Current Report Filing (8-k)

November 02 2022 - 4:02PM

Edgar (US Regulatory)

0001643988

false

0001643988

2022-10-27

2022-10-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 27, 2022

Loop Media, Inc.

(Exact name of registrant as specified in its charter)

| Nevada |

000-55591 |

47-3975872 |

| (State or Other Jurisdiction |

(Commission |

(I.R.S. Employer |

| of Incorporation) |

File Number) |

Identification No.) |

700 N.

Central Ave., Suite 430 Glendale,

CA |

|

91203 |

| (Address of Principal Executive Office) |

|

(Zip Code) |

(213) 436-2100

(Registrant’s telephone number, including

area code)

(Former name, former address and former fiscal

year, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material

pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant

to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name

of each exchange on which registered |

| N/A |

N/A |

N/A |

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2

of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth

company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01 Entry into a Material Definitive Agreement

Amendment to Loan Agreement

As previously announced, effective as of July 29,

2022, Loop Media, Inc. (the “Company”) entered into a Loan and Security Agreement (the “Loan Agreement”)

with Industrial Funding Group, Inc. (the “Initial Lender”) for a revolving loan credit facility for the principal

sum of up to four million dollars ($4.0 million), and through the exercise of an accordion feature, a total sum of up to ten million dollars

($10 million) (the “Loan”), evidenced by a Revolving Loan Secured Promissory Note (the “Note”),

also effective as of July 29, 2022. As of August 2, 2022, the Company borrowed approximately two million dollars ($2.0 million)

under the Loan, and the Initial Lender assigned the Loan Agreement, and the loan documents related thereto, to GemCap Solutions, LLC (the

“Senior Lender”). On October 27, 2022, the Loan Agreement was amended by Amendment Number 1 to the Loan and Security

Agreement and to the Loan Agreement Schedule (the "Loan Agreement Amendment No. 1”) to increase the maximum availability

and maximum credit of the loan from four million dollars ($4,000,000.00) to six million dollars ($6,000,000.00), evidenced by an Amended

and Restated Secured Promissory Note (Revolving Loans), also dated October 27, 2022 (the “Amended and Restated Note”).

The descriptions of the Loan Agreement Amendment

No. 1 and the Amended and Restated Note are qualified in their entirety by reference to the full texts of the Loan Agreement Amendment

No. 1 and the Amended and Restated Note, which are incorporated by reference herein. Copies of the Loan Agreement Amendment No. 1

and the Amended and Restated Note are included herein as Exhibits 10.1 and 10.2, respectively.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation

under an Off-Balance Sheet Arrangement of a Registrant

The information in Item 1.01 with respect to the Amendment to Loan

Agreement is incorporated by reference into this Item 2.03.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, hereunto duly authorized.

| Date: November 2, 2022 |

LOOP MEDIA, INC. |

| |

|

|

| |

By: |

/s/ Jon Niermann |

| |

|

Jon Niermann, CEO |

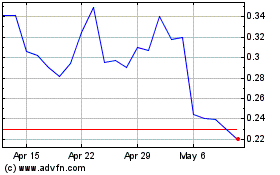

Loop Media (AMEX:LPTV)

Historical Stock Chart

From Mar 2024 to Apr 2024

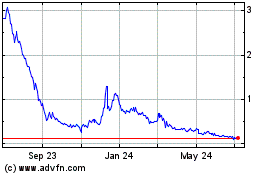

Loop Media (AMEX:LPTV)

Historical Stock Chart

From Apr 2023 to Apr 2024