Filed Pursuant to Rule 497(b)

Registration File No. 033-46080

SPDR® S&P 500® ETF Trust

(“SPY” or the

“Trust”)

(A Unit Investment Trust)

Principal U.S. Listing Exchange for SPDR® S&P 500® ETF Trust: NYSE Arca, Inc. under

the symbol “SPY”

Prospectus Dated January 16, 2020

The U.S. Securities and Exchange Commission has not approved or disapproved these securities or passed upon the accuracy or adequacy of this

prospectus. Any representation to the contrary is a criminal offense. Securities of the Trust (“Units”) are not guaranteed or insured by the Federal Deposit Insurance Corporation or any other agency of the U.S. Government, nor are

such Units deposits or obligations of any bank. Such Units of the Trust involve investment risks, including the loss of principal.

COPYRIGHT 2020 PDR Services LLC

“Standard &

Poor’s®”, “S&P®”, “S&P

500®”, “Standard & Poor’s 500®”, “500®”,

“Standard & Poor’s Depositary Receipts®”, “SPDR®” and “SPDRs®” are registered trademarks of Standard & Poor’s Financial Services LLC, a division of S&P Global, and have been licensed for use by S&P Dow

Jones Indices LLC (“S&P”) and sublicensed for use by State Street Global Advisors Funds Distributors, LLC (formerly known as State Street Global Markets, LLC). The Trust is permitted to use these trademarks pursuant to a sublicense

from State Street Global Advisors Funds Distributors, LLC. The Trust is not sponsored, endorsed, sold or marketed by S&P, its affiliates or its third party licensors.

i

SUMMARY

Investment Objective

The Trust seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the S&P 500® Index (the “Index”).

Fees and Expenses of the Trust

This table estimates the fees and expenses that the Trust pays on an annual basis, which you therefore pay indirectly when you buy and hold Units. It does not reflect brokerage commissions and other fees

to financial intermediaries that you may pay for purchases and sales of Units on the secondary markets.

|

|

|

|

|

|

|

Unitholder Fees:

|

|

|

None

|

|

|

(fees paid directly from your investment)

|

|

|

|

|

Estimated Annual Trust Ordinary Operating Expenses:

(expenses that you pay each year as a percentage of the value of your investment)

|

|

|

|

|

|

|

Current Estimated Annual Trust Ordinary Operating Expenses

|

|

As a % of

Trust Average Net Assets

|

|

|

Trustee’s Fee

|

|

|

0.0494

|

%

|

|

S&P License Fee

|

|

|

0.0302

|

%

|

|

Marketing

|

|

|

0.0141

|

%

|

|

Other Operating Expenses

|

|

|

0.0008

|

%

|

|

|

|

|

|

|

|

Total

|

|

|

0.0945

|

%

|

Future expense accruals will depend primarily on the level of the Trust’s net assets and the level of expenses.

1

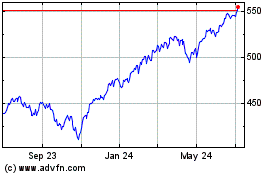

Growth of $10,000 Investment Since Inception(1)(2)

|

(1)

|

Past performance is not necessarily an indication of how the Trust will perform in the future.

|

|

(2)

|

Effective as of September 30, 1997, the Trust’s fiscal year end changed from December 31 to September 30.

|

The Trust’s Investments and Portfolio Turnover

The Trust seeks to achieve its investment objective by holding a portfolio of the common stocks that are included in the Index (the

“Portfolio”), with the weight of each stock in the Portfolio substantially corresponding to the weight of such stock in the Index.

In this prospectus, the term “Portfolio Securities” refers to the common stocks that are actually held by the Trust and make up the Trust’s

Portfolio, while the term “Index Securities” refers to the common stocks that are included in the Index, as determined by the index provider, S&P Dow Jones Indices LLC (“S&P”). At any time, the Portfolio will consist of

as many of the Index Securities as is practicable. To maintain the correspondence between the composition and weightings of Portfolio Securities and Index Securities, State Street Global Advisors Trust Company (the “Trustee”) or its parent

company, State Street Bank and Trust Company (“SSBT”) adjusts the Portfolio from time to time to conform to periodic changes made by S&P to the identity and/or relative weightings of Index Securities in the Index. The Trustee or SSBT

aggregates certain of these adjustments and makes changes to the Portfolio at least monthly, or more frequently in the case of significant changes to the Index.

The Trust may pay transaction costs, such as brokerage commissions, when it buys and sells securities (or “turns over” its Portfolio). Such transaction costs may be higher if there are

significant rebalancings of Index Securities in the Index, which may also result in higher taxes when Units are held in a taxable account. These costs, which are not reflected in estimated annual Trust ordinary operating expenses, affect the

Trust’s performance. During the most recent fiscal year, the Trust’s portfolio turnover rate was 3% of the average value of its portfolio. The Trust’s portfolio turnover rate does not include securities received or delivered from

processing creations or redemptions of Units. Portfolio turnover will be a function of changes to

2

the Index as well as requirements of the Trust Agreement (as defined below in “Organization of the Trust”).

Although the Trust may fail to own certain Index Securities at any particular time, the Trust generally will be substantially invested in Index Securities, which should result in a close correspondence

between the performance of the Index and the performance of the Trust. See “The S&P 500 Index” below for more information regarding the Index. The Trust does not hold or trade futures or swaps and is not a commodity pool.

Dividends

Payments of dividends are made quarterly, on the last Business Day (as defined in “Purchases and Redemptions of Creation Units — Purchase

(Creation)”) of April, July, October and January. See “Dividends and Distributions” and “Additional Information Regarding Dividends and Distributions.”

Redemption of Units

Only certain institutional investors

(typically market makers or other broker-dealers) are permitted to purchase or redeem Units directly with the Trust, and they may do so only in large blocks of 50,000 Units known as “Creation Units.” See “Purchases and

Redemptions of Creation Units — Redemption” and “Trust Agreement” for more information regarding the rights of Beneficial Owners (as defined in “Book-Entry-Only System”).

Voting Rights; Book-Entry-Only-System

Beneficial Owners shall not have the right to vote concerning the Trust, except with respect to termination and as otherwise expressly set forth in the

Trust Agreement. See “Trust Agreement.” Units are represented by one or more global securities registered in the name of Cede & Co., as nominee for The Depository Trust Company (“DTC”) and deposited with, or on

behalf of, DTC. See “Book-Entry-Only System.”

Amendments to the Trust Agreement

The Trust Agreement (as defined below in “Organization of the Trust”) may be amended from time to time by the Trustee and PDR Services, LLC

(the “Sponsor”) without the consent of any Beneficial Owners under certain circumstances described herein. The Trust Agreement may also be amended by the Sponsor and the Trustee with the consent of the Beneficial Owners to modify the

rights of Beneficial Owners under certain circumstances. Promptly after the execution of an amendment to the Trust Agreement, the Trustee arranges for written notice to be provided to Beneficial Owners. See “Trust Agreement — Amendments to

the Trust Agreement.”

3

Principal Risks of Investing in the Trust

As with all investments, there are certain risks of investing in the Trust, and you could lose money on an investment in the Trust. Prospective investors

should carefully consider the risk factors described below, as well as the additional risk factors under “Additional Risk Information” and the other information included in this prospectus, before deciding to invest in Units.

Passive Strategy/Index Risk. The Trust is not actively managed. Rather, the Trust attempts to track the performance of an

unmanaged index of securities. This differs from an actively managed fund, which typically seeks to outperform a benchmark index. As a result, the Trust will hold constituent securities of the Index regardless of the current or projected performance

of a specific security or a particular industry or market sector. Maintaining investments in securities regardless of market conditions or the performance of individual securities could cause the Trust’s return to be lower than if the Trust

employed an active strategy.

Index Tracking Risk. While the Trust is intended to track the performance of the

Index as closely as possible (i.e., to achieve a high degree of correlation with the Index), the Trust’s return may not match or achieve a high degree of correlation with the return of the Index due to expenses and transaction

costs incurred in adjusting the Portfolio. In addition, it is possible that the Trust may not always fully replicate the performance of the Index due to the unavailability of certain Index Securities in the secondary market or due to other

extraordinary circumstances (e.g., if trading in a security has been halted).

Equity Investing Risk. An

investment in the Trust involves risks similar to those of investing in any fund of equity securities, such as market fluctuations caused by such factors as economic and political developments, changes in interest rates and perceived trends in

securities prices.

An investment in the Trust is subject to the risks of any investment in a broadly based portfolio of common stocks,

including the risk that the general level of stock prices may decline, thereby adversely affecting the value of such investment. The value of Portfolio Securities may fluctuate in accordance with changes in the financial condition of the issuers of

Portfolio Securities, the value of common stocks generally and other factors. The identity and weighting of Index Securities and the Portfolio Securities change from time to time.

The financial condition of issuers of Portfolio Securities may become impaired or the general condition of the stock market may deteriorate, either of which may cause a decrease in the value of the

Portfolio and thus in the value of Units. Since the Trust is not actively managed, the adverse financial condition of an issuer will not result in its elimination from the Portfolio unless such issuer is removed from the Index. Common stocks are

susceptible to general stock market fluctuations and to volatile increases and decreases in value as market confidence in and perceptions of their issuers change. These investor perceptions are based on various and unpredictable

4

factors, including expectations regarding government, economic, monetary and fiscal policies, inflation and interest rates, economic expansion or contraction, and global or regional political,

economic and banking crises.

Holders of common stocks of any given issuer incur more risk than holders of preferred stocks and debt

obligations of the issuer because the rights of common stockholders, as owners of the issuer, generally are subordinate to the rights of creditors of, or holders of debt obligations or preferred stocks issued by, such issuer. Further, unlike debt

securities that typically have a stated principal amount payable at maturity, or preferred stocks that typically have a liquidation preference and may have stated optional or mandatory redemption provisions, common stocks have neither a fixed

principal amount nor a maturity. Common stock values are subject to market fluctuations as long as the common stock remains outstanding. The value of the Portfolio will fluctuate over the entire life of the Trust.

There can be no assurance that the issuers of Portfolio Securities will pay dividends. Distributions generally depend upon the declaration of dividends by

the issuers of Portfolio Securities and the declaration of such dividends generally depends upon various factors, including the financial condition of the issuers and general economic conditions.

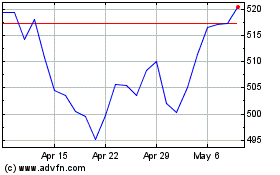

Trust Performance

The following bar chart and table provide an indication of the risks of investing in the Trust by showing changes in the Trust’s performance based on net assets from year to year and by showing how

the Trust’s average annual return for certain time periods compares with the average annual return of the Index. The Trust’s past performance (before and after taxes) is not necessarily an indication of how the Trust will perform in the

future. Updated performance information is available online at http://www.spdrs.com.

The total returns in the bar chart, as well as the total

and after-tax returns presented in the table, have been calculated assuming that the reinvested price for the last income distribution made in the last calendar year shown below (i.e., 12/20/19) was the

net asset value per Unit (“NAV”) on the last Business Day of such year (i.e., 12/31/19), rather than the actual reinvestment price for such distribution which was the NAV on the last Business Day of January of the following calendar

year (e.g., 1/31/20). Therefore, the actual performance calculation for the last calendar year may be different from that shown below in the bar chart and table. No dividend reinvestment services are provided by the Trust (see “Dividends

and Distributions”), so investors’ performance may be different from that shown below in the bar chart and table.

5

Annual Total Return (years ended 12/31)

Highest Quarterly Return: 13.58% for the quarter ended March 31, 2019.

Lowest Quarterly Return: –13.84% for the quarter ended September 30, 2011.

Average Annual Total Returns (for periods ending December 31, 2019)

The after-tax returns presented in the table are calculated using the highest historical individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your specific tax situation and may differ from those shown below. After-tax returns are not relevant to investors who hold Units through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. The returns after taxes can exceed the return before taxes due to an assumed tax benefit for a holder of Units from realizing a

capital loss on a sale of the Units.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Past

One Year

|

|

|

Past

Five Years

|

|

|

Past

Ten Years

|

|

|

Trust

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return Before Taxes

|

|

|

31.25

|

%

|

|

|

11.55

|

%

|

|

|

13.40

|

%

|

|

Return After Taxes on Distributions

|

|

|

30.68

|

%

|

|

|

11.02

|

%

|

|

|

12.91

|

%

|

|

Return After Taxes on Distributions and Sale or Redemption of Creation Units

|

|

|

18.86

|

%

|

|

|

9.09

|

%

|

|

|

11.13

|

%

|

|

Index (reflects no deduction for fees, expenses or taxes)

|

|

|

31.49

|

%

|

|

|

11.70

|

%

|

|

|

13.56

|

%

|

6

PURCHASE AND SALE INFORMATION

Individual Units of the Trust may be purchased and sold on NYSE Arca, Inc. (the “Exchange”), under the market symbol “SPY”, through

your broker-dealer at market prices. Units trade at market prices that may be greater than NAV (premium) or less than NAV (discount). Units are also listed and traded on the Singapore Exchange Securities Trading Limited (stock code S27), the Tokyo

Stock Exchange (code 1557) and the Australian Securities Exchange. In the future, Units may be listed and traded on other non-U.S. exchanges. Units may be purchased on other trading markets or venues in

addition to the Exchange, the Singapore Exchange Securities Trading Limited, the Tokyo Stock Exchange and the Australian Securities Exchange.

Only certain institutional investors (typically market makers or other broker-dealers) are permitted to purchase or redeem Units directly with the Trust,

and they may do so only in large blocks of 50,000 Units known as “Creation Units.” Creation Unit transactions are conducted in exchange for the deposit or delivery of in-kind securities and/or

cash constituting a substantial replication of the securities included in the Index.

TAX

INFORMATION

The Trust will make distributions that are expected to be taxable currently to you as ordinary income and/or capital gains,

unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or individual retirement account. See “Federal Income Taxes,” below, for more information.

THE S&P 500 INDEX

The Index includes five hundred (500) selected companies, all of which are listed on national stock exchanges and spans over 24 separate industry groups. As of December 31, 2019, the five

largest industry groups represented in the Index were: Software & Services 12.46%; Media & Entertainment 8.23%; Pharmaceuticals, Biotechnology & Life Sciences 7.67%; Health Care Equipment & Services 6.54%; and Technology Hardware

& Equipment 6.51%. Since 1968, the Index has been a component of the U.S. Commerce Department’s list of Leading Indicators that track key sectors of the U.S. economy. Current information regarding the market value of the Index is

available from market information services. The Index is determined, comprised and calculated without regard to the Trust.

S&P is not

responsible for and does not participate in the creation or sale of Units or in the determination of the timing, pricing, or quantities and proportions of purchases or sales of Index Securities or Portfolio Securities by the Trust. The information

in this prospectus concerning S&P and the Index has been obtained from sources that the Sponsor believes to be reliable, but the Sponsor takes no responsibility for the accuracy of such information.

7

The following table shows the actual performance of the Index for the years 1960 through 2019. The results

shown should not be considered representative of the income yield or capital gain or loss that may be generated by the Index in the future.

THE RESULTS SHOULD NOT BE CONSIDERED REPRESENTATIVE OF THE FUTURE PERFORMANCE OF THE TRUST.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year

|

|

Calendar

Year-End

Index Value*

|

|

|

Calendar

Year-End Index

Value 1960=100

|

|

|

Change In

Index for

Calendar Year

|

|

|

Calendar

Year-End

Yield**

|

|

|

1960

|

|

|

58.11

|

|

|

|

100.00

|

|

|

|

—

|

%

|

|

|

3.47

|

%

|

|

1961

|

|

|

71.55

|

|

|

|

123.13

|

|

|

|

23.13

|

|

|

|

2.98

|

|

|

1962

|

|

|

63.10

|

|

|

|

108.59

|

|

|

|

–11.81

|

|

|

|

3.37

|

|

|

1963

|

|

|

75.02

|

|

|

|

129.10

|

|

|

|

18.89

|

|

|

|

3.17

|

|

|

1964

|

|

|

84.75

|

|

|

|

145.84

|

|

|

|

12.97

|

|

|

|

3.01

|

|

|

1965

|

|

|

92.43

|

|

|

|

159.06

|

|

|

|

9.06

|

|

|

|

3.00

|

|

|

1966

|

|

|

80.33

|

|

|

|

138.24

|

|

|

|

–13.09

|

|

|

|

3.40

|

|

|

1967

|

|

|

96.47

|

|

|

|

166.01

|

|

|

|

20.09

|

|

|

|

3.20

|

|

|

1968

|

|

|

103.86

|

|

|

|

178.73

|

|

|

|

7.66

|

|

|

|

3.07

|

|

|

1969

|

|

|

92.06

|

|

|

|

158.42

|

|

|

|

–11.36

|

|

|

|

3.24

|

|

|

1970

|

|

|

92.15

|

|

|

|

158.58

|

|

|

|

0.10

|

|

|

|

3.83

|

|

|

1971

|

|

|

102.09

|

|

|

|

175.68

|

|

|

|

10.79

|

|

|

|

3.14

|

|

|

1972

|

|

|

118.05

|

|

|

|

203.15

|

|

|

|

15.63

|

|

|

|

2.84

|

|

|

1973

|

|

|

97.55

|

|

|

|

167.87

|

|

|

|

–17.37

|

|

|

|

3.06

|

|

|

1974

|

|

|

68.56

|

|

|

|

117.98

|

|

|

|

–29.72

|

|

|

|

4.47

|

|

|

1975

|

|

|

90.19

|

|

|

|

155.21

|

|

|

|

31.55

|

|

|

|

4.31

|

|

|

1976

|

|

|

107.46

|

|

|

|

184.93

|

|

|

|

19.15

|

|

|

|

3.77

|

|

|

1977

|

|

|

95.10

|

|

|

|

163.66

|

|

|

|

–11.50

|

|

|

|

4.62

|

|

|

1978

|

|

|

96.11

|

|

|

|

165.39

|

|

|

|

1.06

|

|

|

|

5.28

|

|

|

1979

|

|

|

107.94

|

|

|

|

185.75

|

|

|

|

12.31

|

|

|

|

5.47

|

|

|

1980

|

|

|

135.76

|

|

|

|

233.63

|

|

|

|

25.77

|

|

|

|

5.26

|

|

|

1981

|

|

|

122.55

|

|

|

|

210.89

|

|

|

|

–9.73

|

|

|

|

5.20

|

|

|

1982

|

|

|

140.64

|

|

|

|

242.02

|

|

|

|

14.76

|

|

|

|

5.81

|

|

|

1983

|

|

|

164.93

|

|

|

|

283.82

|

|

|

|

17.27

|

|

|

|

4.40

|

|

|

1984

|

|

|

167.24

|

|

|

|

287.80

|

|

|

|

1.40

|

|

|

|

4.64

|

|

|

1985

|

|

|

211.28

|

|

|

|

363.59

|

|

|

|

26.33

|

|

|

|

4.25

|

|

|

1986

|

|

|

242.17

|

|

|

|

416.75

|

|

|

|

14.62

|

|

|

|

3.49

|

|

|

1987

|

|

|

247.08

|

|

|

|

425.19

|

|

|

|

2.03

|

|

|

|

3.08

|

|

|

1988

|

|

|

277.72

|

|

|

|

477.92

|

|

|

|

12.40

|

|

|

|

3.64

|

|

|

1989

|

|

|

353.40

|

|

|

|

608.15

|

|

|

|

27.25

|

|

|

|

3.45

|

|

|

1990

|

|

|

330.22

|

|

|

|

568.26

|

|

|

|

–6.56

|

|

|

|

3.61

|

|

|

1991

|

|

|

417.09

|

|

|

|

717.76

|

|

|

|

26.31

|

|

|

|

3.24

|

|

|

1992

|

|

|

435.71

|

|

|

|

749.80

|

|

|

|

4.46

|

|

|

|

2.99

|

|

|

1993

|

|

|

464.45

|

|

|

|

802.70

|

|

|

|

7.06

|

|

|

|

2.78

|

|

|

1994

|

|

|

459.27

|

|

|

|

790.34

|

|

|

|

–1.54

|

|

|

|

2.82

|

|

|

1995

|

|

|

615.93

|

|

|

|

1,059.92

|

|

|

|

34.11

|

|

|

|

2.56

|

|

8

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year

|

|

Calendar

Year-End

Index Value*

|

|

|

Calendar

Year-End Index

Value 1960=100

|

|

|

Change In

Index for

Calendar Year

|

|

|

Calendar

Year-End

Yield**

|

|

|

1996

|

|

|

740.74

|

|

|

|

1,274.70

|

|

|

|

20.26

|

%

|

|

|

2.19

|

%

|

|

1997

|

|

|

970.43

|

|

|

|

1,669.99

|

|

|

|

31.01

|

|

|

|

1.77

|

|

|

1998

|

|

|

1,229.23

|

|

|

|

2,115.35

|

|

|

|

26.67

|

|

|

|

1.49

|

|

|

1999

|

|

|

1,469.25

|

|

|

|

2,528.39

|

|

|

|

19.53

|

|

|

|

1.14

|

|

|

2000

|

|

|

1,320.28

|

|

|

|

2,272.04

|

|

|

|

–10.14

|

|

|

|

1.19

|

|

|

2001

|

|

|

1,148.08

|

|

|

|

1,975.70

|

|

|

|

–13.04

|

|

|

|

1.36

|

|

|

2002

|

|

|

879.82

|

|

|

|

1,514.06

|

|

|

|

–23.37

|

|

|

|

1.81

|

|

|

2003

|

|

|

1,111.92

|

|

|

|

1,913.47

|

|

|

|

26.38

|

|

|

|

1.63

|

|

|

2004

|

|

|

1,211.92

|

|

|

|

2,085.56

|

|

|

|

8.99

|

|

|

|

1.72

|

|

|

2005

|

|

|

1,248.29

|

|

|

|

2,148.15

|

|

|

|

3.00

|

|

|

|

1.86

|

|

|

2006

|

|

|

1,418.30

|

|

|

|

2,440.72

|

|

|

|

13.62

|

|

|

|

1.81

|

|

|

2007

|

|

|

1,468.36

|

|

|

|

2,526.86

|

|

|

|

3.53

|

|

|

|

1.89

|

|

|

2008

|

|

|

903.25

|

|

|

|

1,554.38

|

|

|

|

–38.49

|

|

|

|

3.14

|

|

|

2009

|

|

|

1,115.10

|

|

|

|

1,918.95

|

|

|

|

23.45

|

|

|

|

1.95

|

|

|

2010

|

|

|

1,257.64

|

|

|

|

2,164.24

|

|

|

|

12.78

|

|

|

|

1.87

|

|

|

2011

|

|

|

1,257.60

|

|

|

|

2,164.17

|

|

|

|

–0.003

|

|

|

|

2.23

|

|

|

2012

|

|

|

1,426.19

|

|

|

|

2,454.29

|

|

|

|

13.41

|

|

|

|

2.19

|

|

|

2013

|

|

|

1,848.36

|

|

|

|

3,180.79

|

|

|

|

29.60

|

|

|

|

1.89

|

|

|

2014

|

|

|

2,058.90

|

|

|

|

3,543.10

|

|

|

|

11.39

|

|

|

|

2.01

|

|

|

2015

|

|

|

2043.94

|

|

|

|

3517.36

|

|

|

|

–0.0073

|

|

|

|

2.20

|

|

|

2016

|

|

|

2,238.83

|

|

|

|

3,852.74

|

|

|

|

9.53

|

|

|

|

2.10

|

|

|

2017

|

|

|

2,673.61

|

|

|

|

4,600.95

|

|

|

|

19.42

|

|

|

|

1.83

|

|

|

2018

|

|

|

2,506.85

|

|

|

|

4,313.97

|

|

|

|

–6.24

|

|

|

|

2.14

|

|

|

2019

|

|

|

3,230.78

|

|

|

|

5,559.77

|

|

|

|

28.88

|

|

|

|

1.80

|

|

|

*

|

Source: S&P. Reflects no deduction for fees, expenses or taxes.

|

|

**

|

Source: S&P. Yields are obtained by dividing the aggregate cash dividends by the aggregate market value of the stocks in the Index.

|

DIVIDENDS AND DISTRIBUTIONS

Dividends and Capital Gains

Holders of Units receive on the last Business Day of April, July, October and January an amount corresponding to the amount of any cash dividends declared on the Portfolio Securities during the applicable

period, net of fees and expenses associated with operation of the Trust, and taxes, if applicable. Because of such fees and expenses, the dividend yield for Units is ordinarily less than that of the Index. Although all such distributions are

currently made quarterly, under certain limited circumstances the Trustee may vary the times at which such distributions are made.

Any capital

gain income recognized by the Trust in any taxable year that is not distributed during the year ordinarily is distributed at least annually in January of the

9

following taxable year. The Trust may make additional distributions shortly after the end of the year in order to satisfy certain distribution requirements imposed by the Internal Revenue Code of

1986, as amended (the “Code”).

The amount of distributions may vary significantly from period to period. Under limited certain

circumstances, special dividend payments also may be made to holders of Units. See “Additional Information Regarding Dividends and Distributions.” Investors should consult their tax advisors regarding tax consequences associated with Trust

dividends, as well as those associated with Unit sales or redemptions.

No Dividend Reinvestment Service

No dividend reinvestment service is provided by the Trust. Broker-dealers, at their own discretion, may offer a dividend reinvestment

service under which additional Units are purchased in the secondary market at current market prices. Investors should consult their broker-dealer for further information regarding any dividend reinvestment program offered by such broker-dealer.

Distributions in cash that are reinvested in additional Units through a dividend reinvestment service, if offered by an investor’s

broker-dealer, will be taxable dividends to the same extent as if such dividends had been received in cash.

FEDERAL INCOME TAXES

The following is a description of the material U.S. federal income tax consequences of owning and disposing of

Units. The discussion below provides general tax information relating to an investment in Units, but it does not purport to be a comprehensive description of all the U.S. federal income tax considerations that may be relevant to a particular

person’s decision to invest in Units. This discussion does not describe all of the tax consequences that may be relevant in light of the particular circumstances of a beneficial owner of Units, including alternative minimum tax consequences,

Medicare contribution tax consequences and tax consequences applicable to beneficial owners subject to special rules, such as:

|

|

•

|

|

certain financial institutions;

|

|

|

•

|

|

regulated investment companies;

|

|

|

•

|

|

real estate investment trusts;

|

|

|

•

|

|

dealers or traders in securities that use a mark-to-market method of

tax accounting;

|

|

|

•

|

|

persons holding Units as part of a hedging transaction, straddle, wash sale, conversion transaction or integrated transaction or persons entering into

a constructive sale with respect to the Units;

|

10

|

|

•

|

|

U.S. Holders (as defined below) whose functional currency for U.S. federal income tax purposes is not the U.S. dollar;

|

|

|

•

|

|

entities classified as partnerships or otherwise treated as pass-through entities for U.S. federal income tax purposes;

|

|

|

•

|

|

certain former U.S. citizens and residents and expatriated entities;

|

|

|

•

|

|

tax-exempt entities, including an “individual retirement account” or “Roth IRA”; or

|

If an

entity that is classified as a partnership for U.S. federal income tax purposes holds Units, the U.S. federal income tax treatment of a partner will generally depend on the status of the partner and the activities of the partnership. Partnerships

holding Units and partners in such partnerships should consult their tax advisors as to the particular U.S. federal income tax consequences of holding and disposing of the Units.

The following discussion applies only to an owner of Units that (i) is treated as the beneficial owner of such Units for U.S. federal income tax purposes, (ii) holds such Units as capital assets

and (iii) unless otherwise noted, is a U.S. Holder. A “U.S. Holder” is (i) an individual who is a citizen or resident of the United States; (ii) a corporation, or other entity taxable as a corporation, created or organized

in or under the laws of the United States, any state therein or the District of Columbia; or (iii) an estate or trust the income of which is subject to U.S. federal income taxation regardless of its source.

This discussion is based on the Code, administrative pronouncements, judicial decisions, and final, temporary and proposed Treasury regulations all as of

the date hereof, any of which is subject to change, possibly with retroactive effect.

Prospective purchasers of Units are urged to consult

their tax advisors with regard to the application of the U.S. federal income and estate tax laws to their particular situations, as well as any tax consequences arising under the laws of any state, local or foreign taxing jurisdiction.

Taxation of the Trust

The Trust believes that it qualified as a regulated investment company under Subchapter M of the Code (a “RIC”) for its taxable year ended September 30, 2019 and intends to qualify as a RIC

in the current and future taxable years. Assuming that the Trust so qualifies and that it satisfies the distribution requirements described below, the Trust generally will not be subject to U.S. federal income tax on income distributed in a timely

manner to the holders of its Units (“Unitholders”).

To qualify as a RIC for any taxable year, the Trust must, among other things,

satisfy both an income test and an asset diversification test for such taxable year.

11

Specifically, (i) at least 90% of the Trust’s gross income for such taxable year must consist of dividends; interest; payments with respect to certain securities loans; gains from the

sale or other disposition of stock, securities or foreign currencies; other income (including, but not limited to, gains from options, futures or forward contracts) derived with respect to its business of investing in such stock, securities or

currencies; and net income derived from interests in “qualified publicly traded partnerships” (such income, “Qualifying RIC Income”) and (ii) the Trust’s holdings must be diversified so that, at the end of each quarter

of such taxable year, (a) at least 50% of the value of the Trust’s total assets is represented by cash and cash items, securities of other RICs, U.S. government securities and other securities, with such other securities limited, in

respect of any one issuer, to an amount not greater than 5% of the value of the Trust’s total assets and not greater than 10% of the outstanding voting securities of such issuer and (b) not more than 25% of the value of the Trust’s

total assets is invested (x) in the securities (other than U.S. government securities or securities of other RICs) of any one issuer or of two or more issuers that the Trust controls and that are engaged in the same, similar or related trades

or businesses or (y) in the securities of one or more “qualified publicly traded partnerships.” A “qualified publicly traded partnership” is generally defined as an entity that is treated as a partnership for U.S. federal

income tax purposes if (i) interests in such entity are traded on an established securities market or are readily tradable on a secondary market or the substantial equivalent thereof and (ii) less than 90% of such entity’s gross

income for the relevant taxable year consists of Qualifying RIC Income. The Trust’s share of income derived from a partnership other than a “qualified publicly traded partnership” will be treated as Qualifying RIC Income only to the

extent that such income would have constituted Qualifying RIC Income if derived directly by the Trust.

In order to be exempt from U.S. federal

income tax on its distributed income, the Trust must distribute to its Unitholders on a timely basis at least 90% of its “investment company taxable income” (determined prior to the deduction for dividends paid by the Trust) and its net tax-exempt interest income for each taxable year. In general, a RIC’s “investment company taxable income” for any taxable year is its taxable income, determined without regard to net capital gain

(that is, the excess of net long-term capital gains over net short-term capital losses) and with certain other adjustments. Any taxable income, including any net capital gain, that the Trust does not distribute to its Unitholders in a timely manner

will be subject to U.S. federal income tax at regular corporate rates.

A RIC will be subject to a nondeductible 4% excise tax on certain

amounts that it fails to distribute during each calendar year. In order to avoid this excise tax, a RIC must distribute during each calendar year an amount at least equal to the sum of (i) 98% of its ordinary taxable income for the calendar

year, (ii) 98.2% of its capital gain net income for the one-year period ended on October 31 of the calendar year and (iii) any ordinary income and capital gains for previous years that were not

distributed during those years. For purposes of determining whether the Trust has met this distribution requirement, (i) certain ordinary gains and losses that would

12

otherwise be taken into account for the portion of the calendar year after October 31 will be treated as arising on January 1 of the following calendar year and (ii) the Trust will

be deemed to have distributed any income or gains on which it has paid U.S. federal income tax.

If the Trust failed to qualify as a RIC or

failed to satisfy the 90% distribution requirement in any taxable year, the Trust would be subject to U.S. federal income tax at regular corporate rates on its taxable income, including its net capital gain, even if such income were distributed to

its Unitholders, and all distributions out of earnings and profits would be taxable as dividend income. Such distributions generally would be eligible for the dividends-received deduction in the case of corporate U.S. Holders and would constitute

“qualified dividend income” for individual U.S. Holders. See “Federal Income Taxes — Tax Consequences to U.S. Holders — Distributions.” In addition, the Trust could be required to recognize unrealized gains, pay taxes

and make distributions (which could be subject to interest charges) before requalifying for taxation as a RIC. If the Trust fails to satisfy the income test or diversification test described above, however, it may be able to avoid losing its status

as a RIC by timely curing such failure, paying a tax and/or providing notice of such failure to the U.S. Internal Revenue Service (the “IRS”).

In order to meet the distribution requirements necessary to be exempt from U.S. federal income and excise tax, the Trust may be required to make distributions in excess of the yield performance of the

Portfolio Securities and may be required to sell securities.

Tax Consequences to U.S. Holders

Distributions. Distributions of the Trust’s ordinary income and net short-term capital gains will, except as described

below with respect to distributions of “qualified dividend income,” generally be taxable to U.S. Holders as ordinary income to the extent such distributions are paid out of the Trust’s current or accumulated earnings and profits, as

determined for U.S. federal income tax purposes. Distributions (or deemed distributions, as described below), if any, of net capital gains will be taxable as long-term capital gains, regardless of the length of time the U.S. Holder has owned Units.

A distribution of an amount in excess of the Trust’s current and accumulated earnings and profits will be treated as a return of capital that will be applied against and reduce the U.S. Holder’s basis in its Units. If the amount of any

such distribution exceeds the U.S. Holder’s basis in its Units, the excess will be treated as gain from a sale or exchange of the Units.

The ultimate tax characterization of the distributions that the Trust makes during any taxable year cannot be determined until after the end of the

taxable year. As a result, it is possible that the Trust will make total distributions during a taxable year in an amount that exceeds its current and accumulated earnings and profits.

Return-of-capital distributions may result, for example, if the Trust makes distributions of cash amounts deposited in connection with Portfolio Deposits (as

13

defined below in “Purchases and Redemptions of Creation Units — Purchase (Creation)”).

Return-of-capital distributions may be more likely to occur in periods during which the number of outstanding Units fluctuates significantly.

Distributions of the Trust’s “qualified dividend income” to an individual or other non-corporate

U.S. Holder will be treated as “qualified dividend income” and will therefore be taxed at rates applicable to long-term capital gains, provided that the U.S. Holder meets certain holding period and other requirements with respect to its

Units and that the Trust meets certain holding period and other requirements with respect to the underlying shares of stock. “Qualified dividend income” generally includes dividends from domestic corporations and dividends from foreign

corporations that meet certain specified criteria.

Dividends distributed by the Trust to a corporate U.S. Holder will qualify for the

dividends-received deduction only to the extent that the dividends consist of distributions of dividends eligible for the dividends-received deduction received by the Trust and the U.S. Holder meets certain holding period and other requirements with

respect to the underlying shares of stock. Dividends eligible for the dividends-received deduction generally are dividends from domestic corporations.

The Trust intends to distribute its net capital gains at least annually. If, however, the Trust retains any net capital gains for reinvestment, it may elect to treat such net capital gains as having been

distributed to the Unitholders. If the Trust makes such an election, each U.S. Holder will be required to report its share of such undistributed net capital gain as long-term capital gain and will be entitled to claim its share of the U.S. federal

income taxes paid by the Trust on such undistributed net capital gain as a credit against its own U.S. federal income tax liability, if any, and to claim a refund on a properly filed U.S. federal income tax return to the extent that the credit

exceeds such tax liability. In addition, each U.S. Holder will be entitled to increase the adjusted tax basis of its Units by the difference between its share of such undistributed net capital gain and the related credit and/or refund. There can be

no assurance that the Trust will make this election if it retains all or a portion of its net capital gain for a taxable year.

Because the tax

treatment of a distribution depends upon the Trust’s current and accumulated earnings and profits, a distribution received shortly after an acquisition of Units may be taxable, even though, as an economic matter, the distribution represents a

return of the U.S. Holder’s initial investment. Although dividends generally will be treated as distributed when paid, dividends declared in October, November or December, payable to Unitholders of record on a specified date in one of those

months, and paid during the following January, will be treated for U.S. federal income tax purposes as having been distributed by the Trust and received by the Unitholders on December 31 of the year in which declared. Unitholders will be

notified annually as to the U.S. federal tax status of distributions.

Sales and Redemptions of Units. In

general, upon the sale or other disposition of Units, a U.S. Holder will recognize capital gain or loss in an amount equal to the

14

difference, if any, between the amount realized on the sale or other disposition and the U.S. Holder’s adjusted tax basis in the relevant Units. Such gain or loss generally will be long-term

capital gain or loss if the U.S. Holder’s holding period for the relevant Units was more than one year on the date of the sale or other disposition. Under current law, net capital gain (that is, the excess of net long-term capital gains over

net short-term capital losses) recognized by non-corporate U.S. Holders is generally subject to U.S. federal income tax at lower rates than the rates applicable to ordinary income.

Losses recognized by a U.S. Holder on the sale or other disposition of Units held for six months or less will be treated as long-term capital losses to

the extent of any distribution of long-term capital gain received (or deemed received, as discussed above) with respect to such Units. In addition, no loss will be allowed on a sale or other disposition of Units if the U.S. Holder acquires Units, or

enters into a contract or option to acquire Units, within 30 days before or after such sale or other disposition. In such a case, the basis of the Units acquired will be adjusted to reflect the disallowed loss.

If a U.S. Holder receives an in-kind distribution in redemption of Units (which must constitute a Creation Unit,

as discussed in “Purchases and Redemptions of Creation Units — Redemption”), the U.S. Holder will realize gain or loss in an amount equal to the difference between the aggregate fair market value as of the redemption date of the

stocks and cash received in the redemption and the U.S. Holder’s adjusted tax basis in the relevant Units. The U.S. Holder will generally have an initial tax basis in the distributed stocks equal to their respective fair market values on the

redemption date. The IRS may assert that any resulting loss may not be recognized on the ground that there has been no material change in the U.S. Holder’s economic position. The Trust will not recognize gain or loss for U.S. federal income tax

purposes on an in-kind distribution in redemption of Creation Units.

Under U.S. Treasury regulations,

if a U.S. Holder recognizes losses with respect to Units of $2 million or more for an individual U.S. Holder or $10 million or more for a corporate U.S. Holder, the U.S. Holder must file with the IRS a disclosure statement on IRS Form

8886. Direct shareholders of portfolio securities are in many cases exempted from this reporting requirement, but under current guidance, shareholders of a RIC are not exempted. The fact that a loss is reportable under these regulations does not

affect the legal determination of whether the U.S. Holder’s treatment of the loss is proper. Certain states may have similar disclosure requirements.

Portfolio Deposits. Upon the transfer of a Portfolio Deposit (as defined below in “Purchases and Redemptions of Creation Units — Purchase (Creation)”) to the

Trust, a U.S. Holder will generally realize gain or loss with respect to each stock included in the Portfolio Deposit in an amount equal to the difference, if any, between the amount received with respect to such stock and the U.S. Holder’s

basis in the stock. The amount received with respect to each stock included in a Portfolio Deposit is determined by allocating among all of the stocks included in the Portfolio Deposit an

15

amount equal to the fair market value of the Creation Units received (determined as of the date of transfer of the Portfolio Deposit) plus the amount of any cash received from the Trust, reduced

by the amount of any cash that the U.S. Holder pays to the Trust. This allocation is made among such stocks in accordance with their relative fair market values as of the date of transfer of the Portfolio Deposit. The IRS may assert that any loss

resulting from the transfer of a Portfolio Deposit to the Trust may not be recognized on the ground that there has been no material change in the economic position of the U.S. Holder. The Trust will not recognize gain or loss for U.S. federal income

tax purposes on the issuance of Creation Units in exchange for Portfolio Deposits.

Backup Withholding and Information

Returns. Payments on the Units and proceeds from a sale or other disposition of Units will be subject to information reporting unless the U.S. Holder is an exempt recipient. A U.S. Holder will be subject to backup

withholding on all such amounts unless (i) the U.S. Holder is an exempt recipient or (ii) the U.S. Holder provides its correct taxpayer identification number (generally, on IRS Form W-9) and

certifies that it is not subject to backup withholding. Backup withholding is not an additional tax. Any amounts withheld pursuant to the backup withholding rules will be allowed as a credit against the U.S. Holder’s U.S. federal income tax

liability and may entitle the U.S. Holder to a refund, provided that the required information is furnished to the IRS on a timely basis.

Tax Consequences to Non-U.S. Holders

A “Non-U.S.

Holder” is a person that, for U.S. federal income tax purposes, is a beneficial owner of Units and is a nonresident alien individual, a foreign corporation, a foreign trust or a foreign estate. The discussion below does not apply to a Non-U.S. Holder who is a nonresident alien individual and is present in the United States for 183 days or more during any taxable year; a nonresident alien individual who is a former citizen or resident of the

United States; an expatriated entity; a controlled foreign corporation; a passive foreign investment company; a foreign government for purposes of Section 892 of the Code or a tax-exempt organization for

U.S. federal income tax purposes. Such Non-U.S. Holders should consult their tax advisors with respect to the particular tax consequences to them of an investment in the Trust. The U.S. federal income taxation

of a Non-U.S. Holder depends on whether the income that the Non-U.S. Holder derives from the Trust is “effectively connected” with a trade or business that the

Non-U.S. Holder conducts in the United States (and, if required by an applicable tax treaty, is attributable to a U.S. permanent establishment maintained by the Non-U.S.

Holder).

If the income that a Non-U.S. Holder derives from the Trust is not “effectively

connected” with a U.S. trade or business conducted by such Non-U.S. Holder (or, if an applicable tax treaty so provides, the Non-U.S. Holder does not maintain a

permanent establishment in the United States), distributions of “investment company taxable income” to such Non-U.S. Holder will generally be subject to U.S. federal withholding tax at a rate of 30%

(or lower rate under an applicable tax treaty).

16

Provided that certain requirements are satisfied, this withholding tax will not be imposed on dividends paid by the Trust to the extent that the underlying income out of which the dividends are

paid consists of U.S.-source interest income or short-term capital gains that would not have been subject to U.S. withholding tax if received directly by the Non-U.S. Holder (“interest-related

dividends” and “short-term capital gain dividends,” respectively).

A Non-U.S. Holder

whose income from the Trust is not “effectively connected” with a U.S. trade or business (or, if an applicable tax treaty so provides, does not maintain a permanent establishment in the United States) will generally be exempt from U.S.

federal income tax on capital gain dividends and any amounts retained by the Trust that are designated as undistributed capital gains. In addition, such a Non-U.S. Holder will generally be exempt from U.S.

federal income tax on any gains realized upon the sale or exchange of Units.

If the income from the Trust is “effectively connected”

with a U.S. trade or business carried on by a Non-U.S. Holder (and, if required by an applicable tax treaty, is attributable to a U.S. permanent establishment maintained by the

Non-U.S. Holder), any distributions of “investment company taxable income,” any capital gain dividends, any amounts retained by the Trust that are designated as undistributed capital gains and any

gains realized upon the sale or exchange of Units will be subject to U.S. federal income tax, on a net income basis, at the rates applicable to U.S. Holders. A Non-U.S. Holder that is a corporation may also be

subject to the U.S. branch profits tax.

Information returns will be filed with the IRS in connection with certain payments on the Units and

may be filed in connection with payments of the proceeds from a sale or other disposition of Units. A Non-U.S. Holder may be subject to backup withholding on distributions or on the proceeds from a redemption

or other disposition of Units if such Non-U.S. Holder does not certify its non-U.S. status under penalties of perjury or otherwise establish an exemption. Backup

withholding is not an additional tax. Any amounts withheld pursuant to the backup withholding rules will be allowed as a credit against the Non-U.S. Holder’s U.S. federal income tax liability, if any, and

may entitle the Non-U.S. Holder to a refund, provided that the required information is furnished to the IRS on a timely basis.

In order to qualify for the exemption from U.S. withholding on interest-related dividends, to qualify for an exemption from U.S. backup withholding and to qualify for a reduced rate of U.S. withholding

tax on Trust distributions pursuant to an income tax treaty, a Non-U.S. Holder must generally deliver to the withholding agent a properly executed IRS form (generally, Form

W-8BEN or Form W-8BEN-E, as applicable). In order to claim a refund of any Trust-level taxes imposed on undistributed net capital

gain, any withholding taxes or any backup withholding, a Non-U.S. Holder must obtain a U.S. taxpayer identification number and file a U.S. federal income tax return, even if the

Non-U.S. Holder would not otherwise be required to obtain a U.S. taxpayer identification number or file a U.S. income tax return.

17

Under Sections 1471 through 1474 of the Code (“FATCA”), a withholding tax at the rate of 30% will

generally be imposed on payments of dividends on Units to certain foreign entities (including financial intermediaries) unless the foreign entity provides the withholding agent with certifications and other information (which may include information

relating to ownership by U.S. persons of interests in, or accounts with, the foreign entity). Treasury and the IRS have recently issued proposed regulations that (i) provide that “withholdable payments” will not include gross proceeds

from the disposition of property that can produce U.S. source dividends or interest, as otherwise would have been the case after December 31, 2018 and (ii) state that taxpayers may rely on these provisions of the proposed regulations until

final regulations are issued. If FATCA withholding is imposed, a beneficial owner of Units that is not a foreign financial institution generally may obtain a refund of any amounts withheld by filing a U.S. federal income tax return (which may entail

significant administrative burden). Non-U.S. Holders should consult their tax advisors regarding the possible implications of FATCA on their investment in Units.

18

SPDR S&P

500® ETF Trust

Report of

Independent Registered Public Accounting Firm

To the Trustee and Unitholders of the SPDR S&P 500® ETF Trust

Opinion on the Financial Statements

We

have audited the accompanying statement of assets and liabilities, including the schedule of investments, of the SPDR S&P 500 ETF Trust (the “Trust”) as of September 30, 2019, the related statements of operations and of

changes in net assets for each of the three years in the period ended September 30, 2019, including the related notes, and the financial highlights for each of the five years in the period ended September 30, 2019 (collectively

referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Trust as of September 30, 2019, the results of its operations and the changes

in its net assets for each of the three years in the period ended September 30, 2019, and the financial highlights for each of the five years in the period ended September 30, 2019 in conformity with accounting principles generally

accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Trust’s management. Our responsibility is to express an opinion on the Trust’s financial statements based on our audits. We are a public

accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Trust in accordance with the U.S. federal securities laws and the applicable

rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in

accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or

fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting

principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of September 30, 2019 by correspondence with

the custodian and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

/s/ PricewaterhouseCoopers LLP

Boston, Massachusetts

November 26, 2019

We have served as the

auditor of one or more investment companies in the SPDR Funds since 1993.

19

SPDR S&P

500® ETF Trust

Statement of

Assets and Liabilities

September 30, 2019

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

Investments in unaffiliated issuers, at value (Note 2)

|

|

$

|

273,446,316,823

|

|

|

Investments in affiliates of the Trustee and the Sponsor, at value

|

|

|

821,033,702

|

|

|

|

|

|

|

|

|

Total Investments

|

|

|

274,267,350,525

|

|

|

Cash

|

|

|

1,114,827,098

|

|

|

Dividends receivable — unaffiliated issuers (Note 2)

|

|

|

236,512,746

|

|

|

Dividends receivable — affiliated issuers (Note 2)

|

|

|

2,147,052

|

|

|

|

|

|

|

|

|

Total Assets

|

|

|

275,620,837,421

|

|

|

|

|

|

|

|

|

LIABILITIES

|

|

|

|

|

|

Payable for investments purchased

|

|

|

37,185,683

|

|

|

Payable for units of fractional undivided interest (“Units”) redeemed

in-kind

|

|

|

317,146

|

|

|

Accrued Trustee expense (Note 3)

|

|

|

12,590,011

|

|

|

Accrued Marketing expense (Note 3)

|

|

|

22,557,234

|

|

|

Distribution payable

|

|

|

1,254,640,965

|

|

|

Accrued expenses and other liabilities

|

|

|

34,106,683

|

|

|

|

|

|

|

|

|

Total Liabilities

|

|

|

1,361,397,722

|

|

|

|

|

|

|

|

|

NET ASSETS

|

|

$

|

274,259,439,699

|

|

|

|

|

|

|

|

|

NET ASSETS CONSIST OF:

|

|

|

|

|

|

Paid in Capital (Note 4)

|

|

$

|

292,854,928,423

|

|

|

Total distributable earnings (loss)

|

|

|

(18,595,488,724

|

)

|

|

|

|

|

|

|

|

NET ASSETS

|

|

$

|

274,259,439,699

|

|

|

|

|

|

|

|

|

NET ASSET VALUE PER UNIT

|

|

$

|

296.82

|

|

|

|

|

|

|

|

|

UNITS OUTSTANDING (UNLIMITED UNITS AUTHORIZED)

|

|

|

923,982,116

|

|

|

|

|

|

|

|

|

COST OF INVESTMENTS:

|

|

|

|

|

|

Unaffiliated issuers

|

|

$

|

284,405,920,717

|

|

|

Affiliates of the Trustee and the Sponsor (Note 3)

|

|

|

904,772,651

|

|

|

|

|

|

|

|

|

Total Cost of Investments

|

|

$

|

285,310,693,368

|

|

|

|

|

|

|

|

See accompanying notes to financial

statements.

20

SPDR S&P

500® ETF Trust

Statements of

Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended

9/30/19

|

|

|

Year Ended

9/30/18

|

|

|

Year Ended

9/30/17

|

|

|

INVESTMENT INCOME

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividend income — unaffiliated issuers (Note 2)

|

|

$

|

5,569,189,037

|

|

|

$

|

4,995,395,848

|

|

|

$

|

4,737,367,911

|

|

|

Dividend income — affiliates of the Trustee and the Sponsor

|

|

|

14,842,022

|

|

|

|

13,606,086

|

|

|

|

11,842,443

|

|

|

Foreign taxes withheld

|

|

|

—

|

|

|

|

—

|

|

|

|

(9,787

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Investment Income

|

|

|

5,584,031,059

|

|

|

|

5,009,001,934

|

|

|

|

4,749,200,567

|

|

|

|

|

|

|

|

EXPENSES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trustee expense (Note 3)

|

|

|

129,443,668

|

|

|

|

143,201,038

|

|

|

|

126,137,525

|

|

|

S&P license fee (Note 3)

|

|

|

79,275,442

|

|

|

|

80,322,526

|

|

|

|

69,123,020

|

|

|

Marketing expense (Note 3)

|

|

|

36,911,835

|

|

|

|

22,626,082

|

|

|

|

18,358,255

|

|

|

Legal and audit fees

|

|

|

605,028

|

|

|

|

603,472

|

|

|

|

241,998

|

|

|

Other expenses

|

|

|

1,591,672

|

|

|

|

4,372,847

|

|

|

|

2,644,758

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Expenses

|

|

|

247,827,645

|

|

|

|

251,125,965

|

|

|

|

216,505,556

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trustee expense waiver

|

|

|

—

|

|

|

|

—

|

|

|

|

(658,036

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Expenses

|

|

|

247,827,645

|

|

|

|

251,125,965

|

|

|

|

215,847,520

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INVESTMENT INCOME (LOSS)

|

|

|

5,336,203,414

|

|

|

|

4,757,875,969

|

|

|

|

4,533,353,047

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REALIZED AND UNREALIZED GAIN (LOSS)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net realized gain (loss) on:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments — unaffiliated issuers

|

|

|

(1,874,707,476

|

)

|

|

|

(631,225,982

|

)

|

|

|

(1,368,210,820

|

)

|

|

Investments — affiliates of the Trustee and the Sponsor

|

|

|

(2,398,982

|

)

|

|

|

(838,353

|

)

|

|

|

(355,947

|

)

|

|

In-kind redemptions — unaffiliated issuers

|

|

|

19,405,809,495

|

|

|

|

37,318,292,156

|

|

|

|

22,363,636,511

|

|

|

In-kind redemptions — affiliated issuers

|

|

|

39,060,086

|

|

|

|

142,784,439

|

|

|

|

89,897,379

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net realized gain (loss)

|

|

|

17,567,763,123

|

|

|

|

36,829,012,260

|

|

|

|

21,084,967,123

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net change in unrealized appreciation/depreciation on:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments — unaffiliated issuers

|

|

|

(13,388,014,704

|

)

|

|

|

(760,564,842

|

)

|

|

|

12,961,822,882

|

|

|

Investments — affiliates of the Trustee and the Sponsor

|

|

|

(33,757,839

|

)

|

|

|

(158,416,456

|

)

|

|

|

113,290,379

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net change in unrealized appreciation/depreciation

|

|

|

(13,421,772,543

|

)

|

|

|

(918,981,298

|

)

|

|

|

13,075,113,261

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET REALIZED AND UNREALIZED GAIN (LOSS)

|

|

|

4,145,990,580

|

|

|

|

35,910,030,962

|

|

|

|

34,160,080,384

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INCREASE (DECREASE) IN NET ASSETS FROM OPERATIONS

|

|

$

|

9,482,193,994

|

|

|

$

|

40,667,906,931

|

|

|

$

|

38,693,433,431

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying notes to financial

statements.

21

SPDR S&P

500® ETF Trust

Statements of

Changes in Net Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended

9/30/19

|

|

|

Year Ended

9/30/18

|

|

|

Year Ended

9/30/17

|

|

|

INCREASE (DECREASE) IN NET ASSETS FROM OPERATIONS:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net investment income (loss)

|

|

$

|

5,336,203,414

|

|

|

$

|

4,757,875,969

|

|

|

$

|

4,533,353,047

|

|

|

Net realized gain (loss)

|

|

|

17,567,763,123

|

|

|

|

36,829,012,260

|

|

|

|

21,084,967,123

|

|

|

Net change in unrealized appreciation/depreciation

|

|

|

(13,421,772,543

|

)

|

|

|

(918,981,298

|

)

|

|

|

13,075,113,261

|

|

|

|

|

|

|

|

|

|