as a bare trustee on behalf of individuals who hold securities accounts with CDP and Depository Agents

authorized to maintain sub-accounts with CDP in respect of Units, (ii) distributing to CDP account holders and Depository Agents any applicable payments or cash distributions in respect of Units, and

(iii) providing the list of its Depository Agents and holders of Units who have their own direct securities accounts with CDP, if so requested by the Sponsor or the Trustee.

The Trustee arranges for the annual report of the Trust to be mailed to all holders of Units, including the holders of Units in Singapore, no

later than the 60th day after

S-14

the end of the Trust’s fiscal year. The most recent semi-annual report of the Trust may be found on the website http://www.spdrs.com.sg/etf/fund/ref_doc/Semi_Annual_Report_SPY.pdf.

The Sponsor or the Trustee will ensure that in the event that it is necessary to collect and collate any consents or votes of, or

distribute notices, statements, reports, prospectuses, consent instructions, consent forms or other written communications to the holders of Units in Singapore, the relevant materials will be mailed to the holders of Units in Singapore.

8. Declaration

It is hereby declared that no Units shall be created or issued pursuant to this Prospectus later than 12 months, or such other period as

may be prescribed by the law for the time being in force, after the date of this Prospectus.

9. Allotment of Units

A Distribution Agreement was entered into as of April 16, 2018, between (1) the Sponsor, (2) the Trust and (3) ALPS

Distributors, Inc. (“ALPS”), the U.S. Distributor, pursuant to which the Trust and the Sponsor retained ALPS to:

(i) act as the exclusive distributor for the creation and distribution of Creation Units;

(ii) hold itself available to receive and process orders for Creation Units; and

(iii) enter into arrangements with dealers.

It is the duty of the Trust and the Sponsor to create the Creation Units and to request DTC to record on its books the ownership of such Units

in such amounts as ALPS has requested, as promptly as practicable after receipt by the Trustee of the requisite portfolio of securities and any applicable cash component from the creator of the Creation Units or other entities having a Participant

Agreement with the Trustee. Participant Agreements must be entered into between the Trustee and all other persons who are creating Creation Units.

10. Borrowing Powers

There are no borrowing powers conveyed in the Trust Agreement.

11. Sponsor, Trustee and Designated Market Maker

Sponsor

PDR Services LLC

(“PDR”) was originally organized as a corporation under Delaware U.S. law, and was subsequently converted into a limited liability company

S-15

in Delaware on April 6, 1998. On October 1, 2008, NYSE Holdings LLC (formerly known as NYSE Euronext Holdings LLC) (“NYSE Holdings”) acquired the American Stock Exchange LLC

(“Amex”) and all of its subsidiaries, including PDR, which is the Sponsor of the Trust. PDR was formed to act as sponsor for Amex’s exchange traded funds and other unit investment trusts. PDR will remain the Sponsor of the Trust until

it is removed, it is replaced by a successor, it resigns or the Trust Agreement is terminated. Currently, the Sponsor is not permitted to receive remuneration for the services it renders as Sponsor.

PDR is an indirect, wholly-owned subsidiary of Intercontinental Exchange, Inc. (“ICE”). ICE is a publicly-traded entity, trading on

the New York Stock Exchange under the symbol “ICE.”

Trustee

Effective June 16, 2017, the Retired Trustee resigned as trustee of the Trust. The Sponsor appointed the Trustee, a wholly-owned

subsidiary of the Retired Trustee, as trustee of the Trust. The services received, and the trustee fees paid, by the Trust did not change as a result of the change in the identity of the Trustee. The Retired Trustee continues to maintain the

Trust’s accounting records, act as custodian and transfer agent to the Trust, and provided administrative services, including the filing of certain regulatory reports.

The Trustee is a limited purpose trust company organized under the laws of the Commonwealth of Massachusetts, U.S. The Trustee is a direct

wholly-owned subsidiary of the Retired Trustee and as such is regulated by the Federal Reserve System and is subject to applicable U.S. federal and state banking and trust laws and to supervision by the U.S. Federal Reserve, as well as by the

Massachusetts Commissioner of Banks and the regulatory authorities of those states and countries in which a branch of the Trustee is located.

In accordance with the Trust Agreement, the Trustee, inter alia, acts as custodian to the Trust. In this regard, the assets of the Trust

shall be held by, or to the order of the Trustee on behalf of and for the exclusive interest of the holders of the Units. The Trust Agreement does not allow the Trustee to delegate the safekeeping of the assets of the Trust to another custodian. The

Trustee must ensure, inter alia, that adjustments to the Trust’s Portfolio are carried out in accordance with the law and the Trust Agreement.

The Trustee will remain the Trustee of the Trust until it is removed, it resigns or the Trust Agreement is terminated. The remuneration

received by the Trustee in its capacity as Trustee of the Trust is described in the U.S. Prospectus and reflected in the financial statements contained therein. Absent gross negligence, bad faith, wilful misconduct or wilful malfeasance on its part

or reckless disregard of its duties and obligations under the Trust Agreement, the Trustee shall be indemnified from the Trust and held harmless against any loss, liability or expense incurred arising out of or

S-16

in connection with the acceptance or administration of the Trust and any action taken in accordance with the provisions of the Trust Agreement.

Designated Market Maker

The designated market maker of the Trust on the SGX-ST is Societe Generale or such other eligible party

as may be designated from time to time. The designated market maker is required to make a market for the Units in the secondary market on the SGX-ST to provide for an adequately liquid market for the Units, by

amongst others, quoting bid prices to potential sellers and offer prices to potential buyers on the SGX-ST in accordance with the market making requirements of the

SGX-ST.

The designated market maker(s) of the Trust may change from time to time. The latest list

of designated market maker(s) of the Trust is available at http://www.sgx.com.

For the avoidance of doubt, neither the Sponsor nor

the Trustee shall be liable for anything done or omitted or any loss suffered or incurred whatsoever by any person in the event that the designated market maker is not fulfilling its duties to provide for an adequately liquid market for the Units in

accordance with the market making requirements of the SGX-ST.

12. Exercise of Voting Rights on Underlying Securities

The Trustee (rather than the beneficial owners of Units) has the exclusive right to vote all of the voting stocks in the Trust, as Trustee. The

Trustee votes the voting stocks of each issuer in the same proportionate relationship that all other shares of each such issuer are voted (known as “mirror voting”) to the extent permissible and, if not permitted, abstains from voting. The

Trustee shall not be liable to any person for any action or failure to take any action with respect to such voting matters. There are no restrictions on the Trustee’s right to vote securities or Units when such securities or Units are owned by

the Trustee in its individual capacity.

13. Adjustments to Securities Held by the

Trust

The Trust’s Portfolio Securities are not managed and the Trustee adjusts such securities from time to time to

maintain the correspondence between the composition and weightings of the Portfolio Securities and the Index Securities.

14. Use of Financial Derivatives

The Trustee may not use or invest in financial derivatives on behalf of the Trust.

15. Securities Lending and Repurchase Transactions

The Trustee may not engage in any securities lending transactions or repurchase transactions on behalf of the Trust.

S-17

16. Distributions to Beneficial Owners

The Trustee receives all dividends and other cash distributed with respect to the underlying securities in the Trust (including monies

realized by the Trustee from the sale of securities options, warrants or other similar rights received on such securities), and distributes them (less fees, expenses and any applicable taxes) through DTC and the DTC Participants to the beneficial

owners of the Units. A description of the distribution process is contained on pages 10 to 11 and pages 74 to 76 of the U.S. Prospectus. These distribution arrangements will be the same for holders of Units in Singapore, who will receive their

entitlements through CDP. Cash dividends distributed to investors in Singapore will be net of expenses incurred by CDP. Where such expenses equal or exceed the amount of the dividend, investors will not receive any dividend.

17. Consents

PricewaterhouseCoopers LLP, as the auditor of the Trust, has given and has not withdrawn its written consent to the issue of this Prospectus

with the inclusion herein of, and reference to, as the case may be, (i) its name and (ii) its report, in the form and context in which it is referred to in this Prospectus. The report referred to in this Prospectus was not prepared by

PricewaterhouseCoopers LLP for the purpose of inclusion in this Prospectus.

Davis Polk & Wardwell LLP (as legal advisers to the

Sponsor as to U.S. law) has given and has not withdrawn its written consent to the inclusion in this Prospectus or references to its name in the form and context which it appears in this Prospectus.

18. Important Tax Information

|

A.

|

CERTAIN UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS

|

The following is a description of certain U.S. federal income tax consequences of the beneficial ownership of Units by a person that is, for

U.S. federal income tax purposes, a nonresident alien individual, a foreign corporation, a foreign trust or a foreign estate (a “Non-U.S. Holder”). The discussion below does not apply to a Non-U.S. Holder who is a nonresident alien individual and is present in the United States for 183 days or more during any taxable year. Such Non-U.S. Holders should consult

their tax advisors with respect to the particular tax consequences to them of an investment in the Trust. The discussion below provides general tax information relating to a Non-U.S. Holder’s investment

in Units, but it does not purport to be a comprehensive description of all the U.S. federal income tax considerations that may be relevant to a particular Non-U.S. Holder’s decision to invest in Units.

This discussion does not describe all of the tax consequences that may be relevant in light of a Non-U.S. Holder’s particular circumstances or tax consequences applicable to

Non-U.S. Holders subject to special rules, such as a nonresident alien individual who is a former citizen or resident of the United States; an expatriated entity; a controlled

S-18

foreign corporation; a passive foreign investment company; a foreign government for purposes of Section 892 of the Code or a tax-exempt organization

for U.S. federal income tax purposes.

If an entity that is classified as a partnership for U.S. federal income tax purposes holds Units,

the U.S. federal income tax treatment of a partner will generally depend on the status of the partner and the activities of the partnership. Partnerships holding Units and partners in such partnerships should consult their tax advisors as to the

particular U.S. federal income tax consequences of holding and disposing of the Units in light of their specific circumstances.

This

discussion is based on the Internal Revenue Code of 1986, as amended (the “Code”), administrative pronouncements, judicial decisions, and final, temporary and proposed Treasury regulations all as of the date hereof, any of which is subject

to change, possibly with retroactive effect.

Prospective purchasers of Units are urged to consult their tax advisors with regard to the

application of the U.S. federal income and estate tax laws to their particular situations, as well as any tax consequences arising under the laws of any state, local or non-U.S. taxing jurisdiction.

The U.S. federal income taxation of a Non-U.S. Holder depends on whether the income that the Non-U.S. Holder derives from the Trust is “effectively connected” with a trade or business that the Non-U.S. Holder conducts in the United States (and, if required

by an applicable tax treaty, is attributable to a U.S. permanent establishment maintained by the Non-U.S. Holder). If the income that a Non-U.S. Holder derives from the

Trust is not “effectively connected” with a U.S. trade or business conducted by such Non-U.S. Holder (or, if an applicable tax treaty so provides, the Non-U.S.

Holder does not maintain a permanent establishment in the United States), distributions of “investment company taxable income” (as described in the U.S. Prospectus) to such Non-U.S. Holder will

generally be subject to U.S. federal withholding tax at a rate of 30% (or lower rate under an applicable tax treaty). There is currently no income tax treaty between the U.S. and Singapore. Provided that certain requirements are satisfied, this

withholding tax will not be imposed on dividends paid by the Trust to the extent that the underlying income out of which the dividends are paid consists of U.S.-source interest income or short-term capital gains that would not have been subject to

U.S. withholding tax if received directly by the Non-U.S. Holder (“interest-related dividends” and “short-term capital gain dividends”, respectively).

A Non-U.S. Holder whose income from the Trust is not “effectively connected” with a U.S.

trade or business (or, if an applicable tax treaty so provides, does not maintain a permanent establishment in the United States) will generally be exempt from U.S. federal income tax on capital gain dividends and any amounts retained by the Trust

that are designated as undistributed capital gains, as described in the U.S. Prospectus. In addition, such a Non-U.S. Holder will generally be exempt from U.S. federal income tax on any gains realized upon the

sale or exchange of Units.

S-19

If the income from the Trust is “effectively connected” with a U.S. trade or business

carried on by a Non-U.S. Holder (and, if required by an applicable tax treaty, is attributable to a U.S. permanent establishment maintained by the Non-U.S. Holder), any

distributions of “investment company taxable income,” any capital gain dividends, any amounts retained by the Trust that are designated as undistributed capital gains and any gains realized upon the sale or exchange of Units will be

subject to U.S. federal income tax, on a net income basis, at the rates applicable to holders of Units who are U.S. persons for U.S. federal income tax purposes. For more information, see “Federal Income Taxes—Tax Consequences to

U.S. Holders” in the U.S. Prospectus. A Non-U.S. Holder that is a corporation may also be subject to the U.S. branch profits tax.

Information returns will be filed with the U.S. Internal Revenue Service (the “IRS”) in connection with certain payments on the Units

and may be filed in connection with payments of the proceeds from a sale or other disposition of Units. A Non-U.S. Holder may be subject to backup withholding on distributions or on the proceeds from a

redemption or other disposition of Units if such Non-U.S. Holder does not certify its non-U.S. status under penalties of perjury or otherwise establish an exemption.

Backup withholding is not an additional tax. Any amounts withheld pursuant to the backup withholding rules will be allowed as a credit against the Non-U.S. Holder’s U.S. federal income tax liability, if

any, and may entitle the Non-U.S. Holder to a refund, provided that the required information is furnished to the IRS on a timely basis.

In order to qualify for the exemption from U.S. withholding on interest-related dividends, to qualify for an exemption from U.S. backup

withholding and to qualify for a reduced rate of U.S. withholding tax on Trust distributions pursuant to an income tax treaty, a Non-U.S. Holder must generally deliver to the withholding agent a properly

executed IRS form (generally, Form W-8BEN or Form W-8BEN-E, as applicable). In order to claim a refund of any Trust-level

taxes imposed on undistributed net capital gain, any withholding taxes or any backup withholding, a Non-U.S. Holder must obtain a U.S. taxpayer identification number and file a U.S. federal income tax return,

even if the Non-U.S. Holder would not otherwise be required to obtain a U.S. taxpayer identification number or file a U.S. income tax return.

Under Sections 1471 through 1474 of the Code (“FATCA”), a withholding tax at the rate of 30% will generally be imposed on payments of

dividends on Units to certain foreign entities (including financial intermediaries) unless the foreign entity provides the withholding agent with certifications and other information (which may include information relating to ownership by U.S.

persons of interests in, or accounts with, the foreign entity). Treasury and the IRS have issued proposed regulations that (i) provide that “withholdable payments” will not include gross proceeds from the disposition of property that

can produce U.S. source dividends or interest, as otherwise would have been the case after December 31, 2018 and (ii) state that taxpayers may rely on these provisions of the proposed regulations until final

S-20

regulations are issued. If FATCA withholding is imposed, a beneficial owner of Units that is not a foreign financial institution generally may obtain a refund of any amounts withheld by filing a

U.S. federal income tax return (which may entail significant administrative burden). Non-U.S. Holders should consult their tax advisors regarding the possible implications of FATCA on their investment in

Units.

|

B.

|

CERTAIN SINGAPORE TAX CONSIDERATIONS

|

The following is a general description of material Singapore income tax, stamp duty and estate duty consequences of the ownership and disposal

of Units. The summary discussion below is not intended to be, and does not purport to be, a comprehensive analysis of all the tax consequences relating to ownership and disposal of Units by a person who, for purposes of taxation in Singapore, is

regarded as a Singapore resident taxpayer or otherwise. Prospective investors of Units should consult their own tax advisors concerning the tax consequences of their particular situations. This description, which is not intended to and does not

constitute legal or tax advice, is based on laws, regulations and interpretations now in effect and available as of the date of this Prospectus. The laws, regulations and interpretations, however, may change at any time, and any change could be

retroactive to the date of ownership of the Units. These laws and regulations are also subject to various interpretations and the relevant tax authorities or the courts could later disagree with the explanations or conclusions set out below.

General

Subject to

certain exceptions, Singapore tax resident and non-resident companies are subject to Singapore income tax on income accruing in or derived from Singapore and on foreign income received or deemed received in

Singapore.

Foreign-sourced income in the form of branch profits, dividends and service income received or deemed received in Singapore by

a resident corporate taxpayer is, however, tax-exempt (subject to certain conditions) if:

|

|

(a)

|

the foreign income had been subject to tax in the foreign jurisdiction from which they were received. The rate

at which the foreign income was taxed can be different from the headline tax rate;

|

|

|

(b)

|

the highest corporate tax rate of the foreign jurisdiction from which the income is received is at least 15% at

the time the foreign income is received in Singapore; and

|

|

|

(c)

|

the Comptroller of Income Tax is satisfied that the tax exemption would be beneficial to the person resident in

Singapore.

|

Resident and non-resident individuals are generally taxed on income

arising in or derived from Singapore.

All foreign-sourced personal income received or deemed received in Singapore on or after

January 1, 2004 by a Singapore tax resident individual (except where such

S-21

income is received through a partnership in Singapore or where the overseas employment is incidental to a Singapore employment) will be exempt from tax in Singapore. Certain investment income

derived from Singapore sources by individuals on or after January 1, 2004 will also be exempt from tax.

A company is regarded as a

tax resident in Singapore if the control and management of its business is exercised in Singapore; “control and management” is the making of decisions on strategic matters, such as those on company policy and strategy. Typically, the

location of the company’s board of directors meetings, during which strategic decisions are made, is a key factor in determining where the control and management is exercised. An individual is regarded as a tax resident in Singapore for income

tax purposes if, in the calendar year preceding the year of assessment, he is physically present in Singapore or exercised an employment in Singapore (other than as a director of a company) for 183 days or more, or if he is a Singaporean or

Singapore permanent resident if he has established his permanent home in Singapore.

Tax rates

The corporate tax rate is 17% from the Year of Assessment 2010 (i.e., calendar year ended in 2009). With effect from the Year of Assessment

2020, the first SGD10,000 of normal chargeable income will be eligible for a 75% tax exemption, with a further 50% tax exemption given on the next SGD190,000 of normal chargeable income. In respect of new

start-up companies (where any of the first three Years of Assessment falls in or after the Year of Assessment 2020), the first SGD100,000 of normal chargeable income will be eligible for a 75% tax exemption,

with a further 50% tax exemption given on the next SGD100,000 of normal chargeable income.

Singapore tax resident individuals are subject

to tax based on a progressive scale. Since the Year of Assessment 2017 (i.e., calendar year ended in 2016), the top marginal rate is 22%.

The employment income of non-resident individuals is taxed at the flat rate of 15% or the progressive

resident tax rates, whichever is the higher tax amount. From the Year of Assessment 2017, the tax rates for non-resident individuals (except certain reduced final withholding tax rates) has been raised from

20% to 22%. This is to maintain parity between the tax rates of non-resident individuals and the top marginal tax rate of resident individuals.

All tax residents in Singapore will be affected by tax rebates and exemptions granted by the Singapore government from time to time in line

with its current financial and fiscal policies.

Dividends Tax

Dividends accrue in the year that they are declared payable.

S-22

Generally, the following dividends are not taxable:

|

|

(a)

|

dividends paid on or after 1 January 2008 by a Singapore resident company under the one-tier corporate tax system except co-operatives;

|

|

|

(b)

|

foreign dividends received in Singapore on or after 1 January 2004 by resident individuals. If an

individual resident in Singapore receives foreign-sourced dividends through a partnership in Singapore, these dividends may be exempt from Singapore tax if certain conditions are met; and

|

|

|

(c)

|

income distribution from real estate investment trusts (“REITs”), except distributions derived by

individuals through a partnership in Singapore, or from the carrying on of a trade, business or profession in REITs.

|

Capital Gains Tax

Generally, profits or losses derived from the buying and selling of shares or other financial instruments are viewed as personal investments.

These profits are capital gains and are not taxable.

Adoption of FRS 109 treatment for Singapore income tax purposes

In addition, with effect from 1 January 2018, the Financial Reporting Standards 109 (“FRS 109”) has replaced the previous

Financial Reporting Standards 39 (“FRS 39”). For holders of the Units, this means that they may be required, for income tax purposes, to recognise gains or losses, irrespective of disposal, in accordance with FRS 109 and, unlike the

previous approach for FRS 39, there is no option for companies to opt out of the FRS 109 tax treatment.

Holders of the Units who may be

subject to the tax treatment under the FRS 109 should consult their own accounting and tax advisors regarding the Singapore income tax consequences.

Stamp Duty

Stamp duty

will not be imposed on instruments of transfers relating to the Units. In the event of a change of trustee for the SPDR 500 Trust, there will be no stamp duty on any document effecting the appointment of a new trustee and the transfer of trust

assets from the incumbent trustee to the new trustee.

Estate Duty

The Singapore government announced on February 15, 2008 that estate duty would be abolished for deaths occurring on and after

February 15, 2008.

19. Queries and Complaints

Investors may contact ALPS at the following toll free number to seek any clarification regarding the Trust: +1-866-732-8673.

S-23

20. Additional Information on the Index

The index provider is S&P Dow Jones Indices LLC (“S&P”), who is independent from the Trustee. The computation of the Index may be inaccurate or incomplete if, amongst other factors, the information received by S&P is inaccurate or incomplete. No warranty, representation or guarantee is

given as to the accuracy or completeness of the Index and its computation or any information related thereto. The process and the basis of computing and compiling the Index and any of its related formulae, constituent companies and factors may at

any time be changed or altered by S&P without notice.

The Index Securities which comprise the Index are changed by S&P from time

to time. The price of Units may rise or fall as a result of such changes. The composition of the Index may also change if one of the constituent companies were to delist its securities or if a new eligible company were to list its securities and be

added to the Index. If this happens, the weighting or composition of the Index Securities invested by the Trust would be changed as considered appropriate by the Trustee in order to achieve the investment objective. Thus, an investment in Units will

generally reflect the Index as its constituents change from time to time, and not necessarily the way it is comprised at the time of an investment in Units.

The Index Securities held by the Trust will passively reflect the distribution of companies whose securities are included in the Index.

Therefore, adverse changes in the financial condition or share performance of any company included in the Index will not result in the sale of the shares of such company by the Trust, and will be likely to adversely affect the Trust’s net asset

value and the trading price of Units. The Trustee will have limited discretion to remove the securities of such company from the Fund.

A

license agreement (the “License Agreement”) between SSGA FD, an affiliate of the Trustee, and S&P grants a license to SSGA FD to use the Index and to use certain trade names and trademarks of S&P in connection with the Trust. The

Index also serves as a basis for determining the composition of the Portfolio. Currently, the License Agreement is scheduled to terminate on November 29, 2031, but its term may be extended without the consent of any of the beneficial owners of

Units. In the event that the Index is no longer available for use by the Fund, the Trustee will source for a suitable replacement index that gives, in the opinion of the Trustee, the same or substantially similar equity exposure as the Index. There

are no material conditions in the License Agreement in relation to the use of the Index which may prevent the Fund from achieving its investment objective.

Further information on the Index is available online at http://www.spindices.com.

21. Tracking Error Risk

Factors such as the fees and expenses of the Trust, imperfect correlation between the Portfolio Securities and the Index Securities

constituting the Index, rounding of

S-24

share prices, changes to the Index and regulatory policies may affect the Trustee’s ability to achieve close correlation with the performance of the Index. The Trust’s returns may

therefore deviate from the Index and there is no assurance that the Trust will be able to fully track the performance of the Index. The Portfolio Securities may be adjusted from time to time to reflect any changes to the composition of, or the

weighting of securities in, the Index, with a view towards minimizing tracking error of the Trust’s overall returns relative to the performance of the Index.

22. Concentration

If the Index comprises Index Securities that are concentrated in a particular group of stocks, industry or group of industries, the Trust may

be adversely affected by the performance of those stocks and be subject to price volatility. In addition, if the Trust is concentrated in a single stock, group of stocks, industry or group of industries, it may be more susceptible to any single

economic, market, political or regulatory occurrence.

23. Notification

The Units of the SPDR 500 Trust are Specified Investment Products (as defined in MAS Notice SFA 04-N12:

Notice on the Sale of Investment Products and MAS Notice FAA-N16: Notice on Recommendations on Investment Products) and capital markets products other than prescribed capital markets products (as defined in

the Securities and Futures (Capital Markets Products) Regulations 2018).

S-25

SPDR® S&P 500® ETF Trust

(“SPY” or the

“Trust”)

(A Unit Investment Trust)

Principal U.S. Listing Exchange for SPDR® S&P 500® ETF Trust: NYSE Arca, Inc.

under the symbol “SPY”

Prospectus Dated January 14, 2021

The U.S. Securities and Exchange Commission has

not approved or disapproved these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense. Securities of the Trust (“Units”) are not guaranteed or insured by the

Federal Deposit Insurance Corporation or any other agency of the U.S. Government, nor are such Units deposits or obligations of any bank. Such Units of the Trust involve investment risks, including the loss of principal.

COPYRIGHT 2021 PDR Services LLC

“Standard & Poor’s®”, “S&P®”, “S&P

500®”, “Standard & Poor’s 500®”, “500®”,

“Standard & Poor’s Depositary Receipts®”, “SPDR®” and “SPDRs®” are registered trademarks of Standard & Poor’s Financial Services LLC and have been licensed for use by S&P Dow Jones Indices LLC

(“S&P”) and sublicensed for use by State Street Global Advisors Funds Distributors, LLC. The Trust is permitted to use these trademarks pursuant to a sublicense from State Street Global Advisors Funds Distributors, LLC. The Trust is

not sponsored, endorsed, sold or marketed by S&P, its affiliates or its third party licensors.

i

SUMMARY

Investment Objective

The Trust seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the S&P 500® Index (the “Index”).

Fees and Expenses of the Trust

This table estimates the fees and expenses that the Trust pays on an annual basis, which you therefore pay indirectly when you buy and hold Units. It does not reflect brokerage commissions and other fees

to financial intermediaries that you may pay for purchases and sales of Units on the secondary markets.

|

|

|

|

|

|

|

Unitholder Fees:

|

|

|

None

|

|

|

(fees paid directly from your investment)

|

|

|

|

|

Estimated Annual Trust Ordinary Operating Expenses:

(expenses that you pay each year as a percentage of the value of your investment)

|

|

|

|

|

|

|

Current Estimated Annual Trust Ordinary Operating Expenses

|

|

As a % of

Trust Average Net Assets

|

|

|

Trustee’s Fee

|

|

|

0.0555

|

%

|

|

S&P License Fee

|

|

|

0.0302

|

%

|

|

Marketing

|

|

|

0.0070

|

%

|

|

Other Operating Expenses

|

|

|

0.0018

|

%

|

|

|

|

|

|

|

|

Total

|

|

|

0.0945

|

%

|

Future expense accruals will depend primarily on the level of the Trust’s net assets and the level of expenses.

1

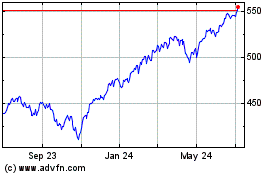

Growth of $10,000 Investment Since Inception(1)(2)

|

(1)

|

Past performance is not necessarily an indication of how the Trust will perform in the future.

|

|

(2)

|

Effective as of September 30, 1997, the Trust’s fiscal year end changed from December 31 to September 30.

|

The Trust’s Investments and Portfolio Turnover

The Trust seeks to achieve its investment objective by holding a portfolio of the common stocks that are included in the Index (the

“Portfolio”), with the weight of each stock in the Portfolio substantially corresponding to the weight of such stock in the Index.

In this prospectus, the term “Portfolio Securities” refers to the common stocks that are actually held by the Trust and make up the Trust’s

Portfolio, while the term “Index Securities” refers to the common stocks that are included in the Index, as determined by the index provider, S&P Dow Jones Indices LLC (“S&P”). At any time, the Portfolio will consist of

as many of the Index Securities as is practicable. To maintain the correspondence between the composition and weightings of Portfolio Securities and Index Securities, State Street Global Advisors Trust Company (the “Trustee”) or its parent

company, State Street Bank and Trust Company (“SSBT”) adjusts the Portfolio from time to time to conform to periodic changes made by S&P to the identity and/or relative weightings of Index Securities in the Index. The Trustee or SSBT

aggregates certain of these adjustments and makes changes to the Portfolio at least monthly, or more frequently in the case of significant changes to the Index.

The Trust may pay transaction costs, such as brokerage commissions, when it buys and sells securities (or “turns over” its Portfolio). Such transaction costs may be higher if there are

significant rebalancings of Index Securities in the Index, which may also result in higher taxes when Units are held in a taxable account. These costs, which are not reflected in estimated annual Trust ordinary operating expenses, affect the

Trust’s performance. During the most recent fiscal year, the Trust’s portfolio turnover rate was 2% of the average value of its portfolio. The Trust’s portfolio

turnover rate does not include securities received or delivered from processing creations or redemptions of Units. Portfolio turnover will be a function of changes to

2

the Index as well as requirements of the Trust Agreement (as defined below in “Organization of the Trust”).

Although the Trust may fail to own certain Index Securities at any particular time, the Trust generally will be substantially invested in Index Securities, which should result in a close correspondence

between the performance of the Index and the performance of the Trust. See “The S&P 500 Index” below for more information regarding the Index. The Trust does not hold or trade futures or swaps and is not a commodity pool.

Dividends

Payments of dividends are made quarterly, on the last Business Day (as defined in “Purchases and Redemptions of Creation Units — Purchase

(Creation)”) of April, July, October and January. See “Dividends and Distributions” and “Additional Information Regarding Dividends and Distributions.”

Redemption of Units

Only certain institutional investors

(typically market makers or other broker-dealers) are permitted to purchase or redeem Units directly with the Trust, and they may do so only in large blocks of 50,000 Units known as “Creation Units.” See “Purchases and

Redemptions of Creation Units — Redemption” and “Trust Agreement” for more information regarding the rights of Beneficial Owners (as defined in “Book-Entry-Only System”).

Voting Rights; Book-Entry-Only-System

Beneficial Owners shall not have the right to vote concerning the Trust, except with respect to termination and as otherwise expressly set forth in the Trust Agreement. See “Trust

Agreement.” Units are represented by one or more global securities registered in the name of Cede & Co., as nominee for The Depository Trust Company (“DTC”) and deposited with, or on behalf of, DTC. See

“Book-Entry-Only System.”

Amendments to the Trust Agreement

The Trust Agreement (as defined below in “Organization of the Trust”) may be amended from time to time by the Trustee and PDR Services, LLC

(the “Sponsor”) without the consent of any Beneficial Owners under certain circumstances described herein. The Trust Agreement may also be amended by the Sponsor and the Trustee with the consent of the Beneficial Owners to modify the

rights of Beneficial Owners under certain circumstances. Promptly after the execution of an amendment to the Trust Agreement, the Trustee arranges for written notice to be provided to Beneficial Owners. See “Trust Agreement — Amendments to

the Trust Agreement.”

3

Principal Risks of Investing in the Trust

As with all investments, there are certain risks of investing in the Trust, and you could lose money on an investment in the Trust. Prospective investors

should carefully consider the risk factors described below, as well as the additional risk factors under “Additional Risk Information” and the other information included in this prospectus, before deciding to invest in Units.

Passive Strategy/Index Risk. The Trust is not actively managed. Rather, the Trust attempts to track the performance of an

unmanaged index of securities. This differs from an actively managed fund, which typically seeks to outperform a benchmark index. As a result, the Trust will hold constituent securities of the Index regardless of the current or projected performance

of a specific security or a particular industry or market sector. Maintaining investments in securities regardless of market conditions or the performance of individual securities could cause the Trust’s return to be lower than if the Trust

employed an active strategy.

Index Tracking Risk. While the Trust is intended to track the performance of the

Index as closely as possible (i.e., to achieve a high degree of correlation with the Index), the Trust’s return may not match or achieve a high degree of correlation with the return of the Index due to expenses and transaction

costs incurred in adjusting the Portfolio. In addition, it is possible that the Trust may not always fully replicate the performance of the Index due to the unavailability of certain Index Securities in the secondary market or due to other

extraordinary circumstances (e.g., if trading in a security has been halted).

Equity Investing and Market

Risk. An investment in the Trust involves risks similar to those of investing in any fund of equity securities, such as market fluctuations caused by such factors as economic and political developments, changes in

interest rates, perceived trends in securities prices, war, acts of terrorism, the spread of infectious disease or other public health issues. Local, regional or global events such as war, acts of terrorism, the spread of infectious disease or other

public health issues, recessions, or other events could have a significant impact on the Trust and its investments and could result in increased premiums or discounts to the Trust’s net asset value.

An investment in the Trust is subject to the risks of any investment in a broadly based portfolio of equity securities, including the risk that the

general level of stock prices may decline, thereby adversely affecting the value of such investment. The value of Portfolio Securities may fluctuate in accordance with changes in the financial condition of the issuers of Portfolio Securities, the

value of equity securities generally and other factors. The identity and weighting of Index Securities and the Portfolio Securities change from time to time.

The financial condition of issuers of Portfolio Securities may become impaired or the general condition of the stock market may deteriorate, either of which may cause a decrease in the value of the

Portfolio and thus in the value of Units. Since the Trust is not actively managed, the adverse financial condition of an issuer will not result in its

4

elimination from the Portfolio unless such issuer is removed from the Index. Equity securities are susceptible to general stock market fluctuations and to volatile increases and decreases in

value as market confidence in and perceptions of their issuers change. These investor perceptions are based on various and unpredictable factors, including expectations regarding government, economic, monetary and fiscal policies, inflation and

interest rates, economic expansion or contraction, and global or regional political, economic and banking crises, as well as war, acts of terrorism and the spread of infectious disease or other public health issues.

An outbreak of infectious respiratory illness caused by a novel coronavirus known as COVID-19 was first detected

in China in December 2019 and was declared a pandemic by the World Health Organization in March 2020. This coronavirus has resulted in travel restrictions, restrictions on gatherings of people (including closings of, or limitations on, dining and

entertainment establishments, as well as schools and universities), closed businesses (or businesses that are restricted in their operations), closed international borders, enhanced health screenings at ports of entry and elsewhere, disruption of

and delays in healthcare service preparation and delivery, prolonged quarantines, cancellations, supply chain disruptions, and lower consumer demand, as well as general concern and uncertainty. The impact of

COVID-19, and other infectious disease outbreaks that may arise in the future, could adversely affect the economies of many nations or the entire global economy, individual issuers and capital markets in ways

that cannot be foreseen. Public health crises caused by the COVID-19 outbreak may exacerbate other pre-existing political, social and economic risks in certain countries

or globally. The duration of the COVID-19 outbreak cannot be determined with certainty. The risk of further spreading of COVID-19 has led to significant uncertainty and

volatility in the financial markets and disruption to the global economy, the consequences of which are currently unpredictable. Certain of the Trust’s investments are likely to have exposure to businesses that, as a result of COVID-19, experience a slowdown or temporary suspension in business activities. These factors, as well as any restrictive measures instituted in order to prevent or control a pandemic or other public health crisis,

such as the one posed by COVID-19, could have a material and adverse effect on the Trust’s investments.

Holders of common stocks of any given issuer incur more risk than holders of preferred stocks and debt obligations of the issuer because the rights of common stockholders, as owners of the issuer,

generally are subordinate to the rights of creditors of, or holders of debt obligations or preferred stocks issued by, such issuer. Further, unlike debt securities that typically have a stated principal amount payable at maturity, or preferred

stocks that typically have a liquidation preference and may have stated optional or mandatory redemption provisions, common stocks have neither a fixed principal amount nor a maturity. Equity securities values are subject to market fluctuations as

long as the equity securities remain outstanding. The value of the Portfolio will fluctuate over the entire life of the Trust.

There can be no

assurance that the issuers of Portfolio Securities will pay dividends. Distributions generally depend upon the declaration of dividends by the issuers of

5

Portfolio Securities and the declaration of such dividends generally depends upon various factors, including the financial condition of the issuers and general economic conditions.

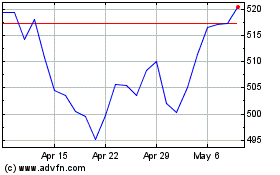

Trust Performance

The following bar chart and table provide an indication of the risks of investing in the Trust by showing changes in the Trust’s performance based on net assets from year to year and by showing how

the Trust’s average annual return for certain time periods compares with the average annual return of the Index. The Trust’s past performance (before and after taxes) is not necessarily an indication of how the Trust will perform in the

future. Updated performance information is available online at http://www.spdrs.com.

The total returns in the bar chart, as well as the

total and after-tax returns presented in the table, have been calculated assuming that the reinvested price for the last income distribution made in the last calendar year shown below (i.e., 12/18/20)

was the net asset value per Unit (“NAV”) on the last Business Day of such year (i.e., 12/31/20), rather than the actual reinvestment price for such distribution which was the NAV on the last Business Day of January of the following

calendar year (e.g., 1/29/21). Therefore, the actual performance calculation for the last calendar year may be different from that shown below in the bar chart and table. No dividend reinvestment services are provided by the Trust (see

“Dividends and Distributions”), so investors’ performance may be different from that shown below in the bar chart and table.

Annual Total Return (years ended 12/31)

Highest Quarterly Return: 20.44% for the quarter ended June 30, 2020.

Lowest Quarterly Return: –19.60% for the quarter ended March 31, 2020.

6

Average Annual Total Returns (for periods ending December 31, 2020)

The after-tax returns presented in the table are calculated using the highest historical individual federal

marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your specific tax situation and may differ from those shown below. After-tax returns are not relevant to investors who hold Units through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. The returns after

taxes can exceed the return before taxes due to an assumed tax benefit for a holder of Units from realizing a capital loss on a sale of the Units.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Past

One Year

|